Anzeige

Meldung des Tages: Das ist kein Gold-Boom, das ist ein Systembruch – und er hat gerade erst begonnen

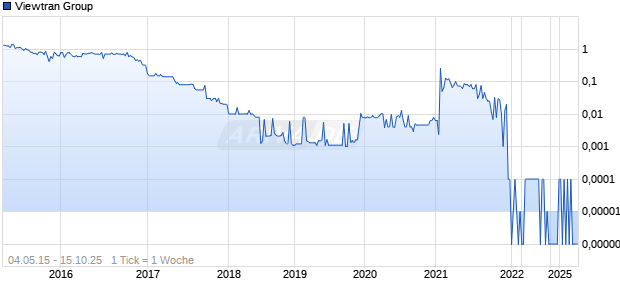

Keine aktuellen Kursdaten verfügbar

Depot/Watchlist

Dieses Wertpapier ist nicht mehr handelbar.

Marktkapitalisierung *

-

Streubesitz

-

KGV

-

Index-Zuordnung

-

- Push

- Intraday

- 1W

- 3M

- 6M

- 1J

- 5J

- Gesamt

Werbung

Mehr Nachrichten kostenlos abonnieren

E-Mail-Adresse

Bitte überprüfe deine die E-Mail-Adresse.

Benachrichtigungen von ARIVA.DE

(Mit der Bestellung akzeptierst du die Datenschutzhinweise)

(Mit der Bestellung akzeptierst du die Datenschutzhinweise)

Vielen Dank, dass du dich für unseren Newsletter angemeldet hast. Du erhältst in Kürze eine E-Mail mit einem Aktivierungslink.

Leider können wir deine Anfrage auf diesem Weg nicht entgegennehmen.

Bitte schreibe uns an: portal.support@ariva.de

Bitte schreibe uns an: portal.support@ariva.de

Termine

Keine Termine bekannt.

Prognose & Kursziel

Keine aktuellen Prognosen oder Kursziele bekannt.

Stammdaten

| Aktientyp | Stammaktie |

Community-Beiträge zu Viewtran Group

Diss_Prof

COCO Group unter neuer WKN

A1JDQS

Diss_Prof

Ergebnisse Q1 2011

http://www.finanznachrichten.de/nachrichten-2011-05/20149414-cogo-reports-strongest-ever-first-quarter-results-008.htm

Diss_Prof

Cogo Board of Directors Approves Change in Domicil

SHENZHEN, China, May 2, 2011 /PRNewswire/ -- Cogo Group, Inc. (Nasdaq: COGO), a leading gateway for global semiconductor companies to access the industrial and technology markets in China, today announced that its Board of Directors has unanimously approved the redomestication of the Company from the State of Maryland to the Cayman Islands. A wholly owned indirect subsidiary of the Company, Cogo Group Cayman, Inc. ("Cogo Cayman"), today filed a registration statement on Form F-4 relating to the redomestication transaction and future stockholder meeting.

It is the Board''s belief that the redomestication will make Cogo''s shares more attractive to non-U.S. investors and ultimately broaden its shareholder base. The redomestication would allow the Company to dual-list its shares on the Hong Kong Stock Exchange but it does not mandate that the dual-listing will occur. Following a successful redomestication, if the Company chooses to initiate the dual-listing process for the Hong Kong Stock Exchange, it would take an estimated three to six months to complete.

After the redomestication, assuming it is approved by the Company''s stockholders, the Company is expected to continue to trade on the NASDAQ stock exchange. Although the Company is expected to be a foreign private issuer after the redomestication, it expects to continue to report quarterly and annual financial results in the same time periods as a U.S. reporting company would, with the same levels of transparency and detail.

Jeffrey Kang, CEO of Cogo, said, "One of the main fiduciary responsibilities of Cogo''s Board of Directors is to maximize value for our shareholders. We believe that by changing our domicile to the Cayman Islands, which will allow the flexibility to dual-list our shares on the Hong Kong Stock Exchange, if we choose to do so, will help broaden our shareholder base to non-U.S. investors. We expect to be able to achieve this result with no material tax changes and limited costs relative to the potential improvement in shareholder value and a broadened shareholder base."

Additional Information about the Redomestication and Where to Find It

In connection with the proposed redomestication, Cogo Cayman has prepared a registration statement containing a proxy statement/prospectus that is filed with the SEC. When completed, a definitive proxy statement/prospectus and a form of proxy will be mailed to the stockholders of the Company, seeking their approval of the transaction. Stockholders are urged to read the proxy statement/prospectus regarding the proposed acquisition carefully and in its entirety because it will contain important information about the proposed redomestication. Stockholders can obtain, without charge, a copy of the proxy statement/prospectus and other relevant documents filed with the SEC from the SEC''s website at http://www.sec.gov. Stockholders will also be able to obtain, without charge, a copy of the proxy statement/prospectus and other relevant documents (when available) by directing a request by e-mail to Wanyee Ho, who@cogo.com.cn.

The Company and its directors and officers may be deemed to be participants in the solicitation of proxies from the Company''s stockholders with respect to the proposed redomestication. Information about the Company''s directors and executive officers and their ownership of the Company''s common stock and warrants is set forth in the Company''s annual report on Form 10-K for the fiscal year ended December 31, 2010. Stockholders may obtain additional information regarding the interests of the Company and its directors and executive officers in the proposed redomestication, which may be different than those of the Company''s stockholders generally, by reading the proxy statement/prospectus and other relevant documents regarding the proposed redomestication when filed with the SEC.

Diss_Prof

+++ News +++

... so langsam wächst auch die Aufmerksamkeit in den Medien... kann meiner Meinung nach nur gut sein für den Aktienkurs... solange die News natürlich positiv sind...

22.03.2011 11:31

Cogo Announces Latest Auto Customer: Great Wall Motors / -- Expects Over 10% Unit Growth in China Automotive Market in 2011

SHENZHEN, China, March 22, 2011 /PRNewswire/ -- Cogo Group, Inc. , ("Cogo") a leading gateway for global semiconductor companies to access the industrial and technology markets in China, today announced the addition of a new automotive customer, Great Wall Motor Company Limited ("Great Wall"), to its portfolio. This win follows Cogo's recent automotive customer wins with BYD (November 2009), Geely (June 2010) and Chery (November 2010), and Cogo now serves four of the largest domestic Chinese auto vendors. Cogo expects to start recording revenue from the Great Wall relationship in the third quarter of 2011.

Cogo, in partnership with a leading global semiconductor supplier, is now offering customized embedded solutions within two key Great Wall models: Haval and Voleex. These solutions include applications such as the body control unit, engine control unit and the transmission control unit.

Great Wall is expected to increase its automobile shipments by approximately 50% to nearly 600,000 units in 2011. One of the largest domestic Chinese auto vendors and a leader in both SUV and pick-up truck sales in the country, Great Wall is also a leading auto exporter and currently exports automobiles to over 125 countries.

Currently, the Addressable Market for Cogo is focused almost exclusively on domestic automobile vendors. International vendors perform most of their design work outside of China and only handle auto assembly within the country. However, as local auto brands gain share over time, it is expected that international vendors will begin to shift more design work to China in order to speed time to market and reduce overall costs. Consequently, Cogo expects key international auto vendors will begin to utilize Cogo's customizable design work in the near future in order to compete with the lower overall cost structure and faster product cycle times of the key domestic vendors

Jeffrey Kang, CEO of Cogo, said, "I am pleased to announce Great Wall as our fourth named auto customer and I expect to add more customers over the coming months. The Chinese auto market is already the largest in the world and is estimated to grow a further 10-15% in 2011. This strong industry growth is the result of a series of demographic trends and the expectations of domestic auto vendors gaining share. Additionally, I believe that our content per automobile will grow over time."

Kang continued, "Our recent success in adding new auto customers and increasing our auto revenue is just the tip of the iceberg. I believe autos are one of Cogo's most favorable end markets. When Cogo reaches $1 billion in total annual revenue, I would expect our auto business will be in the range of $100 million in revenue. "

"As we have indicated in our previous press release on March 1, our first quarter business revenue is tracking better than expected, with particular strength in our Industrials segment. Additionally, the tragedy in Japan has thus far not affected any order patterns from our customers and our supply chain has not been materially disrupted."

About Cogo Group, Inc.:

Cogo Group, Inc. is the leading gateway for global semiconductor companies to access the rapidly growing Industrial and Technology sectors in China. Through its unique business-to-business services platform, Cogo designs customized embedded solutions using technology from suppliers including Intel, Broadcom, Xilinx, SanDisk, Freescale, Atmel and others for a customer base of over 1,600 Chinese OEMs/ODMs. Cogo's customer list includes approximately 100 blue-chip companies, including ZTE, BYD and NARI, as well as over 1,400 Small and Medium Enterprises (SMEs). The Company serves a broad list of rapidly growing end-markets in China, including 3G Smartphones, Tablets, Automotives, High-Speed Railway, Smart Meter/Smart Grid, Healthcare and High Definition Television "HDTV". Cogo's fastest growing end-market is Industrial business, which constituted close to 18% of total company sales at the end of 2010. Cogo has approximately 560 employees, with about 280 focused on engineering and 100 in direct sales.

About Great Wall Motor Company Limited:

Great Wall Motor Company Limited (2333:HK) engages in the design, research and development, manufacture and sales, as well as distribution of sports utility vehicles (SUVs), pick-up trucks, sedans and automobile-related parts and components. It manufactures automotive parts and components used in the production of pick-up trucks, SUVs and sedans. These mainly include self-manufactured engines, front and rear axles, air-conditioning equipment, drag ball pins, lever assembly and other parts and components for the production of automobile.

For further information:

Investor Relations

www.cogo.com.cn/investorinfo.html

communications@cogo.com.cn

H.K.: +852 2730 1518

U.S.: +1 (646) 291 8998

Fax: +86 (755) 2674 3522

Jetzt anmelden und diskutieren

Registrieren

Login

Zum Thread wechseln Häufig gestellte Fragen zur Viewtran Group Aktie und zum Viewtran Group Kurs

Das Tickersymbol der Viewtran Group Aktie lautet VIEWF.

Nein, Viewtran Group zahlt keine Dividenden.