Invesco Real Estate Continues Momentum, Closes on $3 billion of Loan Commitments across North America and Europe in 2024

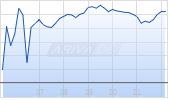

ATLANTA, March 6, 2025 /PRNewswire/ -- Invesco Real Estate, the $88 billion global real estate investment platform of Invesco Ltd., accelerated its lending activity in 2024 with loan commitments across North America and Europe totaling $3 billion in committed capital across 45 unique loans. Multifamily and industrial represented the largest areas of conviction for the group in 2024 with 96% of transactions falling into those sectors.

"We have navigated market cycles for more than 40 years, expanding into new sectors and geographies to uncover attractive opportunities across the real estate investment spectrum," said Bert Crouch, Head of North America, Invesco Real Estate. "We're pleased to reach this milestone that speaks to the strength of our platform, our deep borrower relationships, and Invesco's commitment to innovation in real estate finance."

Finishing a strong year, the team closed $1 billion of loan commitments in 4Q24 alone across 15 floating rate senior loans in North America and one whole loan facility in Europe. In the aggregate, Invesco Real Estate originated seven loans secured by industrial properties (three of which are cross-collateralized), five loans secured by multifamily properties, and four cross-collateralized loans secured by self-storage properties.

"Our approach to the business continues to be grounded in our key principles: a focus on our clients, a focus on our people, and, as it pertains to our investment parameters, our 'credit-over-yield' mandate," said Charlie Rose, Global Head of Credit, Invesco Real Estate. "Our expertise across the capital structure, sectors, and regions helps inform our investment strategy. We focus on sectors that both we and our borrowers have the strongest convictions around, with multifamily and industrial rising to the top as the most attractive property types in 2024."

Since launching a dedicated real estate credit platform in 2017, Invesco Real Estate has committed $18 billion in capital across more than 252 transactions in North America and Europe. In 2024, Invesco Real Estate's originations represented a 215% year-over-year increase in investment activity and the team has now increased loan origination volume sequentially for four consecutive quarters.

2024 Invesco Real Estate loan highlights across North America and Europe include:

- €272.0 million floating-rate senior loan for the refinancing of a portfolio of three prime logistics warehouses located in Barcelona (Spain), Paris (France), and Bristol (UK).

- $260.5 million industrial credit facility consisting of five cross-collateralized and cross-defaulted loans as of year-end 2024, with properties located in CA, NV, and IL.

- $175.9 million floating-rate senior loans for the acquisition of an 8-property portfolio, spanning 2 million square feet of highly functional industrial assets located in key infill markets of Atlanta, GA; Baltimore, MD; Raleigh, NC; Louisville, KY; and High Point, NC.

- $177.0 million floating-rate senior loan for the development of a 715,000 square feet Class A industrial campus comprising four buildings in San Jose, CA.

- $101.0 million and $98.9 million floating-rate senior loans for the refinancing of two Class-A high-rise multifamily properties totaling 400 and 387 units, respectively, located in Washington, D.C.

- €63.5 million floating-rate senior loan for the acquisition of a portfolio of two logistics warehouses located in key logistic hubs in Milan, Italy.

- €20.0 million mezzanine loan for the partial refinancing and development of a logistics center in Psary, Poland.

About Invesco Real Estate

Invesco Real Estate is a global leader in the real estate investment management business with $88 billion in real estate assets under management, 606 employees and 21 regional offices across the U.S., Europe and Asia Pacific as of September 30, 2024. With a 40-year history, Invesco Real Estate invests across the risk return spectrum, from core to opportunistic; in equity and debt; listed and direct; locally and globally. Invesco Real Estate is a business name of Invesco Advisers, Inc., an indirect, wholly owned subsidiary of Invesco Ltd.

About Invesco Ltd.

Invesco Ltd. is a global independent investment management firm dedicated to delivering an investment experience that helps people get more out of life. Our distinctive investment teams deliver a comprehensive range of active, passive, and alternative investment capabilities. With offices in more than 20 countries, Invesco managed $1.85 trillion in assets on behalf of clients worldwide as of December 31, 2024. For more information, visit www.invesco.com.

Contact: Matthew Chisum | 212-652-4368 | matthew.chisum@invesco.com

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/invesco-real-estate-continues-momentum-closes-on-3-billion-of-loan-commitments-across-north-america-and-europe-in-2024-302393973.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/invesco-real-estate-continues-momentum-closes-on-3-billion-of-loan-commitments-across-north-america-and-europe-in-2024-302393973.html

SOURCE Invesco Ltd.

Für dich aus unserer Redaktion zusammengestellt

Dein Kommentar zum Artikel im Forum

Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte.