Date: 07.16.07

Time: 08:53pm

Dow Index Covers Up Weak ActionGreeting Shark Investors:

Although a mere handful of mega-cap stocks were able to lift the Dow to within a few points of the 14,000 mark,

the broader market suffered a bout of profit-taking during Monday’s trading session on breadth that saw a little more than two decliners for every advancer. Still, after the strong run at the end of last week, it should come as no surprise that investors used a day with few catalysts to book some of their recent gains, but despite the weakness, there continued to be

pockets of strong momentum in a few select stocks.

How you view this action and how you deal with it depend greatly on your perspective. Although it would be a mistake to read too much into the declines and the selling would have to get much worse before we saw any technical damage, those who have a greater degree of exposure to some of the more thinly traded stocks likely suffered a bit more during the day’s session while those who have exposure to some of the mega-caps probably fared better. Meanwhile, those who have longer-term perspectives will be sitting tight with an eye towards cutting positions that are overtly lagging while those with shorter time-frames will be more aggressive in their ranges.

We mentioned over the weekend that even though last week’s strength has set up ideal conditions for a “sell-the-news” type reaction to earnings, this continues to be a momentum driven market and the bulls have made it painfully clear to the bears that they will use just about any passable excuse to do some buying. We need to remember that there is still a large supply of would-be buyers out there who have been loathe to chase straight up moves and have been waiting for pullbacks into which they can deploy their capital. Unfortunately for them, those chances have been few and far between which in turn is why we see buyers jump on even the most minor of dips.

All of these factors have set up some interesting and potentially dangerous conditions for both the bulls and the bears as the flood of earnings reports begin to cross the wires Tuesday morning before the bell. Will earnings be strong enough to entice more buying, or will merely in-line reports make it tempting for investors to continue to lock in some profits? Only time will tell, but we do know that prudent investors will maintain their flexibility and be ready to adapt as conditions change.

[strategische Kommaauslassung]

Let’s go to the charts.

The Nasdaq moved lower during Monday's session on light volume. We opened lower, but even though there was some buying mid-morning, selling pressures kicked in mid-afternoon. Technology was mixed with IBM leading the way. We raised some cash today, and cut some laggards. Still, the Nasdaq remains extended and we would like to see some consolidation of recent gains.

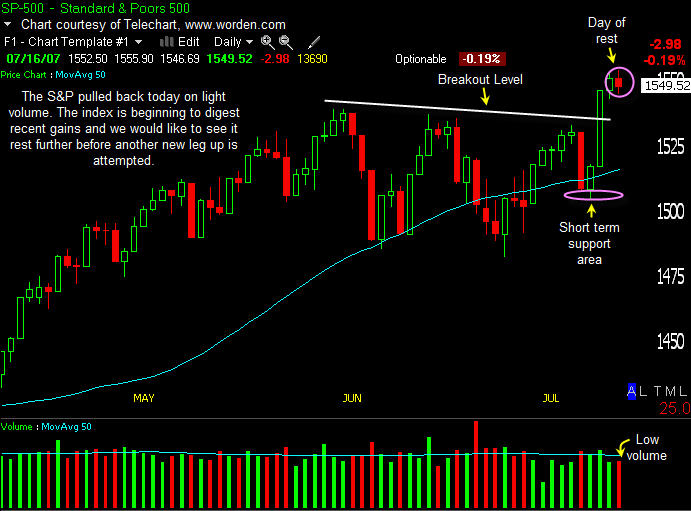

The S&P 500 edged lower during Monday's trade on lower volume. We got off to a quiet start, but the bulls quickly got to work after the open. We did see some selling pressure kick in the middle of the day, but the bears were unable to gain much traction. The index closed off lows, and is beginning to consolidate recent gains. We are remaining patient at these levels.

The Russell 2000 finished the session lower, and continues to struggle to take out resistance levels. Small caps were weak overall today, with some select pockets of strength. We continue to stick with the more short-term trades, and would like to see the index break out before getting more aggressive with new buys.

(Verkleinert auf 81%)

#080">0.50 #080">(0.01%)

#080">0.50 #080">(0.01%) 3.21 (0.23%)

3.21 (0.23%)