COLUMBIA BANKING SYSTEM, INC. REPORTS SECOND QUARTER 2025 RESULTS

| $152 million | | $160 million | | $0.73 | | $0.76 |

| Net income | | Operating net income 1 | | Earnings per common share - | | Operating earnings per common |

| CEO Commentary |

| "Our second quarter results demonstrate our focus on profitability and balance sheet optimization," said Clint Stein, President and CEO. "Commercial loan growth outpaced runoff in transactional portfolios while the net interest margin benefited from loan repricing, controlled deposit pricing, and a rebound in securities yields. Continued expense discipline further supported our strong performance, even as we continue to reinvest in our growing franchise—opening three new branches and planning for the closing of our Pacific Premier acquisition. While customer deposits declined due to normal seasonal activity and increased cash usage, our Business Bank of Choice strategy continues to attract new relationships. We remain laser focused on delivering top-quartile performance and enhancing long-term tangible book value while returning excess capital to our shareholders." |

| –Clint Stein, President and CEO of Columbia Banking System, Inc. |

| 2Q25 HIGHLIGHTS (COMPARED TO 1Q25) | | |

| | | |

| Net Interest | • Net interest income increased by $21 million from the prior quarter, due to higher interest income earned on loans and investment securities and relatively stable funding costs. | |

| • Net interest margin was 3.75%, up 15 basis points from the prior quarter, as the yields on investment securities and loans increased and the cost of interest-bearing liabilities decreased by 2 basis points. | | |

| | | |

| Non-Interest | • Non-interest income decreased by $2 million. Excluding the impact of fair value and hedges,1 non-interest income increased by $8 million, due to higher core fee-generating businesses, like commercial credit cards and wealth management services. | |

| • Non-interest expense decreased by $62 million, primarily due to a legal settlement and severance expense in the first quarter, which did not repeat. | | |

| | | |

| Credit Quality | • Net charge-offs were 0.31% of average loans and leases (annualized), compared to 0.32% in the prior quarter. | |

| • Provision expense was $29 million, compared to $27 million in the prior quarter. | | |

| • Non-performing assets to total assets was 0.35%, unchanged from March 31, 2025. | | |

| | | |

| Capital | • Estimated total risk-based capital ratio of 13.0% and estimated common equity tier 1 risk-based capital ratio of 10.8%. | |

| • Declared a quarterly cash dividend of $0.36 per common share on May 16, 2025, which was paid June 16, 2025. | | |

| | | |

| Notable Items | • The second quarter's small business and retail campaign, which ran through mid-July, brought over $450 million in new deposits to the bank. The campaign was also successful in generating new SBA lending relationships. | |

| • Opened two branches in Arizona, strengthening support for bankers and customers in Phoenix and the surrounding markets. A branch was also opened in Eastern Oregon, bringing essential banking services to an underserved rural community. | | |

| 2Q25 KEY FINANCIAL DATA | |||||

| | | | | | |

| PERFORMANCE METRICS | 2Q25 | | 1Q25 | | 2Q24 |

| Return on average assets | 1.19 % | | 0.68 % | | 0.93 % |

| Return on average common equity | 11.56 % | | 6.73 % | | 9.85 % |

| Return on average tangible common equity 1 | 16.03 % | | 9.45 % | | 14.55 % |

| Operating return on average assets 1 | 1.25 % | | 1.10 % | | 1.08 % |

| Operating return on average common equity 1 | 12.16 % | | 10.87 % | | 11.47 % |

| Operating return on average tangible common equity 1 | 16.85 % | | 15.26 % | | 16.96 % |

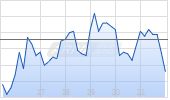

| Net interest margin | 3.75 % | | 3.60 % | | 3.56 % |

| Efficiency ratio | 54.29 % | | 69.06 % | | 59.02 % |

| Operating efficiency ratio, as adjusted 1 | 51.79 % | | 55.11 % | | 53.56 % |

| | | | | | |

| INCOME STATEMENT ($ in 000s, excl. per share data) | 2Q25 | | 1Q25 | | 2Q24 |

| Net interest income | $446,446 | | $424,995 | | $427,449 |

| Provision for credit losses | $29,449 | | $27,403 | | $31,820 |

| Non-interest income | $64,462 | | $66,377 | | $44,703 |

| Non-interest expense | $277,995 | | $340,122 | | $279,244 |

| Pre-provision net revenue 1 | $232,913 | | $151,250 | | $192,908 |

| Operating pre-provision net revenue 1 | $242,126 | | $211,833 | | $219,390 |

| Earnings per common share - diluted | $0.73 | | $0.41 | | $0.57 |

| Operating earnings per common share - diluted 1 | $0.76 | | $0.67 | | $0.67 |

| Dividends paid per share | $0.36 | | $0.36 | | $0.36 |

| | | | | | |

| BALANCE SHEET | 2Q25 | | 1Q25 | | 2Q24 |

| Total assets | $51.9B | | $51.5B | | $52.0B |

| Loans and leases | $37.6B | | $37.6B | | $37.7B |

| Deposits | $41.7B | | $42.2B | | $41.5B |

| Book value per common share | $25.41 | | $24.93 | | $23.76 |

| Tangible book value per common share 1 | $18.47 | | $17.86 | | $16.26 |

Organizational Update

Columbia Banking System, Inc. ("Columbia," the "Company," "we," or "our") continues to plan for its acquisition of Pacific Premier Bancorp, Inc. ("Pacific Premier"), which was announced on April 23, 2025. The shareholders of both companies overwhelmingly approved the combination at their respective special meetings, which were held July 21, 2025. We anticipate closing the transaction as soon as September 1, 2025, pending regulatory approvals and satisfaction of other customary closing conditions. Integration efforts are progressing as planned, driven by the comprehensive preparation of cross-company teams, which are led by Columbia's Integration Management Office, positioning us for a smooth and timely closing once regulatory approvals are secured and other customary closing conditions are satisfied.

Columbia expanded its Arizona footprint with the opening of its second branch in Phoenix and its first in Mesa, bringing the total number of branches in the state to four. We also opened a branch in Eastern Oregon, restoring essential banking services to a bank-less rural community. Our branch strategy encompasses thriving metropolitan areas and core community markets alike, supporting bankers already serving customers in our markets and strengthening opportunities to bring new relationships to Columbia.

Net Interest Income

Net interest income was $446 million for the second quarter of 2025, up $21 million from the prior quarter. The increase reflects higher interest income earned on loans and investment securities and relatively stable funding costs.

Columbia's net interest margin was 3.75% for the second quarter of 2025, up 15 basis points from the first quarter of 2025. Net interest margin benefited from an increase in the yield on taxable investment securities to 4.22% for the second quarter of 2025, up from 3.72% for the first quarter of 2025. The increase is due to higher conditional prepayment rates ("CPR") and the purchase of higher-yielding investment securities during the quarter. The average yield on the loan portfolio increased by 8 basis points between periods to 6.00% for the second quarter of 2025, due primarily to higher yields on commercial and construction loans and a $2 million interest recovery related to a nonperforming loan that repaid in full. The cost of interest-bearing deposits was unchanged between periods at 2.52% for the second quarter of 2025, in line with the cost of interest-bearing deposits for the month of June and as of June 30, 2025. Columbia's cost of interest-bearing liabilities decreased 2 basis points from the prior quarter to 2.78% for the second quarter of 2025, in line with the cost of interest-bearing liabilities for the month of June and as of June 30, 2025. Please refer to the Q2 2025 Earnings Presentation for additional net interest margin change details and interest rate sensitivity information.

Non-interest Income

Non-interest income was $64 million for the second quarter of 2025, down $2 million from the prior quarter. The decrease was driven by quarterly changes in fair value adjustments and mortgage servicing rights ("MSR") hedging activity, due to interest rate fluctuations during the quarter, collectively resulting in a net fair value loss of $1 million in the second quarter compared to a net fair value gain of $9 million in the first quarter, as detailed in our non-GAAP disclosures. Excluding these items, non-interest income was up $8 million[2] between periods, due primarily to higher card-based fee income and growth in other core fee-generating businesses, including swap-related income, financial services and trust revenue, and treasury management fees.

Non-interest Expense

Non-interest expense was $278 million for the second quarter of 2025, down $62 million from the prior quarter, which included a $55 million accrual related to a legal settlement and $15 million in severance expense. Excluding the legal settlement, exit and disposal costs, and merger and restructuring expense, which includes the first quarter's severance expense, non-interest expense was $269 million2, down $1 million from the prior quarter, as lower legal expense—which was separate from the legal settlement—intangible amortization, and other miscellaneous expenses more than offset an increase in compensation costs. Please refer to the Q2 2025 Earnings Presentation for additional expense details.

Balance Sheet

Total consolidated assets were $51.9 billion as of June 30, 2025, up from $51.5 billion as of March 31, 2025. Cash and cash equivalents were $1.9 billion as of June 30, 2025, down from $2.1 billion as of March 31, 2025. Including secured off-balance sheet lines of credit, total available liquidity was $18.6 billion as of June 30, 2025, representing 36% of total assets, 44% of total deposits, and 132% of uninsured deposits. Available-for-sale securities, which are held on balance sheet at fair value, were $8.7 billion as of June 30, 2025, an increase of $424 million relative to March 31, 2025, as purchases and an increase in the fair value of the portfolio offset paydowns. Please refer to the Q2 2025 Earnings Presentation for additional details related to our securities portfolio and liquidity position.

Gross loans and leases were $37.6 billion as of June 30, 2025, an increase of $21 million relative to March 31, 2025. The change primarily reflects 2% annualized growth in commercial and owner-occupied commercial real estate loans, which was offset by 7% annualized contraction in multifamily loans. "Our teams remain focused on relationship-driven activity as we continue to let transactional real estate portfolios wind down," commented Chris Merrywell, President of Columbia Bank. "Loan balances were also impacted by an increase in prepayment activity, which muted a double-digit increase in origination volume relative to both the prior and year-ago quarters." Please refer to the Q2 2025 Earnings Presentation for additional details related to our loan portfolio, which include underwriting characteristics, the composition of our commercial portfolios, and disclosure related to our office portfolio.

Total deposits were $41.7 billion as of June 30, 2025, a decrease of $475 million relative to March 31, 2025, as customer deposits declined due to seasonal tax payments and other customer cash usage. "We experienced customer deposit contraction in April following strong customer balance growth in March," stated Mr. Merrywell. "Seasonal balance declines were accompanied by customers' usage of cash to pay down debt, which impacted loan prepayment activity. The quarter's results also reflect deposit balances moving off balance sheet into our wealth management products, which enhances our core fee income generation as we provide our customers with needs-based solutions." Borrowings were $3.4 billion as of June 30, 2025, an increase of $800 million relative to March 31, 2025. Please refer to the Q2 2025 Earnings Presentation for additional details related to deposit characteristics and flows.

Credit Quality

The allowance for credit losses was $439 million, or 1.17% of loans and leases, as of June 30, 2025, unchanged from March 31, 2025. The provision for credit losses was $29 million for the second quarter of 2025 and reflects credit migration trends, charge-off activity, and changes in the economic forecasts used in credit models.

Net charge-offs were 0.31% of average loans and leases (annualized) for the second quarter of 2025, compared to 0.32% for the first quarter of 2025. Net charge-offs in the FinPac portfolio were $14 million in the second quarter, compared to $17 million in the first quarter. Net charge-offs excluding the FinPac portfolio were $15 million in the second quarter, compared to $13 million in the first quarter. Non-performing assets were $180 million, or 0.35% of total assets, as of June 30, 2025, compared to $178 million, or 0.35% of total assets, as of March 31, 2025. Please refer to the Q2 2025 Earnings Presentation for additional details related to the allowance for credit losses and other credit trends.

Capital

Columbia's book value per common share was $25.41 as of June 30, 2025, compared to $24.93 as of March 31, 2025. The increase reflects net capital generation and a favorable change in accumulated other comprehensive (loss) income ("AOCI") to $(334) million as of June 30, 2025, compared to $(358) million as of the prior quarter-end. The change in AOCI is due primarily to a decrease in the tax-effected net unrealized loss on available-for-sale securities to $311 million as of June 30, 2025, compared to $337 million as of March 31, 2025. Tangible book value per common share3 was $18.47 as of June 30, 2025, compared to $17.86 as of March 31, 2025.

Columbia's estimated total risk-based capital ratio was 13.0%, and its estimated common equity tier 1 risk-based capital ratio was 10.8% as of June 30, 2025, compared to 12.9% and 10.6%, respectively, as of March 31, 2025. Columbia remains above current "well-capitalized" regulatory minimums. The regulatory capital ratios as of June 30, 2025 are estimates, pending completion and filing of Columbia's regulatory reports.

Earnings Presentation and Conference Call Information

Columbia's Q2 2025 Earnings Presentation provides additional disclosure. A copy will be available on our investor relations page: www.columbiabankingsystem.com.

Columbia will host its second quarter 2025 earnings conference call on July 24, 2025 at 2:00 p.m. PT (5:00 p.m. ET). During the call, Columbia's management will provide an update on recent activities and discuss its second quarter 2025 financial results. Participants may join the audiocast or register for the call using the link below to receive dial-in details and their own unique PINs. It is recommended you join 10 minutes prior to the start time.

Join the audiocast: https://edge.media-server.com/mmc/p/skhq48of/

Register for the call: https://register-conf.media-server.com/register/BI5727811477e9400984084cc006a83205

Access the replay through Columbia's investor relations page: https://www.columbiabankingsystem.com/news-market-data/event-calendar/default.aspx

About Columbia Banking System, Inc.

Columbia (Nasdaq: COLB) is headquartered in Tacoma, Washington and is the parent company of Columbia Bank (dba: Umpqua Bank), an award-winning western U.S. regional bank. Columbia Bank is the largest bank headquartered in the Northwest and one of the largest banks headquartered in the West with locations in Arizona, California, Colorado, Idaho, Nevada, Oregon, Utah, and Washington. With over $50 billion of assets, Columbia Bank combines the resources, sophistication, and expertise of a national bank with a commitment to deliver superior, personalized service. The bank supports consumers and businesses through a full suite of services, including retail and commercial banking; Small Business Administration lending; institutional and corporate banking; and equipment leasing. Columbia Bank customers also have access to comprehensive investment and wealth management expertise as well as healthcare and private banking through Columbia Wealth Advisors and Columbia Trust Company, a division of Columbia Bank. Learn more at www.columbiabankingsystem.com.

| | | |

| 1 "Non-GAAP" financial measure. See GAAP to Non-GAAP Reconciliation for additional information. | ||

| 2 "Non-GAAP" financial measure. See GAAP to Non-GAAP Reconciliation for additional information. | ||

| 3 "Non-GAAP" financial measure. See GAAP to Non-GAAP Reconciliation for additional information. | ||

Forward-Looking Statements

This press release includes forward-looking statements within the meaning of the "Safe-Harbor" provisions of the Private Securities Litigation Reform Act of 1995, which management believes are a benefit to shareholders. These statements are necessarily subject to risk and uncertainty and actual results could differ materially due to various risk factors, including those set forth from time to time in our filings with the Securities and Exchange Commission. You should not place undue reliance on forward-looking statements and we undertake no obligation to update any such statements. Forward-looking statements can be identified by words such as "anticipates," "intends," "plans," "seeks," "believes," "estimates," "expects," "target," "projects," "outlook," "forecast," "will," "may," "could," "should," "can" and similar references to future periods. In this press release we make forward-looking statements about strategic and growth initiatives and the result of such activity. Risks and uncertainties that could cause results to differ from forward-looking statements we make include, without limitation: current and future economic and market conditions, including the effects of declines in housing and commercial real estate prices, high unemployment rates, continued or renewed inflation and any recession or slowdown in economic growth particularly in the western United States; economic forecast variables that are either materially worse or better than end of quarter projections and deterioration in the economy that could result in increased loan and lease losses, especially those risks associated with concentrations in real estate related loans; risks related to our proposed transaction with Pacific Premier (the "Transaction"), including, among others, (i) failure to complete the Transaction or unexpected delays related to the Transaction or either party's inability to satisfy closing conditions required to complete the Transaction, (ii) regulatory approvals resulting in the imposition of conditions that could adversely affect the combined company or the expected benefits of the Transaction, (iii) certain restrictions during the pendency of the Transaction that may impact the parties' ability to pursue certain business opportunities or strategic transactions, (iv) diversion of management's attention from ongoing business operations and opportunities, (v) cost savings and any revenue or expense synergies from the Transaction may not be fully realized or may take longer than anticipated to be realized, (vi) deposit attrition, customer or employee loss, and/or revenue loss as a result of the announcement of the Transaction, (viii) expenses related to the Transaction being greater than expected, and (ix) shareholder litigation that could prevent or delay the closing of the Transaction or otherwise negatively impact our business and operations; the impact of proposed or imposed tariffs by the U.S. government and retaliatory tariffs proposed or imposed by U.S. trading partners that could have an adverse impact on customers; our ability to effectively manage problem credits; the impact of bank failures or adverse developments at other banks on general investor sentiment regarding the liquidity and stability of banks; changes in interest rates that could significantly reduce net interest income and negatively affect asset yields and valuations and funding sources; changes in the scope and cost of FDIC insurance and other coverage; our ability to successfully implement efficiency and operational excellence initiatives; our ability to successfully develop and market new products and technology; changes in laws or regulations; potential adverse reactions or changes to business or employee relationships; the effect of geopolitical instability, including wars, conflicts and terrorist attacks; and natural disasters and other similar unexpected events outside of our control. We also caution that the amount and timing of any future common stock dividends or repurchases will depend on the earnings, cash requirements and financial condition of Columbia, market conditions, capital requirements, applicable law and regulations (including federal securities laws and federal banking regulations), and other factors deemed relevant by Columbia's Board of Directors, and may be subject to regulatory approval or conditions.

| TABLE INDEX | |

| | Page |

| Consolidated Statements of Income | 8 |

| Consolidated Balance Sheets | 9 |

| Financial Highlights | 11 |

| Loan & Lease Portfolio Balances and Mix | 12 |

| Deposit Portfolio Balances and Mix | 14 |

| Credit Quality - Non-performing Assets | 15 |

| Credit Quality - Allowance for Credit Losses | 16 |

| Consolidated Average Balance Sheets, Net Interest Income, and Yields/Rates | 18 |

| Residential Mortgage Banking Activity | 20 |

| GAAP to Non-GAAP Reconciliation | 22 |

| Columbia Banking System, Inc. | |||||||||||||

| Consolidated Statements of Income | |||||||||||||

| (Unaudited) | |||||||||||||

| | Quarter Ended | | % Change | ||||||||||

| ($ in thousands, except per share data) | Jun 30, 2025 | | Mar 31, 2025 | | Dec 31, 2024 | | Sep 30, 2024 | | Jun 30, 2024 | | Seq. Quarter | | Year |

| Interest income: | | | | | | | | | | | | | |

| Loans and leases | $ 564,343 | | $ 552,562 | | $ 572,843 | | $ 588,603 | | $ 583,874 | | 2 % | | (3) % |

| Interest and dividends on investments: | | | | | | | | | | | | | |

| Taxable | 80,316 | | 68,688 | | 75,254 | | 76,074 | | 78,828 | | 17 % | | 2 % |

| Exempt from federal income tax | 6,769 | | 6,807 | | 6,852 | | 6,855 | | 6,904 | | (1) % | | (2) % |

| Dividends | 3,444 | | 2,792 | | 2,678 | | 2,681 | | 2,895 | | 23 % | | 19 % |

| Temporary investments and interest bearing deposits | 15,817 | | 16,394 | | 18,956 | | 24,683 | | 23,035 | | (4) % | | (31) % |

| Total interest income | 670,689 | | 647,243 | | 676,583 | | 698,896 | | 695,536 | | 4 % | | (4) % |

| Interest expense: | | | | | | | | | | | | | |

| Deposits | 180,154 | | 176,634 | | 189,037 | | 208,027 | | 207,307 | | 2 % | | (13) % |

| Securities sold under agreement to repurchase and federal funds purchased | 955 | | 974 | | 971 | | 1,121 | | 1,515 | | (2) % | | (37) % |

| Borrowings | 34,542 | | 36,074 | | 39,912 | | 49,636 | | 49,418 | | (4) % | | (30) % |

| Junior and other subordinated debentures | 8,592 | | 8,566 | | 9,290 | | 9,894 | | 9,847 | | — % | | (13) % |

| Total interest expense | 224,243 | | 222,248 | | 239,210 | | 268,678 | | 268,087 | | 1 % | | (16) % |

| Net interest income | 446,446 | | 424,995 | | 437,373 | | 430,218 | | 427,449 | | 5 % | | 4 % |

| Provision for credit losses | 29,449 | | 27,403 | | 28,199 | | 28,769 | | 31,820 | | 7 % | | (7) % |

| Non-interest income: | | | | | | | | | | | | | |

| Service charges on deposits | 19,669 | | 19,301 | | 18,401 | | 18,549 | | 18,503 | | 2 % | | 6 % |

| Card-based fees | 14,559 | | 12,571 | | 14,634 | | 14,591 | | 14,681 | | 16 % | | (1) % |

| Financial services and trust revenue | 5,842 | | 5,187 | | 5,265 | | 5,083 | | 5,396 | | 13 % | | 8 % |

| Residential mortgage banking revenue, net | 7,343 | | 9,334 | | 6,958 | | 6,668 | | 5,848 | | (21) % | | 26 % |

| Gain (loss) on sale of debt securities, net | 1 | | 4 | | 10 | | 3 | | (1) | | (75) % | | nm |

| Gain (loss) on equity securities, net | 410 | | 1,702 | | (1,424) | | 2,272 | | 325 | | (76) % | | 26 % |

| Gain (loss) on loan and lease sales, net | 172 | | 97 | | (1,719) | | 161 | | (1,516) | | 77 % | | nm |

| Gain (loss) on loans held for investment, at fair value | 212 | | 7,016 | | (7,355) | | 9,365 | | (10,114) | | (97) % | | nm |

| BOLI income | 5,184 | | 4,883 | | 4,742 | | 4,674 | | 4,705 | | 6 % | | 10 % |

| Other income | 11,070 | | 6,282 | | 10,235 | | 4,793 | | 6,876 | | 76 % | | 61 % |

| Total non-interest income | 64,462 | | 66,377 | | 49,747 | | 66,159 | | 44,703 | | (3) % | | 44 % |

| Non-interest expense: | | | | | | | | | | | | | |

| Salaries and employee benefits | 154,883 | | 145,239 | | 141,958 | | 147,268 | | 145,066 | | 7 % | | 7 % |

| Occupancy and equipment, net | 47,178 | | 48,170 | | 46,878 | | 45,056 | | 45,147 | | (2) % | | 4 % |

| Intangible amortization | 25,826 | | 27,979 | | 29,055 | | 29,055 | | 29,230 | | (8) % | | (12) % |

| FDIC assessments | 8,144 | | 8,022 | | 8,121 | | 9,332 | | 9,664 | | 2 % | | (16) % |

| Merger and restructuring expense | 8,186 | | 14,379 | | 2,230 | | 2,364 | | 14,641 | | (43) % | | (44) % |

| Legal settlement | — | | 55,000 | | — | | — | | — | | (100) % | | nm |

| Other expenses | 33,778 | | 41,333 | | 38,334 | | 38,283 | | 35,496 | | (18) % | | (5) % |

| Total non-interest expense | 277,995 | | 340,122 | | 266,576 | | 271,358 | | 279,244 | | (18) % | | — % |

| Income before provision for income taxes | 203,464 | | 123,847 | | 192,345 | | 196,250 | | 161,088 | | 64 % | | 26 % |

| Provision for income taxes | 51,041 | | 37,238 | | 49,076 | | 50,068 | | 40,944 | | 37 % | | 25 % |

| Net income | $ 152,423 | | $ 86,609 | | $ 143,269 | | $ 146,182 | | $ 120,144 | | 76 % | | 27 % |

| | | | | | | | | | | | | | |

| Weighted average basic shares outstanding | 209,125 | | 208,800 | | 208,548 | | 208,545 | | 208,498 | | — % | | — % |

| Weighted average diluted shares outstanding | 209,975 | | 210,023 | | 209,889 | | 209,454 | | 209,011 | | — % | | — % |

| Earnings per common share – basic | $ 0.73 | | $ 0.41 | | $ 0.69 | | $ 0.70 | | $ 0.58 | | 78 % | | 26 % |

| Earnings per common share – diluted | $ 0.73 | | $ 0.41 | | $ 0.68 | | $ 0.70 | | $ 0.57 | | 78 % | | 28 % |

| | |||||||||||||

| nm = Percentage changes greater than +/-500% are considered not meaningful and are presented as "nm." |

| Columbia Banking System, Inc. | ||||||

| Consolidated Statements of Income | ||||||

| (Unaudited) | ||||||

| | | Six Months Ended | | % Change | ||

| ($ in thousands, except per share data) | | Jun 30, 2025 | | Jun 30, 2024 | | Year over |

| Interest income: | | | | | | |

| Loans and leases | | $ 1,116,905 | | $ 1,158,918 | | (4) % |

| Interest and dividends on investments: | | | | | | |

| Taxable | | 149,004 | | 153,845 | | (3) % |

| Exempt from federal income tax | | 13,576 | | 13,808 | | (2) % |

| Dividends | | 6,236 | | 6,602 | | (6) % |

| Temporary investments and interest bearing deposits | | 32,211 | | 46,588 | | (31) % |

| Total interest income | | 1,317,932 | | 1,379,761 | | (4) % |

| Interest expense: | | | | | | |

| Deposits | | 356,788 | | 405,742 | | (12) % |

| Securities sold under agreement to repurchase and federal funds purchased | | 1,929 | | 2,781 | | (31) % |

| Borrowings | | 70,616 | | 100,693 | | (30) % |

| Junior and other subordinated debentures | | 17,158 | | 19,734 | | (13) % |

| Total interest expense | | 446,491 | | 528,950 | | (16) % |

| Net interest income | | 871,441 | | 850,811 | | 2 % |

| Provision for credit losses | | 56,852 | | 48,956 | | 16 % |

| Non-interest income: | | | | | | |

| Service charges on deposits | | 38,970 | | 34,567 | | 13 % |

| Card-based fees | | 27,130 | | 27,864 | | (3) % |

| Financial services and trust revenue | | 11,029 | | 9,860 | | 12 % |

| Residential mortgage banking revenue, net | | 16,677 | | 10,482 | | 59 % |

| Gain on sale of debt securities, net | | 5 | | 11 | | (55) % |

| Gain (loss) on equity securities, net | | 2,112 | | (1,240) | | nm |

| Gain (loss) on loan and lease sales, net | | 269 | | (1,295) | | nm |

| Gain (loss) on loans held for investment, at fair value | | 7,228 | | (12,486) | | nm |

| BOLI income | | 10,067 | | 9,344 | | 8 % |

| Other income | | 17,352 | | 17,953 | | (3) % |

| Total non-interest income | | 130,839 | | 95,060 | | 38 % |

| Non-interest expense: | | | | | | |

| Salaries and employee benefits | | 300,122 | | 299,604 | | — % |

| Occupancy and equipment, net | | 95,348 | | 90,438 | | 5 % |

| Intangible amortization | | 53,805 | | 61,321 | | (12) % |

| FDIC assessments | | 16,166 | | 24,124 | | (33) % |

| Merger and restructuring expense | | 22,565 | | 19,119 | | 18 % |

| Legal settlement | | 55,000 | | — | | nm |

| Other expenses | | 75,111 | | 72,154 | | 4 % |

| Total non-interest expense | | 618,117 | | 566,760 | | 9 % |

| Income before provision for income taxes | | 327,311 | | 330,155 | | (1) % |

| Provision for income taxes | | 88,279 | | 85,931 | | 3 % |

| Net income | | $ 239,032 | | $ 244,224 | | (2) % |

| | | | | | | |

| Weighted average basic shares outstanding | | 208,964 | | 208,379 | | 0 % |

| Weighted average diluted shares outstanding | | 209,965 | | 208,999 | | 0 % |

| Earnings per common share – basic | | $ 1.14 | | $ 1.17 | | (3) % |

| Earnings per common share – diluted | | $ 1.14 | | $ 1.17 | | (3) % |

| Columbia Banking System, Inc. | |||||||||||||

| Consolidated Balance Sheets | |||||||||||||

| (Unaudited) | |||||||||||||

| | | | | | | | | | | | % Change | ||

| ($ in thousands, except per share data) | Jun 30, 2025 | | Mar 31, 2025 | | Dec 31, 2024 | | Sep 30, 2024 | | Jun 30, 2024 | | Seq. Quarter | | Year |

| Assets: | | | | | | | | | | | | | |

| Cash and due from banks | $ 608,057 | | $ 591,265 | | $ 496,666 | | $ 591,364 | | $ 515,263 | | 3 % | | 18 % |

| Interest-bearing cash and temporary investments | 1,334,113 | | 1,481,441 | | 1,381,589 | | 1,519,658 | | 1,553,568 | | (10) % | | (14) % |

| Investment securities: | | | | | | | | | | | | | |

| Equity and other, at fair value | 92,958 | | 91,580 | | 78,133 | | 79,996 | | 77,221 | | 2 % | | 20 % |

| Available for sale, at fair value | 8,653,172 | | 8,228,805 | | 8,274,615 | | 8,676,807 | | 8,503,000 | | 5 % | | 2 % |

| Held to maturity, at amortized cost | 2,013 | | 2,057 | | 2,101 | | 2,159 | | 2,203 | | (2) % | | (9) % |

| Loans held for sale | 65,590 | | 64,747 | | 71,535 | | 66,639 | | 56,310 | | 1 % | | 16 % |

| Loans and leases | 37,637,013 | | 37,616,101 | | 37,680,901 | | 37,503,002 | | 37,709,987 | | — % | | — % |

| Allowance for credit losses on loans and leases | (420,907) | | (421,495) | | (424,629) | | (420,054) | | (418,671) | | — % | | 1 % |

| Net loans and leases | 37,216,106 | | 37,194,606 | | 37,256,272 | | 37,082,948 | | 37,291,316 | | — % | | — % |

| Restricted equity securities | 161,380 | | 125,300 | | 150,024 | | 116,274 | | 116,274 | | 29 % | | 39 % |

| Premises and equipment, net | 356,879 | | 344,926 | | 348,670 | | 338,107 | | 337,842 | | 3 % | | 6 % |

| Operating lease right-of-use assets | 110,478 | | 106,696 | | 111,227 | | 106,224 | | 108,278 | | 4 % | | 2 % |

| Goodwill | 1,029,234 | | 1,029,234 | | 1,029,234 | | 1,029,234 | | 1,029,234 | | — % | | — % |

| Other intangible assets, net | 430,443 | | 456,269 | | 484,248 | | 513,303 | | 542,358 | | (6) % | | (21) % |

| Residential mortgage servicing rights, at fair value | 102,863 | | 105,663 | | 108,358 | | 101,919 | | 110,039 | | (3) % | | (7) % |

| Bank-owned life insurance | 704,919 | | 700,768 | | 693,839 | | 691,160 | | 686,485 | | 1 % | | 3 % |

| Deferred tax asset, net | 299,043 | | 311,192 | | 359,425 | | 286,432 | | 361,773 | | (4) % | | (17) % |

| Other assets | 734,194 | | 684,717 | | 730,461 | | 706,375 | | 756,319 | | 7 % | | (3) % |

| Total assets | $ 51,901,442 | | $ 51,519,266 | | $ 51,576,397 | | $ 51,908,599 | | $ 52,047,483 | | 1 % | | — % |

| Liabilities: | | | | | | | | | | | | | |

| Deposits | | | | | | | | | | | | | |

| Non-interest-bearing | $ 13,219,631 | | $ 13,413,927 | | $ 13,307,905 | | $ 13,534,065 | | $ 13,481,616 | | (1) % | | (2) % |

| Interest-bearing | 28,523,026 | | 28,803,767 | | 28,412,827 | | 27,980,623 | | 28,041,656 | | (1) % | | 2 % |

| Total deposits | 41,742,657 | | 42,217,694 | | 41,720,732 | | 41,514,688 | | 41,523,272 | | (1) % | | 1 % |

| Securities sold under agreements to repurchase | 191,435 | | 192,386 | | 236,627 | | 183,833 | | 197,860 | | — % | | (3) % |

| Borrowings | 3,350,000 | | 2,550,000 | | 3,100,000 | | 3,650,000 | | 3,900,000 | | 31 % | | (14) % |

| Junior subordinated debentures, at fair value | 323,015 | | 320,774 | | 330,895 | | 311,896 | | 310,187 | | 1 % | | 4 % |

| Junior and other subordinated debentures, at amortized cost | 107,554 | | 107,611 | | 107,668 | | 107,725 | | 107,781 | | — % | | — % |

| Operating lease liabilities | 124,522 | | 121,282 | | 125,710 | | 121,298 | | 123,082 | | 3 % | | 1 % |

| Other liabilities | 720,377 | | 771,710 | | 836,541 | | 745,331 | | 908,629 | | (7) % | | (21) % |

| Total liabilities | 46,559,560 | | 46,281,457 | | 46,458,173 | | 46,634,771 | | 47,070,811 | | 1 % | | (1) % |

| Shareholders' equity: | | | | | | | | | | | | | |

| Common stock | 5,826,488 | | 5,823,287 | | 5,817,458 | | 5,812,237 | | 5,807,041 | | — % | | — % |

| Accumulated deficit | (150,822) | | (227,006) | | (237,254) | | (304,525) | | (374,687) | | (34) % | | (60) % |

| Accumulated other comprehensive loss | (333,784) | | (358,472) | | (461,980) | | (233,884) | | (455,682) | | (7) % | | (27) % |

| Total shareholders' equity | 5,341,882 | | 5,237,809 | | 5,118,224 | | 5,273,828 | | 4,976,672 | | 2 % | | 7 % |

| Total liabilities and shareholders' equity | $ 51,901,442 | | $ 51,519,266 | | $ 51,576,397 | | $ 51,908,599 | | $ 52,047,483 | | 1 % | | — % |

| | | | | | | | | | | | | | |

| Common shares outstanding at period end | 210,213 | | 210,112 | | 209,536 | | 209,532 | | 209,459 | | — % | | — % |

| Columbia Banking System, Inc. | ||||||||||||||

| Financial Highlights | ||||||||||||||

| (Unaudited) | ||||||||||||||

| | | Quarter Ended | | % Change | ||||||||||

| | | Jun 30, | | Mar 31, | | Dec 31, | | Sep 30, Für dich aus unserer Redaktion zusammengestelltHinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte. Weitere Artikel des AutorsThemen im Trend | ||||||