Aufrufe: 65

Aufrufe: 65

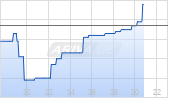

Maurel & Prom: Activity for the year 2025

- M&P working interest production in 2025: 37,096 boepd, up 2% on 2024

- M&P working interest production of 14,662 bopd in Gabon, down 6% versus 2024

- M&P working interest production of 4,289 bopd in Angola, stable versus 2024

- M&P working interest gas production of 59.7 mmcfd in Tanzania, down 3% versus 2024

- M&P working interest oil production of 8,194 bopd in Venezuela, up 34% versus 2024

- Valued production of $504 million and sales of $578 million

- Average oil price of $69.4/b over the period, down 14% compared with 2024 ($80.3/b)

- Service activities and trading of third-party oil contributed $14 million and $102 million to sales respectively

- Negative impact of $42 million from lifting imbalances and inventory revaluation

- Major rotation of the asset portfolio, aimed at refocusing on direct ownership of assets with high development potential

- Sale of M&P’s 20.07% interest in Seplat Energy to Heirs Energies for $496 million

- Completion of the acquisition of a 61% stake in the Sinu-9 gas permit in Colombia

- Entry into Block 3/24 in Angola, which contains several established oil and gas discoveries

- Signing in December of an SPA for the acquisition of Azule Energy’s interests in Blocks 14 & 14K in Angola, subject to customary conditions, in particular pre-emption rights

- Active drilling programme to develop reserves and production

- In Gabon, alongside the ongoing continuous development drilling campaign on the Ezanga permit, drilling underway of an exploration well on the Etekamba permit

- In Tanzania, start of a three-well campaign on the Mnazi Bay permit to significantly increase the field’s production potential

- In Colombia, start of the six-well exploration campaign on Sinu-9 in early February

- M&P working interest 2P reserves at 31 December 2025: 295 mmboe

- Reserves up 28% after restatement of 2025 production

- Significant increase in reserves held in Venezuela, now standing at 148 mmbbls

- Positive net cash position placing the Group in the best position for future external growth operations

- Positive net cash position of $178 million ($460 million in cash and $282 million in debt)

- Position before the impact of M&A transactions in January 2026: additional net cash of $170 million ($248 million from the Seplat Energy sale, less $78 million for the completion of Sinu-9)

Key indicators for 2025

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Q1 | Q2 | Q3 | Q4 | 2025 | 2024 | Change | ||||||

|

|

| |||||||||||

| M&P working interest production |

|

| ||||||||||

| Gabon (oil) | bopd | 15,684 | 15,350 | 14,910 | 12,735 |

|

| 14,662 |

|

| 15,582 | -6% |

| Angola (oil) | bopd | 4,478 | 4,151 | 4,427 | 4,102 |

|

| 4,289 |

|

| 4,302 | -0% |

| Tanzania (gas) | mmcfd | 60,8 | 56,7 | 62,0 | 59,3 |

|

| 59,7 |

|

| 61,4 | -3% |

| Total interests in consolidated entities | boepd | 30,298 | 28,945 | 29,669 | 26,728 |

|

| 28,902 |

|

| 30,125 | -4% |

| Venezuela (oil) | bopd | 8,236 | 7,801 | 8,304 | 8,430 |

|

| 8,194 |

|

| 6,098 | +34% |

| Total production | boepd | 38,534 | 36,746 | 37,973 | 35,158 |

|

| 37,096 |

|

| 36,222 | +2% |

|

|

|

|

|

|

|

|

|

|

|

| ||

| Average sale price |

|

|

|

|

|

|

|

|

|

|

| |

| Oil | $/bbl | 74.9 | 69.7 | 70.2 | 64.3 |

|

| 69.4 |

|

| 80.3 | -14% |

| Gas | $/mmBtu | 4.02 | 4.02 | 4.02 | 4.02 |

|

| 4.02 |

|

| 3.90 | +3% |

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Sales |

|

|

|

|

|

|

|

|

|

|

| |

| Gabon | $mm | 98 | 92 | 93 | 76 |

|

| 359 |

|

| 437 | -18% |

| Angola | $mm | 26 | 22 | 24 | 21 |

|

| 93 |

|

| 109 | -15% |

| Tanzania | $mm | 11 | 12 | 16 | 13 |

|

| 52 |

|

| 48 | +8% |

| Valued production | $mm | 136 | 125 | 133 | 110 |

|

| 504 |

|

| 593 | -15% |

| Service activities | $mm | 4 | 5 | 2 | 2 |

|

| 14 |

|

| 39 |

|

| Trading of third-party oil | $mm | – | 52 | 50 | – |

|

| 102 |

|

| 125 |

|

| Restatement for lifting imbalances & inventory revaluation | $mm | -76 | 42 | 15 | -24 |

|

| -42 |

|

| 51 |

|

| Consolidated sales | $mm | 64 | 224 | 201 | 88 |

|

| 578 |

|

| 808 | -29% |

Total Group production on an M&P working interest basis (including Venezuela) amounted to 37,096 boepd for 2025, up 2% compared with 2024.

The Group’s consolidated production on an M&P working interest basis (excluding Venezuela, not consolidated in sales) stood at 28,902 boepd, down 4% compared with 2024. The average selling price of oil was $69.4/b for the period, down 14% compared with 2024 ($80.3/b).

The Group’s valued production (income from production activities, excluding lifting imbalances and inventory revaluation) amounted to $504 million.

Service activities and trading of third-party oil generated income of $14 million for 2025. The restatement of lifting imbalances, net of inventory revaluation, had a negative impact of $42 million.

Consolidated sales for 2025 stood at $578 million.

Olivier de Langavant, Chief Executive Officer of M&P, declared: “The Group has entered an active growth phase, built around the development of its existing assets and an external growth strategy set to accelerate. The sale of our stake in Seplat Energy represents a key milestone in this momentum: it enables us to crystallise the value created and to secure very significant financial capacity. This enhanced flexibility gives us the means to accelerate the capture of value-accretive acquisition opportunities, in line with our ambition to increase the share of operated assets with high development potential.”

Production activities

Gabon

M&P’s working interest oil production (80%) on the Ezanga permit amounted to 14,662 bopd in 2025, down 6% on 2024. Q4 2025 was marked by pressure issues on the export pipeline, which resulted in reduced production in November and December 2025. The situation returned to normal in January 2026. The combined well potential has meanwhile increased to around 22,000 bopd (gross, i.e. 17,600 bopd net to M&P).

The Mouletsi-2 well drilled on the Etekamba gas permit confirmed the gas-bearing levels encountered in the Mouletsi-1 well in the Gamba and Dentale formations. Start-up is expected by end-2026.

Angola

M&P’s working interest production from Blocks 3/05 (20%) and 3/05A (26.7%) amounted to 4,289 bopd for 2025, stable compared with 2024.

Construction of the Quilemba Solar power plant is progressing in line with plan. Grid connection is expected mid-year.

Tanzania

M&P’s working interest gas production (60%) on the Mnazi Bay permit amounted to 59.7 mmcfd in 2025, down 3% compared with 2024.

The rig is now mobilised on site for the three-well drilling campaign. The spud initially planned for December will now take place during the first half of February. These wells will sustainably increase the gross production potential of the field, which currently stands at around 100 mmcfd, beyond the 130 mmcfd capacity of the facilities.

Venezuela

M&P Iberoamerica’s working interest oil production (40%) on the Urdaneta Oeste field amounted to 8,194 bopd in 2025, up 34% compared with 2024.

Following the expiration on 27 May 2025 of the licence issued by the US Treasury Department's Office of Foreign Assets Control (“OFAC”), M&P adjusted its activities in the country. Production continued normally, while on-site operations were limited to well interventions and maintenance work to ensure the safety of personnel and facilities.

M&P is closely monitoring recent developments in the country and confirms that it submitted a new application to OFAC in early January to obtain a license allowing the restart of all of its activities on the Urdaneta Oeste field. M&P hopes for an early resumption of its operations, which will contribute to the redevelopment of the Venezuelan oil sector.

Sale of M&P’s 20.07% interest in Seplat Energy

M&P entered into a binding agreement on 30 December 2025 in relation to the sale of its entire shareholding of 120.4 million shares, representing a 20.07% interest, in Seplat Energy Plc (“Seplat”), a leading Nigerian independent energy company listed on the London Stock Exchange and the Nigerian Exchange, to Heirs Energies Ltd (“Heirs Energies”).

The sale is at a price of 305 pence per share, corresponding to a total consideration of $496 million, with an initial payment of $248 million received on 31 December 2025, with the balance payable within 30 days, secured by an irrevocable letter of credit.

M&P has been one of Seplat’s three founders and its largest shareholder since inception in 2010, and has supported the company throughout its development into a leading Nigerian energy player with a diversified portfolio across oil and gas, playing a key role in Nigeria’s energy security.

This transaction comes at a time that M&P considers particularly opportune to monetise this position and reallocate resources towards direct investments in oil and gas assets, in line with a growth strategy that the Group intends to accelerate. M&P is also very pleased to transfer its stake to Heirs Energies, a subsidiary of the leading PanAfrican investment company Heirs Holdings, and expresses confidence in Seplat’s ability to continue to thrive with the support of another strong, long-term shareholder.

Acquisition of a 61% interest in the Sinu-9 gas permit in Colombia

The acquisition by M&P of a total 61% working interest and operatorship in the Sinu-9 gas licence in Colombia was successfully completed on 5 January 2026.

The transactions comprise two acquisitions, for a total consideration of $229 million:

- A 40% working interest acquired from MKMS Enerji Anonim Sirketi S.A. (a subsidiary of NG Energy International Corp). The agreement was signed on 9 February 2025, with effective economic date of 1 February 2025;

- An additional 21% working interest acquired from Desarrolladora Oleum S.A. de C.V. and Clean Energy Resources S.A.S, which includes the transfer of operatorship. The agreements were signed on 2 July 2025, with effective economic date at closing.

Taking into account the advance payments already made by M&P, the total outstanding consideration amounted to $185 million. Of this amount, $78 million was paid at completion, with the balance of $108 million payable in instalments during 2026.

M&P now holds a 61% working interest in the Sinu-9 licence and assumes operatorship of the asset. M&P also retains an option to acquire an additional 5% working interest in Sinu-9 from NG Energy for a consideration of $18.75 million within 12 months, subject to adjustments for cash flows from the effective date on 1 February 2025.

Sinu-9 started production in November 2024 as part of the ongoing long-term test of the Magico-1X and Brujo-1X wells. Evacuation infrastructure is in place today for gross production of 30 mmcfd, which will be increased to 40 mmcfd by Q2 2026. Current production level (January 2026) stands at around 14 mmcfd (gross). The start of the six-well exploration campaign is scheduled for February 2026, with the rig currently being mobilised and assembled.

Entry into Block 3/24 in Angola

In early September 2025, M&P signed heads of terms with Angola's National Oil, Gas and Biofuels Agency (“ANPG”) for the risk service contract (“RSC”) covering offshore Block 3/24. The RSC was formally approved by presidential decree on 8 October 2025. Under the agreed terms, Maurel & Prom Angola S.A.S. will hold a 40% interest in Block 3/24, alongside Afentra Plc (operator, 40%) and Sonangol P&P (20%).

This new asset strengthens M&P’s long-term partnership in Angola and underlines its commitment to developing resources responsibly, in collaboration with its partners and the Angolan authorities.

The heads of terms for Block 3/24 set out an initial five-year period to review the development potential of existing discoveries and exploration prospects, followed by a 25-year production period that would subsequently be awarded when a discovery is developed.

Block 3/24 is located in shallow water and covers 545 km², adjacent to existing producing oil fields and undeveloped discoveries in Blocks 3/05 and 3/05A. The block includes five discoveries – Palanca North East, Quissama, Goulongo, Cefo and Kuma – all located in the same Pinda reservoir as the existing oil fields in Blocks 3/05 and 3/05A. In addition, the block contains the previously developed Canuku field cluster, which has produced up to 12,000 barrels per day. The block contains discoveries estimated at more than 130 mmbbls of STOIIP (oil in place) and 400 bcf of GIIP (gas in place).

These discoveries offer a significant opportunity to apply modern technology to deliver short-cycle, low-cost developments tied back to the existing infrastructure in Block 3/05. A number of exploration prospects have also been identified based on existing 3D seismic data.

Signing of an SPA for the acquisition of Azule Energy’s interests in Blocks 14 & 14K offshore Angola

On 10 December 2025, M&P signed, together in a consortium with BW Energy Limited (“BW Energy”), a Sale and Purchase Agreement (“SPA”) with Azule Energy Angola B.V. (“Azule Energy”) for the joint acquisition of a 20% interest in Block 14 (10% net to M&P) and a 10% interest in Block 14K (5% net to M&P), both located offshore Angola.

Closing of the joint transactions remains subject to the receipt of regulatory approvals and the satisfaction of other customary closing conditions and the possible implementation of applicable pre-emption rights. Closing is expected mid-2026.

Group reserves at 31 December 2025

The Group’s reserves correspond to technically recoverable hydrocarbon volumes representing the Group’s share of interests in permits already in production and those revealed by discovery and delineation wells that can be commercially exploited. These reserves at 31 December 2025 were certified by DeGolyer and MacNaughton.

The Group’s 2P reserves amounted to 294.8 mmboe at 31 December 2025, including 167.3 mmboe of proven reserves (1P).

M&P working interest 2P reserves:

| Gabon | Angola | Tanzania | Total consolidated assets | Venezuela | Total Group | |

|

| Oil (mmbbls) | Oil (mmbbls) | Gas (bcf) | Oil eq. (mmboe) | Oil (mmbbls) | Oil eq. (mmboe) |

| 2P reserves at 31/12/2024 | 115.0 | 21.5 | 165.8 | 164.1 | 80.0 | 244.1 |

| Production | -5.4 | -1.6 | -21.8 | -10.5 | -3.0 | -13.5 |

| Revision | -8.2 | +0.9 | +2.2 | -6.9 | +71.1 | +64.2 |

| 2P reserves at 31/12/2025 | 101.4 | 20.8 | 146.2 | 146.6 | 148.1 | 294.8 |

| o/w 1P reserves | 72.2 | 15.5 | 137.9 | 110.7 | 56.7 | 167.3 |

| 1P reserves as a % of 2P | 71% | 75% | 94% | 75% | 38% | 57% |

| Note: Gas-oil conversion rate of 6 bcf/mmboe |

The significant increase in reserves in Venezuela is due to geoscience studies carried out during 2025, which largely confirm the potential of zones previously considered unproven.

These reserves do not include reserves for the Sinu-9 asset in Colombia, as the acquisition was completed in early January.

Financial position

The Group had a positive net cash position of $178 million at 31 December 2025, compared with a positive net cash position of $34 million at end-December 2024.

The cash position stood at $460 million at end-December. Gross debt amounted to $282 million, including $240 million of bank loan (including a $110 million term loan and a tranche of $130 million drawn down on the RCF) and $42 million of shareholder loan.

The cash position mainly reflects the receipt on 31 December 2025 of an initial payment of $248 million in relation to the sale by M&P of its stake in Seplat. It should however be noted that this cash position does not include:

- The $78 million payment made in early January for the completion of the acquisition of the 61% stake in Sinu-9;

- The receipt of a second payment of $248 million, expected at end-January, corresponding to the balance of the sale of the stake in Seplat.

Discussions are ongoing regarding the refinancing of the bank loan to increase its amount and extend its term beyond the current maturity of July 2027.

Glossary

| Français |

|

| Anglais |

| pieds cubes | pc | cf | cubic feet |

| millions de pieds cubes par jour | Mpc/j | mmcfd | million cubic feet per day |

| milliards de pieds cubes | Gpc | bcf | billion cubic feet |

| baril | b | bbl | Barrel |

| barils d’huile par jour | b/j | bopd | barrels of oil per day |

| millions de barils | Mb | mmbbls | million barrels |

| barils équivalent pétrole | bep | boe | barrels of oil equivalent |

| barils équivalent pétrole par jour | bep/j | boepd | barrels of oil equivalent per day |

| millions de barils équivalent pétrole | Mbep | mmboe | million barrels of oil equivalent |

For more information, please visit www.maureletprom.fr/en/

This document may contain forecasts regarding the financial position, results, business and industrial strategy of Maurel & Prom. By their very nature, forecasts involve risk and uncertainty insofar as they are based on events or circumstances which may or may not occur in the future. These forecasts are based on assumptions we believe to be reasonable, but which may prove to be incorrect and which depend on a number of risk factors, such as fluctuations in crude oil prices, changes in exchange rates, uncertainties related to the valuation of our oil reserves, actual rates of oil production and the related costs, operational problems, political stability, legislative or regulatory reforms, or even wars, terrorism and sabotage.

Maurel & Prom is listed on Euronext Paris

CAC Mid & Small – CAC All-Tradable – PEA-PME and SRD eligible

Isin FR0000051070 / Bloomberg MAU.FP / Reuters MAUP.PA

View source version on businesswire.com: https://www.businesswire.com/news/home/20260128955144/en/

Für dich aus unserer Redaktion zusammengestellt

Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte.