Aufrufe: 70

Aufrufe: 70

Xencor Reports Third Quarter 2025 Financial Results

“Xencor’s two novel, first-in-class, CD3 T-cell engaging bispecific antibodies, XmAb819 and XmAb541, have demonstrated compelling clinical data in advanced clear cell renal cell carcinoma and advanced gynecologic and germ cell tumors, respectively. As we continue to advance through dose escalation and cohort expansions in Phase 1 studies evaluating these programs, we expect to identify recommended Phase 3 doses during 2026 to support initiation of pivotal studies during 2027,” said Bassil Dahiyat, Ph.D., president and chief executive officer at Xencor. “The accelerating tempo of clinical development extends to our autoimmune portfolio. In the third quarter we dosed the first patient in our Phase 2b XENITH-UC study of XmAb942, our potential best-in-class antibody targeting TL1A for inflammatory bowel disease, to rapidly identify a pivotal dose regimen for those with moderately to severely active ulcerative colitis, and we dosed the first patient in our Phase 1b study of plamotamab in rheumatoid arthritis. We remain on-track to start clinical studies of XmAb657, our B-cell depleting TCE for the treatment of patients with autoimmune disease by year end 2025, and our lead TL1A x IL23p19 bispecific antibody, now designated XmAb412, in 2026.”

Clinical Program Updates

Oncology

- XmAb819 (ENPP3 x CD3), a novel, first-in-class, tumor-targeted T-cell engaging XmAb® 2+1 bispecific antibody in development for patients with advanced clear cell renal cell carcinoma (ccRCC). The first dose-expansion cohort in the ongoing Phase 1 study is enrolling patients as dose-escalation continues. Xencor plans to select a recommended Phase 3 dose during 2026 to support initiation of a pivotal study in advanced ccRCC during 2027.

At the AACR-NCI-EORTC Conference on Molecular Targets and Cancer Therapeutics in October 2025, Xencor presented initial results from the ongoing Phase 1 dose-escalation study of XmAb819. As of the data cut-off, 69 patients had received XmAb819 across 15 dose cohorts; patients were heavily pre-treated, having received a median of 4 prior lines of therapy. All patients received prior anti-PD1 therapy and prior VEGF-TKI therapy, and 36% of patients were previously treated with a HIF2α inhibitor. XmAb819 demonstrated evidence of anti-tumor activity and an acceptable safety profile that was generally well tolerated across dose levels. Of the 20 efficacy-evaluable patients treated at the dose levels that were preclinically predicted to be within the target dose range, 25% achieved a partial response (PR, per RECIST v1.1) as best response with a 70% disease control rate. The most common treatment-emergent adverse events (AEs) were cytokine release syndrome, rash and gastrointestinal-related toxicities that were primarily Grade 1 or 2 in severity and predominantly associated with prime-step dosing in the first four weeks of treatment. No cases of treatment-related immune effector cell-associated neurotoxicity syndrome (ICANS) were observed. No Grade 5 events were reported. Four patients (6%) were dose-reduced due to treatment-related AEs, and three patients (4%) discontinued treatment due to treatment-related AEs.

- XmAb541 (CLDN6 x CD3), a novel, first-in-class, tumor-targeted T-cell engaging XmAb 2+1 bispecific antibody in development for patients with advanced gynecologic and germ cell tumors. Xencor plans to select a recommended Phase 3 dose during 2026 to support initiation of a pivotal study during 2027.

In October 2025, Xencor presented early efficacy data from a cohort in the ongoing Phase 1 dose-escalation study of XmAb541, ahead of previously guided timelines to begin characterizing target dose range cohorts by year-end 2025. As of the data cut-off, nine patients received XmAb541 in the most recently completed escalation cohort. Confirmed partial responses per RECIST v1.1 were observed in three patients: one patient with ovarian cancer and two patients with germ cell tumors.

Autoimmune & Inflammatory Diseases

- Plamotamab (CD20 x CD3), a clinical-stage, B-cell depleting bispecific T-cell engager in development for patients with rheumatoid arthritis (RA). Xencor is evaluating plamotamab in a Phase 1b proof-of-concept study, for patients with RA who have progressed through prior standard-of-care treatment. The first patient has been dosed in the study, and enrollment is ongoing.

- XmAb942 (Xtend™ anti-TL1A), a potential best-in-class, high-potency, extended half-life antibody in development for patients with inflammatory bowel disease. Xencor is conducting the global XENITH-UC Study, a Phase 2b study of XmAb942 in ulcerative colitis (UC). XENITH-UC is a randomized, double-blind, placebo-controlled trial in patients with moderate-to-severe UC, whose disease has progressed after at least one conventional or advanced therapy. Patient enrollment in the study is ongoing.

Recent Partnership Developments

- Amgen: Amgen initiated the Phase 3 XALience study of xaluritamig, a STEAP1 x CD3 XmAb 2+1 bispecific T-cell engager, in combination with abiraterone versus investigator’s choice therapy in patients with chemotherapy-naïve metastatic castration-resistant prostate cancer. XALute, a Phase 3 monotherapy study of xaluritamig in patients who have previously been treated with taxane-based chemotherapy, is enrolling. Amgen is exploring xaluritamig in other combinations and in earlier stages of prostate cancer with multiple Phase 1b studies ongoing. Xencor is eligible to receive $225 million in future milestone payments and tiered royalties on net sales that range from mid- to high-single digit percentages.

- Astellas: In October 2025, the first clinical data from Astellas’ investigational Claudin18.2-targeted, XmAb 2+1 bispecific CD3 T-cell engager, ASP2138, both as a monotherapy and in combination with standard of care therapies, were presented during the European Society for Medical Oncology congress in Berlin. Astellas is advancing ASP2138 for the treatment of patients with gastric, gastroesophageal junction and pancreatic cancers, and Astellas has announced that planning is ongoing to potentially initiate registrational studies. ASP2138 utilizes the XmAb 2+1 multivalent format to enable activation of T cells against Claudin-18.2 expressing tumor cells. Xencor is eligible to receive $232.5 million in future milestone payments and tiered royalties on net sales that range from high-single to low-double digit percentages.

- Zenas Biopharma: In October 2025, Zenas announced positive results from the Phase 2 MoonStone trial of obexelimab in relapsing multiple sclerosis, in which the primary endpoint of the study was met. Zenas announced it expects to report topline results for the pivotal study of obexelimab in IgG4-Related Disease around year-end with additional readouts through mid-2026. Obexelimab targets CD19 with its variable domain and uses an XmAb Immune Inhibitor Fc Domain. In November 2021, Xencor licensed obexelimab to Zenas. Xencor is eligible to receive $460 million in future milestone payments and tiered royalties on net sales that range from mid-single-digit to mid-teen percentages, dependent on geography. As of September 30, 2025, Xencor owns 3,098,380 shares of common stock in Zenas.

Financial Guidance: Based on current operating plans, Xencor expects to end 2025 with between $570 million and $590 million in cash, cash equivalents and marketable debt securities, and to have cash to fund research and development programs and operations into 2028.

Financial Results for the Third Quarter Ended September 30, 2025

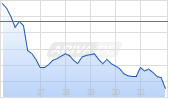

Cash, cash equivalents and marketable debt securities totaled $633.9 million as of September 30, 2025, compared to $706.7 million as of December 31, 2024.

Revenue for the third quarter ended September 30, 2025 was $21.0 million, compared to $17.8 million for the same period in 2024. Revenue earned in the third quarters of 2025 and 2024 was primarily non-cash royalty revenue from Alexion and Incyte.

Research and development (R&D) expenses for the third quarter ended September 30, 2025 were $54.4 million, compared to $58.2 million for the same period in 2024. Decreased R&D spending for the third quarter of 2025 compared to 2024 reflects lower stock-based compensation and lower costs related to programs that are winding down or have been terminated.

General and administrative (G&A) expenses for the third quarter ended September 30, 2025 were $14.2 million, compared to $14.8 million for the same period in 2024. G&A spending for the third quarter of 2025 remained relatively consistent compared to the same period in 2024.

Other income, net, for the third quarter ended September 30, 2025 was $41.5 million, compared to $7.8 million for the same period in 2024. The increase for the third quarter of 2025, compared to 2024, is primarily driven by unrealized gains from marketable equity securities.

Net loss attributable to Xencor for the third quarter ended September 30, 2025 was $6.0 million, or $(0.08) on a fully diluted per share basis, compared to net loss of $46.3 million, or $(0.72) on a fully diluted per share basis, for the same period in 2024.

About Xencor

Xencor is a clinical-stage biopharmaceutical company developing engineered antibodies for the treatment of patients with cancer and autoimmune diseases. More than 20 candidates engineered with Xencor's XmAb® technology are in clinical development, and multiple XmAb medicines are marketed by partners. Xencor's XmAb engineering technology enables small changes to a protein’s structure that result in new mechanisms of therapeutic action. For more information, please visit www.xencor.com.

Forward-Looking Statements

Certain statements contained in this press release may constitute forward-looking statements within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements include statements that are not purely statements of historical fact, and can generally be identified by the use of words such as “potential,” “can,” “will,” “plan,” “may,” “could,” “would,” “expect,” “anticipate,” “seek,” “look forward,” “believe,” “committed,” “investigational,” “indicates,” “supports,” and similar terms, or by express or implied discussions relating to Xencor’s business, including, but not limited to, statements regarding expectations for clinical progress, planned presentations of clinical data, new XmAb candidates and programs, planned and in process clinical trials, financial guidance, the quotations from Xencor's president and chief executive officer, and other statements that are not purely statements of historical fact. Such statements are made on the basis of the current beliefs, expectations, and assumptions of the management of Xencor and are subject to significant known and unknown risks, uncertainties and other factors that may cause actual results, performance or achievements and the timing of events to be materially different from those implied by such statements, and therefore these statements should not be read as guarantees of future performance or results. Such risks include, without limitation, the risks associated with the process of discovering, developing, manufacturing and commercializing drugs that are safe and effective for use as human therapeutics, the ability of publicly disclosed preliminary clinical trial data to support continued clinical development and regulatory approval for specific treatments, the risk of loss of key members of management, the risk that the fair value of our marketable equity securities will decline and the risks, uncertainties and other factors described under the heading “Risk Factors” in Xencor's annual report on Form 10-K for the year ended December 31, 2024 as well as Xencor's subsequent filings with the Securities and Exchange Commission. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. Xencor undertakes no obligation to revise or update these forward-looking statements to reflect events or circumstances after the date hereof, except as required by law.

| Xencor, Inc. | |||||

| Selected Consolidated Balance Sheet Data | |||||

| (in thousands) | |||||

|

|

|

|

| ||

|

| September 30, |

| December 31, | ||

|

| 2025 |

| 2024 | ||

|

| (unaudited) |

|

| ||

| Cash, cash equivalents and marketable debt securities - current | 386,784 |

| 449,846 | ||

| Other current assets |

| 131,657 |

|

| 127,755 |

| Marketable debt securities - long term |

| 247,158 |

|

| 256,833 |

| Other long-term assets |

| 103,212 |

|

| 117,511 |

| Total assets | 868,811 |

| 951,945 | ||

|

|

|

|

| ||

| Total current liabilities | 86,485 |

|

| 87,432 | |

| Liabilities related to the sales of future royalties - long term |

| 87,776 |

|

| 115,159 |

| Other long term liabilities |

| 69,234 |

|

| 75,328 |

| Total liabilities |

| 243,495 |

|

| 277,919 |

| Total stockholders' equity |

| 625,316 |

|

| 674,026 |

| Total liabilities and stockholders’ equity | 868,811 |

| 951,945 | ||

| Xencor, Inc. | |||||||||||||||

| Consolidated Statements of Operations and Comprehensive Loss | |||||||||||||||

| (in thousands, except per share amounts) | |||||||||||||||

|

|

|

|

|

|

|

|

| ||||||||

|

| Three Months Ended |

| Nine Months Ended | ||||||||||||

|

| 2025 |

| 2024 |

| 2025 |

| 2024 | ||||||||

|

| (Unaudited) |

| (Unaudited) | ||||||||||||

| Revenue |

|

|

|

|

|

|

| ||||||||

| Collaborations, milestones, and royalties | 20,999 |

|

| 17,796 |

|

| 97,339 |

|

| 57,700 |

| ||||

| Operating expenses: |

|

|

|

|

|

|

| ||||||||

| Research and development |

| 54,367 |

|

|

| 58,226 |

|

|

| 174,610 |

|

|

| 176,630 |

|

| General and administrative |

| 14,151 |

|

|

| 14,767 |

|

|

| 46,603 |

|

|

| 46,300 |

|

| Total operating expenses |

| 68,518 |

|

|

| 72,993 |

|

|

| 221,213 |

|

|

| 222,930 |

|

| Operating loss |

| (47,519 |

|

| (55,197 |

|

| (123,874 |

|

| (165,230 | ||||

|

|

|

|

|

|

|

|

| ||||||||

| Total other income (expense) |

| 41,492 |

|

|

| 7,755 |

|

|

| 38,507 |

|

|

| (25,110 | |

|

|

|

|

|

|

|

|

| ||||||||

| Loss before income tax expense and noncontrolling interest |

| (6,027 |

|

| (47,442 |

|

| (85,367 |

|

| (190,340 | ||||

| Income tax expense |

| — |

|

|

| — |

|

|

| 117 |

|

|

| — |

|

| Net loss including noncontrolling interest |

| (6,027 |

|

| (47,442 |

|

| (85,484 |

|

| (190,340 | ||||

|

|

|

|

|

|

|

|

| ||||||||

| Net loss attributable to noncontrolling interest |

| — |

|

|

| (1,154 |

|

| (214 |

|

| (3,275 | |||

| Net loss attributable to Xencor, Inc. | (6,027 |

| (46,288 |

| (85,270 |

| (187,065 | ||||||||

|

|

|

|

|

|

|

|

| ||||||||

| Net loss per share attributable to Xencor, Inc. (basic and diluted) | (0.08 |

| (0.72 |

| (1.15 |

| (3.00 | ||||||||

|

|

|

|

|

|

|

|

| ||||||||

| Weighted-average shares used in calculating net loss per share (basic and diluted) |

| 74,413 |

|

|

| 64,023 |

|

|

| 74,122 |

|

|

| 62,310 |

|

|

|

|

|

|

|

|

|

| ||||||||

| Other comprehensive income (loss): |

|

|

|

|

|

|

| ||||||||

| Net unrealized gain on marketable debt securities |

| 900 |

|

|

| 2,452 |

|

|

| 1,821 |

|

|

| 510 |

|

| Comprehensive loss |

| (5,127 |

|

| (44,990 |

|

| (83,663 |

|

| (189,830 | ||||

| Less: comprehensive loss attributable to the noncontrolling interest |

| — |

|

|

| (1,154 |

|

| (214 |

|

| (3,275 | |||

| Comprehensive loss attributable to Xencor, Inc. | (5,127 |

| (43,836 |

| (83,449 |

| (186,555 | ||||||||

View source version on businesswire.com: https://www.businesswire.com/news/home/20251105353167/en/

Für dich aus unserer Redaktion zusammengestellt

Dein Kommentar zum Artikel im Forum

Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte.