Northwest Bancshares, Inc. Announces Fourth Quarter 2025 net income of $46 million, or $0.31 per diluted share

Adjusted net income (non-GAAP) of $49 million, or $0.33 per diluted share

Net interest margin expands to 3.69% amid solid performance

Year to date EPS of $0.92 per diluted share, 16% growth from the prior year

Record quarterly total revenue of $180 million, 17% growth from the prior year

COLUMBUS, Ohio, Jan. 26, 2026 /PRNewswire/ -- Northwest Bancshares, Inc., (the "Company"), (Nasdaq: NWBI) announced net income for the quarter ended December 31, 2025 of $46 million, or $0.31 per diluted share. This represents an increase of $13 million compared to the same quarter last year, when net income was $33 million, or $0.26 per diluted share, and an increase of $43 million compared to the prior quarter, when net income was $3 million, or $0.02 per diluted share. The annualized returns on average shareholders' equity and average assets for the quarter ended December 31, 2025 were 9.70% and 1.10% compared to 8.20% and 0.91% for the same quarter last year and 0.69% and 0.08% from the prior quarter.

Adjusted net income (non-GAAP) for the quarter ended December 31, 2025 was $49 million, or $0.33 per diluted share, which increased by $8 million from $41 million, or $0.29 per diluted share in the prior quarter. This increase was driven by an increase in net interest income of $6 million, coupled with an increase in noninterest income of $6 million and a decrease in adjusted provision expense partially offset by an increase in adjusted noninterest expense of $7 million for the quarter ended December 31, 2025. All quarterly results were impacted by a full quarter of the acquisition of Penns Woods Bancorp, Inc. ("Penns Woods") which closed in late July 2025. The adjusted annualized returns on average shareholders' equity (non-GAAP) and average assets (non-GAAP) for the quarter ended December 31, 2025 were 10.33% and 1.17% compared to 8.89% and 1.01% for the prior quarter.

The Company also announced that its Board of Directors declared a quarterly cash dividend of $0.20 per share payable on February 18, 2026 to shareholders of record as of February 5, 2026. This is the 125th consecutive quarter in which the Company has paid a cash dividend. Based on the market value of the Company's common stock as of December 31, 2025, this represents an annualized dividend yield of approximately 6.7%.

Louis J. Torchio, President and CEO, Northwest Bancshares commented, "2025 was a transformational year for Northwest Bank. We closed on a significant acquisition, drove record revenue of $655 million for the full year, and continued to expand the firm's net interest margin. Coupled with our demonstrated expense management discipline through the closing and integration of our sizeable acquisition, we drove double digit EPS growth, all while investing in the talent, technology, and new financial centers and products to support our future growth."

"I am excited at our prospects in 2026, and anticipate another year of record revenue growth, as we build out our consumer franchise in Columbus, deepen relationships in our existing core markets, and continue to build market share in our commercial lines of business."

Balance Sheet Highlights

| Dollars in thousands | | | | | | | Change 4Q25 vs. | ||

| | 4Q25 | | 3Q25 | | 4Q24 | | 3Q25 | | 4Q24 |

| Average loans receivable | $ 12,982,499 | | 12,568,497 | | 11,204,781 | | 3.3 % | | 15.9 % |

| Average investments | 2,201,221 | | 2,111,928 | | 2,033,991 | | 4.2 % | | 8.2 % |

| Average deposits | 13,771,215 | | 13,296,651 | | 12,028,417 | | 3.6 % | | 14.5 % |

| Average borrowed funds | 354,894 | | 347,357 | | 222,506 | | 2.2 % | | 59.5 % |

- Average loans receivable increased $1.8 billion from the quarter ended December 31, 2024, primarily driven by the Penns Woods acquisition. Compared to the third quarter of 2025, average loans receivable increased by $414 million due to a full quarter impact from the acquisition coupled with internal loan growth.

- Average investments increased $167 million from the quarter ended December 31, 2024 and $89 million from the quarter ended September 30, 2025. The growth in average investments was primarily due to the Penns Woods acquisition and a targeted increase in the overall securities portfolio during the quarter.

- Average deposits grew $1.7 billion from the quarter ended December 31, 2024 and $475 million from the third quarter 2025. The growth in both periods was primarily driven by an increase in interest-bearing account balances primarily due to the addition of the Penns Woods deposit accounts.

- Average borrowings increased $132 million compared to the quarter ended December 31, 2024 due to the acquisition of long term borrowings from Penns Woods. Average borrowings increased $8 million compared to the quarter ended September 30, 2025. The increase is primarily attributable to the acquired long term borrowings and additional short term borrowings to fund loan and securities growth.

Income Statement Highlights

| Dollars in thousands | | | | | | Change 4Q25 vs. | |||

| | 4Q25 | | 3Q25 | | 4Q24 | | 3Q25 | | 4Q24 |

| Interest income | $ 202,825 | | 194,678 | | 170,722 | | 4.2 % | | 18.8 % |

| Interest expense | 60,659 | | 58,704 | | 56,525 | | 3.3 % | | 7.3 % |

| Net interest income | $ 142,166 | | 135,974 | | 114,197 | | 4.6 % | | 24.5 % |

| | | | | | | | | | |

| Net interest margin (FTE) | 3.69 % | | 3.65 % | | 3.42 % | | | | |

- A $32 million increase in interest income that was the result of higher average yields coupled with an increase in average earning assets. The increase in average earning assets was driven by the Penns Woods acquisition during the third quarter. The average yield on loans improved to 5.65% for the quarter ended December 31, 2025 from 5.56% for the quarter ended December 31, 2024 driven by a loan mix shift towards higher yielding commercial loans along with the accretion of loan fair value marks from the acquisition of $4.6 million during the quarter.

- A $4 million increase in interest expense is the result of an increase in the average balance of interest-bearing liabilities partially offset by a decline in the cost of deposits. The cost of interest-bearing liabilities decreased to 2.14% for the quarter ended December 31, 2025 from 2.27% for the quarter ended December 31, 2024.

Compared to the quarter ended September 30, 2025, net interest income increased $6 million and net interest margin increased to 3.69% for the quarter ended December 31, 2025 from 3.65% for the quarter ended September 30, 2025. This increase in net interest income resulted from the following:

- A $8 million increase in interest income driven by growth in the average loan and investment balances and an increase on loan and investments yields compared to the prior quarter. The average yield on loans increased to 5.65% from 5.63% and average investment yields increased to 2.98% from 2.81% for the quarter ended September 30, 2025. The increases were primarily driven by the Penns Woods acquisition, including the accretion of loan fair value marks, coupled with a continued shift in loan mix towards higher yielding commercial loans and adding new securities at rates above the existing portfolio average.

- A $2 million increase in interest expense driven higher average balances on both deposits and borrowings from the Penns Woods acquisition. Average cost of interest-bearing deposits decreased slightly compared to the prior quarter to 1.97% from 1.99% for the September 30, 2025 while average cost of borrowings declined to 3.83% from 3.84% for the quarter ended September 30, 2025.

| Dollars in thousands | | | | | | | Change 4Q25 vs. | | ||

| | 4Q25 | | 3Q25 | | 4Q24 | | 3Q25 | | 4Q24 | |

| Provision for credit losses - loans | $ 5,743 | | 31,394 | | 15,549 | | (81.7) % | | (63.1) % | |

| Provision for credit losses - unfunded commitments | 1,981 | | (189) | | 1,016 | | 1148.1 % | | 95.0 % | |

| Total provision for credit losses expense | $ 7,724 | | 31,205 | | 16,565 | | (75.2) % | | (53.4) % | |

| | | | | | | | | | | |

| Net charge-offs to average loans, annualized | 0.40 % | | 0.29 % | | 0.87 % | | | | | |

The total provision for credit losses for the quarter ended September 30, 2025 was $31 million primarily driven by the Day 1 initial provision from the Penns Woods acquisition of $20.6 million. Excluding the Day 1 provision for credit losses from the acquisition, the provision for credit losses for the quarter ended September 30, 2025 was $10.5 million.

The Company saw an decrease in classified loans to $453 million, or 3.49% of total loans, at December 31, 2025 from $527 million, or 4.07% of total loans, at September 30, 2025 and an increase from $272 million, or 2.44% of total loans, at December 31, 2024. This decrease was driven by improvements within the commercial real estate portfolio which decreased $65 million from the prior quarter. The increase from the prior year was primarily due to classified loans acquired in the Penns Woods acquisition.

| Dollars in thousands | | | | | | Change 4Q25 vs. | |||

| | 4Q25 | | 3Q25 | | 4Q24 | | 3Q25 | | 4Q24 |

| Noninterest income: | | | | | | | | | |

| Gain on sale of investments | $ 142 | | 36 | | — | | 294.4 % | | NA |

| Gain on sale of SBA loans | 437 | | 341 | | 822 | | 28.2 % | | (46.8) % |

| Service charges and fees | 17,377 | | 16,911 | | 15,975 | | 2.8 % | | 8.8 % |

| Trust and other financial services income | 8,416 | | 8,040 | | 7,485 | | 4.7 % | | 12.4 % |

| Gain on real estate owned, net | 148 | | 132 | | 238 | | 12.1 % | | (37.8) % |

| Income from bank-owned life insurance | 8,269 | | 1,751 | | 2,020 | | 372.2 % | | 309.4 % |

| Mortgage banking income | 379 | | 1,003 | | 224 | | (62.2) % | | 69.2 % |

| Other operating income | 2,609 | | 3,984 | | 13,299 | | (34.5) % | | (80.4) % |

| Total noninterest income | $ 37,777 | | 32,198 | | 40,063 | | 17.3 % | | (5.7) % |

Noninterest income decreased from the quarter ended December 31, 2024 by $2 million primarily due to a decrease in other operating income driven by a gain on sale of Visa B shares and a gain on a low income housing tax credit investment in the prior year which was partially offset by an increase in income from bank-owned life insurance due to a large claim recognized in the current quarter. Noninterest income increased from the quarter ended September 30, 2025 by $6 million due primarily to an increase in income from bank-owned life insurance.

| Dollars in thousands | | | | | | Change 4Q25 vs. | |||

| | 4Q25 | | 3Q25 | | 4Q24 | | 3Q25 | | 4Q24 |

| Noninterest expense: | | | | | | | | | |

| Personnel expense | $ 65,143 | | 63,014 | | 53,198 | | 3.4 % | | 22.5 % |

| Non-personnel expense | 48,378 | | 70,484 | | 42,128 | | (31.4) % | | 14.8 % |

| Total noninterest expense | $ 113,521 | | 133,498 | | 95,326 | | (15.0) % | | 19.1 % |

Noninterest expense increased from the quarter ended December 31, 2024 due to a $12 million increase in core compensation and benefits expense due to the addition of Penns Woods employees coupled with an increase in performance based incentive compensation expense. Additionally, non-personnel expense increased by $6 million due to an increase of $2 million of amortization of intangible expense and $1 million of merger and restructuring expense related to the acquisition coupled with increases in operating expenses due to the addition of the Penns Woods branches to our footprint.

Compared to the quarter ended September 30, 2025, personnel expense increased $2 million driven by the same factors discussed above. Non-personnel expense decreased by $22 million due to a $27 million decrease in merger and restructuring expenses in the current quarter which was offset by an increase in processing and other expense due to a full quarter of additional branches and the timing of charitable contributions.

| Dollars in thousands | | | | | | Change 4Q25 vs. | |||

| | 4Q25 | | 3Q25 | | 4Q24 | | 3Q25 | | 4Q24 |

| Income before income taxes | $ 58,698 | | 3,469 | | 42,369 | | 1592.1 % | | 38.5 % |

| Income tax expense | 12,985 | | 302 | | 9,619 | | 4199.7 % | | 35.0 % |

| Net income | $ 45,713 | | 3,167 | | 32,750 | | 1343.4 % | | 39.6 % |

The provision for income taxes increased by $3 million from the quarter ended December 31, 2024 and $13 million from the quarter ended September 30, 2025 primarily due to the quarterly change in income before income taxes.

Net income increased from the quarter ended December 31, 2024 and September 30, 2025 due to the factors discussed above.

Headquartered in Columbus, Ohio, Northwest Bancshares, Inc. is the bank holding company of Northwest Bank. Founded in 1896 Northwest Bank is a full-service financial institution offering a complete line of business and personal banking products, as well as employee benefits and wealth management services. As of December 31, 2025, Northwest operated 151 full-service financial centers and ten free standing drive-up facilities in Pennsylvania, New York, Ohio and Indiana. Northwest Bancshares, Inc.'s common stock is listed on The Nasdaq Stock Market LLC ("NWBI"). Additional information regarding Northwest Bancshares, Inc. and Northwest Bank can be accessed online at www.northwest.com.

Investor Contact: Michael Perry, Corporate Development & Strategy (814) 726-2140

Media Contact: Ian Bailey, External Communications (380) 400-2423

# # #

This release may contain forward-looking statements. When used or incorporated by reference in disclosure documents, the words "believe," "anticipate," "estimate," "expect," "project," "target," "goal" and similar expressions are intended to identify forward-looking statements within the meaning of section 27A of the Securities Act of 1933 and section 21E of the Securities Exchange Act of 1934. These forward-looking statements include but are not limited to: statements of our goals, intentions and expectations; statements regarding our financial condition and results of operations, including statements related to our earnings outlook; statements regarding our business plans, prospects, growth and operating strategies; statements regarding the quality of our loan and investment portfolios; and estimates of our risks and future costs and benefits. These forward-looking statements are based on current beliefs and expectations of our management and are inherently subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond our control. In addition, these forward-looking statements are subject to assumptions with respect to future business strategies and decisions that are subject to change. Such forward-looking statements are subject to certain risks, uncertainties and assumptions, including but not limited to the following: the possibility that any of the anticipated benefits of the merger with Penns Woods will not be realized or will not be realized within the expected time period; the effect of the merger on the combined company's customer and employee relationships and operating results; and other factors that may affect the results of operations and financial condition of the combined company; inflation and changes in the interest rate environment that reduce our margins, our loan origination, or the fair value of financial instruments; changes in asset quality, including increases in default rates on loans and higher levels of nonperforming loans and loan charge-offs generally; changes in laws, government regulations or supervision, examination and enforcement priorities affecting financial institutions, including as part of the regulatory reform agenda of the Trump administration, as well as changes in regulatory fees and capital requirements; changes in federal, state, or local tax laws and tax rates; general economic conditions, either nationally or in our market areas, that are different than expected, including inflationary or recessionary pressures or those related to changes in monetary, fiscal, regulatory, tariff and international trade policies of the U.S. government, including policies of the U.S. Department of Treasury and Board of Governors of the Federal Reserve System, and any related increases in compliance and other costs; trade disputes, barriers to trade or the emergence of trade restrictions and the resulting impacts on market volatility and global trade; growing fiscal deficits; potential recession or slowing of growth in the U.S., Europe and other regions; developments in the Middle East and in Latin America; adverse changes in the securities and credit markets; instability or breakdown in the financial services sector, including failures or rumors of failures of other depository institutions, along with actions taken by governmental agencies to address such turmoil; cyber-security concerns, including an interruption or breach in the security of our website or other information systems; technological changes that may be more difficult or expensive than expected; changes in liquidity, including the size and composition of our deposit portfolio, and the percentage of uninsured deposits in the portfolio; the ability of third-party providers to perform their obligations to us; competition among depository and other financial institutions, including with respect to deposit gathering, service charges and fees; our ability to enter new markets successfully and capitalize on growth opportunities; our ability to manage our internal growth and our ability to successfully integrate acquired entities, businesses or branch offices; changes in consumer spending, borrowing and savings habits; our ability to continue to increase and manage our commercial and personal loans; possible impairments of securities held by us, including those issued by government entities and government sponsored enterprises; changes in the value of our goodwill or other intangible assets; the impact of the economy on our loan portfolio (including cash flow and collateral values), investment portfolio, customers and capital market activities; our ability to receive regulatory approvals for proposed transactions or new lines of business; the effects of any federal government shutdown or the inability of the federal government to manage debt limits; changes in the financial performance and/or condition of our borrowers; the effect of changes in accounting policies and practices, as may be adopted by the regulatory agencies, as well as the Securities and Exchange Commission (the "SEC"), the Public Company Accounting Oversight Board, the Financial Accounting Standards Board ("FASB") and other accounting standard setters; changes in the level and direction of loan delinquencies and write-offs and changes in estimates of the adequacy of the allowance for credit losses; our ability to access cost-effective funding; the effect of global or national war, conflict, or terrorism; our ability to manage market risk, credit risk and operational risk; the disruption to local, regional, national and global economic activity caused by infectious disease outbreaks, and the significant impact that any such outbreaks may have on our growth, operations and earnings; the effects of natural disasters and extreme weather events; changes in our ability to continue to pay dividends, either at current rates or at all; our ability to retain key employees; and our compensation expense associated with equity allocated or awarded to our employees. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those anticipated, estimated, expected or projected. These and other risk factors are more fully described in this presentation and in the Northwest Bancshares, Inc. (the "Company") Annual Report on Form 10-K for the year ended December 31, 2024 under the section entitled "Item 1A - Risk Factors," and from time to time in other filings made by the Company with the SEC. These forward-looking statements speak only at the date of the presentation. The Company expressly disclaims any obligation to publicly release any updates or revisions to reflect any change in the Company's expectations with regard to any change in events, conditions or circumstances on which any such statement is based.

Use of Non-GAAP Financial Measures

This release contains financial information determined by methods other than in accordance with accounting principles generally accepted in the United States of America ("GAAP"). Management uses these "non-GAAP" measures in its analysis of the Company's performance. Management believes these non-GAAP financial measures allow for better comparability of period-to-period operating performance. Additionally, the Company believes this information is utilized by regulators and market analysts to evaluate a company's financial condition and therefore, such information is useful to investors. These disclosures should not be viewed as a substitute for operating results determined in accordance with GAAP, nor are they necessarily comparable to non-GAAP performance measures that may be presented by other companies. See the pages 9 and 10 of this release for reconciliations of non-GAAP financial measures to the most directly comparable GAAP measures where applicable.

| Northwest Bancshares, Inc. and Subsidiaries | |||||

| Consolidated Statements of Financial Condition (Unaudited) | |||||

| (dollars in thousands, except per share amounts) | |||||

| | |||||

| | December 31, 2025 | | September 30, 2025 | | December 31, 2024 |

| Assets | | | | | |

| Cash and cash equivalents | $ 233,647 | | 278,817 | | 288,378 |

| Marketable securities available-for-sale (amortized cost of $1,710,978, $1,405,959 and $1,278,665, respectively) | 1,586,382 | | 1,270,880 | | 1,108,944 |

| Marketable securities held-to-maturity (fair value of $605,929, $618,633 and $637,948, respectively) | 683,369 | | 702,392 | | 750,586 |

| Total cash and cash equivalents and marketable securities | 2,503,398 | | 2,252,089 | | 2,147,908 |

| | | | | | |

| Loans held-for-sale | 22,437 | | 22,297 | | 76,331 |

| Residential mortgage loans | 3,100,780 | | 3,157,853 | | 3,178,269 |

| Home equity loans | 1,507,532 | | 1,520,893 | | 1,149,396 |

| Consumer loans | 2,563,890 | | 2,453,805 | | 1,995,085 |

| Commercial real estate loans | 3,296,902 | | 3,495,664 | | 2,849,862 |

| Commercial loans | 2,538,212 | | 2,312,718 | | 2,007,402 |

| Total loans receivable | 13,007,316 | | 12,940,933 | | 11,180,014 |

| Allowance for credit losses | (150,212) | | (157,396) | | (116,819) |

| Loans receivable, net | 12,857,104 | | 12,783,537 | | 11,063,195 |

| | | | | | |

| FHLB stock, at cost | 36,628 | | 33,349 | | 21,006 |

| Accrued interest receivable | 56,291 | | 55,549 | | 46,356 |

| Real estate owned, net | 76 | | 174 | | 35 |

| Premises and equipment, net | 140,381 | | 139,491 | | 124,246 |

| Bank-owned life insurance | 294,386 | | 303,115 | | 253,137 |

| Goodwill | 444,330 | | 438,402 | | 380,997 |

| Other intangible assets, net | 39,667 | | 47,924 | | 2,837 |

| Other assets | 371,919 | | 305,082 | | 292,176 |

| Total assets | $ 16,766,617 | | 16,381,009 | | 14,408,224 |

| Liabilities and shareholders' equity | | | | | |

| Liabilities | | | | | |

| Noninterest-bearing demand deposits | $ 3,123,229 | | 3,089,963 | | 2,621,415 |

| Interest-bearing demand deposits | 2,995,759 | | 2,898,350 | | 2,666,504 |

| Money market deposit accounts | 2,540,818 | | 2,462,979 | | 2,007,739 |

| Savings deposits | 2,366,513 | | 2,373,413 | | 2,171,251 |

| Time deposits | 2,916,698 | | 2,871,544 | | 2,677,645 |

| Total deposits | 13,943,017 | | 13,696,249 | | 12,144,554 |

| | | | | | |

| Borrowed funds | 446,283 | | 368,241 | | 200,331 |

| Subordinated debt | 114,800 | | 114,800 | | 114,538 |

| Junior subordinated debentures | 130,093 | | 130,028 | | 129,834 |

| Advances by borrowers for taxes and insurance | 37,309 | | 21,840 | | 42,042 |

| Accrued interest payable | 6,846 | | 10,555 | | 6,935 |

| Other liabilities | 197,845 | | 183,560 | | 173,134 |

| Total liabilities | 14,876,193 | | 14,525,273 | | 12,811,368 |

| Shareholders' equity | | | | | |

| Preferred stock, $0.01 par value: 50,000,000 shares authorized, no shares issued | — | | — | | — |

| Common stock, $0.01 par value: 500,000,000 shares authorized, 146,107,964, 146,097,057 and 127,508,003 shares issued and outstanding, respectively | 1,461 | | 1,461 | | 1,275 |

| Additional paid-in capital | 1,270,444 | | 1,268,694 | | 1,033,385 |

| Retained earnings | 689,210 | | 672,843 | | 673,110 |

| Accumulated other comprehensive loss | (70,691) | | (87,262) | | (110,914) |

| Total shareholders' equity | 1,890,424 | | 1,855,736 | | 1,596,856 |

| Total liabilities and shareholders' equity | $ 16,766,617 | | 16,381,009 | | 14,408,224 |

| | | | | | |

| Equity to assets | 11.27 % | | 11.33 % | | 11.08 % |

| Tangible common equity to tangible assets* | 8.64 % | | 8.62 % | | 8.65 % |

| Book value per share | $ 12.94 | | 12.70 | | 12.52 |

| Tangible book value per share* | $ 9.63 | | 9.37 | | 9.51 |

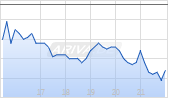

| Closing market price per share | $ 12.00 | | 12.39 | | 13.19 |

| Full time equivalent employees | 2,169 | | 2,190 | | 1,956 |

| Number of banking offices | 161 | | 161 | | 141 |

| | |

| * | Excludes goodwill and other intangible assets (non-GAAP). See reconciliation of non-GAAP financial measures for additional information relating to these items. |

| Northwest Bancshares, Inc. and Subsidiaries | |||||||||

| Consolidated Statements of Income (Unaudited) | |||||||||

| (dollars in thousands, except per share amounts) | |||||||||

| | |||||||||

| | Quarter ended | ||||||||

| | December 31, 2025 | | September 30, 2025 | | June 30, 2025 | | March 31, 2025 | | December 31, 2024 |

| | | | | | |||||

| Interest income: | | | | | | | | | |

| Loans receivable | $ 184,047 | | 177,723 | | 154,914 | | 164,638 | | 155,838 |

| Mortgage-backed securities | 14,071 | | 12,668 | | 12,154 | | 11,730 | | 11,515 |

| Taxable investment securities | 1,324 | | 1,183 | | 999 | | 933 | | 910 |

| Tax-free investment securities | 777 | | 752 | | 512 | | 512 | | 515 |

| FHLB stock dividends | 701 | | 652 | | 318 | | 366 | | 392 |

| Interest-earning deposits | 1,905 | | 1,700 | | 2,673 | | 2,416 | | 1,552 |

| Total interest income | 202,825 | | 194,678 | | 171,570 | | 180,595 | | 170,722 |

| Interest expense: | | | | | | | | | |

| Deposits | 52,947 | | 51,880 | | 46,826 | | 47,325 | | 50,854 |

| Borrowed funds | 7,712 | | 6,824 | | 5,300 | | 5,452 | | 5,671 |

| Total interest expense | 60,659 | | 58,704 | | 52,126 | | 52,777 | | 56,525 |

| Net interest income | 142,166 | | 135,974 | | 119,444 | | 127,818 | | 114,197 |

| Provision for credit losses - loans | 5,743 | | 31,394 | | 11,456 | | 8,256 | | 15,549 |

| Provision for credit losses - unfunded commitments | 1,981 | | (189) | | (2,712) | | (345) | | 1,016 |

| Net interest income after provision for credit losses | 134,442 | | 104,769 | | 110,700 | | 119,907 | | 97,632 |

| Noninterest income: | | | | | | | | | |

| Gain on sale of investments | 142 | | 36 | | — | | — | | — |

| Gain on sale of SBA loans | 437 | | 341 | | 819 | | 1,238 | | 822 |

| Service charges and fees | 17,377 | | 16,911 | | 15,797 | | 14,987 | | 15,975 |

| Trust and other financial services income | 8,416 | | 8,040 | | 7,948 | | 7,910 | | 7,485 |

| Gain on real estate owned, net | 148 | | 132 | | 258 | | 84 | | 238 |

| Income from bank-owned life insurance | 8,269 | | 1,751 | | 1,421 | | 1,331 | | 2,020 |

| Mortgage banking income | 379 | | 1,003 | | 1,075 | | 696 | | 224 |

| Other operating income | 2,609 | | 3,984 | | 3,620 | | 2,109 | | 13,299 |

| Total noninterest income | 37,777 | | 32,198 | | 30,938 | | 28,355 | | 40,063 |

| Noninterest expense: | | | | | | | | | |

| Compensation and employee benefits | 65,143 | | 63,014 | | 55,213 | | 54,540 | | 53,198 |

| Premises and occupancy costs | 8,170 | | 7,707 | | 7,122 | | 8,400 | | 7,263 |

| Office operations | 4,217 | | 3,495 | | 2,910 | | 2,977 | | 3,036 |

| Collections expense | 856 | | 776 | | 838 | | 328 | | 905 |

| Processing expenses | 16,454 | | 15,072 | | 12,973 | | 13,990 | | 15,361 |

| Marketing expenses | 1,827 | | 1,932 | | 3,018 | | 1,880 | | 2,327 |

| Federal deposit insurance premiums | 3,538 | | 3,361 | | 2,296 | | 2,328 | | 2,949 |

| Professional services | 3,366 | | 3,010 | | 3,990 | | 2,756 | | 3,788 |

| Amortization of intangible assets | 2,257 | | 1,974 | | 436 | | 504 | | 526 |

| Merger, asset disposition and restructuring expense | 4,160 | | 31,260 | | 6,244 | | 1,123 | | 2,850 |

| Other expenses | 3,533 | | 1,897 | | 2,500 | | 2,911 | | 3,123 |

| Total noninterest expense | 113,521 | | 133,498 | | 97,540 | | 91,737 | | 95,326 |

| Income before income taxes | 58,698 | | 3,469 | | 44,098 | | 56,525 | | 42,369 |

| Income tax expense | 12,985 | | 302 | | 10,423 | | 13,067 | | 9,619 |

| Net income | $ 45,713 | | 3,167 | | 33,675 | | 43,458 | | 32,750 |

| | | | | | | | | | |

| Basic earnings per share | $ 0.31 | | 0.02 | | 0.26 | | 0.34 | | 0.26 |

| Diluted earnings per share | $ 0.31 | | 0.02 | | 0.26 | | 0.34 | | 0.26 |

| | | | | | | | | | |

| Weighted average common shares outstanding - diluted | 146,703,966 | | 141,175,516 | | 128,114,509 | | 128,299,013 | | 127,968,910 |

| | | | | | | | | | |

| Annualized return on average equity | 9.70 % | | 0.69 % | | 8.26 % | | 10.90 % | | 8.20 % |

| Annualized return on average assets | 1.10 % | | 0.08 % | | 0.93 % | | 1.22 % | | 0.91 % |

| Annualized return on average tangible common equity * | 13.10 % | | 0.90 % | | 10.78 % | | 14.29 % | | 10.81 % |

| Efficiency ratio | 63.09 % | | 79.38 % | | 64.86 % | | 58.74 % | | 61.80 % |

| Efficiency ratio, excluding certain items ** | 59.52 % | | 59.62 % | | 60.42 % | | 57.70 % | | 59.61 % |

| | |

| * | Excludes goodwill and other intangible assets (non-GAAP). See reconciliation of non-GAAP financial measures for additional information relating to these items. |

| ** | Excludes amortization of intangible assets and merger, asset disposition and restructuring expenses (non-GAAP). See reconciliation of non-GAAP financial measures for additional information relating to these items. |

| Northwest Bancshares, Inc. and Subsidiaries | |||

| Consolidated Statements of Income (Unaudited) | |||

| (dollars in thousands, except per share amounts) | |||

| | |||

| | Year ended December 31, | ||

| | 2025 | | 2024 |

| Interest income: | | | |

| Loans receivable | $ 681,322 | | 615,776 |

| Mortgage-backed securities | 50,623 | | 39,793 |

| Taxable investment securities | 4,439 | | 3,274 |

| Tax-free investment securities | 2,553 | | 1,975 |

| FHLB stock dividends | 2,037 | | 1,891 |

| Interest-earning deposits | 8,694 | | 6,487 |

| Total interest income | 749,668 | | 669,196 |

| Interest expense: | | | |

| Deposits | 198,978 | | 205,492 |

| Borrowed funds | 25,288 | | 28,126 |

| Total interest expense | 224,266 | | 233,618 |

| Net interest income | 525,402 | | 435,578 |

| Provision for credit losses - loans | 56,849 | | 27,679 |

| Provision for credit losses - unfunded commitments | (1,265) | | (3,174) |

| Net interest income after provision for credit losses | 469,818 | | 411,073 |

| Noninterest income: | | | |

| Gain/(loss) on sale of investments | 178 | | (39,413) |

| Gain on sale of SBA loans | 2,835 | | 3,819 |

| Service charges and fees | 65,072 | | 62,957 |

| Trust and other financial services income | 32,314 | | 30,102 |

| Gain on real estate owned, net | 622 | | 887 |

| Income from bank-owned life insurance | 12,772 | | 6,327 |

| Mortgage banking income | 3,153 | | 2,321 |

| Other operating income | 12,322 | | 20,010 |

| Total noninterest income | 129,268 | | 87,010 |

| Noninterest expense: | | | |

| Compensation and employee benefits | 237,910 | | 214,455 |

| Premises and occupancy costs | 31,399 | | 29,469 |

| Office operations | 13,599 | | 12,433 |

| Collections expense | 2,798 | | 2,121 |

| Processing expenses | 58,489 | | 59,351 |

| Marketing expenses | 8,657 | | 8,890 |

| Federal deposit insurance premiums | 11,523 | | 11,600 |

| Professional services | 13,122 | | 14,883 |

| Amortization of intangible assets | 5,171 | | 2,452 |

| Merger, asset disposition and restructuring expense | 42,787 | | 5,763 |

| Other expenses | 10,841 | | 7,120 |

| Total noninterest expense | 436,296 | | 368,537 |

| Income before income taxes | 162,790 | | 129,546 |

| Income tax expense | 36,777 | | 29,268 |

| Net income | $ 126,013 | | 100,278 |

| | | | |

| Basic earnings per share | $ 0.93 | | 0.79 |

| Diluted earnings per share | $ 0.92 | | 0.79 |

| | | | |

| Weighted average common shares outstanding - diluted | 136,322,885 | | 127,699,501 |

| | | | |

| Annualized return on average equity | 7.27 % | | 6.41 % |

| Annualized return on average assets | 0.82 % | | 0.70 % |

| Annualized return on tangible common equity * | 9.56 % | | 8.51 % |

| | | | |

| Efficiency ratio | 66.64 % | | 70.52 % |

| Efficiency ratio, excluding certain items ** | 59.32 % | | 64.11 % |

| | |

| * | Excludes goodwill and other intangible assets (non-GAAP). See reconciliation of non-GAAP financial measures for additional information relating to these items. |

| ** | Excludes loss on sale of investments, gain on sale of mortgage servicing rights, amortization of intangible assets and merger, asset disposition and restructuring expenses (non-GAAP). See reconciliation of non-GAAP financial measures for additional information relating to these items. |

| Northwest Bancshares, Inc. and Subsidiaries | |||||||||

| Reconciliation of Non-GAAP Financial Measures (Unaudited) * | |||||||||

| (dollars in thousands, except per share amounts) | |||||||||

| | |||||||||

| | Quarter ended | | Year ended December 31, | ||||||

| | December 31, 2025 | | September 30, 2025 | | December 31, 2024 | | 2025 | | 2024 |

| Reconciliation of net income to adjusted net income: | | | | | | | | | |

| Net income (GAAP) | $ 45,713 | | 3,167 | | 32,750 | | 126,013 | | 100,278 |

| Non-GAAP adjustments | | | | | | | | | |

| Add: merger, asset disposition and restructuring expense | 4,160 | | 31,260 | | 2,850 | | 42,787 | | 5,763 |

| Add: loss on the sale of investments | — | | — | | — | | — | | 39,413 |

| Add: CECL Day 1 non-PCD and unfunded provision expense | — | | 20,664 | | — | | 20,664 | | — |

| Less: tax benefit of non-GAAP adjustments | (1,165) | | (14,539) | | (798) | | (17,766) | | (12,649) |

| Adjusted net income (non-GAAP) | $ 48,708 | | 40,552 | | 34,802 | | 171,698 | | 132,805 |

| Diluted earnings per share (GAAP) | $ 0.31 | | 0.02 | | 0.26 | | 0.92 | | 0.79 |

| Diluted adjusted earnings per share (non-GAAP) | $ 0.33 | | 0.29 | | 0.27 | | 1.26 | | 1.04 |

| | | | | | | | | | |

| Average equity | $ 1,870,088 | | 1,809,395 | | 1,589,228 | | 1,733,909 | | 1,563,454 |

| Average assets | 16,494,008 | | 15,942,440 | | 14,322,864 | | 15,334,189 | | 14,385,171 |

| Annualized return on average equity (GAAP) | 9.70 % | | 0.69 % | | 8.20 % | | 7.27 % | | 6.41 % |

| Annualized return on average assets (GAAP) | 1.10 % | | 0.08 % | | 0.91 % | | 0.82 % | | 0.70 % |

| Annualized return on average equity, excluding merger, asset disposition and restructuring expense, loss on the sale of investments and CECL Day 1 non-PCD and unfunded provision expense, net of tax (non-GAAP) | 10.33 % | | 8.89 % | | 8.71 % | | 9.90 % | | 8.49 % |

| Annualized return on average assets, excluding merger, asset disposition and restructuring expense, loss on sale of investments, and CECL Day 1 non-PCD and unfunded provision expense, net of tax (non-GAAP) | 1.17 % | | 1.01 % | | 0.97 % | | 1.12 % | | 0.92 % |

| |

| The following non-GAAP financial measures used by the Company provide information useful to investors in understanding our operating performance and trends, and facilitate comparisons with the performance of our peers. The following table summarizes the non-GAAP financial measures derived from amounts reported in the Company's Consolidated Statements of Financial Condition. |

| |

| | December 31, 2025 | | September 30, 2025 | | December 31, 2024 |

| Tangible common equity to assets | | | | | |

| Total shareholders' equity | $ 1,890,424 | | 1,855,736 | | 1,596,856 |

| Less: goodwill and intangible assets | (483,997) | | (486,326) | | (383,834) |

| Tangible common equity | $ 1,406,427 | | 1,369,410 | | 1,213,022 |

| | | | | | |

| Total assets | $ 16,766,617 | | 16,381,009 | | 14,408,224 |

| Less: goodwill and intangible assets | (483,997) | | (486,326) | | (383,834) |

| Tangible assets | $ 16,282,620 | | 15,894,683 | | 14,024,390 |

| | | | | | |

| Tangible common equity to tangible assets | 8.64 % | | 8.62 % | | 8.65 % |

| | | | | | |

| Tangible book value per share | | | | | |

| Tangible common equity | $ 1,406,427 | | 1,369,410 | | 1,213,022 |

| Common shares outstanding | 146,107,964 | | 146,097,057 | | 127,508,003 |

| Tangible book value per share | 9.63 | | 9.37 | | 9.51 |

| Northwest Bancshares, Inc. and Subsidiaries | |||||||||||||

| Reconciliation of Non-GAAP Financial Measures (Unaudited) * | |||||||||||||

| (dollars in thousands, except per share amounts) | |||||||||||||

| | |||||||||||||

| | |||||||||||||

| The following table summarizes the non-GAAP financial measures derived from amounts reported in the Company's Consolidated Statements of Income. | |||||||||||||

| | |||||||||||||

| | Quarter ended | | Year ended December 31, | ||||||||||

| | December 31, 2025 | | September 30, 2025 | | June 30, 2025 | | March 31, 2025 | | December 31, 2024 | | 2025 | | 2024 |

| | | | | | | | |||||||

| Annualized return on average tangible common equity | | | | | | | | | | | | | |

| Net income | $ 45,713 | | 3,167 | | 33,675 | | 43,458 | | 32,750 | | 126,013 | | 100,278 |

| | | | | | | | | | | | | | |

| Average shareholders' equity | 1,870,088 | | 1,809,395 | | 1,635,966 | | 1,616,611 | | 1,589,228 | | 1,733,909 | | 1,563,454 |

| Less: average goodwill and intangible assets | (485,252) | | (409,875) | | (383,152) | | (383,649) | | (384,178) | | (415,735) | | (385,074) |

| Average tangible common equity | $ 1,384,836 | | 1,399,520 | | 1,252,814 | | 1,232,962 | | 1,205,050 | | 1,318,174 | | 1,178,380 |

| | | | | | | | | | | | | | |

| Annualized return on average tangible common equity | 13.10 % | | 0.90 % | | 10.78 % | | 14.29 % | | 10.81 % | | 9.56 % | | 8.51 % |

| | | | | | | | | | | | | | |

| Efficiency ratio, excluding loss on the sale of investments, amortization and merger, asset disposition and restructuring expenses | | | | | | | | | | | | | |

| Non-interest expense | $ 113,521 | | 133,498 | | 97,540 | | 91,737 | | 95,326 | | 436,296 | | 368,537 |

| Less: amortization expense | (2,257) | | (1,974) | | (436) | | (504) | | (526) | | (5,171) | | (2,452) |

| Less: merger, asset disposition and restructuring expenses | (4,160) | | (31,260) | | (6,244) | | (1,123) | | (2,850) | | (42,787) | | (5,763) |

| Non-interest expense, excluding amortization and merger, assets disposition and restructuring expenses | $ 107,104 | | 100,264 | | 90,860 | | 90,110 | | 91,950 | | 388,338 | | 360,322 |

| | | | | | | | | | | | | | |

| Net interest income | $ 142,166 | | 135,974 | | 119,444 | | 127,818 | | 114,197 | | 525,402 | | 435,578 |

| Non-interest income | 37,777 | | 32,198 | | 30,938 | | 28,355 | | 40,063 | | 129,268 | | 87,010 |

| Add: loss on the sale of investments | — | | — | | — | | — | | — | | — | | 39,413 |

| Net interest income plus non-interest income, excluding loss on sale of investments | $ 179,943 | | 168,172 | | 150,382 | | 156,173 | | 154,260 | | 654,670 | | 562,001 |

| | | | | | | | | | | | | | |

| Efficiency ratio, excluding loss on sale of investments, amortization and merger, asset disposition and restructuring expenses | 59.52 % | | 59.62 % | | 60.42 % | | 57.70 % | | 59.61 % | | 59.32 % | | 64.11 % |

| | | | | | | | | | | | | | |

| | |

| * | The table summarizes the Company's results from operations on a GAAP basis and on an operating (non-GAAP) basis for the periods indicated. Operating results exclude merger, asset disposition and restructuring expense, loss on sale of investments and gain on sale of mortgage servicing rights. The net tax effect was calculated using statutory tax rates of approximately 28.0%. The Company believes this non-GAAP presentation provides a meaningful comparison of operational performance and facilitates a more effective evaluation and comparison of results to assess performance in relation to ongoing operations. |

| Northwest Bancshares, Inc. and Subsidiaries | |||||

| Deposits (Unaudited) | |||||

| (dollars in thousands) | |||||

| | |||||

| Generally, deposits in excess of $250,000 are not federally insured. The following table provides details regarding the Company's uninsured deposits portfolio: | |||||

| | |||||

| | As of December 31, 2025 | ||||

| | Balance | | Percent of total deposits | | Number of relationships |

| Uninsured deposits per the Call Report (1) | $ 3,737,960 | | 26.8 % | | 6,289 |

| Less intercompany deposit accounts | 1,339,304 | | 9.6 % | | 12 |

| Less collateralized deposit accounts | 435,258 | | 3.1 % | | 260 |

| Uninsured deposits excluding intercompany and collateralized accounts | $ 1,963,398 | | 14.1 % | | 6,017 |

| | |

| (1) | Uninsured deposits presented may be different from actual amounts due to titling of accounts. |

| | |||||

| Our largest uninsured depositor, excluding intercompany and collateralized deposit accounts, had an aggregate uninsured deposit balance of $42.4 million, or 0.31% of total deposits, as of December 31, 2025. Our top ten largest uninsured depositors, excluding intercompany and collateralized deposit accounts, had an aggregate uninsured deposit balance of $236.3 million, or 1.69% of total deposits, as of December 31, 2025. The average uninsured deposit account balance, excluding intercompany and collateralized accounts, was $326,254 as of December 31, 2025. | |||||

| |

| The following table provides additional details for the Company's deposit portfolio: | |||||

| | |||||

| | As of December 31, 2025 | ||||

| | Balance | | Percent of total deposits | | Number of accounts |

| Personal noninterest bearing demand deposits | $ 1,714,326 | | 12.2 % | | 312,429 |

| Business noninterest bearing demand deposits | 1,408,903 | | 10.1 % | | 48,081 |

| Personal interest-bearing demand deposits | 1,401,892 | | 10.1 % | | 54,866 |

| Business interest-bearing demand deposits | 1,593,867 | | 11.4 % | | 9,120 |

| Personal money market deposits | 1,766,973 | | 12.7 % | | 27,259 |

| Business money market deposits | 773,845 | | 5.6 % | | 3,226 |

| Savings deposits | 2,366,513 | | 17.0 % | | 187,565 |

| Time deposits | 2,916,698 | | 20.9 % | | 81,429 |

| Total deposits | $ 13,943,017 | | 100.0 % | | 723,975 |

| |

| Our average deposit account balance as of December 31, 2025 was $19,259. The Company's insured cash sweep deposit balance was $781 million as of December 31, 2025. |

| Northwest Bancshares, Inc. and Subsidiaries | |||||||||||

| Regulatory Capital Requirements (Unaudited) | |||||||||||

| (dollars in thousands) | |||||||||||

| | |||||||||||

| | At December 31, 2025 | ||||||||||

| | Actual (1) | | Minimum capital requirements (2) | | Well capitalized requirements | ||||||

| | Amount | | Ratio | | Amount | | Ratio | | Amount | | Ratio |

| Total capital (to risk weighted assets) | | | | | | | | | | | |

| Northwest Bancshares, Inc. | $ 1,875,097 | | 15.36 % | | $ 1,281,842 | | 10.50 % | | $ 1,220,802 | | 10.00 % |

| Northwest Bank | 1,732,895 | | 14.21 % | | 1,280,528 | | 10.50 % | | 1,219,551 | | 10.00 % |

| | | | | | | | | | | | |

| Tier 1 capital (to risk weighted assets) | | | | | | | | | | | |

| Northwest Bancshares, Inc. | 1,504,320 | | 12.32 % | | 1,037,682 | | 8.50 % | | 732,481 | | 6.00 % |

| Northwest Bank | 1,580,217 | | 12.96 % | | 1,036,618 | | 8.50 % | | 975,641 | | 8.00 % |

| | | | | | | | | | | | |

| Common equity tier 1 capital (to risk weighted assets) | | | | | | | | | | | |

| Northwest Bancshares, Inc. | 1,504,320 | | 12.32 % | | 854,561 | | 7.00 % | | N/A | | N/A |

| Northwest Bank | 1,580,217 | | 12.96 % | | 853,686 | | 7.00 % | | 792,708 | | 6.50 % |

| | | | | | | | | | | | |

| Tier 1 capital (leverage) (to average assets) | | | | | | | | | | | |

| Northwest Bancshares, Inc. | 1,504,320 | | 9.29 % | | 647,636 | | 4.00 % | | N/A | | N/A |

| Northwest Bank | 1,580,217 | | 9.77 % | | 647,141 | | 4.00 % | | 808,926 | | 5.00 % |

| (1) | December 31, 2025 figures are estimated. |

| (2) | Amounts and ratios include the capital conservation buffer of 2.5%, which does not apply to Tier 1 capital to average assets (leverage ratio). For further information related to the capital conservation buffer, see "Item 1. Business - Supervision and Regulation" of our 2024 Annual Report on Form 10-K. |

| Northwest Bancshares, Inc. and Subsidiaries | ||||||||||

| Marketable Securities (Unaudited) | ||||||||||

| (dollars in thousands) | ||||||||||

| | ||||||||||

| | | December 31, 2025 | ||||||||

| Marketable securities available-for-sale | | Amortized cost | | Gross unrealized holding gains | | Gross unrealized holding losses | | Fair value | | Weighted average duration |

| Debt issued by the U.S. government and agencies: | | | | | | | | | | |

| Due after five years through ten years | | $ 1,631 | | 11 | | (13) | | 1,629 | | 3.12 |

| Due after ten years | | 41,673 | | — | | (7,390) | | 34,283 | | 5.83 |

| | | | | | | | | | | |

| Debt issued by government sponsored enterprises: | | | | | | | | | | |

| Due after one year through five years | | 1,040 | | 6 | | (2) | | 1,044 | | 1.51 |

| Due after five years through ten years | | 996 | | 7 | | — | | 1,003 | | 0.42 |

| | | | | | | | | | | |

| Municipal securities: | | | | | | | | | | |

| Due within one year | | 1,810 | | 9 | | — | | 1,819 | | 0.59 |

| Due after one year through five years | | 10,876 | | 118 | | (7) | | 10,987 | | 2.32 |

| Due after five years through ten years | | 25,111 | | 393 | | (1,253) | | 24,251 | | 6.69 |

| Due after ten years | | 52,342 | | 342 | | (6,473) | | 46,211 | | 9.40 |

| | | | | | | | | | | |

| Corporate debt issues: | | | | | | | | | | |

| Due within one year | | 500 | | — | | — | | 500 | | 0.24 |

| Due in one year through five years | | 4,716 | | 12 | | (22) | | 4,706 | | 3.65 |

| Due after five years through ten years | | 46,436 | | 1,429 | | (64) | | 47,801 | | 4.23 |

| Due after ten years | | 4,000 | | 27 | | — | | 4,027 | | 4.42 |

| | | | | | | | | | | |

| Mortgage-backed agency securities: | | | | | | | | | | |

| Fixed rate pass-through | | 402,670 | | 3,940 | | (10,685) | | 395,925 | | 7.24 |

| Variable rate pass-through | | 3,015 | | 66 | | (2) | | 3,079 | | 3.34 |

| Fixed rate agency CMBS | | 616,751 | | 1,553 | | (73,461) | | 544,843 | | 3.67 |

| Variable rate agency CMBS | | 8,341 | | 2 | | — | | 8,343 | | 3.00 |

| Fixed rate agency CMOs | | 451,776 | | 1,685 | | (34,848) | | 418,613 | | 5.35 |

| Variable rate agency CMOs | | 37,294 | | 103 | | (79) | | 37,318 | | 6.44 |

| Total mortgage-backed agency securities | | 1,519,847 | | 7,349 | | (119,075) | | 1,408,121 | | 5.24 |

| Total marketable securities available-for-sale | | $ 1,710,978 | | 9,703 | | (134,299) | | 1,586,382 | | 5.32 |

| | | | | | | | | | | |

| Marketable securities held-to-maturity | | | | | | | | | | |

| Government sponsored | | | | | | | | | | |

| Due after one year through five years | | $ 16,477 | | — | | (98) | | 16,379 | | 0.23 |

| Due after five years through ten years | | 107,988 | | — | | (8,216) | | 99,772 | | 2.79 |

| | | | | | | | | | | |

| Mortgage-backed agency securities: | | | | | | | | | | |

| Fixed rate pass-through | | 98,462 | | 1 | | (9,775) | | 88,688 | | 4.21 |

| Variable rate pass-through | | 310 | | 3 | | — | | 313 | | 3.35 |

| Fixed rate agency CMBS | | 78,270 | | — | | (13,133) | | 65,137 | | 3.43 |

| Fixed rate agency CMOs | | 381,334 | | — | | (46,220) | | 335,114 | | 5.57 |

| Variable rate agency CMOs | | 528 | | — | | (2) | | 526 | | 3.96 |

| Total mortgage-backed agency securities | | 558,904 | | 4 | | (69,130) | | 489,778 | | 5.03 |

| Total marketable securities held-to-maturity | | $ 683,369 | | 4 | | (77,444) | | 605,929 | | 4.65 |

| Northwest Bancshares, Inc. and Subsidiaries | |||||||||

| Asset Quality (Unaudited) | |||||||||

| (dollars in thousands) | |||||||||

| | |||||||||

| | December 31, 2025 | | September 30, 2025 | | June 30, 2025 | | March 31, 2025 | | December 31, 2024 |

| Nonaccrual loans: | | | | | | | | | |

| Residential mortgage loans | $ 12,247 | | 11,497 | | 8,482 | | 7,025 | | 6,951 |

| Home equity loans | 3,755 | | 6,979 | | 3,507 | | 3,004 | | 3,332 |

| Consumer loans | 5,711 | | 5,898 | | 4,418 | | 5,201 | | 5,028 |

| Commercial real estate loans | 57,485 | | 82,580 | | 62,091 | | 31,763 | | 36,967 |

| Commercial loans | 28,085 | | 21,371 | | 23,896 | | 11,757 | | 9,123 |

| Total nonaccrual loans | $ 107,283 | | 128,325 | | 102,394 | | 58,750 | | 61,401 |

| Loans 90 days past due and still accruing | 646 | | 701 | | 493 | | 603 | | 656 |

| Nonperforming loans | 107,929 | | 129,026 | | 102,887 | | 59,353 | | 62,057 |

| Real estate owned, net | 76 | | 174 | | 48 | | 80 | | 35 |

| Other nonperforming assets (1) | — | | — | | — | | 16,102 | | 16,102 |

| Nonperforming assets | $ 108,005 | | 129,200 | | 102,935 | | 75,535 | | 78,194 |

| | | | | | | | | | |

| Nonperforming loans to total loans | 0.83 % | | 1.00 % | | 0.91 % | | 0.53 % | | 0.56 % |

| Nonperforming assets to total assets | 0.64 % | | 0.79 % | | 0.71 % | | 0.52 % | | 0.54 % |

| Allowance for credit losses to total loans | 1.15 % | | 1.22 % | | 1.14 % | | 1.09 % | | 1.04 % |

| Allowance for credit losses to nonperforming loans | 139.18 % | | 121.99 % | | 125.53 % | | 206.91 % | | 188.24 % |

| | |

| (1) | Other nonperforming assets includes nonaccrual loans held-for-sale. |

| Northwest Bancshares, Inc. and Subsidiaries | ||||||||||||

| Loans by Credit Quality Indicators (Unaudited) | ||||||||||||

| (dollars in thousands) | ||||||||||||

| | ||||||||||||

| At December 31, 2025 | | Pass | | Special mention * | | Substandard ** | | Doubtful | | Loss | | Loans receivable |

| Personal Banking: | | | | | | | | | | | | |

| Residential mortgage loans | | $ 3,088,533 | | — | | 12,247 | | — | | — | | 3,100,780 |

| Home equity loans | | 1,503,777 | | — | | 3,755 | | — | | — | | 1,507,532 |

| Consumer loans | | 2,557,577 | | — | | 6,313 | | — | | — | | 2,563,890 |

| Total Personal Banking | | 7,149,887 | | — | | 22,315 | | — | | — | | 7,172,202 |

| Commercial Banking: | | | | | | | | | | | | |

| Commercial real estate loans | | 2,817,802 | | 131,589 | | 347,511 | | — | | — | | 3,296,902 |

| Commercial loans | | 2,392,830 | | 61,852 | | 83,530 | | — | | — | | 2,538,212 |

| Total Commercial Banking | | 5,210,632 | | 193,441 | | 431,041 | | — | | — | | 5,835,114 |

| Total loans | | $ 12,360,519 | | 193,441 | | 453,356 | | — | | — | | 13,007,316 |

| At September 30, 2025 | | | | | | | | | | | | |

| Personal Banking: | | | | | | | | | | | | |

| Residential mortgage loans | | $ 3,146,355 | | — | | 11,498 | | — | | — | | 3,157,853 |

| Home equity loans | | 1,513,914 | | — | | 6,979 | | — | | — | | 1,520,893 |

| Consumer loans | | 2,447,208 | | — | | 6,597 | | — | | — | | 2,453,805 |

| Total Personal Banking | | 7,107,477 | | — | | 25,074 | | — | | — | | 7,132,551 |

| Commercial Banking: | | | | | | | | | | | | |

| Commercial real estate loans | | 2,912,166 | | 171,005 | | 412,493 | | — | | — | | 3,495,664 |

| Commercial loans | | 2,141,236 | | 82,009 | | 89,473 | | — | | — | | 2,312,718 |

| Total Commercial Banking | | 5,053,402 | | 253,014 | | 501,966 | | — | | — | | 5,808,382 |

| Total loans | | $ 12,160,879 | | 253,014 | | 527,040 | | — | | — | | 12,940,933 |

| At June 30, 2025 | | | | | | | | | | | | |

| Personal Banking: | | | | | | | | | | | | |

| Residential mortgage loans | | $ 3,039,809 | | — | | 12,317 | | — | | — | | 3,052,126 |

| Home equity loans | | 1,153,808 | | — | | 3,712 | | — | | — | | 1,157,520 |

| Consumer loans | | 2,206,363 | | — | | 4,912 | | — | | — | | 2,211,275 |

| Total Personal Banking | | 6,399,980 | | — | | 20,941 | | — | | — | | 6,420,921 |

| Commercial Banking: | | | | | | | | | | | | |

| Commercial real estate loans | | 2,266,057 | | 112,852 | | 403,495 | | — | | — | | 2,782,404 |

| Commercial loans | | 1,956,751 | | 87,951 | | 93,797 | | — | | — | | 2,138,499 |

| Total Commercial Banking | | 4,222,808 | | 200,803 | | 497,292 | | — | | — | | 4,920,903 |

| Total loans | | $ 10,622,788 | | 200,803 | | 518,233 | | — | | — | | 11,341,824 |

| At March 31, 2025 | | | | | | | | | | | | |

| Personal Banking: | | | | | | | | | | | | |

| Residential mortgage loans | | $ 3,110,770 | | — | | 10,877 | | — | | — | | 3,121,647 |

| Home equity loans | | 1,138,367 | | — | | 3,210 | | — | | — | | 1,141,577 |

| Consumer loans | | 2,075,719 | | — | | 5,750 | | — | | — | | 2,081,469 |

| Total Personal Banking | | 6,324,856 | | — | | 19,837 | | — | | — | | 6,344,693 |

| Commercial Banking: | | | | | | | | | | | | |

| Commercial real estate loans | | 2,497,722 | | 86,779 | | 208,233 | | — | | — | | 2,792,734 |

| Commercial loans | | 1,964,699 | | 63,249 | | 51,070 | | — | | — | | 2,079,018 |

| Total Commercial Banking | | 4,462,421 | | 150,028 | | 259,303 | | — | | — | | 4,871,752 |

| Total loans | | $ 10,787,277 | | 150,028 | | 279,140 | | — | | — | | 11,216,445 |

| At December 31, 2024 | | | | | | | | | | | | |

| Personal Banking: | | | | | | | | | | | | |

| Residential mortgage loans | | $ 3,167,447 | | — | | 10,822 | | — | | — | | 3,178,269 |

| Home equity loans | | 1,145,856 | | — | | 3,540 | | — | | — | | 1,149,396 |

| Consumer loans | | 1,989,479 | | — | | 5,606 | | — | | — | | 1,995,085 |

| Total Personal Banking | | 6,302,782 | | — | | 19,968 | | — | | — | | 6,322,750 |

| Commercial Banking: | | | | | | | | | | | | |

| Commercial real estate loans | | 2,571,915 | | 72,601 | | 205,346 | | — | | — | | 2,849,862 |

| Commercial loans | | 1,923,382 | | 37,063 | | 46,957 | | — | | — | | 2,007,402 |

| Total Commercial Banking | | 4,495,297 | | 109,664 | | 252,303 | | — | | — | | 4,857,264 |

| Total loans | | $ 10,798,079 | | 109,664 | | 272,271 | | — | | — | | 11,180,014 |

| | |

| * | Includes $38.2 million, $41.0 million, $4.0 million, $4.7 million, and $2.7 million of acquired loans at December 31, 2025, September 30, 2025, June 30, 2025, March 31, 2025, and December 31, 2024, respectively. |

| ** | Includes $93.2 million, $96.9 million, $19.2 million, $18.0 million, and $19.8 million of acquired loans at December 31, 2025, September 30, 2025, June 30, 2025, March 31, 2025, and December 31, 2024, respectively. |

| Northwest Bancshares, Inc. and Subsidiaries | ||||||||||||||||||||||||

| Loan Delinquency (Unaudited) | ||||||||||||||||||||||||

| (dollars in thousands) | ||||||||||||||||||||||||

| | ||||||||||||||||||||||||

| | | December 31, 2025 | | * | | | September 30, 2025 | | * | | | June 30, 2025 | | * | | | March 31, 2025 | | * | | | December 31, 2024 | | * |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Loans delinquent 30 days to 59 days: | | | | | | | | | | | | | | | | | | | | | | | ||

| Residential mortgage | | $ 41,180 | | 1.3 % | | | $ 1,639 | | 0.1 % | | | $ 561 | | — % | | | $ 32,840 | | 1.0 % | | | $ 28,690 | | 0.9 % |

| Home equity loans | | 6,488 | | 0.4 % | | | 4,644 | | 0.3 % | | | 4,664 | | 0.4 % | | | 3,882 | | 0.3 % | | | 5,365 | | 0.5 % |

| Consumer loans | | 14,063 | | 0.5 % | | | 12,257 | | 0.5 % | | | 9,174 | | 0.4 % | | | 8,792 | | 0.4 % | | | 11,102 | | 0.6 % |

| Commercial real estate | | 28,645 | | 0.9 % | | | 14,600 | | 0.4 % | | | 4,585 | | 0.2 % | | | 8,536 | | 0.3 % | | | 5,215 | | 0.2 % |

| Commercial loans | | 5,657 | | 0.2 % | | | 9,974 | | 0.4 % | | | 5,569 | | 0.3 % | | | 6,841 | | 0.3 % | | | 5,632 | | 0.3 % |

| Total loans delinquent 30 days to 59 days | | $ 96,033 | | 0.7 % | | | $ 43,114 | | 0.3 % | | | $ 24,553 | | 0.2 % | | | $ 60,891 | | 0.5 % | | | $ 56,004 | | 0.5 % |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Loans delinquent 60 days to 89 days: | | | | | | | | | | | | | | | | | | | | | | | ||

| Residential mortgage | | $ 10,934 | | 0.4 % | | | $ 7,917 | | 0.3 % | | | $ 8,958 | | 0.3 % | | | $ 3,074 | | 0.1 % | | | $ 10,112 | | 0.3 % |

| Home equity loans | | 2,316 | | 0.2 % | | | 2,671 | | 0.2 % | | | 985 | | 0.1 % | | | 1,290 | | 0.1 % | | | 1,434 | | 0.1 % |

| Consumer loans | | 4,599 | | 0.2 % | | | 3,691 | | 0.2 % | | | 3,233 | | 0.1 % | | | 2,808 | | 0.1 % | | | 3,640 | | 0.2 % |

| Commercial real estate | | 12,941 | | 0.4 % | | | 1,575 | | — % | | | 13,240 | | 0.5 % | | | 2,001 | | 0.1 % | | | 915 | | — % |

| Commercial loans | | 2,899 | | 0.1 % | | | 1,915 | | 0.1 % | | | 2,031 | | 0.1 % | | | 2,676 | | 0.1 % | | | 1,726 | | 0.1 % |

| Total loans delinquent 60 days to 89 days | | $ 33,689 | | 0.3 % | | | $ 17,769 | | 0.1 % | | | $ 28,447 | | 0.3 % | | | $ 11,849 | | 0.1 % | | | $ 17,827 | | 0.2 % |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Loans delinquent 90 days or more: | | | | | | | | | | | | | | | | | | | | | | | ||

| Residential mortgage | | $ 10,001 | | 0.3 % | | | $ 9,427 | | 0.3 % | | | $ 6,905 | | 0.2 % | | | $ 4,005 | | 0.1 % | | | $ 4,931 | | 0.2 % |

| Home equity loans | | 2,492 | | 0.2 % | | | 2,963 | | 0.2 % | | | 1,879 | | 0.2 % | | | 1,893 | | 0.2 % | | | 2,250 | | 0.2 % |

| Consumer loans | | 4,893 | | 0.2 % | | | 4,865 | | 0.2 % | | | 3,486 | | 0.2 % | | | 4,026 | | 0.2 % | | | 3,967 | | 0.2 % |

| Commercial real estate | | 32,745 | | 1.0 % | | | 56,453 | | 1.6 % | | | 41,875 | | 1.5 % | | | 23,433 | | 0.8 % | | | 7,702 | | 0.3 % |

| Commercial loans | | 16,269 | | 0.6 % | | | 9,490 | | 0.4 % | | | 10,433 | | 0.5 % | | | 5,994 | | 0.3 % | | | 7,335 | | 0.4 % |

| Total loans delinquent 90 days or more | | $ 66,400 | | 0.5 % | | | $ 83,198 | | 0.6 % | | | $ 64,578 | | 0.6 % | | | $ 39,351 | | 0.3 % | | | $ 26,185 | | 0.2 % |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Total loans delinquent | | $ 196,122 | | 1.5 % | | | $ 144,081 | | 1.1 % | | | $ 117,578 | | 1.0 % | | | $ 112,091 | | 1.0 % | | | $ 100,016 | | 0.9 % |

| | |

| * | Represents delinquency, in dollars, divided by the respective total amount of that type of loan outstanding. |

| Northwest Bancshares, Inc. and Subsidiaries | |||||||||

| Allowance for Credit Losses (Unaudited) | |||||||||

| (dollars in thousands) | |||||||||

| | |||||||||

| | Quarter ended | ||||||||

| | December 31, 2025 | | September 30, 2025 | | June 30, 2025 | | March 31, 2025 | | December 31, 2024 |

| Beginning balance | $ 157,396 | | 129,159 | | 122,809 | | 116,819 | | 125,813 |

| Initial allowance on loans purchased with credit deterioration | — | | 6,029 | | — | | — | | — |

| Provision | 5,743 | | 31,394 | | 11,456 | | 8,256 | | 15,549 |

| Charge-offs residential mortgage | (228) | | (137) | | (273) | | (588) | | (176) |

| Charge-offs home equity | (558) | | (336) | | (413) | | (273) | | (197) |

| Charge-offs consumer | (4,139) | | (3,994) | | (3,331) | | (3,805) | | (4,044) |

| Charge-offs commercial real estate | (9,765) | | (4,312) | | (293) | | (116) | | (13,997) |

| Charge-offs commercial | (532) | | (2,395) | | (3,597) | | (571) | | (10,400) |

| Recoveries | 2,295 | | 1,988 | | 2,801 | | 3,087 | | 4,271 |

| Ending balance | $ 150,212 | | 157,396 | | 129,159 | | 122,809 | | 116,819 |

| Net charge-offs to average loans, annualized | 0.40 % | | 0.29 % | | 0.18 % | | 0.08 % | | 0.87 % |

| | Year ended December 31, | ||

| | 2025 | | 2024 |

| Beginning balance | $ 116,819 | | 125,243 |

| Initial allowance on loans purchased with credit deterioration | 6,029 | | — |

| Provision | 56,849 | | 27,679 |

| Charge-offs residential mortgage | (1,226) | | (845) |

| Charge-offs home equity | (1,580) | | (1,736) |

| Charge-offs consumer | (15,269) | | (14,738) |

| Charge-offs commercial real estate | (14,486) | | (15,321) |

| Charge-offs commercial | (7,095) | | (14,462) |

| Recoveries | 10,171 | | 10,999 |

| Ending balance | $ 150,212 | | 116,819 |

| Net charge-offs to average loans, annualized | 0.25 % | | 0.32 % |

| Northwest Bancshares, Inc. and Subsidiaries | |||||||||||||||||||||||||||||

| Average Balance Sheet (Unaudited) | |||||||||||||||||||||||||||||

| (dollars in thousands) | |||||||||||||||||||||||||||||

| | |||||||||||||||||||||||||||||

| The following table sets forth certain information relating to the Company's average balance sheet and reflects the average yield on assets and average cost of liabilities for the periods indicated. Such yields and costs are derived by dividing income or expense by the average balance of assets or liabilities, respectively, for the periods presented. Average balances are calculated using daily averages. | |||||||||||||||||||||||||||||

| | |||||||||||||||||||||||||||||

| | Quarter ended | ||||||||||||||||||||||||||||

| | December 31, 2025 | | September 30, 2025 | | June 30, 2025 | | March 31, 2025 | | December 31, 2024 | ||||||||||||||||||||

| | Average balance | | Interest | | Avg. yield/ cost | | Average balance | | Interest | | Avg. yield/ cost | | Average balance | | Interest | | Avg. yield/ cost | | Average balance | | Interest | | Avg. yield/ cost | | Average balance | | Interest | | Avg. yield/ cost |

| Assets: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Interest-earning assets: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Residential mortgage loans | $ 3,147,858 | | 31,814 | | 4.04 % | | $ 3,160,008 | | 31,386 | | 3.97 % | | $ 3,091,324 | | 29,978 | | 3.88 % | | $ 3,155,738 | | 30,394 | | 3.85 % | | $ 3,215,596 | | 31,107 | | 3.87 % |

| Home equity loans | 1,512,049 | | 22,802 | | 5.98 % | | 1,421,717 | | 21,080 | | 5.88 % | | 1,145,655 | | 16,265 | | 5.69 % | | 1,139,728 | | 16,164 | | 5.75 % | | 1,154,456 | | 16,801 | | 5.79 % |

| Consumer loans | 2,412,579 | | 34,436 | | 5.66 % | | 2,330,173 | | 32,729 | | 5.57 % | | 2,073,103 | | 28,648 | | 5.54 % | | 1,948,230 | | 26,273 | | 5.47 % | | 1,918,356 | | 26,293 | | 5.45 % |

| Commercial real estate loans | 3,468,667 | | 53,345 | | 6.02 % | | 3,377,740 | | 51,761 | | 6.00 % | | 2,836,757 | | 43,457 | | 6.06 % | | 2,879,607 | | 56,508 | | 7.85 % | | 2,983,946 | | 46,933 | | 6.15 % |

| Commercial loans | 2,441,346 | | 42,447 | | 6.80 % | | 2,278,859 | | 41,519 | | 7.13 % | | 2,102,115 | | 37,287 | | 7.02 % | | 2,053,213 | | 36,012 | | 7.02 % | | 1,932,427 | | 35,404 | | 7.17 % |

| Total loans receivable (a) (b) (d) | 12,982,499 | | 184,844 | | 5.65 % | | 12,568,497 | | 178,475 | | 5.63 % | | 11,248,954 | | 155,635 | | 5.55 % | | 11,176,516 | | 165,351 | | 6.00 % | | 11,204,781 | | 156,538 | | 5.56 % |

| Mortgage-backed securities (c) | 1,892,074 | | 14,071 | | 2.97 % | | 1,810,209 | | 12,668 | | 2.80 % | | 1,790,423 | | 12,154 | | 2.72 % | | 1,773,402 | | 11,730 | | 2.65 % | | 1,769,151 | | 11,514 | | 2.60 % |

| Investment securities (c) (d) | 309,147 | | 2,339 | | 3.03 % | | 301,719 | | 2,153 | | 2.85 % | | 266,053 | | 1,668 | | 2.51 % | | 263,825 | | 1,599 | | 2.43 % | | 264,840 | | 1,575 | | 2.38 % |

| FHLB stock, at cost | 32,876 | | 701 | | 8.46 % | | 30,434 | | 652 | | 8.51 % | | 17,838 | | 318 | | 7.15 % | | 20,862 | | 366 | | 7.11 % | | 21,237 | | 392 | | 7.35 % |

| Other interest-earning deposits | 170,370 | | 1,905 | | 4.37 % | | 164,131 | | 1,700 | | 4.05 % | | 220,416 | | 2,673 | | 4.85 % | | 243,412 | | 2,416 | | 3.97 % | | 132,273 | | 1,554 | | 4.60 % |

| Total interest-earning assets | 15,386,966 | | 203,860 | | 5.26 % | | 14,874,990 | | 195,648 | | 5.22 % | | 13,543,684 | | 172,448 | | 5.11 % | | 13,478,017 | | 181,462 | | 5.46 % | | 13,392,282 | | 171,573 | | 5.10 % |

| Noninterest-earning assets (e) | 1,107,042 | | | | | | 1,067,450 | | | | | | 924,513 | | | | | | 924,466 | | | | | | 930,582 | | | | |

| Total assets | $ 16,494,008 | | | | | | $ 15,942,440 | | | | | | $ 14,468,197 | | | | | | $ 14,402,483 | | | | | | $ 14,322,864 | | | | |

| Liabilities and shareholders' equity: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Interest-bearing liabilities: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Savings deposits | $ 2,362,215 | | 6,324 | | 1.06 % | | $ 2,343,137 | | 6,679 | | 1.13 % | | $ 2,212,175 | | 6,521 | | 1.18 % | | $ 2,194,305 | | 6,452 | | 1.19 % | | $ 2,152,955 | | 6,549 | | 1.21 % |

| Interest-bearing demand deposits | 2,940,296 | | 9,084 | | 1.23 % | | 2,782,369 | | 8,258 | | 1.18 % | | 2,609,887 | | 7,192 | | 1.11 % | | 2,593,228 | | 7,063 | | 1.10 % | | 2,636,279 | | 7,894 | | 1.19 % |

| Money market deposit accounts | 2,522,362 | | 12,499 | | 1.97 % | | 2,392,748 | | 11,785 | | 1.95 % | | 2,121,088 | | 9,658 | | 1.83 % | | 2,082,948 | | 9,306 | | 1.81 % | | 1,980,769 | | 8,880 | | 1.78 % |

| Time deposits | 2,841,234 | | 25,040 | | 3.50 % | | 2,818,526 | | 25,158 | | 3.54 % | | 2,599,254 | | 23,455 | | 3.62 % | | 2,629,388 | | 24,504 | | 3.78 % | | 2,671,343 | | 27,531 | | 4.10 % |

| Total interest bearing deposits (g) | 10,666,107 | | 52,947 | | 1.97 % | | 10,336,780 | | 51,880 | | 1.99 % | | 9,542,404 | | 46,826 | | 1.97 % | | 9,499,869 | | 47,325 | | 2.02 % | | 9,441,346 | | 50,854 | | 2.14 % |

| Borrowed funds (f) | 354,894 | | 3,425 | | 3.83 % | | 347,357 | | 3,366 | | 3.84 % | | 208,342 | | 2,046 | | 3.94 % | | 224,122 | | 2,206 | | 3.99 % | | 222,506 | | 2,246 | | 4.02 % |

| Subordinated debt | 114,800 | | 2,285 | | 7.79 % | | 114,745 | | 1,335 | | 4.65 % | | 114,661 | | 1,148 | | 4.00 % | | 114,576 | | 1,148 | | 4.01 % | | 114,488 | | 1,148 | | 4.01 % |

| Junior subordinated debentures | 130,051 | | 2,002 | | 6.02 % | | 129,986 | | 2,123 | | 6.39 % | | 129,921 | | 2,106 | | 6.41 % | | 129,856 | | 2,098 | | 6.46 % | | 129,791 | | 2,277 | | 6.87 % |

| Total interest-bearing liabilities | 11,265,852 | | 60,659 | | 2.14 % | | 10,928,868 | | 58,704 | | 2.13 % | | 9,995,328 | | 52,126 | | 2.09 % | | 9,968,423 | | 52,777 | | 2.15 % | | 9,908,131 | | 56,525 | | 2.27 % |

| Noninterest-bearing demand deposits (g) | 3,105,108 | | | | | | 2,959,871 | | | | | | 2,611,597 | | | | | | 2,588,502 | | | | | | 2,587,071 | | | | |

| Noninterest-bearing liabilities | 252,960 | | | | | | 244,306 | | | | | | 225,306 | | | | | | 228,947 | | | | | | 238,434 | | | | |

| Total liabilities | 14,623,920 | | | | | | 14,133,045 | | | | | | 12,832,231 | | | | | | 12,785,872 | | | | | | 12,733,636 | | | | |

| Shareholders' equity | 1,870,088 | | | | | | 1,809,395 | | | | | | 1,635,966 | | | | | | 1,616,611 | | | | | | 1,589,228 | | | | |

| Total liabilities and shareholders' equity | $ 16,494,008 | | | | | | $ 15,942,440 | | | | | | $ 14,468,197 | | | | | | $ 14,402,483 | | | | | | $ 14,322,864 | | | | |

| Net interest income/Interest rate spread FTE | | | 143,201 | | 3.12 % | | | | 136,944 | | 3.09 % | | | | 120,322 | | 3.02 % | | | | 128,685 | | 3.31 % | | | | 115,048 | | 2.83 % |

| Net interest-earning assets/Net interest margin FTE | $ 4,121,114 | | | | 3.69 % | | $ 3,946,122 | | | | 3.65 % | | $ 3,548,356 | | | | 3.56 % | | $ 3,509,594 | | | | 3.87 % | | $ 3,484,151 | | | | 3.42 % |

| Tax equivalent adjustment (d) | | | 1,035 | | | | | | 970 | | | | | | 878 | | | | | | 867 | | | | | | 851 | | |

| Net interest income, GAAP basis | | | 142,166 | | | | | | 135,974 | | | | | | 119,444 | | | | | | 127,818 | | | | | | 114,197 | | |

| Ratio of interest-earning assets to interest- bearing liabilities | 1.37X | | | | | | 1.36X | | | | | | 1.36X | | | | | | 1.35X | | | | | | 1.35X | | | | |

| | |

| (a) | Average gross loans receivable includes loans held as available-for-sale and loans placed on nonaccrual status. |

| (b) | Interest income includes accretion/amortization of deferred loan fees/expenses, which was not material. |

| (c) | Average balances do not include the effect of unrealized gains or losses on securities held as available-for-sale. |

| (d) | Interest income on tax-free investment securities and tax-free loans are presented on a fully taxable equivalent ("FTE") basis. |

| (e) | Average balances include the effect of unrealized gains or losses on securities held as available-for-sale. |

| (f) | Average balances include FHLB borrowings and collateralized borrowings. |

| (g) | Average cost of total deposits were 1.53%, 1.55%, 1.55%, 1.59%, and 1.68%, respectively. |

| Northwest Bancshares, Inc. and Subsidiaries | |||||||||||

| Average Balance Sheet (Unaudited) | |||||||||||

| (in thousands) | |||||||||||

| | |||||||||||

| The following table sets forth certain information relating to the Company's average balance sheet and reflects the average yield on interest-earning assets and average cost of interest-bearing liabilities for the periods indicated. Such yields and costs are derived by dividing income or expense by the average balance of assets or liabilities, respectively, for the periods presented. Average balances are calculated using daily averages. | |||||||||||

| | |||||||||||

| | Year ended December 31, | ||||||||||

| | 2025 | | 2024 | ||||||||

| | Average balance | | Interest | | Avg. yield/ cost (h) | | Average balance | | Interest | | Avg. yield/ cost (h) |

| Assets | | | | | | | | | | | |

| Interest-earning assets: | | | | | | | | | | | |

| Residential mortgage loans | $ 3,138,768 | | 123,572 | | 3.94 % | | $ 3,308,977 | | 127,499 | | 3.85 % |

| Home equity loans | 1,306,128 | | 76,311 | | 5.84 % | | 1,177,431 | | 68,694 | | 5.83 % |

| Consumer loans | 2,192,675 | | 122,086 | | 5.57 % | | 1,988,806 | | 103,694 | | 5.21 % |

| Commercial real estate loans | 3,142,956 | | 205,132 | | 6.44 % | | 3,000,431 | | 183,491 | | 6.02 % |

| Commercial loans | 2,220,111 | | 157,273 | | 6.99 % | | 1,809,574 | | 135,326 | | 7.36 % |

| Loans receivable (a) (b) (d) | 12,000,638 | | 684,374 | | 5.70 % | | 11,285,219 | | 618,704 | | 5.48 % |

| Mortgage-backed securities (c) | 1,816,835 | | 50,623 | | 2.79 % | | 1,739,141 | | 39,793 | | 2.29 % |

| Investment securities (c) (d) | 285,355 | | 7,776 | | 2.72 % | | 287,118 | | 5,825 | | 2.03 % |

| FHLB stock, at cost | 25,549 | | 2,037 | | 7.97 % | | 24,948 | | 1,891 | | 7.58 % |

| Other interest-earning deposits | 199,582 | | 8,693 | | 4.30 % | | 126,097 | | 6,489 | | 5.15 % |

| Total interest-earning assets | 14,327,959 | | 753,503 | | 5.26 % | | 13,462,523 | | 672,702 | | 5.00 % |

| Noninterest-earning assets (e) | 1,006,230 | | | | | | 922,648 | | | | |

| | | | | | | | | | | | |

| Total assets | $ 15,334,189 | | | | | | $ 14,385,171 | | | | |

| | | | | | | | | | | | |

| Liabilities and shareholders' equity | | | | | | | | | | | |

| Interest-bearing liabilities: | | | | | | | | | | | |

| Savings deposits | $ 2,278,597 | | 25,976 | | 1.14 % | | $ 2,142,852 | | 24,222 | | 1.13 % |

| Interest-bearing demand deposits | 2,732,535 | | 31,597 | | 1.16 % | | 2,574,810 | | 27,394 | | 1.06 % |

| Money market deposit accounts | 2,281,300 | | 43,248 | | 1.90 % | | 1,966,732 | | 34,564 | | 1.76 % |

| Time deposits | 2,722,945 | | 98,157 | | 3.60 % | | 2,758,157 | | 119,313 | | 4.33 % |

| Total interest bearing deposits (g) | 10,015,377 | | 198,978 | | 1.99 % | | 9,442,551 | | 205,493 | | 2.18 % |

| Borrowed funds (f) | 284,212 | | 11,044 | | 3.89 % | | 308,540 | | 13,882 | | 4.50 % |

| Subordinated debt | 114,696 | | 5,916 | | 5.13 % | | 114,355 | | 4,592 | | 4.02 % |

| Junior subordinated debentures | 129,954 | | 8,328 | | 6.32 % | | 129,695 | | 9,652 | | 7.32 % |

| Total interest-bearing liabilities | 10,544,239 | | 224,266 | | 2.13 % | | 9,995,141 | | 233,619 | | 2.34 % |

| Noninterest-bearing demand deposits (g) | 2,818,078 | | | | | | 2,582,540 | | | | |

| Noninterest-bearing liabilities | 237,963 | | | | | | 244,036 | | | | |

| | | | | | | | | | | | |

| Total liabilities | 13,600,280 | | | | | | 12,821,717 | | | | |

| | | | | | | | | | | | |

| Shareholders' equity | 1,733,909 | | | | | | 1,563,454 | | | | |

| | | | | | | | | | | | |

| Total liabilities and shareholders' equity | $ 15,334,189 | | | | | | $ 14,385,171 | | | | |

| | | | | | | | | | | | |

| Net interest income/Interest rate spread | | | 529,237 | | 3.13 % | | | | 439,083 | | 2.66 % |

| | | | | | | | | | | | |

| Net interest-earning assets/Net interest margin | $ 3,783,720 | | | | 3.69 % | | $ 3,467,382 | | | | 3.26 % |

| | | | | | | | | | | | |

| Tax equivalent adjustment (d) | | | 3,835 | | | | | | 3,505 | | |

| Net interest income, GAAP basis | | | 525,402 | | | | | | 435,578 | | |

| | | | | | | | | | | | |

| Ratio of interest-earning assets to interest-bearing liabilities | 1.36X | | | | | | 1.35X | | | | |

| | |

| (a) | Average gross loans receivable includes loans held as available-for-sale and loans placed on nonaccrual status. |

| (b) | Interest income includes accretion/amortization of deferred loan fees/expenses, which were not material. |

| (c) | Average balances do not include the effect of unrealized gains or losses on securities held as available-for-sale. |

| (d) | Interest income on tax-free investment securities and tax-free loans are presented on a fully taxable equivalent ("FTE") basis. |

| (e) | Average balances include the effect of unrealized gains or losses on securities held as available-for-sale. |

| (f) | Average balances include FHLB borrowings and collateralized borrowings. |

| (g) | Average cost of deposits were 1.55% and 1.71%, respectively. |

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/northwest-bancshares-inc-announces-fourth-quarter-2025-net-income-of-46-million-or-0-31-per-diluted-share-302670380.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/northwest-bancshares-inc-announces-fourth-quarter-2025-net-income-of-46-million-or-0-31-per-diluted-share-302670380.html

SOURCE Northwest Bancshares, Inc.

Für dich aus unserer Redaktion zusammengestellt

Dein Kommentar zum Artikel im Forum

Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte.