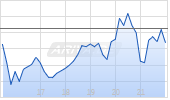

Ultragenyx Stock Declines After Missing Primary Endpoints on its Phase III Orbit and Cosmic Studies

NEW YORK, Jan. 23, 2026 /PRNewswire/ -- Levi & Korsinsky, LLP is investigating Ultragenyx Pharmaceutical Inc. (Nasdaq: RARE) following the Company's announcement of topline results from its Phase III Orbit and Cosmic Studies, focusing on the effectiveness of setrusumab (UX143) on Osteogenesis Imperfecta. Investors with concerns about Ultragenyx's business operations may click here for more information.

Ultragenyx reported the study results on December 29, 2025. Both studies failed to achieve their primary endpoint of a reduction in annualized clinical fracture rate against placebo in the Orbit study and against biophosphonates, the standard care, in the Cosmic study.

The Phase III studies also failed to correlate the secondary result to a reduction in fracture rate, despite successfully showing an improvement in the tested patients' bone density. Ultragenyx had previously relied on the results Phase II of the Orbit study to claim a causal link between improved bone density and a reduction in annualized fracture rate.

In announcing the results, the company pointed to a "low fracture rate in the placebo group" as a justification for Orbit's failed results. Management had previously highlighted there were no "uncontrolled factors" in the study and they had crafted the study in such a way to "actually increase their fractures, which would give [them] more opportunities to see the difference between [the test groups]."

Analyst coverage following the results turned cautious as analysts quickly began slashing their price targets. Barclays noted it now sees "limited opportunity for drug approval despite some trend of clinical benefit."

Levi & Korsinsky maintains a national securities practice with offices in New York, California, Connecticut, and D.C. Over the past 20 years, the team at Levi & Korsinsky has secured hundreds of millions of dollars for aggrieved shareholders and built a track record of winning high-stakes cases. Our firm has extensive expertise representing investors in complex securities litigation and a team of over 70 employees to serve our clients. For seven years in a row, Levi & Korsinsky has ranked in ISS Securities Class Action Services' Top 50 Report as one of the top securities litigation firms in the United States.

CONTACT:

Joseph E. Levi, Esq.

Levi & Korsinsky, LLP

33 Whitehall Street, 27th Floor

New York, NY 10004

Tel: (212) 363-7500

Fax: (212) 363-7171

Email: jlevi@levikorsinsky.com

www.zlk.com

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/ultragenyx-stock-declines-after-missing-primary-endpoints-on-its-phase-iii-orbit-and-cosmic-studies-302669091.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/ultragenyx-stock-declines-after-missing-primary-endpoints-on-its-phase-iii-orbit-and-cosmic-studies-302669091.html

SOURCE Levi & Korsinsky, LLP

Für dich aus unserer Redaktion zusammengestellt

Dein Kommentar zum Artikel im Forum

Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte.