http://www.ariva.de/dow-jones-industrial-average

Ich bin von L&S - Daten ausgegangen. Tatsächlich sind es jedoch die Kurse von FfM 20:00. Der Dow hatte zeitlich erst danach mit der Rally gestartet.

von Corey Rosenblom via Afraid-to-trade-Blog

They’ll get you every time. Today’s intraday stock market action was an excellent example of the “rounded reversal” day concept in action. Let’s see it in the DIA and how we might have managed risk and traded it.

DIA 5-min chart:

The day started with the news that the market moving “Jobs Report” showed a loss of over 500,000 US jobs, indicating that the economy continues to deteriorate steadily - unemployment in November stood at 6.7%. You would expect a market freefall, right? I mean, how could the market end higher on such a day? It’s funny going and reading some official reports of the trading day vs the news - they’re looking for explanations as to why such an odd occurrence happened.

If you’ve been trading for any length of time, you know that it’s often best to ignore the expected direction we think certain major news reports will take us. I don’t mean run out and fade the news blindly, but don’t let yourself get emotionally hurt and suffer unnecessary losses by fighting the tape on a day such as this that goes beyond all normal instincts.

That being said, the day began with a downside gap that made a run to the upside to ‘fill the gap,’ but fell just short before price plunged - expectantly - to new lows on the day near $81.50 (Dow 8,150). Then the market did something… unexpected by many newer (and some seasoned) traders.

The new lows just prior to 11:00 EST formed on a distinct positive momentum divergence. The proper play was to short the market as it tested the falling 20 period EMA at 11:00am, particularly with the confluence of dojis at EMA resistance.

But the market didn’t fall. Stops should have been placed just above the green EMA (green arrow) and taken not long after the market breached that area. For me, there wasn’t enough to get bullish at that level, but it was enough to cause bearish pause and adopt a “Hmm. This is interesting - let’s wait and see” attitude.

Price then found solid resistance at the falling 50 period EMA and made a quick, 1-bar move lower… before reversing again and taking out any shorts who placed entries and stops just above this blue average.

Finally, when price found support at the confluence of the 20 and 50 period EMAs, and more importantly when these EMAs crossed ‘bullishly’ (green highlighted arrow), that was your signal that all bearish bets were officially off the table and to get long the market for a potential ’rounded reversal’ swing into at least yesterday’s close (dotted line) which occurred suddenly.

At this point, the second pullback around 2:30 was the golden entry, as price had proven itself by forming a series of higher highs and higher lows and finding support two times at the rising EMAs. Buyers were rewarded by a quick, surging market as remaining shorts threw in the towel and helped force price higher into the close.

It was a slightly irritating day in some senses, but bulls can end the week satisfied, given the turmoil caused in this week’s trading.

Let’s look just a bit closer at the intraday price structure to see something that was available only to the most astute traders and seasoned intraday Elliotticians.

DIA 5-min chart with Elliott Waves:

The purpose of looking at these charts is to build your pattern recognition skills so that you can more easily identify patterns in real-time as they form and take advantage of them.

First Waves are usually known as “disbelief” waves that are seen as a reason to - in this case - get short again. Wave 1 terminated around noon into EMA resistance. First waves often form on positive momentum divergences as well, which we saw.

Second waves often are known as “gotcha” waves or are periods when - in this case - short sellers say “Ha - I told you so” but price fails to make new lows (remember Wave 2 cannot retrace 100% of Wave 1).

Third Waves often begin in confusion, as short-sellers slowly take their stops and price forms the “Sweet Spot” reversal structure (in terms of higher highs and lows) and price often crests above key EMAs at this point, and usually moving average crossovers occur in third waves. People begin to see price as rising and short sellers capitulate into the newly rising and strengthening up-trend.

Fourth Waves tend to be rather orderly (sometimes) and are seen as profit-taking waves and also places to re-establish (or enter fresh) positions to the long side - whether or not you’re looking at price from an Elliott Wave perspective - they just feel good (in terms of a retracement entry sense).

Finally, the Fifth Wave is where aggressive longs who have been holding since lower levels take their profits and latecomers enter the market, hoping for endless gains. Fifth waves often end in negative momentum divergences and on weaker momentum/volume readings.

That journey takes you in a little bit into some of the psychology behind a classic Elliott Wave impulse, one of which occurred today in the face of so much opposition (virtually everyone to whom I spoke before noon said the market was going to capitulate into the weekend - I didn’t disagree).

But ultimately, the market respects its own opinion, and the forces of supply and demand rule the day no matter what the headline news might be.

Take today’s action as an educational lesson, annotate the intraday charts in your own way, and enjoy the weekend upon us!

http://blog.afraidtotrade.com/gotta-watch-those-rounded-reversal-days/

Angenehme Strategie aus dem FundMyMutualFund-Blog, gefällt mir recht gut. Anbei ein Auszug:

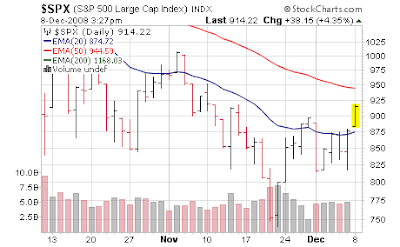

.....My game plan is as follows - we went into this week with the lowest short exposure in months and I want to respect the power of Kool Aid. We are making our first real move over the 20 day moving average in 3 months (excluding 1 day in early November), and we now raise troops to attack the 50 day which is S&P 950 (roughly). As we get there I am going to mimic the bank trades I made earlier today - which is to lighten up exposure as we get to a key resistance area and then sit back and watch. In fact I've taken off more of the long financial and commercial real estate late this afternoon - the latter of which makes my skin crawl to be long (however, hard to argue with the P&L benefit). Either we fall back at resistance (S&P 950) and turn back down or we break through and party with Santa Obama. I don't know what we will do, nor do we need to guess. When we get there the price action will tell us - predictions are just for pundits. So we are going to lop off long exposure as we move upward and then be super high in cash awaiting the market to tell us where we go next. Being flexible, we will be more than willing to get the long exposure all back if we blast off past S&P 950.... but within the confines of a primary bear market sell first, and assess second. And more than willing to turn back to the dark side if we begin a breakdown (if hope fades)

If we break through 950 (bullish) we then have a very easy tell at S&P 1000 which were early November highs. That will be the next resistance and we'll do the exact same operations we do at 950 - cut back as we hit it, assess. Rinse, lather, repeat. A break above 1000 would be bullish again.... respecting the downside, I look at S&P 900 which we broke above for the first time in 3 weeks today to act as a support. And then we repeat all the levels we've talked about the past few weeks, S&P 870 and 840 etc etc. The importance is the behavior - will participants "buy on dips" this time - the dips which are sure to come relatively soon after this insistent of a move up? That will be key of a change to character.

Remember, this behavior is much more normal in bear markets then what we've been through the last 3 months - seeing absolutely no rallies is the abnormal act. Not the act of seeing multi week, in fact multi month rallies within the bear market - that's typical. This helps us work off some very oversold conditions. So this is about 2 weeks of rally... nothing special. Just volatile. You can see "reversion to mean" trades everywhere - all the worst hit stuff is now rallying the hardest - Prologis (a REIT) up 40%. Las Vegas Sands (LVS) reliant on US consumers spending again? Up nearly 20%. DryShips (DRYS) - global trade is back on as the global economy revives? Up 50%. MercadoLibre (MELI) - as China rebounds so will everything in South America? - up 36% Etc. Reversion to mean trades everywhere aka shorts run for cover. None of this is leadership or a new group(s) emerging as stock market leaders- that's what we really need.

Remember, this is all sort of a big hoax of a rally - it's all about sentiment and "looking through the darkness" and "knowing the worst is behind us" blah blah blah. We've had these rallies over and over in 2008 and I expect throughout 2009. This is the "2nd half 2009 recovery" rally combined with "government will save us" rally. Even if they are premature we still want to catch some of the upside and not get punished with our short exposure, so we can be cynics but we don't want to be poor cynics. Obama has high intellect and will energize the troops and people will be thankful there at least appears to be some grand plan, as opposed to the current administration which has been exposed as clueless in every facet over the past decade. So just from a "we might have a chance with these guys" sentiment stand point we should be more bullish from there. I still contend the Obama honeymoon will be over as reality settles in by late spring/summer - we should be facing 8%+ unemployment and Obama will say "I told you it will get worse before it gets better". But the market is not about reality - perception is reality. For now "we are saved". Let's position ourselves accordingly - enjoy the gains, while protecting a large part of our portfolio from a return of reality/downside risk. With these crazy ETFs, we can return with half our portfolio what used to take 80% exposure.

At some point here in the next weeks/months the galloping market will offer us some excellent profit opportunities on the short side... the higher the better (more profit when we falter) We can profit both down and up; the trick shall be timing the sentiment shifts. And as you can see everything I talk about is technical because fundamentals mean nothing and government interventions dominate every day. Hence the rules of the game change by the day, so we have nothing left but technical indicators - i.e. what is the herd doing? So we're sticking with that until the government stops dominating the discussion.

http://www.fundmymutualfund.com/2008/12/updated-battle-plan.html

|