Anzeige

Meldung des Tages: Hypothekenkapital trifft KI: FUTR expandiert vom Automobilsektor in die 13,5 Bill. Dollar Hypothekenindustrie

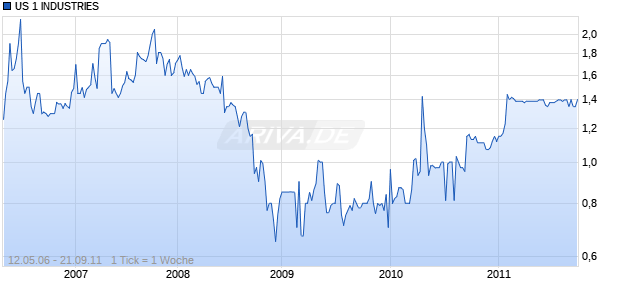

US 1 INDUSTRIES

Aktie

WKN: 866331 ISIN: US9033691067

Keine aktuellen Kursdaten verfügbar

Depot/Watchlist

Dieses Wertpapier ist nicht mehr handelbar.

Marktkapitalisierung *

-

Streubesitz

-

KGV

-

Index-Zuordnung

-

- Push

- Intraday

- 1W

- 3M

- 6M

- 1J

- 5J

- Gesamt

Werbung

Mehr Nachrichten kostenlos abonnieren

E-Mail-Adresse

Bitte überprüfe deine die E-Mail-Adresse.

Benachrichtigungen von ARIVA.DE

(Mit der Bestellung akzeptierst du die Datenschutzhinweise)

(Mit der Bestellung akzeptierst du die Datenschutzhinweise)

Vielen Dank, dass du dich für unseren Newsletter angemeldet hast. Du erhältst in Kürze eine E-Mail mit einem Aktivierungslink.

Leider können wir deine Anfrage auf diesem Weg nicht entgegennehmen.

Bitte schreibe uns an: portal.support@ariva.de

Bitte schreibe uns an: portal.support@ariva.de

Termine

Keine Termine bekannt.

Prognose & Kursziel

Keine aktuellen Prognosen oder Kursziele bekannt.

Stammdaten

| Aktienanzahl | 12,02 Mio. |

| Aktientyp | Stammaktie |

Community-Beiträge zu US 1 INDUSTRIES

timm

in Berlin 9,41%

nicht schlecht

timm

Zahlen sind doch vielversprechend, wieso keiner...

PERIOD ENDING 31-Dec-03 30-Sep-03 30-Jun-03 31-Mar-03

Total Revenue 30,608 30,877 31,709 28,553

Cost of Revenue 20,335 25,874 27,554 22,764

Gross Profit 10,273 5,004 4,155 5,789

Operating Expenses

Research Development - - - -

Selling General and Administrative 10,027 4,680 3,529 5,262

Non Recurring - - - -

Others - - - -

Total Operating Expenses - - - -

Operating Income or Loss 246 324 626 527

Income from Continuing Operations

Total Other Income/Expenses Net 40 74 84 120

Earnings Before Interest And Taxes 232 297 710 647

Interest Expense 105 121 138 130

Income Before Tax 127 177 572 517

Income Tax Expense - - - -

Minority Interest (54) (39) (31) (30)

Net Income From Continuing Ops 127 238 540 487

Non-recurring Events

Discontinued Operations - - - -

Extraordinary Items - - - -

Effect Of Accounting Changes - - - -

Other Items - - - -

Net Income 127 238 540 487

Preferred Stock And Other Adjustments - - - -

Net Income Applicable To Common Shares $127 $238 $540 $487

timm

Hat irgendjemand mehr?

Form 10-K for US 1 INDUSTRIES INC

--------------------------------------------------------------------------------

26-Mar-2004

Annual Report

Item 12. Security Ownership of Certain Beneficial Owners and Management.

Security Ownership of Management

The following table sets forth the number and percentage of shares of Common Stock that as of March 19, 2003 are deemed to be beneficially owned by each director of the company and director nominee, by each executive officer of the Company and by all directors and executive officers of the company as a group

Number of Shares of

Common Stock

Name and position Beneficially Owned Percentage of Class

----------------- ------------------ -------------------

Michael E Kibler 2,830,790 (1,2) 24%

Director, President and

Chief Executive Officer

Robert I. Scissors, 51,770 (4) *

Director

Lex L. Venditti 20,000 *

Director

Brad A. James 166,981 *

William Sullivan 18,000 (5) *

Harold E. Antonson 2,890,235 (1,2,3) 25%

Chief Financial Officer,

Treasurer and Director

All Directors and Executive Officers 3,135,863 27% * Indicates less than 1% ownership.

(1) As general partner of August Investment Partnership, August Investment Corporation may be deemed to be the beneficial owner of the shares of common stock of the Company owned by August Investment Partnership. Messrs. Kibler and Antonson own August Investment Corporation in equal shares and, as a result, may be deemed to be the beneficial owner of the shares of common stock of the Company owned by August Investment Partnership. (2) As Director of Eastern Refrigerated Express Inc, an entity under common control) Messrs. Kibler and Antonson may be deemed to be beneficial owner of 522,439 Shares of Common Stock owned by Eastern. (3) Mr. Antonson disclaims beneficial ownership of 197,500 shares of Common Stock owned by American Inter-Fidelity Exchange, of which Mr. Antonson is Secretary and Treasurer (4) Includes 11,770 shares held in the Saundra L. Scissors Trust of which Mr. and Mrs. Scissors are joint trustees. (5) Includes 18,000 shares owned by ERX, Inc. of which Mr. Sullivan is a controlling owner.

Security Ownership of Certain Beneficial Owners

The following table sets forth the number and percentage of shares of Common Stock beneficially owned as of December 31, 2003 by any person who is known to the Company to be the beneficial owner of more than five percent of the outstanding shares of Common Stock:

Number of Shares of

Name and Address of Common Stock Percentage

Beneficial Owner Beneficially Owned of Class

---------------- ------------------ --------

Harold E. Antonson 2,890,235 (1,2,3) 25%

8400 Louisiana Street

Merrillville, IN 46410

August Investment Partnership 1,150,946 10% 8400 Louisiana Street Merrillville, IN 46410

Michael Kibler 2,830,790 (1,3) 24%

8400 Louisiana Street

Merrillville, IN 46410

(1) As general partner of August Investment Partnership, August Investment Corporation may be deemed to be the beneficial owner of the shares of common stock of the Company owned by August Investment Partnership. Messrs. Kibler and Antonson own August Investment Corporation in equal shares and, as a result, may be deemed to be the beneficial owner of the shares of common stock of the Company owned by August Investment Partnership.

(2) Mr. Antonson disclaims beneficial ownership of 197,500 shares of Common Stock owned by American Inter-Fidelity Exchange, of which Mr. Antonson is Secretary and Treasurer.

(3) As directors of Eastern Refrigerated Express, Inc., Messrs. Antonson and Kibler may be deemed to be beneficial owners of 522,439 shares of Common Stock owned by Eastern.

timm

wieso ist es so ruhig hier? sind doch gute Zahlen

US 1 Industries Announces 2003 Year-End and Fourth Quarter Earnings

Friday March 12, 12:41 pm ET

GARY, Ind.--(BUSINESS WIRE)--March 12, 2004--US 1 Industries, Inc. (OTCBB:USOO - News) announced today the results for its fourth quarter and fiscal year ended December 31, 2003. Revenues for the fourth quarter increased 9.5 percent to $30.6 million compared to $28 million in the same period in 2002. It is the twentieth consecutive quarter in which revenues have increased over the comparable previous year quarter.

Fourth quarter operating income derived from operations decreased to $245,726 compared to $632,287 in the comparable quarter in 2002.

Net income available to common shares in the fourth quarter was $127,365 or $.01 per share compared to $574,841 or $.05 per share in the comparable quarter in 2002.

For the year ended December 31, 2003, revenues were $121.7 million, an increase of 16.9 percent over 2002 revenues of $104.2 million. Income from operations decreased to $1.7 million in 2003, compared to $2.4 million in 2002.

Net income available to common shares in 2003 was $1.4 million or $0.12 per common share compared to $2.2 million or $0.20 per common share in 2002. Net income in 2002 included a benefit from the conversion of preferred shares into common, which increased earnings by $610,000 or $.05 per common share.

