JLL Reports Financial Results for Second-Quarter 2025

JLL notched its fifth consecutive quarter of double-digit revenue growth and achieved a 32% increase in diluted earnings per share

CHICAGO, Aug. 6, 2025 /PRNewswire/ -- Jones Lang LaSalle Incorporated (NYSE: JLL) today reported operating performance for the second quarter of 2025 with diluted earnings per share of $2.32 (up 32%) and adjusted diluted earnings per share1 of $3.30 (up 29%). Resilient4 and Transactional4 revenues both achieved at least six quarters of consecutive growth.

- Second-quarter revenue was $6.3 billion, up 10% in local currency1 with Resilient4 revenues up 11% and Transactional4 revenues up 7%

- Real Estate Management Services' momentum continued, up 11%, driven by Project Management and Workplace Management

- Capital Markets Services achieved 12% growth, led by performance of the debt advisory and investment sales businesses

- Leasing, within Leasing Advisory, increased 5%, highlighted by industrial in the U.S. and office in the U.S. and Asia Pacific

- The meaningful increase in profit reflected revenue growth, improved platform leverage and ongoing cost discipline

- Investment Management's $2.9 billion of capital raised during the first half of 2025 surpassed 2024's full-year capital raise amount

"JLL's strong second-quarter results on both the top and bottom line reflect our unwavering commitment to our clients as they navigate the uneven market environment," said Christian Ulbrich, JLL CEO. "The investments we've made in our people and platform are driving sustainable, organic growth and greater operating efficiency, especially in our resilient businesses. We doubled share repurchases in the second quarter and, given our year-to-date performance and solid underlying business trends, we increased the mid-point of our full-year Adjusted EBITDA target range."

| Summary Financial Results

| Three Months Ended June 30, | | Six Months Ended June 30, | ||||||||

| 2025 | | 2024 | % Change | % Change | | 2025 | | 2024 | % Change | % Change | |

| | | | | | | | | | | | |

| Revenue | $ 6,250.1 | | $ 5,628.7 | 11 % | 10 % | | $ 11,996.5 | | $ 10,753.2 | 12 % | 12 % |

| | | | | | | | | | | | |

| Net income attributable to common shareholders | $ 112.3 | | $ 84.4 | 33 % | 32 % | | $ 167.6 | | $ 150.5 | 11 % | 10 % |

| Adjusted net income attributable to common shareholders1 | 159.4 | | 123.2 | 29 | 29 | | 271.0 | | 209.2 | 30 | 28 |

| | | | | | | | | | | | |

| Diluted earnings per share | $ 2.32 | | $ 1.75 | 33 % | 32 % | | $ 3.46 | | $ 3.12 | 11 % | 10 % |

| Adjusted diluted earnings per share1 | 3.30 | | 2.55 | 29 | 29 | | 5.60 | | 4.33 | 29 | 28 |

| | | | | | | | | | | | |

| Adjusted EBITDA1 | $ 291.7 | | $ 246.3 | 18 % | 17 % | | $ 516.5 | | $ 433.4 | 19 % | 19 % |

| | | | | | | | | | | | |

| Cash flows from operating activities | $ 332.8 | | $ 273.9 | 22 % | n/a | | $ (434.8) | | $ (403.6) | (8) % | n/a |

| Free Cash Flow6 | 288.4 | | 235.7 | 22 % | n/a | | (523.7) | | (485.0) | (8) % | n/a |

| Note: For discussion and reconciliation of non-GAAP financial measures, see the Notes following the Financial Statements in this news release. | |||||||||||

Consolidated Second-Quarter 2025 Performance Highlights:

| Consolidated

| Three Months Ended June 30, | | % | | % | | Six Months Ended June 30, | | % | | % | ||||

| 2025 | | 2024 | | | | 2025 | | 2024 | | | |||||

| Real Estate Management Services | $ 4,894.0 | | $ 4,369.9 | | 12 % | | 11 % | | $ 9,463.4 | | $ 8,439.1 | | 12 % | | 12 % |

| Leasing Advisory | 676.8 | | 642.2 | | 5 | | 5 | | 1,262.9 | | 1,162.6 | | 9 | | 9 |

| Capital Markets Services | 520.3 | | 457.6 | | 14 | | 12 | | 955.6 | | 835.2 | | 14 | | 14 |

| Investment Management | 103.1 | | 102.6 | | — | | (2) | | 201.6 | | 206.0 | | (2) | | (3) |

| Software and Technology Solutions | 55.9 | | 56.4 | | (1) | | (1) | | 113.0 | | 110.3 | | 2 | | 3 |

| Total revenue | $ 6,250.1 | | $ 5,628.7 | | 11 % | | 10 % | | $ 11,996.5 | | $ 10,753.2 | | 12 % | | 12 % |

| Gross contract costs6 | $ 4,186.8 | | $ 3,747.4 | | 12 % | | 11 % | | $ 8,129.1 | | $ 7,246.1 | | 12 % | | 13 % |

| Platform operating expenses | 1,844.6 | | 1,717.4 | | 7 | | 6 | | 3,509.0 | | 3,227.3 | | 9 | | 9 |

| Restructuring and acquisition charges5 | 21.3 | | 11.5 | | 85 | | 87 | | 41.0 | | 13.2 | | 211 | | 213 |

| Total operating expenses | $ 6,052.7 | | $ 5,476.3 | | 11 % | | 10 % | | $ 11,679.1 | | $ 10,486.6 | | 11 % | | 12 % |

| Net non-cash MSR and mortgage banking | $ (4.2) | | $ (11.8) | | 64 % | | 64 % | | $ (17.1) | | $ (20.8) | | 18 % | | 18 % |

| Note: For discussion and reconciliation of non-GAAP financial measures, see the Notes following the Financial Statements in this news release. Percentage variances in the Performance | |||||||||||||||

Revenue

Revenue increased 10% compared with the prior-year quarter. Resilient revenues were collectively up 11%, highlighted by Workplace Management, up 10%, and Project Management, up 22%, both within Real Estate Management Services. The collective 7% increase in Transactional revenue was led by Investment Sales, Debt/Equity Advisory and Other, within Capital Markets Services, up 14% (excluding the impact of non-cash MSR and mortgage banking derivative activity).

On a year-to-date basis, revenue increased 12%. Resilient revenues grew 12% collectively, highlighted by Workplace Management, up 13%, and Project Management, up 19%. Transactional revenues increased 10% collectively, led by Investment Sales, Debt/Equity, up 18% (excluding the impact of non-cash MSR and mortgage banking derivative activity), and Leasing, within Leasing Advisory, up 9%.

Refer to segment performance highlights for additional detail.

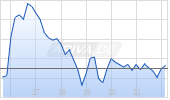

The following chart reflects the year-over-year change in revenue for each of the trailing eight quarters (QTD revenues, on a local currency basis). The chart shows the change in Transactional, Resilient and total revenue. Refer to Footnote 4 for the definitions of Resilient and Transactional revenues.

Net income and Adjusted EBITDA:

| ($ in millions, except per share data, "LC" = local currency) | Three Months Ended June 30, | | Six Months Ended June 30, | ||||||||

| 2025 | | 2024 | % Change | % Change | | 2025 | | 2024 | % Change | % Change | |

| | | | | | | | | | | | |

| Net income attributable to common shareholders | $ 112.3 | | $ 84.4 | 33 % | 32 % | | $ 167.6 | | $ 150.5 | 11 % | 10 % |

| Adjusted net income attributable to common shareholders1 | 159.4 | | 123.2 | 29 | 29 | | 271.0 | | 209.2 | 30 | 28 |

| | | | | | | | | | | | |

| Diluted earnings per share | $ 2.32 | | $ 1.75 | 33 % | 32 % | | $ 3.46 | | $ 3.12 | 11 % | 10 % |

| Adjusted diluted earnings per share1 | 3.30 | | 2.55 | 29 | 29 | | 5.60 | | 4.33 | 29 | 28 |

| | | | | | | | | | | | |

| Adjusted EBITDA1 | $ 291.7 | | $ 246.3 | 18 % | 17 % | | $ 516.5 | | $ 433.4 | 19 % | 19 % |

| | | | | | | | | | | | |

| Effective tax rate ("ETR") | 19.5 % | | 19.5 % | 0 bps | n/a | | 19.5 % | | 19.5 % | 0 bps | n/a |

For the quarter, higher Adjusted EBITDA and margin were largely driven by Resilient revenue growth (primarily within Real Estate Management Services) as well as Transactional revenue growth from Investment Sales, Debt/Equity Advisory and Other (within Capital Markets Services), together with enhanced platform leverage and continued cost discipline (partially enabled by increased use of technology and shared service centers).

For the second quarter, the following three items were the most meaningful year-over-year differences between net income attributable to common shareholders and non-GAAP measures1:

- Equity losses - Investment Management and Software and Technology Solutions: Total aggregate equity losses, primarily associated with Software and Technology Solutions investments, were $28.7 million in 2025, greater than the $16.3 million in 2024.

- Restructuring and acquisition charges: The expense was $9.8 million higher in 2025, compared with 2024, primarily due to an increase in severance and other employment-related charges, including expenses associated with the change in reporting segments.

- The above two items were partially offset by less headwinds from net non-cash MSR and mortgage derivative activities.

The following charts reflect the aggregation of segment Adjusted EBITDA for the second quarter and June year-to-date. Refer to the segment performance highlights for additional detail.

Cash Flows and Capital Allocation:

| ($ in millions) | Three Months Ended June 30, | | Six Months Ended June 30, | ||||||

| 2025 | | 2024 | Change in USD | | 2025 | | 2024 | Change in USD | |

| Cash flows from operating activities | $ 332.8 | | $ 273.9 | 22 % | | $ (434.8) | | $ (403.6) | (8) % |

| Free Cash Flow6 | 288.4 | | 235.7 | 22 % | | (523.7) | | (485.0) | (8) % |

Incremental cash inflow in the second quarter was primarily attributable to (i) advance cash payments from clients, primarily associated with new/renewed Real Estate Management Services clients, (ii) improved collection of trade receivables, and (iii) lower cash taxes paid. These drivers were partially offset by greater commission payments compared with the prior-year quarter.

Share repurchase activity is noted in the following table. As of June 30, 2025, $952.0 million remained authorized for repurchase.

| | Three Months Ended June 30, | | Six Months Ended June 30, | ||

| | 2025 | 2024 | | 2025 | 2024 |

| Total number of shares repurchased (in thousands) | 176.5 | 103.7 | | 251.8 | 214.4 |

| Total paid for shares repurchased (in millions) | $ 41.4 | $ 20.1 | | $ 61.2 | $ 40.2 |

Net Debt, Leverage and Liquidity6:

| | June 30, 2025 | | March 31, 2025 | | June 30, 2024 |

| Net Debt (in millions) | $ 1,586.7 | | $ 1,754.0 | | $ 1,752.0 |

| Net Leverage Ratio | 1.2x | | 1.4x | | 1.7x |

| Corporate Liquidity (in millions) | $ 3,321.4 | | $ 3,312.4 | | $ 2,449.4 |

The lower Net Debt, compared with March 31, 2025, was driven by positive free cash flow for the second quarter. The Net Debt reduction from June 30, 2024, reflected improved free cash flow over the trailing twelve months ended June 30, 2025, compared with the twelve-month period ended June 30, 2024.

In addition to the Corporate Liquidity detailed above, the company maintains a commercial paper program (the "Program") with $2.5 billion authorized for issuance. As of June 30, 2025, there was $690.0 million outstanding under the Program.

Real Estate Management Services Second-Quarter 2025 Performance Highlights:

| Real Estate Management Services

| Three Months Ended June 30, | | % | | % | | Six Months Ended June 30, | | % | | % | ||||

| 2025 | | 2024 | | | | 2025 | | 2024 | | | |||||

| Revenue | $ 4,894.0 | | $ 4,369.9 | | 12 % | | 11 % | | $ 9,463.4 | | $ 8,439.1 | | 12 % | | 12 % |

| Workplace Management | 3,349.1 | | 3,021.1 | | 11 | | 10 | | 6,612.7 | | 5,892.8 | | 12 | | 13 |

| Project Management | 971.6 | | 788.1 | | 23 | | 22 | | 1,719.1 | | 1,444.5 | | 19 | | 19 |

| Property Management | 454.4 | | 436.6 | | 4 | | 4 | | 900.0 | | 866.3 | | 4 | | 4 |

| Portfolio Services and Other | 118.9 | | 124.1 | | (4) | | (5) | | 231.6 | | 235.5 | | (2) | | (2) |

| Segment operating expenses | $ 4,816.5 | | $ 4,309.6 | | 12 % | | 11 % | | $ 9,349.1 | | $ 8,336.8 | | 12 % | | 12 % |

| Segment platform operating expenses | 643.5 | | 592.5 | | 9 | | 7 | | 1,245.8 | | 1,150.6 | | 8 | | 9 |

| Gross contract costs6 | 4,173.0 | | 3,717.1 | | 12 | | 12 | | 8,103.3 | | 7,186.2 | | 13 | | 13 |

| Adjusted EBITDA1 | $ 106.6 | | $ 88.6 | | 20 % | | 19 % | | $ 172.9 | | $ 160.0 | | 8 % | | 7 % |

| Note: For discussion and reconciliation of non-GAAP financial measures, see the Notes following the Financial Statements in this news release. Percentage variances in the Performance | |||||||||||||||

Real Estate Management Services revenue growth was driven by continued strong performance in Workplace Management, with client wins slightly outpacing mandate expansions, as incremental pass-through costs augmented high single-digit management fee growth. Higher Project Management revenue was led by new or expanded contracts in the U.S. and Asia Pacific, as a mid-teens management fee increase was supplemented by higher pass-through costs.

The increase in Adjusted EBITDA and margin was primarily attributable to the top-line performance described above, coupled with continued cost discipline. These drivers overcame headwinds from the favorable prior-year impact of incentive compensation accruals timing.

Leasing Advisory Second-Quarter 2025 Performance Highlights:

| Leasing Advisory

| Three Months Ended June 30, | | % | | % | | Six Months Ended June 30, | | % | | % | ||||

| 2025 | | 2024 | | | | 2025 | | 2024 | | | |||||

| Revenue | $ 676.8 | | $ 642.2 | | 5 % | | 5 % | | $ 1,262.9 | | $ 1,162.6 | | 9 % | | 9 % |

| Leasing | 651.5 | | 619.1 | | 5 | | 5 | | 1,217.6 | | 1,116.4 | | 9 | | 9 |

| Advisory, Consulting and Other | 25.3 | | 23.1 | | 10 | | 8 | | 45.3 | | 46.2 | | (2) | | (2) |

| Segment operating expenses | $ 567.8 | | $ 539.3 | | 5 % | | 5 % | | $ 1,069.0 | | $ 994.2 | | 8 % | | 8 % |

| Segment platform operating expenses | 564.5 | | 531.0 | | 6 | | 6 | | 1,063.7 | | 979.5 | | 9 | | 9 |

| Gross contract costs6 | 3.3 | | 8.3 | | (60) | | (60) | | 5.3 | | 14.7 | | (64) | | (64) |

| Adjusted EBITDA1 | $ 120.4 | | $ 112.1 | | 7 % | | 6 % | | $ 217.4 | | $ 186.9 | | 16 % | | 15 % |

| Note: For discussion and reconciliation of non-GAAP financial measures, see the Notes following the Financial Statements in this news release. Percentage variances in the Performance | |||||||||||||||

Compared with the prior-year quarter, increased revenue was driven by Leasing growth across major asset classes, led by continued momentum in industrial and office. Geographically, Leasing revenue grew most significantly in the United States, with notable contributions from France, Australia and Singapore. The U.S. was primarily driven by growth in industrial, both from higher volume and deal size, while a notable increase in deal size for U.S. office was largely offset by lower volume as the asset class was up low single digits. With the backdrop of decelerating growth in the broader market, Leasing performed in line with global office volumes and outperformed U.S. office volumes (decline of 3%) in the second quarter, according to JLL Research.

The increases in Adjusted EBITDA and margin were largely driven by the revenue growth described above, tempered by discrete, variable operating expenses in the second quarter as compensation and benefits expenses as a percentage of revenue improved year-over-year for the quarter (enabled by increased use of technology and shared service centers).

Capital Markets Services Second-Quarter 2025 Performance Highlights:

| Capital Markets Services

| Three Months Ended June 30, | | % | | % | | Six Months Ended June 30, | | % | | % | ||||

| 2025 | | 2024 | | | | 2025 | | 2024 | | | |||||

| Revenue | $ 520.3 | | $ 457.6 | | 14 % | | 12 % | | $ 955.6 | | $ 835.2 | | 14 % | | 14 % |

| Investment Sales, Debt/Equity Advisory and | 384.8 | | 332.1 | | 16 | | 14 | | 710.3 | | 599.8 | | 18 | | 18 |

| Net non-cash MSR and mortgage banking | (4.2) | | (11.8) | | 64 | | 64 | | (17.1) | | (20.8) | | 18 | | 18 |

| Value and Risk Advisory | 97.7 | | 95.8 | | 2 | | — | | 179.3 | | 176.0 | | 2 | | 2 |

| Loan Servicing | 42.0 | | 41.5 | | 1 | | 1 | | 83.1 | | 80.2 | | 4 | | 4 |

| Segment operating expenses | $ 488.3 | | $ 453.5 | | 8 % | | 6 % | | $ 908.5 | | $ 831.9 | | 9 % | | 9 % |

| Segment platform operating expenses | 486.6 | | 441.7 | | 10 | | 9 | | 905.7 | | 806.5 | | 12 | | 12 |

| Gross contract costs6 | 1.7 | | 11.8 | | (86) | | (85) | | 2.8 | | 25.4 | | (89) | | (89) |

| Adjusted EBITDA1 | $ 54.7 | | $ 33.8 | | 62 % | | 61 % | | $ 103.3 | | $ 58.8 | | 76 % | | 73 % |

| Note: For discussion and reconciliation of non-GAAP financial measures, see the Notes following the Financial Statements in this news release. Percentage variances in the | |||||||||||||||

Capital Markets Services top-line growth was fueled by debt advisory and investment sales. The residential sector delivered the most significant contribution to the year-over-year increase, with notable contributions also coming from the office, industrial and retail sectors. Geographically, the U.S., Japan and MENA2 led the revenue growth.

In the current quarter, the company recognized approximately $14.0 million of incremental expense associated with an enhanced loss-share agreement with Fannie Mae for a specific three-loan portfolio. The impact of this item on year-over-year performance is more than offset by the $18.0 million expense recognized in the prior-year quarter associated with the August 2024 repurchase of a loan which JLL originated and then sold to Fannie Mae.

Adjusted EBITDA and margin improvements for the quarter were primarily attributable to the revenue growth described above and the net impact of year-over-year loan-related losses. In addition, compensation and benefits expense as a percentage of revenue modestly improved year-over-year for the second quarter (enabled by increased use of technology and shared service centers).

Investment Management Second-Quarter 2025 Performance Highlights:

| Investment Management

| Three Months Ended June 30, | | % | | % | | Six Months Ended June 30, | | % | | % | ||||

| 2025 | | 2024 | | | | 2025 | | 2024 | | | |||||

| Revenue | $ 103.1 | | $ 102.6 | | — % | | (2) % | | $ 201.6 | | $ 206.0 | | (2) % | | (3) % |

| Advisory fees | 93.3 | | 93.1 | | — | | (2) | | 182.6 | | 185.4 | | (2) | | (2) |

| Transaction fees and other | 6.5 | | 6.9 | | (6) | | (9) | | 15.0 | | 15.8 | | (5) | | (6) |

| Incentive fees | 3.3 | | 2.6 | | 27 | | 24 | | 4.0 | | 4.8 | | (17) | | (19) |

| Segment operating expenses | $ 89.5 | | $ 90.3 | | (1) % | | (3) % | | $ 175.2 | | $ 174.9 | | — % | | — % |

| Segment platform operating expenses | 81.2 | | 81.5 | | — | | (3) | | 158.7 | | 157.7 | | 1 | | — |

| Gross contract costs6 | 8.3 | | 8.8 | | (6) | | (5) | | 16.5 | | 17.2 | | (4) | | (4) |

| Adjusted EBITDA1 | $ 16.3 | | $ 22.7 | | (28) % | | (32) % | | $ 32.1 | | $ 43.7 | | (27) % | | (28) % |

| Note: For discussion and reconciliation of non-GAAP financial measures, see the Notes following the Financial Statements in this news release. Percentage variances in the Performance | |||||||||||||||

The slight decline in Investment Management advisory fees was primarily due to lower assets under management ("AUM"), continuing to reflect asset dispositions on behalf of certain clients in the fourth quarter of 2024.

The changes in Adjusted EBITDA and margin were largely driven by the absence of the $8.2 million gain recognized in the prior-year quarter following the purchase of a controlling interest in a fund managed by the company.

AUM3 increased 3% in USD (2% in local currency) during the quarter, and decreased 2% in USD and local currency over the trailing twelve months. Changes in AUM are detailed in the tables below (in billions):

| Quarter-to-date | |

| Beginning balance (March 31, 2025) | $ 82.3 |

| Asset acquisitions/takeovers | 1.3 |

| Asset dispositions/withdrawals | (1.3) |

| Valuation changes | 0.7 |

| Foreign currency translation | 1.2 |

| Change in uncalled committed capital and cash held | 0.7 |

| Ending balance (June 30, 2025) | $ 84.9 |

| Trailing Twelve Months | |

| Beginning balance (June 30, 2024) | $ 86.6 |

| Asset acquisitions/takeovers | 5.8 |

| Asset dispositions/withdrawals | (7.6) |

| Valuation changes | 1.9 |

| Foreign currency translation | 0.2 |

| Change in uncalled committed capital and cash held | (2.0) |

| Ending balance (June 30, 2025) | $ 84.9 |

Software and Technology Solutions Second-Quarter 2025 Performance Highlights:

| Software and Technology Solutions

| Three Months Ended June 30, | | % | | % | | Six Months Ended June 30, | | % | | % | ||||

| 2025 | | 2024 | | | | 2025 | | 2024 | | | |||||

| Revenue | $ 55.9 | | $ 56.4 | | (1) % | | (1) % | | $ 113.0 | | $ 110.3 | | 2 % | | 3 % |

| Segment operating expenses | $ 69.3 | | $ 72.1 | | (4) % | | (4) % | | $ 136.3 | | $ 135.6 | | 1 % | | 1 % |

| Segment platform operating expenses, | 71.3 | | 68.5 | | 4 | | 4 | | 140.0 | | 130.9 | | 7 | | 7 |

| Carried interest (benefit) expense(a) | (2.5) | | 2.2 | | (214) | | (217) | | (4.9) | | 2.1 | | (333) | | (336) |

| Gross contract costs6 | 0.5 | | 1.4 | | (64) | | (64) | | 1.2 | | 2.6 | | (54) | | (51) |

| Adjusted EBITDA1 | $ (6.3) | | $ (10.9) | | 42 % | | 43 % | | $ (9.2) | | $ (16.0) | | 43 % | | 41 % |

| Note: For discussion and reconciliation of non-GAAP financial measures, see the Notes following the Financial Statements in this news release. Percentage variances in the Performance | |||||||||||||||

| (a) Carried interest expense/benefit is associated with equity earnings/losses on Spark Venture Funds investments. | |||||||||||||||

Lower Software and Technology Solutions revenue was primarily due to reduced technology spend from certain large existing clients, partially offset by low double-digit growth in software services.

The improvement in Adjusted EBITDA was primarily attributable to the favorable change in carried interest expense/benefit.

About JLL

For over 200 years, JLL (NYSE: JLL), a leading global commercial real estate and investment management company, has helped clients buy, build, occupy, manage and invest in a variety of commercial, industrial, hotel, residential and retail properties. A Fortune 500® company with annual revenue of $23.4 billion and operations in over 80 countries around the world, our more than 112,000 employees bring the power of a global platform combined with local expertise. Driven by our purpose to shape the future of real estate for a better world, we help our clients, people and communities SEE A BRIGHTER WAYSM. JLL is the brand name, and a registered trademark, of Jones Lang LaSalle Incorporated. For further information, visit jll.com.

Connect with us

https://www.linkedin.com/company/jll

https://www.facebook.com/jll

https://twitter.com/jll

| Live Webcast | | Conference Call | |

| Management will offer a live webcast for shareholders, analysts and investment The link to the live webcast and audio replay can be accessed at the Investor | | The conference call can be accessed live over the phone by | |

| | | | |

| Supplemental Information | | Contact | |

| Supplemental information regarding the second quarter 2025 earnings call has | | If you have any questions, please contact Sean Coghlan, Head of | |

| | Phone: | +1 312 252 8943 | |

| | Email: | ||

Cautionary Note Regarding Forward-Looking Statements

Statements in this news release regarding, among other things, future financial results and performance, achievements, plans, objectives and share repurchases may be considered forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements involve known and unknown risks, uncertainties, and other factors, the occurrence of which are outside JLL's control which may cause JLL's actual results, performance, achievements, plans, and objectives to be materially different from those expressed or implied by such forward-looking statements. For additional information concerning risks, uncertainties, and other factors that could cause actual results to differ materially from those anticipated in forward-looking statements, and risks to JLL's business in general, please refer to those factors discussed under "Risk Factors," "Business," "Management's Discussion and Analysis of Financial Condition and Results of Operations," "Quantitative and Qualitative Disclosures about Market Risk," and elsewhere in JLL's Annual Report on Form 10-K, Quarterly Report on Form 10-Q and other reports filed with the Securities and Exchange Commission. Any forward-looking statements speak only as of the date of this release, and except to the extent required by applicable securities laws, JLL expressly disclaims any obligation or undertaking to publicly update or revise any forward-looking statements contained herein to reflect any change in expectations or results, new information, developments or any change in events.

| JONES LANG LASALLE INCORPORATED | |||||||

| Consolidated Statements of Operations (Unaudited) | |||||||

| | |||||||

| | Three Months Ended June 30, | | Six Months Ended June 30, | ||||

| (in millions, except share and per share data) | 2025 | | 2024 | | 2025 | | 2024 |

| | | | | | | | |

| Revenue | $ 6,250.1 | | $ 5,628.7 | | $ 11,996.5 | | $ 10,753.2 |

| | | | | | | | |

| Operating expenses: | | | | | | | |

| Compensation and benefits | $ 2,835.1 | | $ 2,599.2 | | $ 5,509.7 | | $ 5,014.8 |

| Operating, administrative and other | 3,128.6 | | 2,803.3 | | 5,989.1 | | 5,335.3 |

| Depreciation and amortization | 67.7 | | 62.3 | | 139.3 | | 123.3 |

| Restructuring and acquisition charges5 | 21.3 | | 11.5 | | 41.0 | | 13.2 |

| Total operating expenses | $ 6,052.7 | | $ 5,476.3 | | $ 11,679.1 | | $ 10,486.6 |

| | | | | | | | |

| Operating income | $ 197.4 | | $ 152.4 | | $ 317.4 | | $ 266.6 |

| | | | | | | | |

| Interest expense, net of interest income | 35.3 | | 41.7 | | 59.9 | | 72.2 |

| Equity losses | (27.4) | | (15.4) | | (53.0) | | (19.1) |

| Other income | 2.5 | | 9.7 | | 4.2 | | 11.2 |

| | | | | | | | |

| Income before income taxes and noncontrolling interest | 137.2 | | 105.0 | | 208.7 | | 186.5 |

| Income tax provision | 26.7 | | 20.5 | | 40.7 | | 36.4 |

| Net income | 110.5 | | 84.5 | | 168.0 | | 150.1 |

| | | | | | | | |

| Net (loss) income attributable to noncontrolling interest | (1.8) | | 0.1 | | 0.4 | | (0.4) |

| | | | | | | | |

| Net income attributable to common shareholders | $ 112.3 | | $ 84.4 | | $ 167.6 | | $ 150.5 |

| | | | | | | | |

| Basic earnings per common share | $ 2.36 | | $ 1.77 | | $ 3.53 | | $ 3.17 |

| Basic weighted average shares outstanding (in 000's) | 47,483 | | 47,539 | | 47,475 | | 47,512 |

| | | | | | | | |

| Diluted earnings per common share | $ 2.32 | | $ 1.75 | | $ 3.46 | | $ 3.12 |

| Diluted weighted average shares outstanding (in 000's) | 48,334 | | 48,317 | | 48,372 | | 48,302 |

| | | | | | | | |

| Please reference accompanying financial statement notes. | |||||||

| JONES LANG LASALLE INCORPORATED | |||||||

| Selected Segment Financial Data (Unaudited) | |||||||

| | Three Months Ended June 30, | | Six Months Ended June 30, | ||||

| (in millions) | 2025 | | 2024 | | 2025 | | 2024 |

| Real Estate Management Services | | | | | | | |

| Revenue | $ 4,894.0 | | $ 4,369.9 | | $ 9,463.4 | | $ 8,439.1 |

| | | | | | | | |

| Platform compensation and benefits | $ 465.8 | | $ 416.5 | | $ 897.4 | | $ 817.0 |

| Platform operating, administrative and other | 147.5 | | 146.8 | | 286.7 | | 275.4 |

| Depreciation and amortization | 30.2 | | 29.2 | | 61.7 | | 58.2 |

| Segment platform operating expenses | 643.5 | | 592.5 | | 1,245.8 | | 1,150.6 |

| Gross contract costs6 | 4,173.0 | | 3,717.1 | | 8,103.3 | | 7,186.2 |

| Segment operating expenses | $ 4,816.5 | | $ 4,309.6 | | $ 9,349.1 | | $ 8,336.8 |

| Segment operating income | $ 77.5 | | $ 60.3 | | $ 114.3 | | $ 102.3 |

| Add: | | | | | | | |

| Equity earnings Für dich aus unserer Redaktion zusammengestelltHinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte. Weitere Artikel des AutorsThemen im Trend | |||||||