Invesco Provides Estimated Capital Gain Distribution Information for 2025

ATLANTA, Nov. 20, 2025

ATLANTA, Nov. 20, 2025 /PRNewswire/ -- Invesco Ltd. (NYSE: IVZ), a leading global provider of exchange-traded funds (ETFs), announced today that it expects to deliver capital gains distributions to the following Invesco ETFs.1

For the funds listed in the Table, the ex-date for the 2025 capital gains distributions will be Monday, December 22, 2025. The record date will be Monday, December 22, 2025, and the payable date will be Friday, December 26, 2025.

Table

| Ticker | Fund Name | Estimated | Estimated | Total Capital Gain |

| PIN | Invesco India ETF | - | 1.68 | 1.68 |

| PSCI | Invesco S&P SmallCap Industrials ETF | 0.16 | 1.36 | 1.52 |

| IDMO | Invesco S&P International Developed Momentum ETF | 0.74 | 0.30 | 1.04 |

| IVRA | Invesco Real Assets ESG ETF | 0.47 | - | 0.47 |

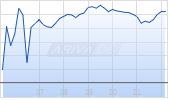

| PBP | Invesco S&P 500 BuyWrite ETF | - | 0.18 | 0.18 |

| MTRA | Invesco International Growth Focus ETF | 0.15 | - | 0.15 |

| IQSZ | Invesco Global Equity Net Zero ETF | 0.10 | - | 0.10 |

| BSJX | Invesco BulletShares 2033 High Yield Corporate Bond ETF | 0.08 | - | 0.08 |

| HIYS | Invesco High Yield Select ETF | - | 0.07 | 0.07 |

| GTOC | Invesco Core Fixed Income ETF | 0.03 | - | 0.03 |

| BSJW | Invesco BulletShares 2032 High Yield Corporate Bond ETF | 0.02 | - | 0.02 |

| |

| 1 Estimated capital gains and Funds information presented here is not final; these are initial estimates as of October 31, 2025 and will change based on market volatility, portfolio and shareholder activity and tax adjustments. Estimates are also not provided for BulletShares Funds liquidating in December. |

| |

For more information regarding the taxation of Invesco ETFs, please visit the Invesco ETF Tax Center. Invesco ETFs does not offer tax advice. Please consult your tax adviser for information regarding your own personal tax situation.

For additional information, shareholders of the ETFs which are scheduled for changes may call Invesco at 800-983-0903 or ETFInvestor@Invesco.com.

For media questions please call 212-829-7324.

About Invesco Ltd.

Invesco Ltd. is one of the world's leading asset management firms with over 8,300 employees helping clients in more than 120 countries. With $2.1 trillion in assets under management as of Sept. 30, 2025, we deliver a comprehensive range of active, passive and alternative investment capabilities. Our collaborative mindset, breadth of solutions and global scale mean we're well positioned to help retail and institutional investors rethink challenges and find new possibilities for success. For more information, visit www.invesco.com.

Important Information

ETFs trade like stocks, fluctuate in market value and may trade at prices above or below the ETF's net asset value. Brokerage commissions and ETF expenses will reduce returns.

ETF shares may be bought or sold throughout the day at their market price, not their Net Asset Value (NAV), on the exchange on which they are listed. Shares of ETFs are tradable on secondary markets and may trade either at a premium or a discount to their NAV on the secondary market.

Because the Shares are traded in the secondary market, a Broker may charge a commission to execute a transaction in Shares, and an investor also may incur the cost of the spread between the price at which a dealer will buy Shares and the somewhat higher price at which a dealer will sell Shares.

There are risks involved with investing in ETFs, including possible loss of money. Index-based ETFs are not actively managed. Actively managed ETFs do not necessarily seek to replicate the performance of a specified index. Both index-based and actively managed ETFs are subject to risks similar to stocks, including those related to short selling and margin maintenance. Ordinary brokerage commissions apply. The Fund's return may not match the return of the Index. The Funds are subject to certain other risks. Please see the current prospectus for more information regarding the risk associated with an investment in the Funds.

Shares are not individually redeemable and owners of the Shares may acquire those Shares from the Fund and tender those Shares for redemption to the Fund in Creation Unit aggregations only, typically consisting of 10,000, 20,000, 25,000, 50,000, 80,000, 100,000 or 150,000 Shares.

This does not constitute a recommendation of any investment strategy or product for a particular investor. Investors should consult a financial professional before making any investment decisions.

Before investing, investors should carefully read the prospectus/summary prospectus and carefully consider the investment objectives, risks, charges and expenses. For this and more complete information about the Fund call 800 983 0903 or visit invesco.com for the prospectus/summary prospectus.

Invesco Distributors, Inc. is the US distributor for Invesco's retail products and private placements; and is an indirect, wholly owned subsidiary of Invesco Ltd.

NA4886050 11/25

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/invesco-provides-estimated-capital-gain-distribution-information-for-2025-302621383.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/invesco-provides-estimated-capital-gain-distribution-information-for-2025-302621383.html

SOURCE Invesco Ltd.

Für dich aus unserer Redaktion zusammengestellt

Dein Kommentar zum Artikel im Forum

Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte.

![Invesco S&P 500 BuyWrite ETF [ETF] Chart Invesco S&P 500 BuyWrite ETF [ETF] Chart](https://www.ariva.de/chart/images/chart.png?z=a135802026~b40~w170x100~Uintraday~YP0~YQ0)

![Invesco S&P SmallCap Industrials ETF [Common Shares] Chart Invesco S&P SmallCap Industrials ETF [Common Shares] Chart](https://www.ariva.de/chart/images/chart.png?z=a135802170~b40~w170x100~Uintraday~YP0~YQ0)