Shareholder's Equity increased to $3.4 million for the year ended December 31, 2003 from $1.9 million for the year ended December 31, 2002.

US 1, through its subsidiaries, operates primarily as a non-asset based service provider to independent businesses operating in the trucking and logistics industries. It offers financial resources, risk management services, insurance and information technology to small independent business owners enhancing their ability to compete in the trucking and logistics industry.

Statements in this news release that relate to future plans, financial results or projections, events or performance, are forward-looking statements subject to a number of known and unknown risks and uncertainties that could cause actual operations or results to differ materially from those described or anticipated.

-0-

US 1 INDUSTRIES,INC AND SUBSIDIARIES

CONSOLIDATED STATEMENT OF OPERATIONS

----------------------------------------------------------------------

(Dollars in Three months ended Twelve months ended

thousands, December 31, December 31,

except per share

data) 2003 2002 2003 2002

----------------------------------------------------------------------

Operating Revenues $30,608 $27,957 $121,747 $104,186

----------- ----------- -----------------------

Operating Expenses:

Purchased

Transportation/

Commissions 25,377 23,258 102,047 87,349

Insurance & Claims 1,414 1,213 5,293 4,342

Salaries, Wages, and

Other 1,975 1,504 6,828 5,050

General and

Administrative 1,596 1,349 5,856 5,043

----------- ----------- ----------- -----------

Total operating

expenses 30,362 27,324 120,024 101,784

----------- ----------- ----------- -----------

Operating income

(loss) 246 633 1,723 2,402

----------- ----------- ----------- -----------

Total other

income (expense) (65) (17) (176) (600)

----------- ----------- ----------- -----------

Net Income before

Minority Interest $181 $616 $1,547 $1,802

Minority

Interest Expense (54) (42) (154) (118)

Net income before

Preferred Shares

Dividend $127 $574 $1,393 $1,684

Preferred Share

Dividend - - - (57)

Gain on Redemption of

Preferred Shares - - - 610

----------- ----------- ----------- -----------

Net Income to

common shares $127 $574 $1,393 $2,237

----------- ----------- ----------- -----------

----------- ----------- ----------- -----------

Earnings per

share

Earnings derived

from Operations: $0.01 $0.05 $0.12 $0.15

Earnings derived

from Stock

Conversion: $- $- $- $0.05

Net Earnings Per

Share Basic $0.01 $0.05 $0.12 $0.20

Net Earnings Per

Share Diluted $0.01 $0.05 $0.11 $0.20

----------- ----------- ----------- -----------

----------- ----------- ----------- -----------

Weighted average

common shares

outstanding -

basic 11,618,224 11,618,224 11,618,224 11,075,758

----------- ----------- ----------- -----------

----------- ----------- ----------- -----------

Weighted average

common shares

outstanding -

diluted 11,940,416 11,618,224 11,940,416 11,075,758

----------- ----------- ----------- -----------

----------- ----------- ----------- -----------

US 1 INDUSTRIES, INC.

CONSOLIDATED BALANCE SHEETS

----------------------------------------------------------------------

(Dollars in thousands) December 31, December 31,

2003 2002

----------------------------------------------------------------------

Assets:

Current assets $20,054 $19,236

Fixed assets 971 1,157

Net assets held sale or investment 54 54

Non-current deferred tax asset 600 600

Other assets 398 397

-------- --------

Total assets $22,077 $21,444

======== ========

Liabilities

Current Liabilities $15,167 $16,270

Long term debt 3,176 3,114

Minority Interest 325 203

Redeemable Preferred Stock 0 0

Shareholder's equity 3,409 1,857

-------- --------

Total liabilities and

shareholder's equity $22,077 $21,444

======== ========

--------------------------------------------------------------------------------

Contact:

US 1 Industries, Inc.

Michael Kibler, 219-977-5217

Email: mibler@us1industries.com

--------------------------------------------------------------------------------

Source: US 1 Industries, Inc.

Jetzt anmelden und diskutieren

Registrieren

Login

Zum Thread wechseln Häufig gestellte Fragen zur US 1 INDUSTRIES Aktie und zum US 1 INDUSTRIES Kurs

Nein, US 1 INDUSTRIES zahlt keine Dividenden.