Aufrufe: 53

Aufrufe: 53

Cannae Holdings, Inc. Files Definitive Proxy Materials In Connection with December 12, 2025 Annual Meeting

Cannae is urging all shareholders to vote on the WHITE proxy card and to protect their investment by voting “FOR” ONLY Cannae’s four highly qualified and experienced director nominees (Erika Meinhardt, Barry B. Moullet, James B. Stallings, Jr., and Frank P. Willey). All Cannae shareholders of record as of the close of business on October 30, 2025, will be entitled to vote at the Annual Meeting.

The Company’s Board of Directors (the “Board”) also issued the following letter to shareholders in connection with the filing.

Fellow Shareholders,

It is an exciting time to be a Cannae shareholder. Last year, your Board and management team announced a clear and comprehensive plan to enhance long term shareholder value. Our strategy represents a decisive shift in our investment and capital allocation philosophies. More specifically, we:

- Rebalanced our portfolio away from certain of our existing public investments to opportunistically reinvest in proprietary private investments that we believe will deliver outsized shareholder returns and grow net asset value;

- Returned capital to shareholders through continued share buybacks at a discount to net asset value and our newly instituted quarterly dividend; and

- Worked with our portfolio companies on strategic initiativesandimproving financial performance.

In furtherance of these efforts, the Board recently directed management to continue concentrating our efforts where Cannae has a durable edge: in sports and related assets. That means owning or exerting meaningful influence over teams and ventures in the sports ecosystem alongside related businesses. For example, and as indicated below, Cannae’s investment in Black Knight Football has been a remarkable success. Furthermore, the Board directed management to dispose of a number of non-core assets in public and private companies to take advantage of expiring tax benefits and maintain the capital return discipline and the financial flexibility that underpins Cannae’s broader strategy.

In parallel with these strategic and operational initiatives, we enhanced our leadership and governance structure, including internalization of Cannae’s management function, to strengthen oversight, improve shareholder alignment, and ensure effective execution of this transformation to deliver long term shareholder returns.

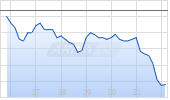

We made significant progress on each of these initiatives, and the market has responded positively. The discount to our net asset value narrowed by approximately 20% from its 44% average over the 12-month period ended January 31, 2024, before the announced strategic changes1, clearly indicating that our plan is working and creating value for shareholders. We are proud of our progress to date and believe that Cannae is well positioned to sustain this momentum into the future.

At the upcoming annual meeting of shareholders on December 12, 2025, you will have an important decision to make about Cannae’s future. This year, Carronade Capital, a hedge fund typically focused on distressed debt, is seeking to replace four of Cannae’s highly experienced independent directors, representing one-third of our Board of Directors.

Your vote will determine whether our momentum in pursuing long term shareholder value continues. We urge you to protect your investment by voting “FOR” ONLY Cannae’s four highly qualified and experienced director nominees (Erika Meinhardt, Barry B. Moullet, James B. Stallings, Jr., and Frank P. Willey).

Cannae is a Leading Permanent Capital Vehicle

Cannae provides public market investors with access to compelling investment opportunities through its ownership stakes in a portfolio of operating companies. We believe that our ability to leverage permanent capital and duration enables us to optimize investment returns across the portfolio. We operate as a long-term owner that seeks to secure control and governance rights in our portfolio companies to steward our investments and enhance the value of the underlying businesses. We have no preset time constraints dictating when we sell or dispose of our businesses, as we seek to maximize returns. Our strategy has generated $3.3 billion of net investment gains representing a multiple on invested capital of 2.0x since inception.

Rebalancing Our Portfolio

Over the past 21 months, we have reshaped our portfolio to provide our public market investors with capital returns and access to proprietary investment opportunities that we believe will deliver outsized returns. Today, these proprietary private investments constitute approximately 80% of our net asset value, an increase from approximately 30% in February 2024, when the plan was announced. We believe this shift provides our investors with unique investments that will grow net asset value and drive outsized shareholder returns.

Strategic Disposition of Public Assets

Since 2024, we have opportunistically sold significant stakes of our largest public equity holdings, allowing us to strategically reinvest and increase shareholder capital return.

In 2024, we raised $470 million through share sales of our public portfolio companies Dun & Bradstreet (“DNB”), Alight, Dayforce, and Paysafe. A majority of these proceeds were used for conducting share buybacks, dividends, and investments in attractive, high-returning private company investments, as well as paying down high-cost debt.

Our momentum continued into 2025. In the second and third quarters, we sold the remaining stake in DNB, our largest public investment, in connection with its sale to Clearlake Capital valued at $7.7 billion. The sale generated additional net proceeds to Cannae of $630 million.

In total, we have generated $1.1 billion in proceeds from investment sales since 2024. These actions have enabled us to continue aggressively returning capital to our shareholders while also opportunistically reinvesting capital in select attractive proprietary opportunities.

Proprietary Private Market Investments

Cannae has delivered on its commitment to invest in high-quality proprietary private companies. Cannae has bought significant ownership stakes in these investments, securing meaningful governance rights and the ability to work with management to drive returns. Recent highlights include:

- Entered into a strategic partnership with JANA Partners to acquire 50% of the management company, while also positioning Cannae to unlock a new stream of investment opportunities via JANA’s proprietary pipeline. JANA has built an impressive track record over its 24-year history as a leader in engaged investing. We believe the business is well positioned for future growth in assets under management and strong returns. Through our partnership and ownership of the management company, JANA has already provided cash flows and also surfaced multiple unique investment opportunities for Cannae. Following purchase of an initial 20% stake in 2024, we closed on an additional 30% stake in September 2025, lifting Cannae’s ownership share to 50%.

- Acquired a 53% stake in the Watkins Company for $80 million, including $20 million in convertible preferred equity with 8% annual dividend payments. The Watkins Company is a 157-year-old leading producer of high-quality flavoring products, one of the highest growth categories in the U.S. food industry. The company has a strong brand, with proven on-shelf and financial performance and is well positioned for continued market share growth in both the extract and spices categories.

- Invested approximately $86 million in Black Knight Football Club US, LP (“Black Knight Football”), which owns 100% of the equity interests of A.F.C. Bournemouth (“Bournemouth”) of the English Premier League and has interest in clubs in the top leagues of France, Portugal, and Scotland. As discussed below, Black Knight Football continues to perform strongly since our initial investment in December 2022.

Returning Capital to Shareholders

We have executed a significant capital return program, distributing more than $540 million to shareholders since February 2024 through dividends and share repurchases. Recent highlights include:

- Returned nearly $500 million via share repurchases representing ~34% of Cannae’s outstanding common stock since February 2024, including $228 million in 2024 and approximately $270 million thus far in 2025. We expect to achieve the previously announced $300 million repurchase target in conjunction with the DNB sale by the end of the year. We executed the share purchases at a discount to net asset value, which we believe represents an attractive use of our capital.

- Instituted a dividend in 2024 to provide shareholders with an ongoing return of capital as Cannae executes its long-term strategic plan. To date, the dividend has returned a total of approximately $46 million to shareholders. The Board approved a 25% increase in Cannae’s quarterly dividend to $0.60 per share annually in August 2025.

Working with Portfolio Companies to Improve Financial Performance

Our management team and Board continuously partner with the leadership teams of our portfolio companies to improve revenues, expand margins, execute strategic transactions, and increase long-term enterprise value. Highlights include:

- Worked with Black Knight Football on improving operations, enhancing facilities, expanding teams under ownership, improving sporting performance, and driving enterprise value growth. Today, Black Knight Football is a leading global football operator. It integrates operations across the group of teams, which includes ownership of Bournemouth in the Premier League, FC Lorient in French Ligue 1, Moreirense FC in Portugal’s Primera Liga, and Hibernian FC of the Scottish Premiership. At Bournemouth,post-investment,Cannae quickly worked to improve key areas of the club including investment in key players to improve on-field performance, as well as hiring new management including a new president of business, president of football and head coach. These investments have worked as evidenced by: (i) revenue increasing by nearly 30% since our acquisition, (ii) an ascension in the Premier League table from 15th in the 2023/24 season to 9th in the 2024/25 season and now to 5th in the 2025/26 season as of the date of this letter and (iii) in summer 2025, Bournemouth had a historic transfer window which generated a combined net profit of over $120 million through player sales demonstrating the success of early player investments. Based on reported transfer fees for the 2025 summer transfer window, Bournemouth had the second highest net profit on player trading in all of European football.

Cannae has helped Bournemouth improve infrastructure, including in 2025 opening a new world-leading performance center and completing the acquisition of Vitality Stadium, Bournemouth’s home since 1910. Bournemouth has commenced a stadium redevelopment at Vitality that will grow capacity from 11,300 to over 20,200 seats, add more hospitality and significantly enhance matchday experience at an attractive return on investment. In May 2025, Bournemouth was included in Sportico’s annual list of the World’s 50 Most Valuable Football Clubs for the first time in the club’s history, at a $630 million value based on its 2023/24 season revenue.

- Worked with the DNB management team to achieve improved results leading to DNB’s sale to Clearlake Capital for $7.7 billion. Since taking DNB private in 2019, we replaced management, reduced the company’s expense structure, and improved operations, resulting in approximately 40% revenue growth, 60% EBITDA growth, and almost 600 basis points of margin expansion while reducing leverage from 9x to 3.6x. These changes resulted in DNB’s sale, which delivered significant capital to Cannae and its shareholders.

- Working with Computer Services, Inc. (CSI) management team to grow the company, expand its offerings, and increase cash flows. Since the investment in November 2022, CSI has closed multiple acquisitions, launched several new products and partnerships, and obtained a strategic investment from TA Associates, a leading private equity firm. In conjunction with the TA transaction, Cannae received a $37 million distribution, equal to 43% of the initial capital invested, while the remaining $49 million of invested capital is now marked at $104 million, representing an increase of 111%.

Leadership and Governance Enhancements

Cannae regularly reviews and enhances its leadership and governance structure. Recent actions include:

- Refreshed the Board by adding three highly qualified independent directors since 2024. Each of these new directors brings deep financial, investing, and governance experience to our Board, strengthening the oversight of Cannae’s business, strategy, and operations. Doug Ammerman, who joined our Board in 2024, now serves as Chairman of the Board. William Royan, who joined our Board in 2025, serves on the Related Person Transaction Committee and Corporate Governance and Nominating Committee, and Woodrow Tyler, who joined our Board in 2025, serves on the Related Person Transaction Committee.

- Initiated declassification of the Board. Pending approval by shareholders at the annual meeting, our directors will be annually elected, beginning with the class up for election in 2026.

- Executed an executive leadership and Board transition through the appointment of a new Chief Executive Officer and the transition of William Foley to Vice Chairman of the Board. Ryan Caswell, who was previously our President, has been appointed as our Chief Executive Officer. Mr. Foley, who was previously our Chairman, now serves as our Vice Chairman of the Board, where he will continue to support Cannae’s strategic investment activities focusing on our sports and entertainment and spirits businesses.

- Eliminated the external manager structure. The Board transitioned from our external manager structure in 2024, reducing ongoing management fees from $37.7 million in 2023 to $7.6 million annually beginning in the third quarter of 2024. As part of the shift to an internal management structure, the majority of the compensation for our key executives is comprised of restricted stock to create greater alignment with our shareholders.

Carronade is Not Aligned with Other Shareholders

Carronade Capital, a hedge fund typically focused on distressed debt, is seeking to replace four of Cannae’s highly experienced independent directors, representing one-third of the Board. We are committed to constructive dialogue with all of our shareholders, including Carronade, and have sought to engage to understand its views on the company, its strategy, and its path forward. Notably, Carronade is not a long-term shareholder of Cannae. Carronade purchased its first shares in September 2024, and first contacted Cannae in December 2024, nearly a year after Cannae began implementing its strategic transformation.

Carronade is late to arrive – and its activist campaign largely mirrors the same ideas that Cannae has already been implementing as part of its February 2024 strategic plan.

- Reduction of public company holdings on an accelerated timeline: Already executed.

We have delivered $1.1 billion in investment sale proceeds since 2024, and have reshaped 80% of our portfolio’s net asset value towards proprietary private investment opportunities.

- Return of capital to shareholders: Already executed.

We have distributed more than $540 million to shareholders since February 2024 through dividend and share repurchases.

- Implementation of cost reduction program: Already executed.

We have reduced operating cost and further aligned incentives with shareholders by internalization of the management function, reducing management fees from $37.7 million in 2023 to $7.6 million on a go-forward basis.

- Performance-based compensation for management: Already executed.

Performance-based earnouts are a significant—and defining—feature of our compensation plan. Dayforce, which returned 5x our invested capital and generated nearly $2 billion in investment gains, was the primary driver of our Investment Success Incentive Payments structure and, as a direct result of that success, contributed over 30% of aggregate compensation paid since 2017.

The extensive support from our shareholders and leading proxy advisor ISS underlines the quality of our compensation program. Over the last 5 years, ISS has consistently recommended in favor of our advisory vote on executive compensation (say-on-pay) and we have received average shareholder support of 90% over that time.

- Addition of new independent directors to the Board: Already executed.

Three new independent directors have joined since 2024. They now hold key leadership and oversight roles, including as Chairman of the Board, on the Related Person Transaction Committee, and on the Corporate Governance and Nominating Committee.

To date, Carronade has failed to present new ideas to drive sustained shareholder value. In this context, Carronade has nominated a slate of directors without the relevant experience to manage Cannae and its portfolio companies. Carronade’s attempt to replace four of your highly experienced directors, who have each played a critical role in overseeing Cannae’s strategic priorities, puts your investment at risk.

Cannae’s Strategic Fit-For-Purpose Board is Superior to Carronade’s Nominees

Cannae’s permanent capital business model requires a Board with long-term operational and relevant industry experience, investing acumen, and proven-public company oversight. Our four director nominees fully represent these qualifications.

In contrast, based on publicly available biographies, Carronade’s nominees have limited public company operating experience, limited industry experience relevant to our portfolio, and no demonstrated track record of creating shareholder value in companies like Cannae. In fact, they appear to have shared backgrounds or connections in distressed debt, which is irrelevant to the current needs of Cannae’s Board. Replacing directors now would inject execution risk just as our strategy is providing meaningful results and the net asset value discount is narrowing.

As indicated below, on a seat-by-seat basis, we believe Cannae’s nominated directors are far superior to Carronade’s candidates:

- Barry Moullet: With a career highlighted by executive roles at Darden Restaurants and Focus Brands Inc., Mr. Moullet provides extensive operational leadership with a focus on foodservice operations, procurement, and cost and vendor discipline. Mr. Moullet’s experience is further deepened by his work at BBM Executive Insights, a consulting firm he founded to optimize supply chain management for foodservice clients. This expertise gives him crucial insights that directly benefit our restaurant portfolio.

- By contrast, Carronade nominee Dennis Prieto has no industry experience relevant to our portfolio, no public company board experience, and no public company leadership experience. His primary expertise in distressed debt and restructuring, which stems from his time working alongside Carronade principal, Dan Gopper at distressed credit firm Aurelius Capital Management, is not relevant to Cannae or its portfolio companies.

- James Stallings: Mr. Stallings’ career covers a wide spectrum of the technology sector, focusing on enterprise systems, technology modernization, risk, and cybersecurity mitigation. Mr. Stallings has established himself as an entrepreneur, held leadership roles at IBM (NYSE: IBM), and built a successful career as an investor. Mr. Stallings serves on the board of Fidelity National Information Services (NYSE: FIS), where he has overseen significant M&A transactions. Mr. Stallings’ deep strategy, leadership, and investing experience in an industry directly relevant to our portfolio enhances our oversight, uncovers emerging investments opportunities, and provides a critical operational perspective in our boardroom.

- By contrast, Carronade nominee Mona Aboelnaga Kanaan has no relevant sector expertise, with a generalist investment background, and lacks both the public company leadership and industry experience needed to guide our companies. Her unsuccessful tenure as Chief Executive Officer of Proctor Investment Management, and dismal track record as a director of Perpetual Limited, Webster Financial, and Mondee Holdings, raise significant concern.

- Erika Meinhardt: Ms. Meinhardt brings over 30 years of operational and executive leadership to our Board with a focus on operations, human capital, and execution discipline. Ms. Meinhardt’s proven track record managing and growing complex public company operations, highlighted by her role transforming FNF into the largest U.S. title insurance underwriter with margins above its peers, benefits the Board and management team.

- By contrast, Carronade nominee Benjamin Duster has no public company leadership experience and has a history of short-term director stints, serving on 12 public boards over the last 15 years. His directorships include Republic First Bancorp, which faced regulatory issues and Chapter 11 bankruptcy filing.

- Frank Willey: Mr. Willey’s extensive legal career focused on governance, transactions, and legal, regulatory, and risk oversight. Mr. Willey’s experience serving in multiple public company general counsel roles makes him exceptionally qualified to steward Cannae’s strategy and the complex landscape in which Cannae operates. His experience extends to public board leadership, including his role as a director of Carl Karcher Enterprises (NYSE: CKR), an international restaurant chain whose business is directly relevant to our portfolio, and as a director of PennyMac Mortgage Investment Trust (NYSE: PMT). Mr. Willey serves as Vice Chairman of Commercial Bank of California.

- By contrast, Carronade nominee Cherie Schaible has no public company leadership experience, nor any public company board experience. She does not have direct experience at companies operating in an industry relevant to the Cannae portfolio. Her work experience appears to be of limited relevance, as it involves legal roles at private companies and nine years at American International Group, where she did not appear to reach a senior-level role such as general counsel.

What a Vote “FOR” the Board’s Slate of Nominated Directors Delivers Next

- Maintain execution momentum on a plan that is already closing the net asset value discount and growing long-term shareholder value.

- Preserve a fit-for-purpose Board with deep experience in operations, technology, supply chain/restaurants, legal, governance, and risk oversight—matching Cannae’s permanent capital model.

- Reinforce clear capital allocation strategy which prioritizes share buybacks at a discount to net asset value, retiring higher-cost debt, and reinvesting in high cash-flow private investments—as demonstrated historically.

- Avoid disruption from replacing up to one-third of Cannae’s Board with a dissident slate lacking relevant public company operations and investment experience.

Your Vote Matters

We believe that replacing our qualified nominees with Carronade’s nominees at this time would disrupt Cannae’s progress at a pivotal moment, putting shareholder value at risk.

We strongly urge shareholders to vote “FOR” ONLY Cannae’s four highly qualified and experienced director nominees (Erika Meinhardt, Barry B. Moullet, James B. Stallings, Jr., and Frank P. Willey). Your vote will ensure that Cannae has the right directors with the necessary skills to oversee the execution of our strategic plan and ongoing initiatives.

Your vote is extremely important, no matter how many shares you own. Please use the enclosed WHITE proxy card to vote “FOR” ONLY Cannae’s four nominees today (Erika Meinhardt, Barry B. Moullet, James B. Stallings, Jr., and Frank P. Willey). You can elect our nominees by signing, dating, and returning the WHITE proxy card in the postage-paid envelope included in your proxy materials. Please DISCARD the gold proxy card you receive from Carronade. If you have mistakenly voted using the gold proxy card, you may cancel that vote by simply voting again using Cannae’s WHITE proxy card – only your latest-dated vote will count.

Thank you for your continued support of and investment in Cannae.

Sincerely,

The Cannae Board

| If you have any questions or require any assistance with voting your shares, please contact the Company’s proxy solicitor:

Innisfree M&A Incorporated 501 Madison Avenue, 20th floor New York, New York 10022 Shareholders may call toll free: (877) 750-0637 Banks and Brokers may call collect: (212) 750-5833 |

Forward-Looking Statements and Risk Factors

This communication includes forward-looking statements within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. These statements are not historical facts, but instead represent only our beliefs regarding future events, many of which, by their nature, are inherently uncertain and outside of our control. Forward-looking statements include statements about our business, strategic plans, future performance, return of capital, and the impact of our actions on shareholder value, and commitments outlined in this communication or elsewhere. These statements can be identified by words such as “anticipates,” “intends,” “plans,” “seeks,” “believes,” “estimates,” “expects,” and similar references to future periods, or by the inclusion of forecasts or projections. We caution readers not to place undue reliance on forward-looking statements. We expect that certain disclosures made in this communication may be updated or revised in the future as the quality and completeness of our data and methodologies continue to improve. Important factors that could cause actual results to differ materially from expectations are described under the heading “Risk Factors” in our most recent Annual Report on Form 10-K and in other filings we make with the SEC. Forward-looking statements speak only as of the date they are made, and we undertake no obligation to update publicly or otherwise revise any forward-looking statements, whether as a result of new information, future events, or other factors, except where we are expressly required to do so by law.

Important Additional Information and Where to Find It

The Company has filed a definitive proxy statement on Schedule 14A, an accompanying WHITE proxy card, and other relevant documents with the SEC in connection with the solicitation of proxies from the Company’s shareholders for the Company’s Annual Meeting. THE COMPANY’S SHAREHOLDERS ARE STRONGLY ENCOURAGED TO READ THE COMPANY’S DEFINITIVE PROXY STATEMENT (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO), THE ACCOMPANYING WHITE PROXY CARD, AND ANY OTHER DOCUMENTS FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY CONTAIN IMPORTANT INFORMATION. Shareholders may obtain a free copy of the definitive proxy statement, an accompanying WHITE proxy card, any amendments or supplements to the definitive proxy statement, and other documents that the Company files with the SEC at no charge from the SEC’s website at www.sec.gov. Copies will also be available at no charge by clicking the “SEC Filings” link in the “Financials” section of the Company’s website at https://www.cannaeholdings.com/financial-information/sec-filings.

| ____________________ |

| 1 Cannae announced a series of strategic and governance updates in February 2024, including an executive leadership transition, a strategic partnership with JANA, the appointment of a new independent director, and the internalization of the management function. |

View source version on businesswire.com: https://www.businesswire.com/news/home/20251105052678/en/

Für dich aus unserer Redaktion zusammengestellt

Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte.