Eine nette Erklärung für das Geschehen an den Edelmetallmärkten. Viel Vergnügen bei der Lektüre. Permanent Silver 'Conspiracy' Explained | ||||

|

Good Morning,

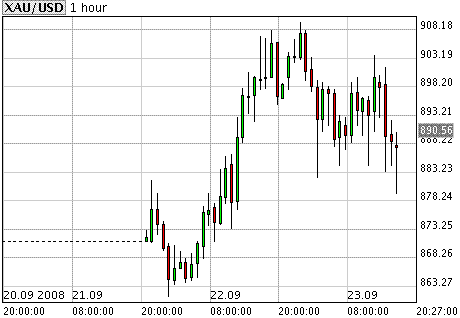

Proving nine out of ten prognosticators wrong, the Fed did not lower interest rates on Tuesday. Proving 1 out of ten pundits right, the Fed did throw AIG a lifeline (of sorts) by extending it an $85 billion loan - but not without conditions and direct control of its management. Finally, proving the remainder of oracles wrong, the Fed's actions yielded a slightly...higher (?) gold price instead of the opposite knee-jerk reaction to such a bold move. Conventional wisdom? Priceless.

Gold rallied to near $788 overnight mainly on perceptions that the AIG reprieve could also buy the commodities sector some time and some customers on the long side in lieu of the hitherto incessant hemorrhage of funds from the complex as a result of margin call after margin call. A stoppage of forced sales and a hoped-for return of the some of the speculative spirit in various assets and the easing up in the hoarding of cash is what markets are effectively expecting out of the Fed's move. Hope the hopes won't end up in the 'conventional wisdom' bin. To be sure, markets wanted a big cut in the discount rate and whined when they did not get it. C'est la vie as well.

Traders will now have to make do with a sky that remains defiantly in place, and with the new realities of a market within which the Fed draws certain lines while erasing part of others it drew just hours prior. That, and a host of heavy-duty regulatory and supervisory heavy-handedness coming down the pipeline. Difficult environments to make money in, you say? Let's consider the alternatives for just a moment. AIG with its neural network-like interconnectedness fails, assets blown out, dominoes falling...

On second thought, let's not consider that alternative. The Fed and former AIG head Greenberg certainly did not. A host of people seen on TV have laid the 'guilty' placard at the front door of the Bush administration. Nancy Pelosi, Larry Summers, and many more have been heard from and they have painted a picture of a wild, wild West having taken place over the last eight years on Wall Street. And now, the aftermath. Whoever inherits 1600 Pennsylvania Ave. will have their job cut out for them as regards the issue of the economy and the markets. Candidate McCain saw the economy as 'fundamentally strong' on Monday only to talk of "total crisis" on Tuesday. Better interview some good economic brains quickly.

New York bullion trading opened the mid-week session on the plus side, adding $4 at $782.70 and the trade is scanning the financial press for the next installment of this year-long tragedy. Thus far, it can focus on the meltdown (this one the real thing) in the Russian markets and the vital signs of WaMu. The dollar took a light hit down to 78.80 on the index, while crude oil rebounded $3.30 to $94.40 this morning. Perhaps a day of reflection is what participants are hoping for after the wild bronco rides they have been experiencing. Silver gained 33 cents to $10.78 while the noble metals presented a more promising picture as well, with platinum adding $25 to $1064 and palladium rising $1 to $223 per ounce. The mood remains cautious as perceptions that Crisis - Part II is not the final installment of the drama that has been playing across markets. Near-term direction remains as unclear as it has been of late. Rallies may elicit sellers who doubt the recovery as easily as they might draw fresh buyers perceiving a bottom having been put into place. More conventional wisdom.

Speaking of which, recent hoopla about the silver market's putative price suppression has yielded some responses from people who have been watching and writing about the metal for quite some time. Dr. Gary North has published two articles debunking such theories. Yesterday, we received a video rebuttal from CPM Group New York. We have posted it in this section (see below) as well as on kitcosilver.com - You might want to take a look and listen to learn more about your favorite metal and its market.

For those of you unfamiliar with the work of this firm:

CPM Group is a leading commodities market research, consulting, asset management, and investment-banking firm. CPM focuses on various commodities markets from precious metals to tropical soft commodities. In its twenty years as an independent company, CPM has consistently delivered unique, market-leading research and services to clients ranging from individual investors to leading international organizations worldwide. CPM’s market contacts around the world provide information and insight that enables CPM’s research group to formulate unique market analyses and forecasts. Their annual yearbooks on gold, silver, and the platinum-group metals are highly sought-after publications in our industry. You may find their research available at www.CPMGroup.com

CPM Group was founded in 1986 by Jeffrey M. Christian.

Mr. Christian was previously the head of commodities research at J. Aron & Company, which was acquired by Goldman Sachs & Co. Mr. Christian formed CPM group through a management buy-out of the commodities research group of Goldman, Sachs & Co. with the vision to provide independent market leading research on the commodities markets to a variety of customers ranging from sovereign governments to investment funds.

At the request of several of its clients who are directly involved with the production and trading of, and investment in the silver market, CPM Group decided it was timely to produce this primer on the inner workings of silver and to dispel and reject the currently circulating stories regarding silver price suppression and product shortage theories.

We hope you approach the video with an open mind and a willingness to reason and are confident that you will find much valuable information in it. We would like to thank Mr. Christian and his group for making this exclusive video available to Kitco's audience.

Perhaps a bit calmer conditions to look for today (that's a hope). We may not get them, as housing starts fell hard. The dollar may not like that but for now it is not showing any such signs. AIG is safe for now, but stock futures were slipping in early going.

Video: WHAT Silver Price Conspiracy? An Educated Explanation.

Happ(ier) Trading.

Jon Nadler

Senior Analyst

Kitco Bullion Dealers Montreal