Annual Survey of Bank and Credit Union Executives Reveals Top Priorities, Concerns

Operational efficiency, growth, and fraud take center stage amid economic uncertainty

MONETT, Mo., May 1, 2025 /PRNewswire/ -- Banks and credit unions are prioritizing operational efficiency while focusing on growing deposits and loans, according to Jack Henry's seventh annual Strategy Benchmark.

The survey of 149 C-level executives at financial institutions using Jack Henry™ products and services highlights the critical issues and opportunities facing the industry.

"As growing non-interest expense and loan-loss provisions put downward pressure on net income in 2024, community banks and credit unions entered 2025 with growing urgency around efficiency," said Lee Wetherington, Senior Director of Jack Henry Corporate Strategy. "Given data is key to both efficiency and growth, leading institutions must strategically leverage data they have — and aggressively aggregate data they don't have — to drive more with less and create new value where it matters most."

Most of the banks and credit unions surveyed (76%) plan to increase their investments in technology over the next two years, with a third of respondents projecting a 6% to 10% increase in tech spend.

"Financial institutions are favoring technology solutions that can help them affordably and effectively enhance digital services, combat fraud, and automate their back office," said Jennifer Geis, Senior Analyst of Jack Henry Corporate Strategy.

Key Findings from the 2025 Strategy Benchmark:

- Top Priorities

- Banks: Growing deposits, increasing operational efficiency, and growing loans are top strategic priorities for banks.

- Credit Unions: Increasing operational efficiency, growing loans, and acquiring accountholders are highest on the list for credit unions.

- Leading Concerns

- Banks: Net interest margin compression, fraud losses, and acquiring/retaining talent are the biggest concerns for banks.

- Credit Unions: Fraud losses, acquiring younger accountholders, and cyberattacks are most concerning to credit unions.

- Technology Investments

- Digital Banking and Cybersecurity: Both banks and credit unions plan to invest in digital banking, fraud prevention, and automation to enhance the user experience and guard against rising cyber threats like phishing attacks, ransomware, and other malware.

- Artificial Intelligence (AI): Credit unions continue to invest heavily in AI, while banks' investments in AI increased significantly over last year.

- Small Businesses

- 80% of banks and credit unions plan to expand services for small businesses over the next two years, up from 78% in 2024 and 65% in 2023.

- Top planned services: payments, digital service tools, and credit/lending.

- Payments

- 89% of financial institutions plan to add new payment services over the next two years, with FedNow® being the top priority for both banks and credit unions.

- Digital card issuance, same-day ACH, and contactless cards round out the top payment priorities.

The study's results are based on an online survey conducted in January and February 2025 of a diverse sample of Jack Henry clients with assets ranging from less than $500 million to more than $5 billion. Download the eBook to learn more.

About Jack Henry & Associates, Inc.®

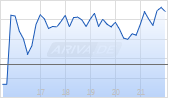

Jack Henry™ (Nasdaq: JKHY) is a well-rounded financial technology company that strengthens connections between financial institutions and the people and businesses they serve. We are an S&P 500 company that prioritizes openness, collaboration, and user centricity – offering banks and credit unions a vibrant ecosystem of internally developed modern capabilities as well as the ability to integrate with leading fintechs. For more than 48 years, Jack Henry has provided technology solutions to enable clients to innovate faster, strategically differentiate, and successfully compete while serving the evolving needs of their accountholders. We empower approximately 7,500 clients with people-inspired innovation, personal service, and insight-driven solutions that help reduce the barriers to financial health. Additional information is available at www.jackhenry.com.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/annual-survey-of-bank-and-credit-union-executives-reveals-top-priorities-concerns-302443941.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/annual-survey-of-bank-and-credit-union-executives-reveals-top-priorities-concerns-302443941.html

SOURCE Jack Henry & Associates, Inc.

Für dich aus unserer Redaktion zusammengestellt

Dein Kommentar zum Artikel im Forum

Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte.