Investors who purchased Six Flags Entertainment Corporation (NYSE: FUN) Should Contact Wolf Haldenstein Immediately

Lead Plaintiff Deadline is January 5, 2026

NEW YORK, Nov. 18, 2025 /PRNewswire/ -- Wolf Haldenstein Adler Freeman & Herz LLP announces that a securities class lawsuit on behalf all purchasers or acquirers of Six Flags Entertainment Corporation (f/k/a CopperSteel HoldCo, Inc.) (NYSE: FUN) common stock pursuant or traceable to the company's registration statement and prospectus issued in connection with the July 1, 2024 merger of legacy Six Flags Entertainment Corporation ("Legacy Six Flags") with Cedar Fair, L.P. ("Cedar Fair"), has been filed in the United States District Court for the Northern District of Ohio.

Investors have until January 5, 2026 to seek appointment as lead plaintiff.

PLEASE CLICK HERE TO JOIN THE CASE AND SUBMIT CONTACT INFORMATION

Allegations

The complaint alleges violations of the Securities Act of 1933, claiming that Six Flags and certain senior executives made false or misleading statements and omitted material facts in the registration statement and prospectus issued for the merger. Investors were misled about the true financial and operational health of Legacy Six Flags and the viability of the merger, resulting in substantial losses after the truth emerged.

Specifically, plaintiffs allege that:

- Legacy Six Flags suffered from years of underinvestment, leaving its parks in need of significant additional capital and operational expenditure to maintain competitive with other amusement parks.

- Despite public claims of "transformational investment initiatives," the company's parks required hundreds of millions in undisclosed capital infusions.

- Following his appointment as Chief Executive Officer in November 2021, Selim Bassoul drastically cut employee headcount to reduce costs, which degraded operations and guest experience.

- These operational and capital deficiencies undermined the rationale for the merger as presented to investors.

Stock Impact

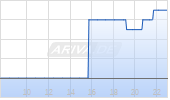

- Stock price at merger close (July 1, 2024): $55 per share

- Subsequent low: $14.81 on November 11, 2025

- Decline: Approximately 73%

Lead Plaintiff Deadline

Investors who suffered losses have until January 5, 2026, to seek appointment as lead plaintiff.

This illustrious firm, founded in 1888, is steadfast in their pursuit of justice for investors who have suffered financial harm due to these misrepresented statements. The law firm brings to the fore over 125 years of legal expertise in securities litigation and has a proven track record of protecting the rights of investors.

We encourage all investors who have been affected or have information that will assist in our investigation, to contact Wolf Haldenstein Adler Freeman & Herz LLP.

Contact:

- Phone: (800) 575-0735 or (212) 545-4774

- Email: classmember@whafh.com

- Contact Person: Gregory Stone, Director of Case and Financial Analysis

Firm Website: Wolf Haldenstein Adler Freeman & Herz LLP

This press release may be considered Attorney Advertising in some jurisdictions under the applicable law and ethical rules.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/investors-who-purchased-six-flags-entertainment-corporation-nyse-fun-should-contact-wolf-haldenstein-immediately-302618496.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/investors-who-purchased-six-flags-entertainment-corporation-nyse-fun-should-contact-wolf-haldenstein-immediately-302618496.html

SOURCE Wolf Haldenstein Adler Freeman & Herz LLP

Für dich aus unserer Redaktion zusammengestellt

Dein Kommentar zum Artikel im Forum

Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte.