URBAN ONE, INC. REPORTS THIRD QUARTER 2025 RESULTS

SILVER SPRING, Md., Nov. 4, 2025

SILVER SPRING, Md., Nov. 4, 2025 /PRNewswire/ -- Urban One, Inc. (NASDAQ: UONEK and UONE) today reported its results for the three months ended September 30, 2025. For the three months ended September 30, 2025, net revenue was approximately $92.7 million, a decrease of 16.0% from the same period in 2024. The Company reported operating income of approximately $2.5 million for the three months ended September 30, 2025, compared to an operating loss of approximately $26.2 million for the three months ended September 30, 2024. Broadcast and digital operating income1 was approximately $20.0 million for the three months ended September 30, 2025, a decrease of 43.6% from the same period in 2024. Net loss was approximately $2.8 million or $(0.06) per share (basic) for the three months ended September 30, 2025 compared to net loss of approximately $31.8 million or $(0.68) per share (basic) for the same period in 2024. Adjusted EBITDA2 was approximately $14.2 million for the three months ended September 30, 2025, compared to approximately $25.4 million for the same period in 2024.

Alfred C. Liggins, III, Urban One's CEO and President stated, "Third quarter results came in slightly softer than expected across the board. Core radio, excluding political, finished down 8.1%, and our Radio segment is currently pacing down 30.2% all-in and 6.4% ex political for the fourth quarter of 2025. Revenues at our Reach Media and Digital segments were down 40.0% and 30.0% respectively, which was on the lower end of expectations. Cable TV advertising was down 5.4% and affiliate revenue was down 9.1% driven by continuing subscriber churn. In light of the soft overall market conditions, we are reducing our full year guidance from $60.0 million of Adjusted EBITDA2 to $56.0 to $58.0 million. Our focus remains on controlling costs, managing debt, leverage and liquidity. During the third quarter of 2025, we repurchased $4.5 million of our 2028 Notes at an average price of approximately 52.0% of par, reducing our outstanding debt balance to $487.8 million."

| | Three Months Ended | | Nine Months Ended | ||||

| | 2025 | | 2024 | | 2025 | | 2024 |

| | (unaudited) | | (unaudited) | ||||

| CONSOLIDATED STATEMENTS OF OPERATIONS | (in thousands, except share data) | | (in thousands, except share data) | ||||

| NET REVENUE | $ 92,677 | | $ 110,393 | | $ 276,543 | | $ 332,547 |

| OPERATING EXPENSES | | | | | | | |

| Programming and technical, excluding stock-based compensation | 34,705 | | 33,911 | | 93,950 | | 99,826 |

| Selling, general and administrative, excluding stock-based compensation(a) | 48,993 | | 53,466 | | 148,591 | | 169,174 |

| Stock-based compensation | 365 | | 1,152 | | 1,615 | | 3,615 |

| Depreciation and amortization | 6,104 | | 1,238 | | 11,942 | | 6,081 |

| Impairment of goodwill and intangible assets | — | | 46,823 | | 136,521 | | 127,581 |

| Total operating expenses | 90,167 | | 136,590 | | 392,619 | | 406,277 |

| Operating income (loss) | 2,510 | | (26,197) | | (116,076) | | (73,730) |

| INTEREST AND INVESTMENT INCOME | 512 | | 1,088 | | 2,094 | | 4,863 |

| INTEREST EXPENSE | (9,448) | | (11,649) | | (30,076) | | (37,051) |

| GAIN ON RETIREMENT OF DEBT | 2,125 | | 3,472 | | 44,009 | | 18,771 |

| OTHER INCOME, NET | 359 | | 74 | | 675 | | 974 |

| Loss from consolidated operations before benefit from income taxes | (3,942) | | (33,212) | | (99,374) | | (86,173) |

| BENEFIT FROM INCOME TAXES | 1,121 | | 1,814 | | 6,845 | | 17,824 |

| NET LOSS FROM CONSOLIDATED OPERATIONS | (2,821) | | (31,398) | | (92,529) | | (68,349) |

| LOSS FROM UNCONSOLIDATED JOINT VENTURE | — | | — | | — | | (411) |

| NET LOSS | (2,821) | | (31,398) | | (92,529) | | (68,760) |

| NET INCOME (LOSS) ATTRIBUTABLE TO NON-CONTROLLING INTERESTS | 9 | | 400 | | (55) | | 976 |

| NET LOSS ATTRIBUTABLE TO COMMON STOCKHOLDERS | $ (2,830) | | $ (31,798) | | $ (92,474) | | $ (69,736) |

| | | | | | | | |

| Weighted-average shares outstanding - basic3 | 44,366,979 | | 47,105,290 | | 44,631,511 | | 48,614,438 |

| Weighted-average shares outstanding - diluted4 | 44,366,979 | | 47,105,290 | | 44,631,511 | | 48,614,438 |

| |

| (a) Corporate selling, general and administrative expenses have been collapsed with Selling, general and administrative expenses in the consolidated statements of operations. |

Effective January 1, 2025, the Company modified the composition of two of our reportable segments to reflect changes in how they operate their business. The Company transferred the connected television ("CTV") offering within our Digital segment to our Cable Television segment. This change aligns the CTV offering with the results of operations within our Cable Television segment. Prior period Cable Television and Digital segment information has been reclassified to conform to the current period presentation. In addition, prior period segment information has been recast between the Sales and marketing and the General and administrative to conform the presentation of significant segment expenses used to evaluate performance by the Chief Operating Decision Maker ("CODM").

Detailed segment data for the three and nine months ended September 30, 2025 and 2024 is presented in the following tables:

| | Three Months Ended | ||||||||||

| | (in thousands) | ||||||||||

| | Consolidated | | Radio | | Reach Media | | Digital | | Cable | | Corporate/ |

| NET REVENUE | $ 92,677 | | $ 34,725 | | $ 6,147 | | $ 12,696 | | $ 39,790 | | $ (681) |

| Less: | | | | | | | | | | | |

| Programming and technical | 34,705 | | 14,275 | | 3,089 | | 3,238 | | 14,267 | | (164) |

| Sales and marketing | 28,234 | | 10,699 | | 2,624 | | 8,245 | | 7,161 | | (495) |

| General and administrative | 20,759 | | 7,011 | | 726 | | 484 | | 3,852 | | 8,686 |

| Add back: | | | | | | | | | | | |

| Severance-related costs | 1,620 | | 1,223 | | 83 | | 35 | | 6 | | 273 |

| Litigation settlement costs (c) | 3,078 | | 3,078 | | — | | — | | — | | — |

| Other costs(d) | 524 | | 77 | | — | | — | | — | | 447 |

| Adjusted EBITDA2 | $ 14,201 | | $ 7,118 | | $ (209) | | $ 764 | | $ 14,516 | | $ (7,988) |

| | |||||||||||

| | Three Months Ended | ||||||||||

| | (in thousands) | ||||||||||

| | Consolidated | | Radio | | Reach Media | | Digital (a) | | Cable | | Corporate/ |

| NET REVENUE | $ 110,393 | | $ 39,716 | | $ 10,247 | | $ 18,291 | | $ 42,797 | | $ (658) |

| Less: | | | | | | | | | | | |

| Programming and technical | 33,911 | | 11,779 | | 3,700 | | 3,481 | | 15,177 | | (226) |

| Sales and marketing (b) | 29,758 | | 13,896 | | 1,346 | | 8,147 | | 6,800 | | (431) |

| General and administrative (b) | 23,708 | | 8,006 | | 916 | | 660 | | 3,933 | | 10,193 |

| Add back/(deduct): | | | | | | | | | | | |

| Severance-related costs | 251 | | 145 | | — | | — | | — | | 106 |

| Other costs (income)(d) | 2,147 | | 1,215 | | (742) | | (720) | | — | | 2,394 |

| Adjusted EBITDA2 | $ 25,414 | | $ 7,395 | | $ 3,543 | | $ 5,283 | | $ 16,887 | | $ (7,694) |

| | |||||||||||

| | Nine Months Ended | ||||||||||

| | (in thousands) | ||||||||||

| | Consolidated | | Radio | | Reach Media | | Digital | | Cable | | Corporate/ |

| NET REVENUE | $ 276,543 | | $ 104,028 | | $ 17,315 | | $ 33,162 | | $ 124,053 | | $ (2,015) |

| OPERATING EXPENSES: | | | | | | | | | | | |

| Programming and technical | 93,950 | | 35,561 | | 9,635 | | 9,692 | | 39,548 | | (486) |

| Sales and marketing | 85,620 | | 35,634 | | 7,802 | | 21,604 | | 22,088 | | (1,508) |

| General and administrative | 62,971 | | 20,434 | | 2,487 | | 1,229 | | 11,258 | | 27,563 |

| Add back/(deduct): | | | | | | | | | | | |

| Severance-related costs | 1,839 | | 1,300 | | 198 | | 37 | | 6 | | 298 |

| Litigation settlement costs (c) | 3,078 | | 3,078 | | — | | — | | — | | — |

| Other costs (income)(d) | 2,099 | | 127 | | — | | 2 | | (1) | | 1,971 |

| Adjusted EBITDA2 | $ 41,018 | | $ 16,904 | | $ (2,411) | | $ 676 | | $ 51,164 | | $ (25,315) |

| | |||||||||||

| | Nine Months Ended | ||||||||||

| | (in thousands) | ||||||||||

| | Consolidated | | Radio | | Reach Media | | Digital (a) | | Cable | | Corporate/ |

| NET REVENUE | $ 332,547 | | $ 118,066 | | $ 37,648 | | $ 44,551 | | $ 134,113 | | $ (1,831) |

| Less: | | | | | | | | | | | |

| Programming and technical | 99,826 | | 34,543 | | 10,824 | | 10,504 | | 44,690 | | (735) |

| Sales and marketing (b) | 98,238 | | 38,451 | | 14,571 | | 21,342 | | 25,247 | | (1,373) |

| General and administrative (b) | 70,936 | | 23,733 | | 2,679 | | 1,641 | | 12,056 | | 30,827 |

| Add back/(deduct): | | | | | | | | | | | |

| Severance-related costs | 831 | | 264 | | — | | — | | 89 | | 478 |

| Other costs (income)(d) | 12,215 | | 922 | | (743) | | (720) | | — | | 12,756 |

| Adjusted EBITDA2 | $ 76,593 | | $ 22,525 | | $ 8,831 | | $ 10,344 | | $ 52,209 | | $ (17,316) |

| |

| (a) Effective January 1, 2025, segment information for the prior periods has been recast to include reclassification of a portion of revenues from our CTV offering from the Digital segment to the Cable Television segment. |

| (b) Effective January 1, 2025, prior period segment information has been recast between Sales and marketing and General and administrative to conform the presentation of significant expenses used to evaluate performance by the CODM. |

| (c) Non-recurring litigation settlement costs include an approximately $3.1 million charge related to the rate increase for royalties for historical periods due to the Radio Music Licensing Committee's settled litigation with Broadcast Music, Inc. and the American Society of Composers Authors and Publishers in August 2025. |

| (d) Other costs (income) include the remaining non-recurring costs (income) used to arrive at Adjusted EBITDA. |

| | Three Months Ended | | Nine Months Ended | |||

| | 2025 | 2024 | | 2025 | | 2024 |

| PER SHARE DATA - basic and diluted: | (in thousands, except per share data) | | (in thousands, except per share data) | |||

| Net loss attributable to common stockholders (basic) | $ (0.06) | $ (0.68) | | $ (2.07) | | $ (1.43) |

| Net loss attributable to common stockholders (diluted) | $ (0.06) | $ (0.68) | | $ (2.07) | | $ (1.43) |

| | | | | | | |

| Broadcast and digital operating income | $ 19,958 | $ 35,370 | | $ 68,638 | | $ 101,580 |

| | | | | | | |

| Broadcast and digital operating income reconciliation: | | | | | | |

| Net loss attributable to common stockholders | $ (2,830) | $ (31,798) | | $ (92,474) | | $ (69,736) |

| Add back/(deduct) certain non-broadcast and digital operating income items included in net loss: | | | | | | |

| Interest and investment income | (512) | (1,088) | | (2,094) | | (4,863) |

| Interest expense | 9,448 | 11,649 | | 30,076 | | 37,051 |

| Benefit from income taxes | (1,121) | (1,814) | | (6,845) | | (17,824) |

| Corporate selling, general and administrative expenses, excluding stock-based compensation | 10,979 | 12,354 | | 34,636 | | 38,033 |

| Stock-based compensation | 365 | 1,152 | | 1,615 | | 3,615 |

| Gain on retirement of debt | (2,125) | (3,472) | | (44,009) | | (18,771) |

| Other income, net | (359) | (74) | | (675) | | (974) |

| Loss from unconsolidated joint venture | — | — | | — | | 411 |

| Depreciation and amortization | 6,104 | 1,238 | | 11,942 | | 6,081 |

| Net income (loss) attributable to non-controlling interests | 9 | 400 | | (55) | | 976 |

| Impairment of goodwill and intangible assets | — | 46,823 | | 136,521 | | 127,581 |

| Broadcast and digital operating income | $ 19,958 | $ 35,370 | | $ 68,638 | | $ 101,580 |

| | | | | | | |

| Adjusted EBITDA2 | $ 14,201 | $ 25,414 | | $ 41,018 | | $ 76,593 |

| | | | | | | |

| Adjusted EBITDA2 reconciliation: | | | | | | |

| Net loss attributable to common stockholders | $ (2,830) | $ (31,798) | | $ (92,474) | | $ (69,736) |

| Interest and investment income | (512) | (1,088) | | (2,094) | | (4,863) |

| Interest expense | 9,448 | 11,649 | | 30,076 | | 37,051 |

| Benefit from income taxes | (1,121) | (1,814) | | (6,845) | | (17,824) |

| Depreciation and amortization | 6,104 | 1,238 | | 11,942 | | 6,081 |

| EBITDA | $ 11,089 | $ (21,813) | | $ (59,395) | | $ (49,291) |

| Stock-based compensation | 365 | 1,152 | | 1,615 | | 3,615 |

| Gain on retirement of debt | (2,125) | (3,472) | | (44,009) | | (18,771) |

| Other income, net | (359) | (74) | | (675) | | (974) |

| Loss from unconsolidated joint venture | — | — | | — | | 411 |

| Net income (loss) attributable to non-controlling interests | 9 | 400 | | (55) | | 976 |

| Corporate costs(a) | 524 | 1,385 | | 1,633 | | 10,232 |

| Litigation settlement costs(b) | 3,078 | — | | 3,078 | | — |

| Severance-related costs | 1,620 | 251 | | 1,839 | | 831 |

| Impairment of goodwill and intangible assets | — | 46,823 | | 136,521 | | 127,581 |

| Loss from ceased non-core businesses initiatives(c) | — | 762 | | 466 | | 1,983 |

| Adjusted EBITDA2 | $ 14,201 | $ 25,414 | | $ 41,018 | | $ 76,593 |

| |

| (a) Corporate costs primarily include professional fees related to the material weakness remediation efforts. |

| (b) Non-recurring litigation settlement costs include an approximately $3.1 million charge related to the rate increase for royalties for historical periods due to the Radio Music Licensing Committee's settled litigation with Broadcast Music, Inc. and the American Society of Composers Authors and Publishers in August 2025. |

| (c) In 2024, we made an immaterial change to the definition of Adjusted EBITDA2 by adding back the loss from ceased non-core operations. All historical periods were recast to reflect this immaterial change. |

| | September 30, | | December 31, |

| | (in thousands) | ||

| SELECTED CONSOLIDATED BALANCE SHEET DATA: | (Unaudited) | ||

| Cash and cash equivalents and restricted cash | $ 79,810 | | $ 137,574 |

| Intangible assets, net(a) | 340,185 | | 490,024 |

| Total assets | 723,476 | | 944,790 |

| Total debt (including current portion, net of issuance costs) | 484,278 | | 579,069 |

| Total liabilities | 642,058 | | 765,857 |

| Total stockholders' equity | 78,832 | | 170,945 |

| Redeemable non-controlling interests | 2,586 | | 7,988 |

| | |||

| (a) Intangible assets, net include Goodwill, Radio Broadcasting Licenses, net, Other Intangible Assets, net, and Launch Assets. | |||

| | |||

| | September 30, | | Applicable |

| SELECTED LEVERAGE DATA: | (in thousands) | | |

| 7.375% senior secured notes due February 2028, net of issuance costs of approximately $3.6 million (fixed rate) | $ 484,278 | | 7.375 % |

Cautionary Note Regarding Forward-Looking Statements

This press release includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements represent management's current expectations and are based upon information available to Urban One at the time of this release. These forward-looking statements involve known and unknown risks, uncertainties, and other factors, some of which are beyond Urban One's control, which may cause the actual results to differ materially from any future results, performance or achievements expressed or implied by such forward-looking statements. Important factors that could cause actual results to differ materially are described in Urban One's reports on Forms 10-K, 10-Q, 8-K and other filings with the Securities and Exchange Commission (the "SEC"). Urban One does not undertake any duty to update any forward-looking statements.

For the three months ended September 30, 2025, we recognized approximately $92.7 million in net revenue compared to approximately $110.4 million during the three months ended September 30, 2024. These amounts are net of agency commissions. We recognized approximately $34.7 million of revenue from our Radio Broadcasting segment during the three months ended September 30, 2025, compared to approximately $39.7 million for the three months ended September 30, 2024, a decrease of approximately $5.0 million primarily driven by weaker overall market demand from the national and local advertisers and non-returning political revenues. We recognized approximately $6.1 million of revenue from our Reach Media segment during the three months ended September 30, 2025, compared to approximately $10.2 million for the three months ended September 30, 2024, a decrease of approximately $4.1 million. The decrease was primarily driven by a decrease in national sales. We recognized approximately $12.7 million of revenue from our Digital segment during the three months ended September 30, 2025, compared to approximately $18.3 million during the three months ended September 30, 2024, a decrease of approximately $5.6 million. This decrease was primarily driven by the decrease in direct revenue streams and political revenue. We recognized approximately $39.8 million of revenue from our Cable Television segment during the three months ended September 30, 2025, compared to approximately $42.8 million during the three months ended September 30, 2024, a decrease of approximately $3.0 million. The decrease was primarily driven by the churn of subscribers and lower advertising sales.

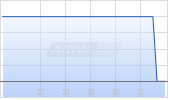

The following charts indicate the sources of our net revenues for the three months and year ended September 30, 2025:

| | Three Months Ended September 30, | | | | | ||

| | 2025 | | 2024 | | $ Change | | % Change |

| | | | | | | | |

| Net revenue: | (in thousands) | | | ||||

| Radio advertising | $ 38,123 | | $ 44,991 | | $ (6,868) | | (15.3) % |

| Political advertising | 201 | | 3,547 | | (3,346) | | (94.3) % |

| Digital advertising(a) | 12,685 | | 17,327 | | (4,642) | | (26.8) % |

| Cable Television advertising(a) | 22,674 | | 23,975 | | (1,301) | | (5.4) % |

| Cable Television affiliate fees | 17,089 | | 18,808 | | (1,719) | | (9.1) % |

| Event revenues & other | 1,905 | | 1,745 | | 160 | | 9.2 % |

| Net revenue | $ 92,677 | | $ 110,393 | | $ (17,716) | | (16.0) % |

| | Nine Months Ended September 30, | | | | | ||

| | 2025 | | 2024 | | $ Change | | % Change |

| | | | | | | | |

| Net revenue: | (in thousands) | | | ||||

| Radio advertising | $ 112,967 | | $ 131,753 | | $ (18,786) | | (14.3) % |

| Political advertising | 594 | | 6,935 | | (6,341) | | (91.4) % |

| Digital advertising(a) | 33,148 | | 43,209 | | (10,061) | | (23.3) % |

| Cable Television advertising(a) | 71,076 | | 75,104 | | (4,028) | | (5.4) % |

| Cable Television affiliate fees | 52,867 | | 58,910 | | (6,043) | | (10.3) % |

| Event revenues & other | 5,891 | | 16,636 | | (10,745) | | (64.6) % |

| Net revenue | $ 276,543 | | $ 332,547 | | $ (56,004) | | (16.8) % |

| |

| (a) Effective January 1, 2025, segment information for the prior periods has been recast to include reclassification of a portion of revenues from our CTV offering from the Digital segment to the Cable Television segment. |

Operating expenses, excluding depreciation and amortization, stock-based compensation, and impairment of goodwill and intangible assets, were approximately $83.7 million for the three months ended September 30, 2025, compared to approximately $87.4 million for the comparable period in 2024. The overall decrease in operating expenses was primarily due to lower expenses across most segments and lower third-party professional fees.

There was no impairment of goodwill and intangible assets during the three months ended September 30, 2025. The Company recorded impairment of goodwill and intangible assets of approximately $46.8 million for the three months ended September 30, 2024. The impairment loss of approximately $46.8 million during the three months ended September 30, 2024 was associated with the impairment of broadcasting licenses within the Radio Broadcasting segment and the TV One Trade Name. The primary factors leading to the impairments were an increase in discount rate, continued decline of projected gross market revenues for Radio Broadcasting, projected revenues for TV One and a decline in operating profit margin.

Depreciation and amortization expense was approximately $6.1 million for the three months ended September 30, 2025, compared to approximately $1.2 million for the three months ended September 30, 2024, an increase of approximately $4.9 million due to the TV One Trade Name amortization and radio broadcasting license amortization as a result of the Company's change from indefinite-lived to a finite-lived intangible asset in 2025.

Interest and investment income was approximately $0.5 million for the three months ended September 30, 2025, compared to approximately $1.1 million for the three months ended September 30, 2024. The decrease was driven by lower cash and cash equivalents balances during the three months ended September 30, 2025, than in the corresponding period in 2024.

Interest expense was approximately $9.4 million for the three months ended September 30, 2025, compared to approximately $11.6 million for the three months ended September 30, 2024, a decrease of approximately $2.2 million. During the three months ended September 30, 2025, the Company repurchased approximately $4.5 million of its 2028 Notes at a weighted average price of approximately 52.0% of par, resulting in a net gain on retirement of debt of approximately $2.1 million.

For the three months ended September 30, 2025, we recorded a benefit from income taxes of approximately $1.1 million on the pre-tax loss of approximately $3.9 million resulting with an annual effective tax rate of 28.4%. For the three months ended September 30, 2024, we recorded a benefit from income taxes of approximately $1.8 million on pre-tax loss of approximately $33.2 million resulting with an annual effective tax rate of 5.5%. This rate includes $2.9 million of discrete tax expense primarily related to return to provision adjustments, changes in valuation allowance for certain of our state net operation losses, and stock-based compensation.

Other pertinent financial information includes capital expenditures of approximately $3.1 million and $1.6 million for the three months ended September 30, 2025 and 2024, respectively.

During the three months ended September 30, 2025, the Company repurchased 176,591 shares of Class A Common Stock of approximately $0.3 million at an average price of $1.75 per share. During the three months ended September 30, 2025, the Company repurchased 592,822 shares of Class D Common Stock in the amount of approximately $0.4 million at an average price of $0.73 per share. During the three months ended September 30, 2024, the Company repurchased 1,015,023 shares of Class A Common Stock in the amount of approximately $2.0 million at an average price of $2.01 per share and repurchased 586,989 shares of Class D Common Stock in the amount of approximately $0.8 million at an average price of $1.31 per share.

Supplemental Financial Information:

For comparative purposes, the following more detailed statements of operations for the three months September 30, 2025 are included.

| | Three Months Ended September 30, 2025 | ||||||||||

| | (in thousands) | ||||||||||

| | Consolidated | | Radio Broadcasting | | Reach Media | | Digital | | Cable Television | | All Other - Corporate/ Eliminations |

| NET REVENUE | $ 92,677 | | $ 34,725 | | $ 6,147 | | $ 12,696 | | $ 39,790 | | $ (681) |

| OPERATING EXPENSES: | | | | | | | | | | | |

| Programming and technical | 34,705 | | 14,275 | | 3,089 | | 3,238 | | 14,267 | | (164) |

| Selling, general and administrative (a) | 48,993 | | 17,710 | | 3,350 | | 8,729 | | 11,013 | | 8,191 |

| Stock-based compensation | 365 | | 141 | | 23 | | 48 | | 7 | | 146 |

| Depreciation and amortization | 6,104 | | 4,807 | | 37 | | 393 | | 689 | | 178 |

| Total operating expenses | 90,167 | | 36,933 | | 6,499 | | 12,408 | | 25,976 | | 8,351 |

| Operating income (loss) | 2,510 | | (2,208) | | (352) | | 288 | | 13,814 | | (9,032) |

| INTEREST AND INVESTMENT INCOME | 512 | | — | | — | | — | | — | | 512 |

| INTEREST EXPENSE | (9,448) | | (2) | | — | | — | | — | | (9,446) |

| GAIN ON RETIREMENT OF DEBT | 2,125 | | — | | — | | — | | — | | 2,125 |

| OTHER INCOME, NET | 359 | | 350 | | — | | — | | — | | 9 |

| (Loss) income from consolidated operations before benefit from (provision for) income taxes | (3,942) | | (1,860) | | (352) | | 288 | | 13,814 | | (15,832) |

| BENEFIT FROM (PROVISION FOR) INCOME TAXES | 1,121 | | 5,314 | | 245 | | 314 | | (3,021) | | (1,731) |

| NET (LOSS) INCOME | (2,821) | | 3,454 | | (107) | | 602 | | 10,793 | | (17,563) |

| NET INCOME ATTRIBUTABLE TO NON-CONTROLLING INTERESTS | 9 | | — | | 9 | | — | | — | | — |

| NET (LOSS) INCOME ATTRIBUTABLE TO COMMON STOCKHOLDERS | $ (2,830) | | $ 3,454 | | $ (116) | | $ 602 | | $ 10,793 | | $ (17,563) |

| Adjusted EBITDA2 | $ 14,201 | | $ 7,118 | | $ (209) | | $ 764 | | $ 14,516 | | $ (7,988) |

| |

| (a) Corporate selling, general and administrative expenses have been collapsed with Selling, general and administrative expenses in the consolidated statements of operations. |

| | Three Months Ended September 30, 2024 | ||||||||||

| | (in thousands) | ||||||||||

| | Consolidated | | Radio Broadcasting | | Reach Media | | Digital (a) | | Cable Television (a) | | All Other - Corporate/ Eliminations |

| NET REVENUE | $ 110,393 | | $ 39,716 | | $ 10,247 | | $ 18,291 | | $ 42,797 | | $ (658) |

| OPERATING EXPENSES: | | | | | | | | | | | |

| Programming and technical | 33,911 | | 11,779 | | 3,700 | | 3,481 | | 15,177 | | (226) |

| Selling, general and administrative (b, c) | 53,466 | | 21,902 | | 2,263 | | 8,806 | | 10,733 | | 9,762 |

| Stock-based compensation | 1,152 | | 125 | | 28 | | 56 | | 21 | | 922 |

| Depreciation and amortization | 1,238 | | 509 | | 39 | | 401 | | 47 | | 242 |

| Impairment of goodwill and intangible assets | 46,823 | | 37,734 | | — | | — | | 9,089 | | — |

| Total operating expenses | 136,590 | | 72,049 | | 6,030 | | 12,744 | | 35,067 | | 10,700 |

| Operating (loss) income | (26,197) | | (32,333) | | 4,217 | | 5,547 | | 7,730 | | (11,358) |

| INTEREST AND INVESTMENT INCOME | 1,088 | | — | | — | | — | | — | | 1,088 |

| INTEREST EXPENSE | (11,649) | | (58) | | — | | — | | — | | (11,591) |

| GAIN ON RETIREMENT OF DEBT | 3,472 | | — | | — | | — | | — | | 3,472 |

| OTHER INCOME (LOSS), NET | 74 | | (12) | | — | | — | | — | | 86 |

| (Loss) income from consolidated operations before benefit from (provision for) income taxes | (33,212) | | (32,403) | | 4,217 | | 5,547 | | 7,730 | | (18,303) |

| BENEFIT FROM (PROVISION FOR) INCOME TAXES | 1,814 | | 2,344 | | (941) | | (380) | | (1,218) | | 2,009 |

| NET (LOSS) INCOME | (31,398) | | (30,059) | | 3,276 | | 5,167 | | 6,512 | | (16,294) |

| NET INCOME ATTRIBUTABLE TO NON-CONTROLLING INTERESTS | 400 | | — | | — | | — | | — | | 400 |

| NET (LOSS) INCOME ATTRIBUTABLE TO COMMON STOCKHOLDERS | $ (31,798) | | $ (30,059) | | $ 3,276 | | $ 5,167 | | $ 6,512 | | $ (16,694) |

| Adjusted EBITDA2 | $ 25,414 | | $ 7,395 | | $ 3,543 | | $ 5,283 | | $ 16,887 | | $ (7,694) |

| |

| (a) Effective January 1, 2025, segment information for the prior periods has been recast to include reclassification of a portion of revenues from our CTV offering from Digital to Cable Television. |

| (b) Corporate selling, general and administrative expenses have been collapsed with Selling, general and administrative expenses in the consolidated statements of operations. |

| (c) Effective January 1, 2025, prior period segment information has been realigned between the Sales and marketing and the General and administrative significant segment expenses in this Quarterly Report on Form 10-Q. This provides the CODM with a more appropriate alignment of significant segment expenses used to evaluate segment performance. |

| | Nine Months Ended September 30, 2025 | ||||||||||

| | (in thousands) | ||||||||||

| | Consolidated | | Radio Broadcasting | | Reach Media | | Digital | | Cable Television | | All Other - Corporate/ Eliminations |

| NET REVENUE | $ 276,543 | | $ 104,028 | | $ 17,315 | | $ 33,162 | | $ 124,053 | | $ (2,015) Für dich aus unserer Redaktion zusammengestelltHinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte. Weitere Artikel des AutorsThemen im Trend |