Associated Banc-Corp Reports First Quarter 2025 Net Income Available to Common Equity of $99 Million, or $0.59 per Common Share

GREEN BAY, Wis., April 24, 2025 /PRNewswire/ -- Associated Banc-Corp (NYSE: ASB) ("Associated" or "Company") today reported net income available to common equity ("earnings") of $99 million, or $0.59 per common share, for the quarter ended March 31, 2025. These amounts compare to a loss of $164 million, or $1.03 per common share, for the quarter ended December 31, 2024 and earnings of $78 million, or $0.52 per common share, for the quarter ended March 31, 2024.

"2025 is off to a strong start at Associated Bank," said President and CEO Andy Harmening. "During the first quarter, we achieved several key milestones of our strategic plan, completing our commercial expansion, achieving a record-high net promoter score, and finalizing the balance sheet repositioning we announced in December. Importantly, the emerging momentum from our initiatives helped us deliver another strong financial quarter, with over $500 million in loan and deposit growth, 16 basis points of margin expansion, ten basis points of CET1 capital accretion and solid credit quality trends."

"The current macroeconomic environment has added an element of uncertainty for the industry, but here at Associated, we're entering this period of uncertainty with the major investments in our strategic plan completed, a strengthened profitability profile, a solid capital position, and a foundational discipline on credit and risk management. We continue to feel well-positioned to deliver enhanced value for our stakeholders in 2025."

First Quarter 2025 Highlights (all comparisons to Fourth Quarter 2024)

- Diluted earnings per common share of $0.59

- Total period end loan growth of $526 million

- Total period end deposit growth of $548 million

- Total period end core customer deposit1 growth of $503 million

- Net interest income of $286 million

- Net interest margin of 2.97%

- Noninterest income of $59 million

- Noninterest expense of $211 million

- Provision for credit losses of $13 million

- Allowance for credit losses on loans / total loans of 1.34%

- Net charge offs / average loans (annualized) of 0.12%

1 This is a non-GAAP financial measure. See financial tables for a reconciliation of non-GAAP financial measures to GAAP financial measures.

Loans

First quarter 2025 average total loans of $30.1 billion decreased $91 million from the prior quarter and increased 3%, or $742 million, from the same period last year. With respect to first quarter 2025 average balances by loan category:

- Commercial and business lending increased $250 million from the prior quarter and increased $908 million from the same period last year to $11.7 billion.

- Commercial real estate lending increased $107 million from the prior quarter and decreased $76 million from the same period last year to $7.3 billion.

- Consumer lending decreased $448 million from the prior quarter and decreased $90 million from the same period last year to $11.1 billion.

First quarter 2025 period end total loans of $30.3 billion increased 2%, or $526 million, from the prior quarter and increased 3%, or $800 million, from the same period last year. With respect to first quarter 2025 period end balances by loan category:

- Commercial and business lending increased $327 million from the prior quarter and increased $1.1 billion from the same period last year to $12.0 billion.

- Commercial real estate lending increased $196 million from the prior quarter and increased $85 million the same period last year to $7.4 billion.

- Consumer lending increased $3 million from the prior quarter and decreased $374 million from the same period last year to $10.8 billion.

We continue to expect 2025 period end loan growth of 5% to 6% as compared to the year ended December 31, 2024.

Deposits

First quarter 2025 average deposits of $34.8 billion increased 1%, or $496 million, from the prior quarter and increased 5%, or $1.6 billion, from the same period last year. With respect to first quarter 2025 average balances by deposit category:

- Noninterest-bearing demand deposits decreased $98 million from the prior quarter and decreased $242 million from the same period last year to $5.6 billion.

- Savings increased $30 million from the prior quarter and increased $234 million from the same period last year to $5.2 billion.

- Interest-bearing demand deposits increased $408 million from the prior quarter and increased $542 million from the same period last year to $8.0 billion.

- Money market deposits increased $155 million from the prior quarter and decreased $37 million from the same period last year to $6.1 billion.

- Total time deposits decreased $157 million from the prior quarter and increased $873 million from the same period last year to $8.1 billion.

- Network transaction deposits increased $157 million from the prior quarter and increased $196 million from the same period last year to $1.8 billion.

First quarter 2025 period end deposits of $35.2 billion increased 2%, or $548 million, from the prior quarter and increased 4%, or $1.5 billion, from the same period last year. With respect to first quarter 2025 period end balances by deposit category:

- Noninterest-bearing demand deposits increased $360 million from the prior quarter and decreased $118 million from the same period last year to $6.1 billion.

- Savings increased $114 million from the prior quarter and increased $123 million from the same period last year to $5.2 billion.

- Interest-bearing demand deposits decreased $50 million from the prior quarter and increased $328 million from the same period last year to $9.1 billion.

- Money market deposits increased $182 million from the prior quarter and increased $98 million from the same period last year to $6.8 billion.

- Total time deposits decreased $59 million from the prior quarter and increased $1.1 billion from the same period last year to $7.9 billion.

- Network transaction deposits (included in money market and interest-bearing demand deposits) increased $125 million from the prior quarter and increased $90 million from the same period last year to $1.9 billion.

We continue to expect 2025 period end total deposit growth of 1% to 2% and period end core customer deposit growth of 4% to 5% as compared to the year ended December 31, 2024.

Net Interest Income and Net Interest Margin

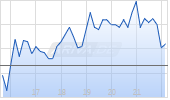

First quarter 2025 net interest income of $286 million increased $16 million from the prior quarter and increased $28 million from the same period last year. The net interest margin increased to 2.97%, reflecting a 16 basis point increase from the prior quarter and an 18 basis point increase from the same period last year.

- The average yield on total loans for the first quarter of 2025 decreased 15 basis points from the prior quarter and decreased 39 basis points from the same period last year to 5.83%.

- The average cost of total interest-bearing liabilities for the first quarter of 2025 decreased 23 basis points from the prior quarter and decreased 49 basis points from the same period last year to 3.06%.

- The net free funds benefit for the first quarter of 2025 decreased 6 basis points from the prior quarter and decreased 12 basis points from the same period last year to 0.58%.

We continue to expect total net interest income growth of 12% to 13% in 2025.

Noninterest Income

First quarter 2025 total noninterest income of $59 million increased $266 million from the prior quarter and decreased $6 million, or 10%, from the same period last year. The increase relative to the prior quarter was primarily driven by nonrecurring items recognized in the fourth quarter of 2024 as a result of the balance sheet repositioning announced in December of 2024. The decrease relative to the same period last year was primarily driven by a $7 million loss related to the settlement of the mortgage sale announced in December of 2024. With respect to first quarter 2025 noninterest income line items:

- The Company recognized a small investment securities net gain in the first quarter of 2025 as compared to a $148 million net loss in the prior quarter and a $4 million net gain in the same period last year. The loss in the prior quarter was primarily driven by a net loss on a sale of investments recognized in the fourth quarter of 2024 as a result of the balance sheet repositioning announced in December of 2024.

- The Company incurred a loss on mortgage portfolio sale of $7 million in the first quarter of 2025 as compared to a $130 million loss in the prior quarter and no loss in the same period last year. The current and prior quarter losses were driven by the mortgage portfolio sale as a result of the balance sheet repositioning announced in December of 2024.

- Capital markets, net decreased $5 million from the prior quarter and increased slightly from the same period last year.

- Wealth management fees decreased $2 million from the prior quarter and increased $1 million from the same period last year.

- Card-based fees decreased $2 million from the prior quarter and decreased $1 million from the same period last year.

After adjusting to exclude the fourth quarter 2024 and first quarter 2025 impacts of the mortgage and investment securities sales we announced in December 2024, we continue to expect total noninterest income growth of between 0% and 1% in 2025.

Noninterest Expense

First quarter 2025 total noninterest expense of $211 million decreased $14 million from the prior quarter, driven primarily by a $14 million expense for a loss on prepayments of FHLB advances recognized in the fourth quarter of 2024 as a result of the balance sheet repositioning announced in December of 2024, and increased $13 million from the same period last year. With respect to first quarter 2025 noninterest expense line items:

- Personnel expense decreased $2 million from the prior quarter and increased $5 million from the same period last year.

- Occupancy expense increased $1 million from the prior quarter and increased $2 million from the same period last year.

- FDIC assessment expense increased $1 million from the prior quarter and decreased $4 million from the same period last year.

- Other noninterest expense increased $1 million from the prior quarter and increased $7 million from the same period last year.

After adjusting to exclude the $14 million impact of the loss on prepayments of FHLB advances recognized in the fourth quarter of 2024, we continue to expect total noninterest expense to grow by 3% to 4% in 2025.

Taxes

First quarter 2025 tax expense was $19 million compared to a $16 million tax benefit in the prior quarter and $20 million of tax expense in the same period last year. First quarter 2025 tax expense included a $6 million benefit from a partial release of a valuation allowance on deferred taxes. The tax benefit recognized in the prior quarter was primarily driven by a loss on income before income taxes as a result of nonrecurring items associated with the balance sheet repositioning announced in December 2024. The effective tax rate for the first quarter of 2025 was 16.0% compared to an effective tax rate of 19.8% in the same period last year.

We continue to expect the annual effective tax rate to be between 19% and 21% in 2025.

Credit

First quarter 2025 provision for credit losses on loans was $13 million, compared to a provision of $17 million in the prior quarter and a provision of $24 million in the same period last year. With respect to first quarter 2025 credit quality:

- Nonaccrual loans of $135 million increased $12 million from the prior quarter and decreased $44 million from the same period last year. The nonaccrual loans to total loans ratio was 0.44% in the first quarter, up from 0.41% in the prior quarter and down from 0.60% in the same period last year.

- First quarter 2025 net charge offs of $9 million decreased compared to net charge offs of $12 million in the prior quarter and decreased compared to net charge offs of $22 million in the same period last year.

- The allowance for credit losses on loans (ACLL) of $407 million increased $4 million compared to the prior quarter and increased $19 million compared to the same period last year. The ACLL to total loans ratio was 1.34% in the first quarter, down from 1.35% in the prior quarter and up from 1.31% in the same period last year.

In 2025, we continue to expect to adjust provision to reflect changes to risk grades, economic conditions, loan volumes, and other indications of credit quality.

Capital

The Company's capital position remains strong, with a CET1 capital ratio of 10.11% at March 31, 2025. The Company's capital ratios continue to be in excess of the Basel III "well-capitalized" regulatory benchmarks on a fully phased in basis.

FIRST QUARTER 2025 EARNINGS RELEASE CONFERENCE CALL

The Company will host a conference call for investors and analysts at 4:00 p.m. Central Time (CT) today, April 24, 2025. Interested parties can access the live webcast of the call through the Investor Relations section of the Company's website, http://investor.associatedbank.com. Parties may also dial into the call at 877-407-8037 (domestic) or 201-689-8037 (international) and request the Associated Banc-Corp first quarter 2025 earnings call. The first quarter 2025 financial tables with an accompanying slide presentation will be available on the Company's website just prior to the call. An audio archive of the webcast will be available on the Company's website approximately fifteen minutes after the call is over.

ABOUT ASSOCIATED BANC-CORP

Associated Banc-Corp (NYSE: ASB) has total assets of $43 billion and is the largest bank holding company based in Wisconsin. Headquartered in Green Bay, Wisconsin, Associated is a leading Midwest banking franchise, offering a full range of financial products and services from nearly 200 banking locations serving more than 100 communities throughout Wisconsin, Illinois, Minnesota and Missouri. The Company also operates loan production offices in Indiana, Kansas, Michigan, New York, Ohio and Texas. Associated Bank, N.A. is an Equal Housing Lender, Equal Opportunity Lender and Member FDIC. More information about Associated Banc-Corp is available at www.associatedbank.com.

FORWARD-LOOKING STATEMENTS

Statements made in this presentation which are not purely historical are forward-looking statements, as defined in the Private Securities Litigation Reform Act of 1995. This includes any statements regarding management's plans, objectives, or goals for future operations, products or services, and forecasts of its revenues, earnings, or other measures of performance. Such forward-looking statements may be identified by the use of words such as "believe," "expect," "anticipate," "plan," "estimate," "should," "intend," "target," "outlook," "project," "guidance," "forecast," or similar expressions. Forward-looking statements are based on current management expectations and, by their nature, are subject to risks and uncertainties. Actual results may differ materially from those contained in the forward-looking statements. Factors which may cause actual results to differ materially from those contained in such forward-looking statements include those identified in the Company's most recent Form 10-K and subsequent Form 10-Qs and other SEC filings, and such factors are incorporated herein by reference.

NON-GAAP FINANCIAL MEASURES

This press release and related materials may contain references to measures which are not defined in generally accepted accounting principles ("GAAP"). Information concerning these non-GAAP financial measures can be found in the financial tables. Management believes these measures are meaningful because they reflect adjustments commonly made by management, investors, regulators, and analysts to evaluate the adequacy of earnings per common share, provide a greater understanding of ongoing operations and enhance comparability of results with prior periods.

| Associated Banc-Corp Consolidated Balance Sheets (Unaudited) | | | | | | | |

| ($ in thousands) | March 31, | December 31, | Seql Qtr $ | September 30, | June 30, | March 31, | Comp Qtr $ |

| Assets | | | | | | | |

| Cash and due from banks | $ 521,323 | $ 544,059 | $ (22,737) | $ 554,631 | $ 470,818 | $ 429,859 | $ 91,464 |

| Interest-bearing deposits in other financial institutions | 711,033 | 453,590 | 257,443 | 408,101 | 484,677 | 420,114 | 290,919 |

| Federal funds sold and securities purchased under agreements to resell | 105 | 21,955 | (21,850) | 4,310 | 3,600 | 1,610 | (1,505) |

| Investment securities available for sale, at fair value | 4,796,570 | 4,581,434 | 215,136 | 4,152,527 | 3,912,730 | 3,724,148 | 1,072,422 |

| Investment securities held to maturity, net, at amortized cost | 3,705,793 | 3,738,687 | (32,894) | 3,769,150 | 3,799,035 | 3,832,967 | (127,174) |

| Equity securities | 23,331 | 23,242 | 89 | 23,158 | 22,944 | 19,571 | 3,760 |

| Federal Home Loan Bank and Federal Reserve Bank stocks, at cost | 194,244 | 179,665 | 14,578 | 178,168 | 212,102 | 173,968 | 20,276 |

| Residential loans held for sale | 47,611 | 646,687 | (599,076) | 67,219 | 83,795 | 52,414 | (4,803) |

| Commercial loans held for sale | 7,910 | 32,634 | (24,724) | 11,833 | — | — | 7,910 |

| Loans | 30,294,127 | 29,768,586 | 525,541 | 29,990,897 | 29,618,271 | 29,494,263 | 799,864 |

| Allowance for loan losses | (371,348) | (363,545) | (7,802) | (361,765) | (355,844) | (356,006) | (15,342) |

| Loans, net | 29,922,780 | 29,405,041 | 517,739 | 29,629,131 | 29,262,428 | 29,138,257 | 784,523 |

| Tax credit and other investments | 254,187 | 258,886 | (4,699) | 265,385 | 246,300 | 255,252 | (1,065) |

| Premises and equipment, net | 377,521 | 379,093 | (1,572) | 373,816 | 369,968 | 367,618 | 9,903 |

| Bank and corporate owned life insurance | 690,551 | 689,000 | 1,552 | 686,704 | 683,451 | 685,089 | 5,462 |

| Goodwill | 1,104,992 | 1,104,992 | — | 1,104,992 | 1,104,992 | 1,104,992 | — |

| Other intangible assets, net | 29,457 | 31,660 | (2,203) | 33,863 | 36,066 | 38,268 | (8,811) |

| Mortgage servicing rights, net | 86,251 | 87,683 | (1,433) | 81,977 | 85,640 | 85,226 | 1,025 |

| Interest receivable | 159,729 | 167,772 | (8,044) | 167,777 | 173,106 | 167,092 | (7,363) |

| Other assets | 675,748 | 676,987 | (1,239) | 698,073 | 672,256 | 640,638 | 35,110 |

| Total assets | $ 43,309,136 | $ 43,023,068 | $ 286,068 | $ 42,210,815 | $ 41,623,908 | $ 41,137,084 | $ 2,172,052 |

| Liabilities and stockholders' equity | | | | | | | |

| Noninterest-bearing demand deposits | $ 6,135,946 | $ 5,775,657 | $ 360,289 | $ 5,857,421 | $ 5,815,045 | $ 6,254,135 | $ (118,189) |

| Interest-bearing deposits | 29,060,767 | 28,872,777 | 187,990 | 27,696,877 | 26,875,995 | 27,459,023 | 1,601,744 |

| Total deposits | 35,196,713 | 34,648,434 | 548,279 | 33,554,298 | 32,691,039 | 33,713,158 | 1,483,555 |

| Short-term funding | 311,335 | 470,369 | (159,033) | 917,028 | 859,539 | 765,671 | (454,336) |

| FHLB advances | 2,027,297 | 1,853,807 | 173,490 | 1,913,294 | 2,673,046 | 1,333,411 | 693,886 |

| Other long-term funding | 591,382 | 837,635 | (246,253) | 844,342 | 536,113 | 536,055 | 55,327 |

| Allowance for unfunded commitments | 35,276 | 38,776 | (3,500) | 35,776 | 33,776 | 31,776 | 3,500 |

| Accrued expenses and other liabilities | 460,574 | 568,485 | (107,911) | 532,842 | 588,057 | 588,341 | (127,767) |

| Total liabilities | 38,622,578 | 38,417,506 | 205,071 | 37,797,579 | 37,381,571 | 36,968,412 | 1,654,166 |

| Stockholders' equity | | | | | | | |

| Preferred equity | 194,112 | 194,112 | — | 194,112 | 194,112 | 194,112 | — |

| Common equity | 4,492,446 | 4,411,450 | 80,996 | 4,219,125 | 4,048,225 | 3,974,561 | 517,885 |

| Total stockholders' equity | 4,686,558 | 4,605,562 | 80,996 | 4,413,236 | 4,242,337 | 4,168,673 | 517,885 |

| Total liabilities and stockholders' equity | $ 43,309,136 | $ 43,023,068 | $ 286,068 | $ 42,210,815 | $ 41,623,908 | $ 41,137,084 | $ 2,172,052 |

| |

| Numbers may not recalculate due to rounding conventions. |

| Associated Banc-Corp | |||||||||

| ($ in thousands, except per share data) | | | Seql Qtr | | | | Comp Qtr | ||

| 1Q25 | 4Q24 | $ Change | % Change | 3Q24 | 2Q24 | 1Q24 | $ Change | % Change | |

| Interest income | | | | | | | | | |

| Interest and fees on loans | $ 433,299 | $ 453,253 | $ (19,954) | (4) % | $ 465,728 | $ 456,788 | $ 454,472 | $ (21,173) | (5) % |

| Interest and dividends on investment securities | | | | | | | | | |

| Taxable | 69,702 | 50,524 | 19,178 | 38 % | 51,229 | 50,278 | 46,548 | 23,154 | 50 % |

| Tax-exempt | 13,956 | 14,469 | (513) | (4) % | 14,660 | 14,669 | 14,774 | (818) | (6) % |

| Other interest | 8,920 | 10,478 | (1,558) | (15) % | 8,701 | 8,539 | 7,595 | 1,325 | 17 % |

| Total interest income | 525,877 | 528,724 | (2,847) | (1) % | 540,318 | 530,274 | 523,388 | 2,489 | — % |

| Interest expense | | | | | | | | | |

| Interest on deposits | 209,140 | 222,888 | (13,748) | (6) % | 231,623 | 221,062 | 226,231 | (17,091) | (8) % |

| Interest on federal funds purchased and securities sold under agreements to repurchase | 3,622 | 3,203 | 419 | 13 % | 3,385 | 2,303 | 2,863 | 759 | 27 % |

| Interest on other short-term funding | — | 668 | (668) | (100) % | 6,144 | 6,077 | 4,708 | (4,708) | (100) % |

| Interest on FHLB advances | 16,090 | 17,908 | (1,818) | (10) % | 24,799 | 34,143 | 21,671 | (5,581) | (26) % |

| Interest on other long-term funding | 11,085 | 13,769 | (2,684) | (19) % | 11,858 | 10,096 | 10,058 | 1,027 | 10 % |

| Total interest expense | 239,937 | 258,436 | (18,499) | (7) % | 277,809 | 273,681 | 265,530 | (25,593) | (10) % |

| Net interest income | 285,941 | 270,289 | 15,652 | 6 % | 262,509 | 256,593 | 257,858 | 28,083 | 11 % |

| Provision for credit losses | 13,003 | 16,986 | (3,982) | (23) % | 20,991 | 23,008 | 24,001 | (10,998) | (46) % |

| Net interest income after provision for credit losses | 272,938 | 253,303 | 19,635 | 8 % | 241,518 | 233,585 | 233,857 | 39,081 | 17 % |

| Noninterest income | | | | | | | | | |

| Wealth management fees | 22,498 | 24,103 | (1,605) | (7) % | 24,144 | 22,628 | 21,694 | 804 | 4 % |

| Service charges and deposit account fees | 12,814 | 13,232 | (418) | (3) % | 13,708 | 12,263 | 12,439 | 375 | 3 % |

| Card-based fees | 10,442 | 11,948 | (1,506) | (13) % | 11,731 | 11,975 | 11,267 | (825) | (7) % |

| Other fee-based revenue | 5,251 | 5,182 | 68 | 1 % | 5,057 | 4,857 | 4,402 | 849 | 19 % |

| Capital markets, net | 4,345 | 9,032 | (4,687) | (52) % | 4,317 | 4,685 | 4,050 | 295 | 7 % |

| Mortgage banking, net | 3,822 | 3,387 | 435 | 13 % | 2,132 | 2,505 | 2,662 | 1,160 | 44 % |

| Loss on mortgage portfolio sale | (6,976) | (130,406) | 123,430 | (95) % | — | — | — | (6,976) | N/M |

| Bank and corporate owned life insurance | 5,204 | 2,322 | 2,883 | 124 % | 4,001 | 4,584 | 2,570 | 2,634 | 102 % |

| Asset (losses) gains, net | (878) | 364 | (1,242) | N/M | (474) | (627) | (306) | (572) | 187 % |

| Investment securities gains (losses), net | 4 | (148,194) | 148,198 | N/M | 100 | 67 | 3,879 | (3,875) | (100) % |

| Other | 2,251 | 2,257 | (6) | — % | 2,504 | 2,222 | 2,327 | (76) | (3) % |

| Total noninterest income (loss) | 58,776 | (206,772) | 265,549 | N/M | 67,221 | 65,159 | 64,985 | (6,209) | (10) % |

| Noninterest expense | | | | | | | | | |

| Personnel | 123,897 | 125,944 | (2,047) | (2) % | 121,036 | 121,581 | 119,395 | 4,502 | 4 % |

| Technology | 27,139 | 26,984 | 154 | 1 % | 27,217 | 27,161 | 26,200 | 939 | 4 % |

| Occupancy | 15,381 | 14,325 | 1,056 | 7 % | 13,536 | 13,128 | 13,633 | 1,748 | 13 % |

| Business development and advertising | 6,386 | 7,408 | (1,022) | (14) % | 6,683 | 7,535 | 6,517 | (131) | (2) % |

| Equipment | 4,527 | 4,729 | (202) | (4) % | 4,653 | 4,450 | 4,599 | (72) | (2) % |

| Legal and professional | 6,083 | 6,861 | (778) | (11) % | 5,639 | 4,429 | 4,672 | 1,411 | 30 % |

| Loan and foreclosure costs | 2,594 | 1,951 | 642 | 33 % | 2,748 | 1,793 | 1,979 | 615 | 31 % |

| FDIC assessment | 10,436 | 9,139 | 1,298 | 14 % | 8,223 | 7,131 | 13,946 | (3,510) | (25) % |

| Other intangible amortization | 2,203 | 2,203 | — | — % | 2,203 | 2,203 | 2,203 | — | — % |

| Loss on prepayments of FHLB advances | — | 14,243 | (14,243) | (100) % | — | — | — | — | N/M |

| Other | 11,974 | 10,496 | 1,478 | 14 % | 8,659 | 6,450 | 4,513 | 7,461 | 165 % |

| Total noninterest expense | 210,619 | 224,282 | (13,664) | (6) % | 200,597 | 195,861 | 197,657 | 12,962 | 7 % |

| Income (loss) before income taxes | 121,095 | (177,752) | 298,847 | N/M | 108,142 | 102,884 | 101,185 | 19,910 | 20 % |

| Income tax expense (benefit) | 19,409 | (16,137) | 35,546 | N/M | 20,124 | (12,689) | 20,016 | (607) | (3) % |

| Net income (loss) | 101,687 | (161,615) | 263,301 | N/M | 88,018 | 115,573 | 81,169 | 20,518 | 25 % |

| Preferred stock dividends | 2,875 | 2,875 | — | — % | 2,875 | 2,875 | 2,875 | — | — % |

| Net income (loss) available to common equity | $ 98,812 | $ (164,490) | $ 263,301 | N/M | $ 85,143 | $ 112,698 | $ 78,294 | $ 20,518 | 26 % |

| Earnings (loss) per common share | | | | | | | | | |

| Basic | $ 0.60 | $ (1.04) | $ 1.64 | N/M | $ 0.56 | $ 0.75 | $ 0.52 | $ 0.08 | 15 % |

| Diluted | $ 0.59 | $ (1.03) | $ 1.62 | N/M | $ 0.56 | $ 0.74 | $ 0.52 | $ 0.07 | 13 % |

| Average common shares outstanding | | | | | | | | | |

| Basic | 165,228 | 157,710 | 7,518 | 5 % | 150,247 | 149,872 | 149,855 | 15,373 | 10 % |

| Diluted | 166,604 | 159,164 | 7,441 | 5 % | 151,492 | 151,288 | 151,292 | 15,312 | 10 % |

| |

| N/M = Not meaningful |

| Numbers may not recalculate due to rounding conventions. |

| Associated Banc-Corp Selected Quarterly Information | | | | | |

| | | | | | |

| ($ in millions except per share data; shares repurchased and outstanding in thousands) | 1Q25 | 4Q24 | 3Q24 | 2Q24 | 1Q24 |

| Per common share data | | | | | |

| Dividends | $ 0.23 | $ 0.23 | $ 0.22 | $ 0.22 | $ 0.22 |

| Market value: | | | | | |

| High | 25.63 | 28.14 | 23.95 | 22.48 | 22.00 |

| Low | 21.06 | 20.64 | 20.07 | 19.90 | 19.73 |

| Close | 22.53 | 23.90 | 21.54 | 21.15 | 21.51 |

| Book value / share | 27.09 | 26.55 | 27.90 | 26.85 | 26.37 |

| Tangible book value / share | 20.25 | 19.71 | 20.37 | 19.28 | 18.78 |

| Performance ratios (annualized) | | | | | |

| Return on average assets | 0.97 % | (1.53) % | 0.85 % | 1.13 % | 0.80 % |

| Noninterest expense / average assets | 2.00 % | 2.12 % | 1.93 % | 1.92 % | 1.95 % |

| Effective tax rate | 16.03 % | N/M | 18.61 % | (12.33) % | 19.78 % |

| Dividend payout ratio(a) | 38.33 % | N/M | 39.29 % | 29.33 % | 42.31 % |

| Net interest margin | 2.97 % | 2.81 % | 2.78 % | 2.75 % | 2.79 % |

| Selected trend information | | | | | |

| Average full time equivalent employees(b) | 4,006 | 3,982 | 4,041 | 4,025 | 4,070 |

| Branch count | 183 | 188 | 188 | 188 | 188 |

| Assets under management, at market value(c) | $ 14,685 | $ 14,773 | $ 15,033 | $ 14,304 | $ 14,171 |

| Mortgage portfolio serviced for others | $ 6,243 | $ 6,285 | $ 6,302 | $ 6,307 | $ 6,349 |

| Mortgage servicing rights, net / mortgage portfolio serviced for others | 1.38 % | 1.40 % | 1.30 % | 1.36 % | 1.34 % |

| Shares repurchased during period(d) | 900 | — | — | — | 900 |

| Shares outstanding, end of period | 165,807 | 166,178 | 151,213 | 150,785 | 150,739 |

| Selected quarterly ratios | | | | | |

| Loans / deposits | 86.07 % | 85.92 % | 89.38 % | 90.60 % | 87.49 % |

| Stockholders' equity / assets | 10.82 % | 10.70 % | 10.46 % | 10.19 % | 10.13 % |

| Risk-based capital(e)(f) | | | | | |

| Total risk-weighted assets | $ 33,801 | $ 33,950 | $ 33,326 | $ 32,768 | $ 32,753 |

| Common equity Tier 1 | $ 3,417 | $ 3,397 | $ 3,238 | $ 3,172 | $ 3,089 |

| Common equity Tier 1 capital ratio | 10.11 % | 10.01 % | 9.72 % | 9.68 % | 9.43 % |

| Tier 1 capital ratio | 10.68 % | 10.58 % | 10.30 % | 10.27 % | 10.02 % |

| Total capital ratio | 12.75 % | 12.61 % | 12.36 % | 12.34 % | 12.08 % |

| Tier 1 leverage ratio | 8.69 % | 8.73 % | 8.49 % | 8.37 % | 8.24 % |

| | |

| N/M = Not meaningful | |

| Numbers may not recalculate due to rounding conventions. | |

| (a) | Ratio is based upon basic earnings per common share. |

| (b) | Average full time equivalent employees without overtime. |

| (c) | Excludes assets held in brokerage accounts. |

| (d) Für dich aus unserer Redaktion zusammengestelltHinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte. Weitere Artikel des AutorsThemen im Trend | |