Northwest Bancshares, Inc. Announces Second Quarter 2025 net income of $34 million, or $0.26 per diluted share

Total revenue grew 54% and net interest income increased 12% over prior year quarter

Successful completion and systems conversion of Penns Woods merger

Strong 2Q net interest margin at 3.56% as we continue to manage our funding costs and maintain our loan yield

Noninterest income grew 9% over prior quarter

2Q25 adjusted (non-GAAP) net income of $38 million, or $0.30 per diluted share

Commercial C&I lending momentum continues with 19% growth in the last year

COLUMBUS, Ohio, July 29, 2025 /PRNewswire/ -- Northwest Bancshares, Inc., (the "Company"), (Nasdaq: NWBI) announced net income for the quarter ended June 30, 2025 of $34 million, or $0.26 per diluted share. This represents an increase of $29 million compared to the same quarter last year, when net income was $5 million, or $0.04 per diluted share, and a decrease of $10 million compared to the prior quarter, when net income was $43 million, or $0.34 per diluted share. The annualized returns on average shareholders' equity and average assets for the quarter ended June 30, 2025 were 8.26% and 0.93% compared to 1.24% and 0.13% for the same quarter last year and 10.90% and 1.22% from the prior quarter.

Adjusted net income (non-GAAP) for the quarter ended June 30, 2025 was $38 million, or $0.30, per diluted share, which decreased by $6 million from $44 million, or $0.35, per diluted share, in the prior quarter. This decrease was primarily driven by an $8 million decrease in net interest income impacted by a large non-accrual interest income recovery in the prior quarter. The adjusted annualized returns on average shareholders' equity (non-GAAP) and average assets (non-GAAP) for the quarter ended June 30, 2025 were 9.36% and 1.06% compared to 11.11% and 1.25% for the prior quarter.

The Company also announced that its Board of Directors declared a quarterly cash dividend of $0.20 per share payable on August 19, 2025 to shareholders of record as of August 8, 2025. This is the 123rd consecutive quarter in which the Company has paid a cash dividend. Based on the market value of the Company's common stock as of June 30, 2025, this represents an annualized dividend yield of approximately 6.3%.

Louis J. Torchio, President and CEO, Northwest Bancshares commented, "I am pleased with our performance in the second quarter of 2025, as we continue to execute our strategy, delivering on our commitment to sustainable, responsible and profitable growth. Overall, we built on our strong start to the year, with net interest margin expansion and revenue growth, and we continued to exercise prudent expense control, resulting in further improvements in our efficiency ratio.

"Despite a still unpredictable operating environment, I am confident and excited about Northwest's prospects for the year ahead. Although we are always evaluating acquisition opportunities for additional scale and strategic benefits, with the Penns Woods acquisition and conversion just behind us, we are primarily focused on optimizing the operations and financial performance of the newly combined entity. We continue to enhance our capabilities, expand our footprint thru new branch openings, and provide personalized services and expertise to our customers and communities we serve."

| Dollars in thousands | | | | | | | Change 2Q25 vs. | ||

| | 2Q25 | | 1Q25 | | 2Q24 | | 1Q25 | | 2Q24 |

| Average loans receivable | $ 11,248,954 | | 11,176,516 | | 11,368,749 | | 0.6 % | | (1.1) % |

| Average investments | 2,056,476 | | 2,037,227 | | 2,021,347 | | 0.9 % | | 1.7 % |

| Average deposits | 12,154,001 | | 12,088,371 | | 12,086,362 | | 0.5 % | | 0.6 % |

| Average borrowed funds | 208,342 | | 224,122 | | 323,191 | | (7.0) % | | (35.5) % |

- Average loans receivable decreased $120 million from the quarter ended June 30, 2024 driven by our personal banking portfolio, which decreased by $265 million as cash flows from this portfolio were reinvested in our commercial portfolios. This was partially offset by growth in our commercial banking portfolio, which grew by $145 million in total, including a $332 million increase in our commercial and industrial portfolio as we have continued to build-out our commercial lending verticals. Compared to the first quarter of 2025, average loans receivable increased by $72 million with growth in our personal banking portfolio of $66 million.

- Average investments grew $35 million from the quarter ended June 30, 2024 and $19 million from the quarter ended March 31, 2025. The growth in average investments was primarily due to an increase in net portfolio purchases during the quarter to reach a normalized percentage of total assets for liquidity purposes.

- Average deposits grew $68 million from the quarter ended June 30, 2024 and $66 million from the quarter ended March 31, 2025. The growth in both periods was primarily driven by an increase in money market, interest-bearing checking and saving account balances partly due to customers shifting funds to these competitively priced products as their time deposits matured. These increases were partially offset by a decrease in brokered time deposit balances as growth in core deposits provided sufficient funding.

- Average borrowings decreased $115 million compared to the quarter end June 30, 2024 and decreased $16 million compared to the quarter ended March 31, 2025. The decrease in average borrowings from the prior year is primarily attributable to the strategic pay-down of wholesale borrowings with the proceeds from our investment portfolio restructuring in the second quarter of 2024.

Income Statement Highlights

| Dollars in thousands | | | | | | Change 2Q25 vs. | |||

| | 2Q25 | | 1Q25 | | 2Q24 | | 1Q25 | | 2Q24 |

| Interest income | $ 171,570 | | 180,595 | | 166,854 | | (5.0) % | | 2.8 % |

| Interest expense | 52,126 | | 52,777 | | 60,013 | | (1.2) % | | (13.1) % |

| Net interest income | $ 119,444 | | 127,818 | | 106,841 | | (6.6) % | | 11.8 % |

| | | | | | | | | | |

| Net interest margin | 3.56 % | | 3.87 % | | 3.20 % | | | | |

Compared to the quarter ended June 30, 2024, net interest income increased $13 million and net interest margin increased to 3.56% from 3.20% for the quarter ended June 30, 2024. This increase in net interest income resulted primarily from:

- A $5 million increase in interest income that was the result of higher average yields, partly offset by lower average earning assets. The average yield on loans improved to 5.55% for the quarter ended June 30, 2025 from 5.47% for the quarter ended June 30, 2024. This increase was driven by a loan mix shift towards higher yielding commercial loans. The average yields on investments increased due to a portfolio restructuring completed in the second quarter of 2024.

- A $8 million decrease in interest expense was the result of a decline in the cost of deposits in conjunction with a decrease in the average balance of borrowings. The cost of interest-bearing liabilities decreased to 2.09% for the quarter ended June 30, 2025 from 2.40% for the quarter ended June 30, 2024.

Compared to the quarter ended March 31, 2025, net interest income decreased $8 million and net interest margin decreased to 3.56% for the quarter ended June 30, 2025 from 3.87%. This decrease in net interest income resulted from the following:

- A $9 million decrease in interest income driven by an interest recovery of $13.1 million on a non-accrual commercial loan payoff during the quarter ended March 31, 2025. This was partially offset by higher growth in the average loan balances and an increase on investments yields compared to the prior quarter. The average yield on loans decreased to 5.55% from 6.00% and average investment yields increased to 2.69% from 2.62% for the quarter ended March 31, 2025. The decrease in loan yields was impacted by the non-accrual interest recoveries in the prior quarter. Excluding this interest recovery, the yield on loans for the quarter ended March 31, 2025 was 5.52% and the net interest margin was 3.48%.

- A $1 million decrease in interest expense driven by lower interest expense on deposits as average cost declined compared to the prior quarter to 1.97% from 2.02% for the quarter ended March 31, 2025.

| Dollars in thousands | | | | | | | Change 2Q25 vs. | ||

| | 2Q25 | | 1Q25 | | 2Q24 | | 1Q25 | | 2Q24 |

| Provision for credit losses - loans | $ 11,456 | | 8,256 | | 2,169 | | 38.8 % | | 428.2 % |

| Provision for credit losses - unfunded commitments | (2,712) | | (345) | | (2,539) | | 686.1 % | | 6.8 % |

| Total provision for credit losses expense | $ 8,744 | | 7,911 | | (370) | | 10.5 % | | (2463.2) % |

The total provision for credit losses for the quarter ended June 30, 2025 was $9 million primarily driven by downgrades and individual assessments within our commercial real estate portfolio offset by changes in the economic forecasts coupled with a decline in our reserves for unfunded commitments in the current period. This decline is based on the timing of origination and funding of commercial construction loans and lines of credit.

The Company saw an increase in classified loans to $518 million, or 4.57% of total loans, at June 30, 2025 from $257 million, or 2.26% of total loans, at June 30, 2024 and $279 million, or 2.49% of total loans, at March 31, 2025. This increase was driven by changes in our commercial real estate portfolio which increased $195 million.

| Dollars in thousands | | | | | | Change 2Q25 vs. | |||

| | 2Q25 | | 1Q25 | | 2Q24 | | 1Q25 | | 2Q24 |

| Noninterest income: | | | | | | | | | |

| Loss on sale of investments | $ — | | — | | (39,413) | | NA | | NA |

| Gain on sale of SBA loans | 819 | | 1,238 | | 1,457 | | (33.8) % | | (43.8) % |

| Service charges and fees | 15,797 | | 14,987 | | 15,527 | | 5.4 % | | 1.7 % |

| Trust and other financial services income | 7,948 | | 7,910 | | 7,566 | | 0.5 % | | 5.0 % |

| Gain on real estate owned, net | 258 | | 84 | | 487 | | 207.1 % | | (47.0) % |

| Income from bank-owned life insurance | 1,421 | | 1,331 | | 1,371 | | 6.8 % | | 3.6 % |

| Mortgage banking income | 1,075 | | 696 | | 901 | | 54.5 % | | 19.3 % |

| Other operating income | 3,620 | | 2,109 | | 3,255 | | 71.6 % | | 11.2 % |

| Total noninterest income | $ 30,938 | | 28,355 | | (8,849) | | 9.1 % | | (449.6) % |

Noninterest income increased $40 million from the quarter ended June 30, 2024 driven by a $39 million loss on the sale of investment securities in the prior year quarter. Excluding the loss on sale of securities, noninterest income was flat from the second quarter of 2024. Noninterest income increased by $3 million from the quarter ended March 31, 2025, due primarily to an increase in other operating income, driven by a gain on equity method investments, coupled with an increase in service charges and fees driven by commercial loan fees and deposit related fees based on customer activity.

| Dollars in thousands | | | | | | Change 2Q25 vs. | |||

| | 2Q25 | | 1Q25 | | 2Q24 | | 1Q25 | | 2Q24 |

| Noninterest expense: | | | | | | | | | |

| Personnel expense | $ 55,213 | | 54,540 | | 53,531 | | 1.2 % | | 3.1 % |

| Non-personnel expense | 42,327 | | 37,197 | | 38,889 | | 13.8 % | | 8.8 % |

| Total noninterest expense | $ 97,540 | | 91,737 | | 92,420 | | 6.3 % | | 5.5 % |

Noninterest expense increased from the quarter ended June 30, 2024 due to a $2 million increase in personnel expenses driven by an increase in core and incentive compensation coupled with an increase in non-personnel expense of $3 million due to merger and restructuring expenses in the current period.

Compared to the quarter ended March 31, 2025, noninterest expense increased due to an increase in non-personnel expense of $5 million due to merger and restructuring expenses in the quarter ended June 30, 2025.

| Dollars in thousands | | | | | | Change 2Q25 vs. | |||

| | 2Q25 | | 1Q25 | | 2Q24 | | 1Q25 | | 2Q24 |

| Income before income taxes | $ 44,098 | | 56,525 | | 5,942 | | (22.0) % | | 642.1 % |

| Income tax expense | 10,423 | | 13,067 | | 1,195 | | (20.2) % | | 772.2 % |

| Net income | $ 33,675 | | 43,458 | | 4,747 | | (22.5) % | | 609.4 % |

The provision for income taxes increased by $9 million from the quarter ended June 30, 2024 and decreased $3 million from the quarter ended March 31, 2025 primarily due to the quarterly change in income before income taxes.

Net income increased from the quarter ended June 30, 2024 and decreased from the quarter ended March 31, 2025 due to the factors discussed above.

Headquartered in Columbus, Ohio, Northwest Bancshares, Inc. is the bank holding company of Northwest Bank. Founded in 1896 Northwest Bank is a full-service financial institution offering a complete line of business and personal banking products, as well as employee benefits and wealth management services. As of June 30, 2025, Northwest operated 131 full-service financial centers and ten free standing drive-up facilities in Pennsylvania, New York, Ohio and Indiana. Northwest Bancshares, Inc.'s common stock is listed on The Nasdaq Stock Market LLC ("NWBI"). Additional information regarding Northwest Bancshares, Inc. and Northwest Bank can be accessed online at www.northwest.com.

Investor Contact: Michael Perry, Corporate Development & Strategy (814) 726-2140

Media Contact: Ian Bailey, External Communications (380) 400-2423

# # #

Forward-Looking Statements - This release may contain forward-looking statements with respect to the financial condition and results of operations of Northwest Bancshares, Inc. including, without limitation, statements relating to the earnings outlook of the Company. These forward-looking statements involve certain risks and uncertainties. Factors that may cause actual results to differ materially from those contemplated by such forward-looking statements include, among others, the following possibilities: (1) changes in the interest rate environment; (2) competitive pressure among financial services companies or instability or breakdown in the financial services sector; (3) general economic conditions including inflation, an increase in non-performing loans or changes in monetary, fiscal, regulatory and tariff policies of the U.S. government; (4) changes in legislation or regulatory requirements, including as part of the regulatory reform agenda of the Trump administration; (5) difficulties in continuing to improve operating efficiencies; (6) difficulties in the integration of acquired businesses or the ability to complete sales transactions; (7) increased risk associated with commercial real-estate and business loans; (8) changes in liquidity, including the size and composition of our deposit portfolio; (9) reduction in the value of our goodwill and other intangible assets; and (10) the effect of any pandemic, war or act of terrorism. Management has no obligation to revise or update these forward-looking statements to reflect events or circumstances that arise after the date of this release, except as required by law.

| Northwest Bancshares, Inc. and Subsidiaries Consolidated Statements of Financial Condition (Unaudited) (dollars in thousands, except per share amounts) | |||||

| | |||||

| | June 30, | | December 31, | | June 30, |

| Assets | | | | | |

| Cash and cash equivalents | $ 267,075 | | 288,378 | | 228,433 |

| Marketable securities available-for-sale (amortized cost of $1,341,651, $1,278,665 and $1,202,354, respectively) | 1,194,883 | | 1,108,944 | | 1,029,191 |

| Marketable securities held-to-maturity (fair value of $628,936, $637,948 and $663,292, respectively) | 719,561 | | 750,586 | | 784,208 |

| Total cash and cash equivalents and marketable securities | 2,181,519 | | 2,147,908 | | 2,041,832 |

| | | | | | |

| Loans held-for-sale | 13,104 | | 76,331 | | 9,445 |

| Residential mortgage loans | 3,052,126 | | 3,178,269 | | 3,315,303 |

| Home equity loans | 1,157,520 | | 1,149,396 | | 1,180,486 |

| Consumer loans | 2,211,275 | | 1,995,085 | | 2,080,058 |

| Commercial real estate loans | 2,782,404 | | 2,849,862 | | 3,026,958 |

| Commercial loans | 2,138,499 | | 2,007,402 | | 1,742,114 |

| Total loans receivable | 11,341,824 | | 11,180,014 | | 11,354,364 |

| Allowance for credit losses | (129,159) | | (116,819) | | (125,070) |

| Loans receivable, net | 11,212,665 | | 11,063,195 | | 11,229,294 |

| | | | | | |

| FHLB stock, at cost | 17,809 | | 21,006 | | 20,842 |

| Accrued interest receivable | 46,987 | | 46,356 | | 48,739 |

| Real estate owned, net | 48 | | 35 | | 74 |

| Premises and equipment, net | 123,402 | | 124,246 | | 128,208 |

| Bank-owned life insurance | 255,708 | | 253,137 | | 253,890 |

| Goodwill | 380,997 | | 380,997 | | 380,997 |

| Other intangible assets, net | 1,897 | | 2,837 | | 3,954 |

| Other assets | 250,971 | | 292,176 | | 277,723 |

| Total assets | $ 14,485,107 | | 14,408,224 | | 14,385,553 |

| Liabilities and shareholders' equity | | | | | |

| Liabilities | | | | | |

| Noninterest-bearing demand deposits | $ 2,643,099 | | 2,621,415 | | 2,581,699 |

| Interest-bearing demand deposits | 2,622,695 | | 2,666,504 | | 2,565,750 |

| Money market deposit accounts | 2,153,078 | | 2,007,739 | | 1,964,841 |

| Savings deposits | 2,211,509 | | 2,171,251 | | 2,148,727 |

| Time deposits | 2,570,648 | | 2,677,645 | | 2,826,362 |

| Total deposits | 12,201,029 | | 12,144,554 | | 12,087,379 |

| | | | | | |

| Borrowed funds | 198,008 | | 200,331 | | 242,363 |

| Subordinated debt | 114,713 | | 114,538 | | 114,364 |

| Junior subordinated debentures | 129,964 | | 129,834 | | 129,703 |

| Advances by borrowers for taxes and insurance | 47,865 | | 42,042 | | 52,271 |

| Accrued interest payable | 7,729 | | 6,935 | | 21,423 |

| Other liabilities | 143,731 | | 173,134 | | 181,452 |

| Total liabilities | 12,843,039 | | 12,811,368 | | 12,828,955 |

| Shareholders' equity | | | | | |

| Preferred stock, $0.01 par value: 50,000,000 shares authorized, no shares issued | — | | — | | — |

| Common stock, $0.01 par value: 500,000,000 shares authorized, 127,842,403, 127,508,003 and 127,307,997 shares issued and outstanding, respectively | 1,278 | | 1,275 | | 1,273 |

| Additional paid-in capital | 1,037,615 | | 1,033,385 | | 1,027,703 |

| Retained earnings | 699,049 | | 673,110 | | 657,706 |

| Accumulated other comprehensive loss | (95,874) | | (110,914) | | (130,084) |

| Total shareholders' equity | 1,642,068 | | 1,596,856 | | 1,556,598 |

| Total liabilities and shareholders' equity | $ 14,485,107 | | 14,408,224 | | 14,385,553 |

| | | | | | |

| Equity to assets | 11.34 % | | 11.08 % | | 10.82 % |

| Tangible common equity to tangible assets * | 8.93 % | | 8.65 % | | 8.37 % |

| Book value per share | $ 12.84 | | 12.52 | | 12.23 |

| Tangible book value per share * | $ 9.85 | | 9.51 | | 9.20 |

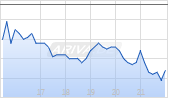

| Closing market price per share | $ 12.78 | | 13.19 | | 11.55 |

| Full time equivalent employees | 1,998 | | 1,956 | | 1,991 |

| Number of banking offices | 141 | | 141 | | 139 |

| * | Excludes goodwill and other intangible assets (non-GAAP). See reconciliation of non-GAAP financial measures for additional information relating to these items. |

| Northwest Bancshares, Inc. and Subsidiaries Consolidated Statements of Income (Unaudited) (dollars in thousands, except per share amounts) | |||||||||

| | |||||||||

| | Quarter ended | ||||||||

| | June 30, | | March 31, | | December 31, | | September 30, | | June 30, |

| | | | | | |||||

| Interest income: | | | | | | | | | |

| Loans receivable | $ 154,914 | | 164,638 | | 155,838 | | 156,413 | | 153,954 |

| Mortgage-backed securities | 12,154 | | 11,730 | | 11,515 | | 10,908 | | 9,426 |

| Taxable investment securities | 999 | | 933 | | 910 | | 842 | | 728 |

| Tax-free investment securities | 512 | | 512 | | 515 | | 512 | | 457 |

| FHLB stock dividends | 318 | | 366 | | 392 | | 394 | | 498 |

| Interest-earning deposits | 2,673 | | 2,416 | | 1,552 | | 2,312 | | 1,791 |

| Total interest income | 171,570 | | 180,595 | | 170,722 | | 171,381 | | 166,854 |

| Interest expense: | | | | | | | | | |

| Deposits | 46,826 | | 47,325 | | 50,854 | | 54,198 | | 52,754 |

| Borrowed funds | 5,300 | | 5,452 | | 5,671 | | 5,881 | | 7,259 |

| Total interest expense | 52,126 | | 52,777 | | 56,525 | | 60,079 | | 60,013 |

| Net interest income | 119,444 | | 127,818 | | 114,197 | | 111,302 | | 106,841 |

| Provision for credit losses - loans | 11,456 | | 8,256 | | 15,549 | | 5,727 | | 2,169 |

| Provision for credit losses - unfunded commitments | (2,712) | | (345) | | 1,016 | | (852) | | (2,539) |

| Net interest income after provision for credit losses | 110,700 | | 119,907 | | 97,632 | | 106,427 | | 107,211 |

| Noninterest income: | | | | | | | | | |

| Loss on sale of investments | — | | — | | — | | — | | (39,413) |

| Gain on sale of SBA loans | 819 | | 1,238 | | 822 | | 667 | | 1,457 |

| Service charges and fees | 15,797 | | 14,987 | | 15,975 | | 15,932 | | 15,527 |

| Trust and other financial services income | 7,948 | | 7,910 | | 7,485 | | 7,924 | | 7,566 |

| Gain on real estate owned, net | 258 | | 84 | | 238 | | 105 | | 487 |

| Income from bank-owned life insurance | 1,421 | | 1,331 | | 2,020 | | 1,434 | | 1,371 |

| Mortgage banking income | 1,075 | | 696 | | 224 | | 744 | | 901 |

| Other operating income | 3,620 | | 2,109 | | 13,299 | | 1,027 | | 3,255 |

| Total noninterest income/(loss) | 30,938 | | 28,355 | | 40,063 | | 27,833 | | (8,849) |

| Noninterest expense: | | | | | | | | | |

| Compensation and employee benefits | 55,213 | | 54,540 | | 53,198 | | 56,186 | | 53,531 |

| Premises and occupancy costs | 7,122 | | 8,400 | | 7,263 | | 7,115 | | 7,464 |

| Office operations | 2,910 | | 2,977 | | 3,036 | | 2,811 | | 3,819 |

| Collections expense | 838 | | 328 | | 905 | | 474 | | 406 |

| Processing expenses | 12,973 | | 13,990 | | 15,361 | | 14,570 | | 14,695 |

| Marketing expenses | 3,018 | | 1,880 | | 2,327 | | 2,004 | | 2,410 |

| Federal deposit insurance premiums | 2,296 | | 2,328 | | 2,949 | | 2,763 | | 2,865 |

| Professional services | 3,990 | | 2,756 | | 3,788 | | 3,302 | | 3,728 |

| Amortization of intangible assets | 436 | | 504 | | 526 | | 590 | | 635 |

| Merger, asset disposition and restructuring expense | 6,244 | | 1,123 | | 2,850 | | 43 | | 1,915 |

| Other expenses | 2,500 | | 2,911 | | 3,123 | | 909 | | 952 |

| Total noninterest expense | 97,540 | | 91,737 | | 95,326 | | 90,767 | | 92,420 |

| Income before income taxes | 44,098 | | 56,525 | | 42,369 | | 43,493 | | 5,942 |

| Income tax expense | 10,423 | | 13,067 | | 9,619 | | 9,875 | | 1,195 |

| Net income | $ 33,675 | | 43,458 | | 32,750 | | 33,618 | | 4,747 |

| | | | | | | | | | |

| Basic earnings per share | $ 0.26 | | 0.34 | | 0.26 | | 0.26 | | 0.04 |

| Diluted earnings per share | $ 0.26 | | 0.34 | | 0.26 | | 0.26 | | 0.04 |

| | | | | | | | | | |

| Weighted average common shares outstanding - diluted | 128,114,509 | | 128,299,013 | | 127,968,910 | | 127,714,511 | | 127,199,039 |

| | | | | | | | | | |

| Annualized return on average equity | 8.26 % | | 10.90 % | | 8.20 % | | 8.50 % | | 1.24 % |

| Annualized return on average assets | 0.93 % | | 1.22 % | | 0.91 % | | 0.93 % | | 0.13 % |

| Annualized return on average tangible common equity * | 10.78 % | | 14.29 % | | 10.81 % | | 11.26 % | | 1.65 % |

| Efficiency ratio | 64.86 % | | 58.74 % | | 61.80 % | | 65.24 % | | 94.31 % |

| Efficiency ratio, excluding certain items ** | 60.42 % | | 57.70 % | | 59.61 % | | 64.78 % | | 65.41 % |

| * | Excludes goodwill and other intangible assets (non-GAAP). See reconciliation of non-GAAP financial measures for additional information relating to these items. |

| ** | Excludes loss on sale of investments, amortization of intangible assets and merger, asset disposition and restructuring expenses (non-GAAP). See reconciliation of non-GAAP financial measures for additional information relating to these items. |

| Northwest Bancshares, Inc. and Subsidiaries Consolidated Statements of Income (Unaudited) (dollars in thousands, except per share amounts) | |||

| | |||

| | Six months ended June 30, | ||

| | 2025 | | 2024 |

| Interest income: | | | |

| Loans receivable | $ 319,552 | | 303,525 |

| Mortgage-backed securities | 23,884 | | 17,370 |

| Taxable investment securities | 1,932 | | 1,522 |

| Tax-free investment securities | 1,024 | | 948 |

| FHLB stock dividends | 684 | | 1,105 |

| Interest-earning deposits | 5,089 | | 2,623 |

| Total interest income | 352,165 | | 327,093 |

| Interest expense: | | | |

| Deposits | 94,151 | | 100,440 |

| Borrowed funds | 10,752 | | 16,574 |

| Total interest expense | 104,903 | | 117,014 |

| Net interest income | 247,262 | | 210,079 |

| Provision for credit losses - loans | 19,712 | | 6,403 |

| Provision for credit losses - unfunded commitments | (3,057) | | (3,338) |

| Net interest income after provision for credit losses | 230,607 | | 207,014 |

| Noninterest income: | | | |

| Loss on sale of investments | — | | (39,413) |

| Gain on sale of SBA loans | 2,057 | | 2,330 |

| Service charges and fees | 30,784 | | 31,050 |

| Trust and other financial services income | 15,858 | | 14,693 |

| Gain on real estate owned, net | 342 | | 544 |

| Income from bank-owned life insurance | 2,752 | | 2,873 |

| Mortgage banking income | 1,771 | | 1,353 |

| Other operating income | 5,729 | | 5,684 |

| Total noninterest income | 59,293 | | 19,114 |

| Noninterest expense: | | | |

| Compensation and employee benefits | 109,753 | | 105,071 |

| Premises and occupancy costs | 15,522 | | 15,091 |

| Office operations | 5,887 | | 6,586 |

| Collections expense | 1,166 | | 742 |

| Processing expenses | 26,963 | | 29,420 |

| Marketing expenses | 4,898 | | 4,559 |

| Federal deposit insurance premiums | 4,624 | | 5,888 |

| Professional services | 6,746 | | 7,793 |

| Amortization of intangible assets | 940 | | 1,336 |

| Merger, asset disposition and restructuring expense | 7,367 | | 2,870 |

| Other expenses | 5,411 | | 3,088 |

| Total noninterest expense | 189,277 | | 182,444 |

| Income before income taxes | 100,623 | | 43,684 |

| Income tax expense | 23,490 | | 9,774 |

| Net income | $ 77,133 | | 33,910 |

| | | | |

| Basic earnings per share | $ 0.60 | | 0.27 |

| Diluted earnings per share | $ 0.60 | | 0.27 |

| | | | |

| Weighted average common shares outstanding - diluted | 128,347,141 | | 127,345,379 |

| | | | |

| Annualized return on average equity | 9.56 % | | 4.41 % |

| Annualized return on average assets | 1.08 % | | 0.47 % |

| Annualized return on tangible common equity * | 12.51 % | | 5.88 % |

| | | | |

| Efficiency ratio | 61.74 % | | 79.60 % |

| Efficiency ratio, excluding certain items ** | 59.03 % | | 66.36 % |

| * | Excludes goodwill and other intangible assets (non-GAAP). See reconciliation of non-GAAP financial measures for additional information relating to these items. |

| ** | Excludes loss on sale of investments, amortization of intangible assets and merger, asset disposition and restructuring expenses (non-GAAP). See reconciliation of non-GAAP financial measures for additional information relating to these items. |

| Northwest Bancshares, Inc. and Subsidiaries Reconciliation of Non-GAAP Financial Measures (Unaudited) * (dollars in thousands, except per share amounts) | |||||||||

| | |||||||||

| | Quarter ended | | Six months ended June 30, | ||||||

| | June 30, | | March 31, | | June 30, | | 2025 | | 2024 |

| Reconciliation of net income to adjusted net income: | | | | | | | | | |

| Net income (GAAP) | $ 33,675 | | 43,458 | | 4,747 | | 77,133 | | 33,910 |

| Non-GAAP adjustments | | | | | | | | | |

| Add: merger, asset disposition and restructuring expense | 6,244 | | 1,123 | | 1,915 | | 7,367 | | 2,870 |

| Add: loss on the sale of investments | — | | — | | 39,413 | | — | | 39,413 |

| Less: tax benefit of non-GAAP adjustments | (1,748) | | (314) | | (11,572) | | (2,063) | | (11,839) |

| Adjusted net income (non-GAAP) | $ 38,171 | | 44,267 | | 34,503 | | 82,437 | | 64,354 |

| Diluted earnings per share (GAAP) | $ 0.26 | | 0.34 | | 0.04 | | 0.60 | | 0.27 |

| Diluted adjusted earnings per share (non-GAAP) | $ 0.30 | | 0.35 | | 0.27 | | 0.64 | | 0.51 |

| | | | | | | | | | |

| Average equity | $ 1,635,966 | | 1,616,611 | | 1,541,434 | | 1,626,342 | | 1,545,651 |

| Average assets | 14,468,197 | | 14,402,483 | | 14,458,592 | | 14,435,522 | | 14,433,602 |

| Annualized return on average equity (GAAP) | 8.26 % | | 10.90 % | | 1.24 % | | 9.56 % | | 4.41 % |

| Annualized return on average assets (GAAP) | 0.93 % | | 1.22 % | | 0.13 % | | 1.08 % | | 0.47 % |

| Annualized return on average equity, excluding merger, asset disposition and restructuring expense and loss on the sale of investments, net of tax (non-GAAP) | 9.36 % | | 11.11 % | | 9.00 % | | 10.22 % | | 8.37 % |

| Annualized return on average assets, excluding merger, asset disposition and restructuring expense and loss on sale of investments, net of tax (non-GAAP) | 1.06 % | | 1.25 % | | 0.96 % | | 1.15 % | | 0.90 % |

| The following non-GAAP financial measures used by the Company provide information useful to investors in understanding our operating performance and trends, and facilitate comparisons with the performance of our peers. The following table summarizes the non-GAAP financial measures derived from amounts reported in the Company's Consolidated Statements of Financial Condition. |

Für dich aus unserer Redaktion zusammengestellt

Dein Kommentar zum Artikel im Forum

Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte.