AllianceBernstein Expands Lifetime Income Platform with Fixed Annuity Version of Secure Income Portfolio

NASHVILLE, Tenn., Oct. 16, 2025 /PRNewswire/ -- AllianceBernstein L.P. (AB) today announced it will provide another approach to delivering lifetime income to Defined Contribution (DC) plan participants with a new edition of AB's Secure Income Portfolio (SIP). Through an allocation to a fixed annuity, it delivers a consistent stream of guaranteed income, principal protection and steady asset growth.

"This represents the next evolution in our lifetime income platform, enabling DC plan sponsors to have a broader set of income options from which to choose," said Jennifer DeLong, Head of Defined Contribution at AllianceBernstein. "Over our many years of experience, one thing has remained consistent — we've stayed centered on our core philosophy to focus on what matters most to participants — providing lifetime income without sacrificing control of or access to their savings, growth potential in all life stages, and flexibility to customize to the unique needs of each plan."

The solution also provides participants with guaranteed retirement income, while maintaining access to their savings at any time, without forfeiting control.

The fixed annuity guarantee is issued by an insurance company subsidiary of Corebridge Financial, Inc.i

"Corebridge is committed to helping individuals take actions that strengthen financial security leading up to and all the way through retirement," said Terri Fiedler, President of Retirement Services at Corebridge Financial. "Establishing an income strategy for retirement years is a critical step on that journey."

More than a decade ago, AB launched the Lifetime Income Strategy (LIS) as a fully liquid target-date portfolio solution that integrates a Secure Income Portfolio option as a component to deliver guaranteed income to participants. LIS was designed to comply with qualified default investment alternative (QDIA) regulations and thus serve as a true default. Last month, the Department of Labor issued an Advisory Opinion validating that LIS meets the requirements to serve as a QDIA.

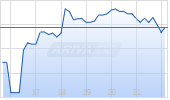

As an industry leader with approximately $13B in assets under managementii in lifetime income solutions, AB specializes in designing innovative investment strategies that help retirement savers be better prepared for the future. AB and Equitable, the retirement subsidiary of AB's parent company Equitable Holdings, were early pioneers in the secure guaranteed income market. Equitable serves as one of the participating insurers in AB's Lifetime Income Strategy (LIS), which launched in 2012.

Today's announcement builds on AB's lifetime income platform, which in addition to LIS, consists of the AB Secure Income Portfolio available separately as a Collective Investment Trust, and now this alternative version for plan sponsors to consider.

About AllianceBernstein

AllianceBernstein is a leading global investment management firm that offers diversified investment services to institutional investors, individuals, and private wealth clients in major world markets. As of September 2025, AllianceBernstein had $860 billion in assets under management. Additional information about AB may be found on our website, www.alliancebernstein.com.

This material is general in nature, was developed for educational use only, and is not intended to provide financial, legal, fiduciary, accounting or tax advice, nor is it intended to make any recommendations. Applicable laws and regulations are complex and subject to change. Please consult with your financial professional regarding your situation. For legal, accounting or tax advice consult the appropriate professional.

Fixed Annuities are long-term insurance products designed for retirement. Withdrawals may be subject to withdrawal charges and federal and/or state income taxes. A 10% federal early withdrawal tax penalty may apply if taken before age 59 1/2.

The availability of IncomEdge® Control Flex will vary by state. Contract terms and conditions are subject to regulatory approval.

i IncomEdge® Control Flex is a group fixed unallocated annuity issued by The Variable Annuity Life Insurance Company (Houston, TX) on policy forms VG-814 (7/25), VG-814-DP (7/25) and VL 40934 VER 8/2025.

All guarantees are based on the claims paying ability of the issuing insurance company.

ii Assets under management as of June 30, 2025.

![]() View original content:https://www.prnewswire.com/news-releases/alliancebernstein-expands-lifetime-income-platform-with-fixed-annuity-version-of-secure-income-portfolio-302585859.html

View original content:https://www.prnewswire.com/news-releases/alliancebernstein-expands-lifetime-income-platform-with-fixed-annuity-version-of-secure-income-portfolio-302585859.html

SOURCE AllianceBernstein

Für dich aus unserer Redaktion zusammengestellt

Dein Kommentar zum Artikel im Forum

Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte.