BMO Survey: Gen Z and Millennials Face Challenges Raising a Family Amid Rising Financial Pressures

- Top factors influencing decisions on whether to have children include financial stability and finding the right partner.

- Nearly nine-in-ten find balancing the emotional and financial demands of parenthood challenging.

TORONTO, Aug. 13, 2025 /CNW/ - The latest BMO Real Financial Progress Index reveals seven-in-ten Gen Z (70%) and Millennials (69%) want to have children but worry doing so would negatively affect their financial security. While 81% of Canadians say being a parent brings joy and fulfillment to their lives, over half (53%) of parents admit having children compromised their financial security.

The BMO survey examines how the financial and emotional challenges related to raising children in the current economic environment are shaping parenting decisions and found:

- Family Defining Decisions: Financial stability (44%) is the top consideration influencing Canadians' decision on whether to have children, followed by finding the right partner (34%), the ability to be fully present for their child(ren) (27%), mental and physical health (24%) and career goals and/or prospects (17%). Over a third (35%) would reconsider their decision not to have children if there was less of a negative effect on their finances.

- Family Size Aspirations: On average, aspiring parents want two children, but that number rises to three if financial constraints are removed.

- Emotional Toll of Parenthood: 89% say balancing the emotional and financial demands of parenthood is challenging and over half (55%) regularly feel overwhelmed by their family's financial responsibilities – a sentiment felt most profoundly among Gen Z (72%) and Millennials (72%).

- Keeping Up with the Jones: Over three quarters (76%) admit there is pressure for parents to keep up with other families by spending more than they should.

- Long-Term Implications: 86% report that everyday childcare costs including daycare, after-school programs, and school supplies, negatively affect their ability to save for long-term goals such as higher education or homeownership.

"For many Canadians, starting and raising a family is one of life's most meaningful journeys, but it can also bring significant financial and emotional pressures," said Gayle Ramsay, Head, Everyday Banking, Segment & Customer Growth, BMO. "To help ease that burden, we encourage families to have open, ongoing conversations about money and to create a financial plan that reflects their values and long-term goals – whether it is buying a home, saving for their child's education and more. Working with an advisor can provide guidance through life's changes, and help families stay on track and focus on what matters most – spending more time together and making real financial progress."

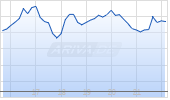

According to BMO Economics, the current economic environment is testing the resilience of households in Canada. The Bank of Canada's Survey of Consumer Expectations suggests most respondents have a negative opinion of their financial health, likely given concerns about tariffs and trade, a rising unemployment rate and sagging home prices in parts of Ontario and British Columbia.

However, financial conditions are improving with lower interest rates, falling borrowing costs and steady income gains in the past year, meaning the overall debt service burden has fallen from earlier record highs. Household financial stress should improve further if the Canadian government can negotiate a trade deal with the U.S. and if the Bank of Canada resumes policy easing, as anticipated, in the fall. The latter would further reduce the mortgage reset burden on many homeowners in the next two years.

The Price of Parenthood

The BMO Real Financial Progress Index found 84% of Canadians feel the costs associated with raising children have become unmanageable, with parents saying the most surprising costs include groceries (39%); toys and activities such as sports and recreational clubs (37%); daycare, private schools and afterschool care (31%); housing costs to accommodate a child (30%); baby supplies such diapers, formula, etc. (28%); new clothing for the child(ren) (27%); strollers, car seats and other similar items (25%); and extra childcare help such as a nanny, babysitting, etc. (21%).

While concerns about the financial demands of parenting remain high, many Canadians plan to support their children well into adulthood, with 22% saying support should continue until their child secures a full-time job, 18% planning to provide support until the child moves out, and 22% believing parents should offer support regardless of life stage. On average, Canadians feel parents should financially support their children in some capacity for 19 years; notably, 29% believe this support should last for as long as the parents are alive.

BMO Helps Families Make Real Financial Progress

BMO offers some tips to help Canadians and their families stay on track towards their financial goals and make real financial progress:

- Build a Family-Centered Financial Plan: Creating a financial plan as a family can help foster unity and accountability. Families should regularly set aside time to discuss finances and include children in age-appropriate ways including creating a budget, providing a weekly allowance, and/or collaborating on goals such as saving for a family vacation, education for the child(ren) or an emergency fund.

- BMO My Financial Progress: Available through BMO's Mobile Banking app and Online Banking, this innovative, digital goal planning platform helps clients create personalized and adaptive long-term plans, gain comprehensive insights into their finances and access personalized strategies to help them reach their goals.

- Maximize Government Benefits:

- Canada Child Benefit (CCB): This tax-free monthly payment from the Canada Revenue Agency (CRA) is designed to help families with the cost of raising children under 18. The amount received depends on adjusted family net income (AFNI), the number and age of children in the household, and marital status. For families with an AFNI below $37,487, they are eligible to receive up to $7,997 a year for children under 6 and $6,748 a year for children aged 6–17.

- Child Disability Benefit (CDB): The tax-free monthly payment supports families raising children under 18 with severe and prolonged physical or mental impairments. For example, for the period of July 2025 to June 2026, eligible families can receive up to $3,411 annually per child, with amounts reduced based on income. No separate application is required if the child qualifies for the Disability Tax Credit and the family receives the Canada Child Benefit.

- GST/HST Credit: The tax-free quarterly payment issued by CRA helps low- and modest-income Canadians offset the cost of sales taxes on everyday purchases. It may also include payments from provincial and territorial programs. For the benefit period of July 2025 to June 2026, eligible individuals may receive up to $533 if single, $698 if married or common-law, plus $184 per child under 19. Most Canadians are automatically considered when they file their annual tax return.

- Leverage Tax Strategies: Efficient tax planning can lower the household's tax burden and maximize potential returns. CRA offers a range of family benefits to help alleviate some of the financial burden for families including:

- Registered Education Savings Plans (RESP): A RESP is a long-term, tax-sheltered savings plan that helps families save for their child's education. The earlier families start investing in a RESP, the more time the investment has time to grow. Families can contribute up to $2,500 per year to receive the full $500 Canada Education Savings Grant.

- Child Care Expenses Deduction: Fees for daycare, summer camp or boarding school for children under 16 can be deducted if parents are either working or attending school full time.

- Medical Expenses: Families can claim either all or part of a medical expense including prenatal care with a nurse, fertility treatments and/or hospital upgrades.

- Foster Family Financial Literacy: Teaching kids how to spend, save, and share (the 3S-Strategy) early helps build lifelong money habits.

- Young Children (Ages 8 and Under): To instill early habits of earnings and savings, use tangible tools like coins and bills to introduce basic concepts through allowances or chore-based rewards.

- Tweens (Ages 9-12): Reinforce the 3S-Strategy with prepaid or debit cards and involve them in budgeting and saving for goals. A prepaid or debit card can help them manage money across categories, earn interest and save toward goals. Parents should maintain control over bank accounts and regularly review balances to their child's track progress and spending habits.

- Teens (Ages 13 and Older): As teens begin earning money through part-time jobs, allowances, or gifts, introduce budgeting across categories, and set up automatic transfers for larger goals.

- Explore into Employer Benefits and Wellness Programs to Help Ease Parenting Costs and Reduce Stress: Through its employee benefits, BMO offers short-term care services to help with back-up care for childcare and adult/elder care (via Telus Health). BMO also recognizes there are different paths to becoming a parent and provides financial support to help employees who choose to grow their families through fertility treatments, surrogacy or adoption. Additionally, BMO Parents Employee Resource Group supports parents and caregivers through community, honest conversations and networking.

To learn more about how BMO can help clients make financial progress, visit www.bmo.com/main/personal.

About the BMO Real Financial Progress Index

Launched in February 2021, the BMO Real Financial Progress Index is an indicator of how consumers feel about their personal finances and whether they are making financial progress. The index aims to spark dialogue that will help consumers reach their financial goals and to humanize a topic that causes anxiety for many – money.

The research detailed in this document was conducted by Ipsos in Canada from June 10 to July 17, 2025. A sample of n=2,501 adults ages 18+ in Canada were collected. Quotas and weighting were used to ensure the composition of the samples reflects that of the Canadian population according to census parameters. The surveys have a credibility interval of +/- 2.4 per cent 19 times out of 20, of what the results would have been had all Canadian adults 18+ been surveyed.

About BMO Financial Group

BMO Financial Group is the seventh largest bank in North America by assets, with total assets of $1.4 trillion as of April 30, 2025. Serving customers for 200 years and counting, BMO is a diverse team of highly engaged employees providing a broad range of personal and commercial banking, wealth management, global markets and investment banking products and services to 13 million customers across Canada, the United States, and in select markets globally. Driven by a single purpose, to Boldly Grow the Good in business and life, BMO is committed to driving positive change in the world, and making progress for a thriving economy, sustainable future, and inclusive society.

SOURCE BMO Financial Group

Für dich aus unserer Redaktion zusammengestellt

Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte.