'...Most mainstream economists believe in a "natural rate of interest" at which markets clear and the economy reaches equilibrium.

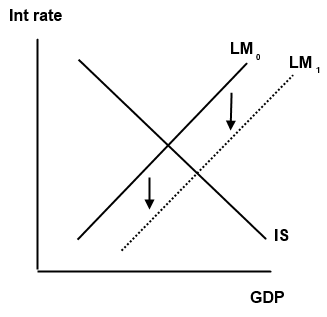

This view is often displayed through the use of crude and unrealistic models such as the IS/LM model. The LM curve of the IS/LM model assumes that exogenous injections of base money should normally reduce interest rates and boost demand (or vice versa). This is generally presented like this: (s.u.)

Under this view, once interest rates fall to zero they reach what"s referred to as the "zero lower bound" where nominal rates can go no lower. If there is a strong preference to hold any extra money that is injected into the system then this doesn"t result in higher inflation (because banks won"t "lend it out"). Therefore, the addition of more base money loses its power to drive growth higher. And most mainstream economists will argue that this is a sign that the "natural rate of interest" is actually negative. Therefore, the economy won"t reach equilibrium, prices won"t clear, inflation will remain low and unemployment will remain high. For years now, we"ve seen economists using some variation of this description to argue for altering expectations (to reduce real interest rates), implementing negative nominal interest rates (to entice currency holders to spend or lend their balances) or to implement other policies...'

Read more at pragcap.com/...genous-money-debate-matters#mEVmLgvvWfkS6IfL.99

'Being a contrarian is tough, lonely and generally right'

auch wenn mir das mögliche Potential unklar ist. An die von einigen beschworene Zeitenwende glauben weder ich noch der Markt, zumal es dafür an fundamentalen Grund fehlt. Ob die relative Schwäche russ Aktien bzw der Währung wirklich kausal an der Ukraine oder den angedrohten Sanktionen hängt halte ich übrigens nicht für ausgemacht..

auch wenn mir das mögliche Potential unklar ist. An die von einigen beschworene Zeitenwende glauben weder ich noch der Markt, zumal es dafür an fundamentalen Grund fehlt. Ob die relative Schwäche russ Aktien bzw der Währung wirklich kausal an der Ukraine oder den angedrohten Sanktionen hängt halte ich übrigens nicht für ausgemacht..