A Partner's Finances Can End a Relationship: 55% of Daters Surveyed Say Debt Can be a Dealbreaker, According to New Earnest Report

Earnest's new research reveals that debt is quietly shaping who we date, trust, and commit to.

SAN FRANCISCO, Feb. 3, 2026 /PRNewswire/ -- Love may be blind, but debt is quietly shaping who Americans date, trust, and commit to. That's according to the 2026 Debt and Dating Research Report released today by Earnest, a leading fintech company on a mission to empower ambitious professionals to make confident financial decisions, which found financial liabilities have officially become a filter for romantic compatibility. The study of over 1,100 participants found that 55% of respondents say at least one type of debt is an automatic dealbreaker—led by payday loans (41%) and high-interest credit card debt (14%).

Even as debt becomes a key compatibility filter, most couples are avoiding the conversation altogether. Despite 60% citing money as their leading source of relationship tension, 61% say they wait until they're officially exclusive before disclosing debt—creating a silence that often fuels stress, mistrust, and conflict.

This silence carries a heavy emotional toll:

- Debt is harder to admit than who you voted for: 25% of daters rank debt as their most avoided conversation topic, making it more uncomfortable to discuss than politics (22%), religion (7%), or family drama (7%).

- Debt is sabotaging dating confidence before anyone even swipes: Nearly half (43%) report that their dating confidence fluctuates based on how their debt is perceived, and 11% say debt makes them feel 'undateable.'

- Money fights are about habits, not just balances: The top drivers of financial conflict are differences in spending habits (58%) and stress about making ends meet (58%). One-third (33%) of couples in conflict also cite 'financial avoidance' or hiding purchases as a significant stressor.

Despite these anxieties, the data suggests that debt is rarely a dealbreaker when met with a clear strategy:

- The "Repayment" Green Flag: 61% of respondents will overlook a partner's debt if they are "actively paying it down," and 34% say a clear repayment plan nullifies the red flag.

- Student debt gets sympathy. Credit card debt gets side-eye: Daters are nearly 5x more accepting of student loan debt (threshold of ~$55K) than credit card debt (~$12K), viewing "investment debt" through a far more sympathetic lens.

- Debt stops couples from taking the next step: When a plan is absent, debt stalls life stages. Nearly one-quarter (23%) would delay moving in with a partner carrying $20K–$49K in non-mortgage debt—though 15% take an unconditional view, stating no amount of debt would prevent cohabitation.

"In dating today, unmanaged debt is perceived as an unmanaged life. People aren't walking away because someone has debt; they're walking away because they don't see ownership," said Emily Childers, Chief Marketing Officer at Earnest. "A clear plan is the difference between a red flag and a green one."

The full findings from Earnest's 2026 Debt and Dating Research Report can be found here. For borrowers interested in learning more about how they can potentially save money by refinancing their student loans, please visit https://www.earnest.com/refinance-student-loans.

Methodology

The study is based on proprietary data collected in November 2025, including an anonymous survey of 1,102 Americans conducted via Prolific and hosted on Qualtrics, as well as qualitative insights from five in-depth user interviews.

Disclaimer: The opinions expressed by the interview subjects are not necessarily those of Earnest. This post provides personal finance educational information, and it is not intended to provide legal, financial, or tax advice.

About Earnest

Since 2013, Earnest has empowered ambitious students and professionals through life's biggest financial milestones. Whether it's funding higher education, refinancing student debt as careers take off, or financing life's next chapter, we provide the right tools at the right time. We empower people on their journey from debt to wealth through flexible student loan refinancing and personal loans that help them take control and start building the life they envision.

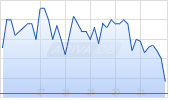

Earnest is a subsidiary of Navient (Nasdaq: NAVI).

Earnest Loans are made by Earnest Operations LLC. Earnest Operations LLC, NMLS #1204917. 300 Frank H. Ogawa Plaza, Suite 340, Oakland, CA 94612. California Financing Law License 6054788. Visit www.earnest.com/licenses for a full list of licensed states. For California residents: Loans will be arranged or made pursuant to a California Financing Law License.

Earnest student refinance loans are serviced by Earnest Operations LLC with support from Higher Education Loan Authority of the State of Missouri (MOHELA) (NMLS# 1442770). Earnest LLC and its subsidiaries, including Earnest Operations LLC, are not sponsored by agencies of the United States of America.

© 2026 Earnest LLC. All rights reserved.

Media contact:

Earnest PR

press@earnest.com

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/a-partners-finances-can-end-a-relationship-55-of-daters-surveyed-say-debt-can-be-a-dealbreaker-according-to-new-earnest-report-302677369.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/a-partners-finances-can-end-a-relationship-55-of-daters-surveyed-say-debt-can-be-a-dealbreaker-according-to-new-earnest-report-302677369.html

SOURCE Earnest

Für dich aus unserer Redaktion zusammengestellt

Dein Kommentar zum Artikel im Forum

Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte.