Aufrufe: 40

Aufrufe: 40

Kirby McInerney LLP Announces the Filing of a Securities Class Action on Behalf of DMC Global Inc. Investors (BOOM)

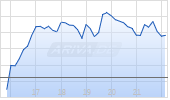

On October 21, 2024, after market close, DMC Global issued a press release entitled, "DMC Global Provides Business and Strategic Review Update, Announced Governance Changes," which revealed that "third quarter sales are expected to be approximately $152 million versus prior guidance of $158 million to $168 million." The results reflect weaker-than-expected sales at both Arcadia Products ("Arcadia"), DMC Global's architectural building products business, and DynaEnergetics, DMC Global's energy products business. The press release further announced that its third quarter financial results will include an approximately $142 million non-cash goodwill impairment charge associated with DMC Global's December 2021 acquisition of a controlling interest in Arcadia coupled with Arcadia's recent financial performance and near-term outlook. On this news, DMC Global shares declined by $2.36 per share, or approximately 18%, from $12.93 per share on October 21, 2024, to close at $10.57 on October 22, 2024.

Then, on November 4, 2024, after market close, DMC Global issued another press release entitled, "DMC Global Reports Third Quarter Financial Results," in which it reported Q3 2024 sales of $152.4 million, a $159.4 million net loss, and adjusted EBITDA of $5.7 million. On this news, the price of DMC Global shares declined by $0.59 per share, from $9.84 per share on November 4, 2024, to close at $9.25 per share the next (Next Aktie) day.

The Complaint alleges that defendants, throughout the Class Period, made false and/or misleading statements and/or failed to disclose that: (1) the goodwill associated with the Company's principal business segment, Arcadia, was overstated due to the adverse events and circumstances affecting that reporting segment; (2) DMC Global's materially inadequate internal systems and processes were adversely affecting its operations; (3) the Company's inadequate systems and processes prevented it from ensuring reasonably accurate guidance and that its public disclosures were timely, accurate, and complete; and (4) as a result, defendants misrepresented DMC Global's operations and financial results.

If you purchased or otherwise acquired DMC Global securities, have information, or would like to learn more about this investigation, please contact Thomas W. Elrod of Kirby McInerney LLP by email at investigations@kmllp.com, or by filling out this CONTACT FORM, to discuss your rights or interests with respect to these matters without any cost to you.

Kirby McInerney LLP is a New York-based plaintiffs' law firm concentrating in securities, antitrust, whistleblower, and consumer litigation. The firm's efforts on behalf of shareholders in securities litigation have resulted in recoveries totaling billions of dollars. Additional information about the firm can be found at Kirby McInerney LLP's website.

This press release may be considered Attorney Advertising in some jurisdictions under the applicable law and ethical rules.

Contacts

Kirby McInerney LLP

Thomas W. Elrod, Esq.

212-699-1180

https://www.kmllp.com

investigations@kmllp.com

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/233120

Für dich aus unserer Redaktion zusammengestellt

Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte.