Freedom Financial Holdings Announces Earnings for First Quarter of 2025

FAIRFAX, Va., April 29, 2025 /PRNewswire/ -- Freedom Financial Holdings (OTCQX: FDVA), (the "Company" or "Freedom"), the holding company for The Freedom Bank of Virginia (the "Bank") today announced net income of $2,019,348 or $0.28 per diluted share for the first quarter compared to net income of $1,156,906, or $0.16 per diluted share for the three months ended December 31, 2024, and net income of $1,164,226 or $0.16 per diluted share for the three months ended March 31, 2024.

Joseph J. Thomas, President, and CEO, commented, "We are pleased to start off 2025 with strong results with net income increasing 73.4% over the comparable quarter in 2024 sustaining the momentum we gained in the second half of last year. We continue to see improvement in our cost of funds dropping 23 basis points in the first quarter enabling net interest margin expansion of 59 basis points to 3.03%. Despite the challenging economic environment, we continue to see improvement in the credit quality of our loan portfolio with non-accrual loans down 22% to $10.7 million. Our entire team is working hard to grow local, core deposits and we experienced a 26% annualized increase in non-interest deposits in the quarter. With our organic core deposit growth, cash flow from investments, and loan pre-payments, we are driving improved financial performance and franchise profile."

First Quarter 2025 Highlights include:

- The Company posted net income of $2,019,348 or $0.28 per diluted share for the first quarter compared to net income of $1,156,906 or $0.16 per diluted share for the three months ended December 31, 2024, and net income of $1,164,226 or $0.16 per diluted share for the three months ending March 31, 2024.

- Tangible Book Value per share increased during the quarter to $11.87 on March 31, 2025, compared to $11.39 on December 31, 2024.

- Return on Average Assets ("ROAA") was 0.76% for the quarter ended March 31, 2025, compared to ROAA of 0.41% for the quarter ended December 31, 2024, and 0.43% for the three months ended March 31, 2024.

- Return on Average Equity ("ROAE") was 9.95% for the quarter ended March 31, 2025, compared to ROAE of 5.58% for the three months ended December 31, 2024, and 6.05% for the three months ended March 31, 2024.

- Total Assets were $1.08 billion on March 31, 2025, a decrease of $8.3 million or 0.77% from total assets on December 31, 2024.

- Loans held-for-investment (excluding PPP loans) decreased by $15.1 million or 1.96% during the quarter.

- Total deposits increased by $1.34 million or by 0.15% during the quarter. Non-interest-bearing demand deposits increased by $8.83 million during the quarter to $142.5 million and represented 15.64% of total deposits on March 31, 2025.

- The net interest margin1 increased in the first quarter to 3.03%, higher by 59 basis points compared to the linked quarter and higher by 49 basis points compared to the same period in 2024. The increase in the net interest margin across linked quarters was a result of lower funding costs and recognition of previously uncollected interest from problem loan resolutions, with such interest contributing 41 basis points to the net interest margin.

- The cost of funds was 3.23% for the first quarter, lower by 23 basis points compared to the linked quarter and lower by 37 basis points compared to the same period in 2024, as a result of a decline in deposit costs and borrowing costs.

- Non-interest income decreased by 23% compared to the linked quarter and decreased by 16.70% compared to the same period in 2024. The decrease in non-interest income in the first quarter of 2025 was primarily due to lower revenue from the gain on sale of SBA loans and bank service charges and fees.

- Non-interest expense decreased by $447,994 in the first quarter or by 6.93% compared to the linked quarter and decreased by 3.3% compared to the same period in 2024. The decrease in expenses compared to the linked quarter was largely due to a reduction in non-recurring expenses in prior periods primarily related to software costs for the new online banking platform, consulting fees related to FDICIA, and legal fees related to loan workouts. Excluding these non-recurring costs, non-interest expenses would have been flat to the prior quarter.

- The Efficiency Ratio2 was 69.22% for the quarter ended March 31, 2025, compared to 84.07% for the linked quarter and 80.64% for the same period in 2024.

- Uninsured deposits were 22.50% of total deposits and total liquidity to uninsured deposits3 was 122.33% of uninsured deposits on March 31, 2025.

- Net charge offs were 0.03% of average loans compared to 0.26% in the prior quarter. The ratio of non-accrual loans to loans held-for-investment was 1.45% on March 31, 2025, compared to 1.78% on December 31, 2024, and 1.74% on March 31, 2024. The ratio of non-performing assets to total assets was 1.01% on March 31, 2025, compared to 1.25% on December 31, 2024, and 1.21% on March 31, 2024.

- The Company recognized a provision for loan losses of $284,683, primarily related to specific reserves for one loan relationship.

- The ratio of the allowance for loan losses to loans held-for-investment was 0.88% compared to 0.85% in the linked quarter.

- The Company continues to be well capitalized and capital ratios continue to be strong with a Leverage ratio of 10.76%, Common Equity Tier 1 ratio of 14.14%, Tier 1 Risk Based Capital ratio of 14.14% and a Total Capital ratio of 14.95% as of March 31, 2025.

Net Interest Income

The Company recorded net interest income of $7.72 million for the first quarter of 2025, higher by 20.17% compared to the linked quarter, and lower by 17.91% compared to the same period in 2024. The net interest margin in the first quarter of 2025 was 3.03%, higher by 59 basis points compared to the linked quarter and higher by 49 basis points compared to the same period in 2024.

The following factors contributed to the changes in net interest margin during the first quarter of 2025 compared to the linked and calendar quarters.

- Yields on average earning assets were 6.11% in the first quarter of 2025, higher by 35 basis points compared to the linked quarter, and higher by 12 basis points compared to the prior year calendar quarter. The increase in yields on average earning assets in the first quarter was primarily due to recognition of uncollected interest from problem loan resolutions.

- Loan yields increased by 59 basis points to 6.74% from 6.15% in the linked quarter, while yields on investment securities decreased by 14 basis points to 4.55% from 4.69% in the linked quarter. Loan yields increased by 35 basis points, while yields on investment securities decreased by 33 basis points compared to the calendar quarter.

- Cost of funds decreased by 23 basis points to 3.23% from 3.46% in the linked quarter, and by 37 basis points compared to the prior year quarter, due to lower deposit costs.

Non-interest Income

Non-interest income was $1 million for the first quarter, a decrease of 23% when compared to the linked quarter and an increase of 16.70% when compared to the same period in 2024. The decrease in non-interest income in the first quarter of 2025 compared to the linked quarter was due to lower revenue from the gain on sale of SBA loans and bank service charges and fees.

Total Revenue4

Total revenue, defined as the sum of net interest income, before provision for loan losses, and non-interest income, was higher by 13.04% compared to the linked quarter and higher by 12.65% compared to the calendar quarter in 2024. The increase in total revenue compared to the linked quarter was due to an increase in the net interest margin.

Non-interest Expense

Non-interest expense in the first quarter decreased by $447,995 or by 6.93% compared to the linked quarter and decreased by 3.30% compared to the same period in 2024. The increase in expenses compared to the linked quarter was largely non-recurring and primarily related to personnel costs, an increase in software costs for the new online banking platform, consulting fees related to FDICIA compliance, and legal fees related to loan workouts. Excluding these non-recurring costs, non-interest expenses would have been flat to the prior quarter. The increase in expenses compared to the calendar quarter primarily related to higher compensation costs, higher occupancy costs and higher professional fees, largely related to legal fees and accounting fees related to FDICIA.

The Efficiency Ratio was 69.22% for the quarter ended March 31, 2025, compared to 84.07% for the linked quarter and 80.64% for the same period in 2024.

Asset Quality

Non-accrual loans decreased in the first quarter and were 1.45% of loans held-for-investment compared to 1.78% of loans held-for-investment at the end of the linked quarter. Total non-performing assets (defined as the sum of loans on non-accrual, loans greater than 90 days past due and accruing, and OREO assets) were 1.01% of total assets as of March 31, 2025, compared to 1.25% of total assets, at the end of the linked quarter.

The Company recognized a provision for loan losses of $284,683, primarily related to specific reserves for one loan relationship.

The Company's ratio of Allowance for Loan Losses to loans held-for-investment was 0.88% as of March 31, 2025, compared to the ratio of Allowance for Loan Losses to loans held-for-investment of 0.85% as of December 31, 2024.

Total Assets

Total assets on March 31, 2025, were $1.08 billion compared to total assets of $1.09 billion on December 31, 2024. Changes in major asset categories since December 31, 2024, were as follows:

- Interest bearing deposits at banks decreased by $16.0 million.

- Available for sale investment balances decreased by $5.88 million.

- Other loans held-for investment decreased by $15.07 million

Total Liabilities

Total liabilities on March 31, 2025, were $1.00 billion compared to total liabilities of $1.01 billion on December 31, 2024. Total deposits were $910.87 million on March 31, 2025, compared to total deposits of $909.53 million on December 31, 2024. Non-interest-bearing demand deposits increased by $8.83 million during the first quarter and comprised 15.64% of total deposits at the end of the first quarter. Other interest-bearing demand deposits decreased by $3.28 million and time deposits decreased by $8.38 million during the quarter. Federal Home Loan Bank borrowings decreased during the quarter by $10.0 million.

Stockholders' Equity and Capital

Stockholders' equity as of March 31, 2025, was $81.11 million compared to $81.44 million on December 31, 2024. AOCI improved during the first quarter as there was a decrease in unrealized losses on available-for-sale securities. The tangible book value of the Company's common stock on March 31, 2025, was $11.87 per share compared to $11.39 on December 31, 2024. Excluding AOCI losses/gains5, the tangible book value of the Company's common stock on March 31, 2025, was $14.26 per share compared to $13.94 on December 31, 2024.

Stock Buyback Program

In the first quarter, the Company purchased 177,692 shares pursuant to its previously announced share repurchase program. As of March 31, 2025, the Company had repurchased 214,400 of the 250,000 shares authorized for repurchase under the program. Our Board of Directors continues to believe that the share buyback program represents a disciplined capital management strategy for the Company.

Capital Ratios

As of March 31, 2025, the Bank's capital ratios were well above regulatory minimum capital ratios for well-capitalized bank holding companies. The Bank's capital ratios as of March 31, 2025, and December 31, 2024, were as follows:

| | March 31, 2025 | December 31, 2024 |

| | | |

| Total Capital Ratio | 14.95 % | 14.35 % |

| | | |

| Tier 1 Capital Ratio | 14.14 % | 13.57 % |

| | | |

| Common Equity Tier 1 Capital Ratio | 14.14 % | 13.57 % |

| | | |

| Leverage Ratio | 10.76 % | 10.39 % |

About Freedom Financial Holdings, Inc.

Freedom Financial Holdings, Inc. is the holding company of The Freedom Bank of Virginia, a community bank with locations in Fairfax, Reston, Chantilly, Vienna, and Manassas, Virginia. For information about deposits, loans and other services, visit the website at www.freedom.bank.

Forward Looking Statements

This release contains forward-looking statements, including our expectations with respect to future events that are subject to various risks and uncertainties. Factors that could cause actual results to differ materially from management's projections, forecasts, estimates, and expectations include: fluctuation in market rates of interest and loan and deposit pricing; general economic and financial market conditions, in the United States generally and particularly in the markets in which the Company operates and in which its loans are concentrated, including the effects of declines in real estate values, increases in unemployment levels, inflation, recessions and slowdowns in economic growth, including as a result of COVID-19 and the impact of geopolitical conflicts, such as the war between Russia and Ukraine; adverse developments in the financial services industry such as the recent bank failures; maintenance and development of well-established and valued client relationships and referral source relationships; the adequacy or inadequacy of our allowance for loan and lease losses; acquisition or loss of key production personnel; and the potential adverse effects of unusual and infrequently occurring events, such as weather-related disasters, wars, terrorist acts or public health events, and of governmental and societal responses thereto; these potential adverse effects may include, without limitation, adverse effects on the ability of the Company's borrowers to satisfy their obligations to the Company, on the value of collateral securing loans, on the demand for the Company's loans or its other products and services, on incidents of cyberattack and fraud, on the Company's liquidity or capital positions, on risks posed by reliance on third-party service providers, on other aspects of the Company's business operations and on financial markets and economic growth. The Company cautions readers that the list of factors above is not exclusive. The forward-looking statements are made as of the date of this release, and the Company may not undertake steps to update the forward-looking statements to reflect the impact of any circumstances or events that arise after the date the forward-looking statements are made. In addition, our past results of operations are not necessarily indicative of future performance.

Contact:

Joseph J. Thomas

President & Chief Executive Officer

703-667-4161: Phone

jthomas@freedom.bank: Email

| | FREEDOM FINANCIAL HOLDINGS | ||

| | CONSOLIDATED BALANCE SHEETS | ||

| | | | |

| | (Unaudited) | | (Audited) |

| | March 31, | | December 31, |

| | 2025 | | 2024 |

| ASSETS | | | |

| Cash and Due from Banks | $ 6,456,093 | | $ 5,685,008 |

| Interest Bearing Deposits with Banks | 39,016,262 | | 23,004,874 |

| Securities Available-for-Sale | 203,807,955 | | 209,687,859 |

| Securities Held-to-Maturity | 19,852,060 | | 20,315,651 |

| Restricted Stock Investments | 5,777,800 | | 6,249,000 |

| Loans Held for Sale | 5,487,972 | | 5,963,969 |

| PPP Loans Held for Investment | 137,066 | | 159,825 |

| Other Loans Held for Investment | 752,664,602 | | 767,737,719 |

| Allowance for Credit Losses | (6,592,220) | | (6,534,757) |

| Net Loans | 751,697,420 | | 761,362,787 |

| Bank Premises and Equipment, net | 742,588 | | 767,773 |

| Accrued Interest Receivable | 3,991,413 | | 4,155,077 |

| Deferred Tax Asset | 7,230,083 | | 7,560,441 |

| Bank-Owned Life Insurance | 27,781,480 | | 27,560,616 |

| Right of Use Asset, net | 3,361,641 | | 1,874,403 |

| Other Assets | 12,428,097 | | 16,299,753 |

| Total Assets | $ 1,082,142,892 | | $ 1,090,487,211 |

| LIABILITIES AND STOCKHOLDERS' EQUITY | | | |

| Deposits | | | |

| Demand Deposits | | | |

| Non-interest Bearing | $ 142,497,191 | | $ 133,665,194 |

| Interest Bearing | 472,115,491 | | 475,397,117 |

| Savings Deposits | 8,034,522 | | 3,866,241 |

| Time Deposits | 288,222,304 | | 296,603,142 |

| Total Deposits | 910,869,508 | | 909,531,694 |

| Federal Home Loan Bank Advances | 55,000,000 | | 65,000,000 |

| Other Borrowings | 146,377 | | 159,825 |

| Subordinated Debt (Net of Issuance Costs) | 19,870,125 | | 19,850,643 |

| Accrued Interest Payable | $ 1,846,477 | | 2,445,741 |

| Lease Liability | 1,855,161 | | 2,013,912 |

| Other Liabilities | 9,420,497 | | 10,045,990 |

| Total Liabilities | $ 999,008,145 | | $ 1,009,047,805 |

| Stockholders' Equity | | | |

| Preferred stock, $0.01 par value, 5,000,000 shares authorized: | | | |

| 0 Shares Issued and Outstanding, March 31, 2025 and December 31, 2024 | | | |

| Common Stock, $0.01 Par Value, 25,000,000 Shares: | | | |

| 23,000,000 Shares Voting and 2,000,000 Shares Non-voting. | | | |

| Voting Common Stock: | | | |

| 7,002,103 and 7,268,087 Shares Issued and Outstanding at March 31, 2025 and December 31, 2024 respectively (Includes 135,343 and 118,032 Unvested Shares | 70,021 | | 71,501 |

| Non-Voting Common Stock: 0 Shares Issued and Outstanding at respectively) |

- | |

- |

| Additional Paid-in Capital | 56,532,591 | | 58,347,356 |

| Accumulated Other Comprehensive Income, Net | (16,748,443) | | (18,240,683) |

| Retained Earnings | 43,280,578 | | 41,261,232 |

| Total Stockholders' Equity | 83,134,747 | | 81,439,406 |

| Total Liabilities and Stockholders' Equity | $ 1,082,142,892 | | $ 1,090,487,211 |

| | FREEDOM FINANCIAL HOLDINGS | ||||

| | CONSOLIDATED STATEMENTS OF OPERATIONS | ||||

| | | | | | |

| | (Unaudited) | | (Unaudited) | | |

| | For the three | | For the three | | |

| | months ended | | months ended | | |

| | March 31, 2025 | | March 31, 2024 | | |

| Interest Income | | | | | |

| Interest and Fees on Loans | $ 12,703,493 | | $ 12,283,239 | | |

| Interest on Investment Securities | 2,613,258 | | 2,871,479 | | |

| Interest on Deposits with Other Banks | 262,507 | | 328,257 | | |

| Total Interest Income | 15,579,258 | | 15,482,975 | | |

| Interest Expense | | | | | |

| Interest on Deposits | 6,946,194 | | 8,023,891 | | |

| Interest on Borrowings | 913,154 | | 911,927 | | |

| Total Interest Expense | 7,859,348 | | 8,935,817 | | |

| | | | | | |

| Net Interest Income | 7,719,910 | | 6,547,158 | | |

| Provision for Credit Losses | (284,683) | | 27,486 | | |

| Net Interest Income after | | | | | |

| Provision for Credit Losses | 7,435,227 | | 6,574,644 | | |

| Non-Interest Income | | | | | |

| Mortgage Loan Gain-on-Sale and Fee Revenue | 654,530 | | 536,724 | | |

| SBA Gain-on-Sale Revenue | - | | 287,032 | | |

| Service Charges and Other Income | 70,334 | | 117,361 | | |

| Gain on Sale of Securities | - | | - | | |

| Servicing Income | 32,442 | | 35,253 | | |

| Swap Fee Income | - | | - | | |

| Increase in Cash Surrender Value of Bank- | | | | | |

| owned Life Insurance | 220,864 | | 197,963 | | |

| Total Non-interest Income | 978,170 | | 1,174,333 | | |

| | | | | | |

| Total Revenue6 | 8,698,080 | | 7,721,491 | | |

| | | | | | |

| Non-Interest Expenses | | | | | |

| Officer and Employee Compensation | | | | | |

| and Benefits | 3,769,535 | | 3,735,139 | | |

| Occupancy Expense | 242,163 | | 391,876 | | |

| Equipment and Depreciation Expense | 8,726 | | 20,661 | | |

| Insurance Expense | 225,766 | | 224,007 | | |

| Professional Fees | 470,310 | | 526,574 | | |

| Data and Item Processing | 538,213 | | 435,967 | | |

| Advertising | 83,115 | | 114,999 | | |

| Franchise Taxes and State Assessment Fees | 314,214 | | 309,869 | | |

| Mortgage Fees and Settlements | 87,258 | | 95,001 | | |

| Other Operating Expense | 281,611 | | 372,233 | | |

| Total Non-interest Expenses | 6,020,911 | | 6,226,326 | | |

| Income Before Income Taxes | 2,392,486 | | 1,522,651 | | |

| Income Tax Expense/(Benefit) | 373,138 | | 358,425 | | |

| Net Income | $ 2,019,348 | | $ 1,164,226 | | |

| Earnings per Common Share - Basic | $ 0.28 | | $ 0.16 | | |

| Earnings per Common Share - Diluted | $ 0.28 | | $ 0.16 | | |

| Weighted-Average Common Shares | | | | | |

| Outstanding - Basic | 7,283,696 | | 7,285,108 | | |

| Weighted-Average Common Shares | | | | | |

| Outstanding - Diluted | 7,285,900 | | 7,325,415 | | |

| | | | | | |

| | | | | | |

| Efficiency Ratio | 69.22 % | | 80.64 % | | |

| FREEDOM FINANCIAL HOLDINGS | |||||||||

| CONSOLIDATED STATEMENTS OF OPERATIONS | |||||||||

| | | | | | | | | | |

| | (Unaudited) | | (Unaudited) | | (Unaudited) | | (Unaudited) | | (Unaudited) |

| | For the three | | For the three | | For the three | | For the three | | For the three |

| | months ended | | months ended | | months ended | | months ended | | months ended |

| | March 31, 2025 | | December 31, 2024 | | September 30, 2024 | | June 30, 2024 | | March 31, 2024 |

| Interest Income | | | | | | | | | |

| Interest and Fees on Loans | $ 12,703,493 | | $ 11,991,578 | | $ 12,358,391 | | $ 11,893,288 | | $ 12,283,239 |

| Interest on Investment Securities | 2,613,258 | | 2,798,420 | | 2,932,219 | | 2,927,306 | | 2,871,479 |

| Interest on Deposits with Other Banks | 262,507 | | 446,184 | | 390,373 | | 375,815 | | 328,257 |

| Total Interest Income | 15,579,258 | | 15,236,182 | | 15,680,983 | | 15,196,409 | | 15,482,975 |

| | | | | | | | | | |

| Interest Expense | | | | | | | | | |

| Interest on Deposits | 6,946,194 | | 7,628,382 | | 7,968,925 | | 7,865,934 | | 8,023,891 |

| Interest on Borrowings | 913,154 | | 1,183,419 | | 1,613,452 | | 1,142,481 | | 911,926 |

| Total Interest Expense | 7,859,348 | | 8,811,801 | | 9,582,377 | | 9,008,415 | | 8,935,817 |

| | | | | | | | | | |

| Net Interest Income | 7,719,910 | | 6,424,381 | | 6,098,606 | | 6,187,994 | | 6,547,158 |

| Provision for Credit Losses | (284,683) | | (14,922) | | 546,439 | | (1,167,997) | | (27,486) |

| Net Interest Income after | | | | | | | | | |

| Provision/Recovery for Credit Losses | 7,435,227 | | 6,439,303 | | 5,552,167 | | 7,355,991 | | 6,574,644 |

| Non-Interest Income | | | | | | | | | |

| Mortgage Loan Gain-on-Sale and Fee Revenue | 654,530 | | 769,060 | | 649,097 | | 745,366 | | 536,724 |

| SBA Gain-on-Sale Revenue | - | | - | | - | | - | | 287,032 |

| Service Charges and Other Income | 70,334 | | 252,275 | | 255,889 | | 221,022 | | 117,361 |

| Gains on Sale of Securities | - | | - | | - | | 1,816 | | - |

| Servicing Income | 32,442 | | 36,090 | | 36,752 | | 42,268 | | 35,253 |

| Swap Fee Income | - | | - | | - | | - | | - |

| Increase in Cash Surrender Value of Bank- | | | | | | | | | |

| owned Life Insurance | 220,864 | | 212,876 | | 211,642 | | 206,796 | | 197,963 |

| Total Non-interest Income | 978,170 | | 1,270,301 | | 1,153,380 | | 1,217,268 | | 1,174,333 |

| | | | | | | | | | |

| | | | | | | | | | |

| Total Revenue5 | $ 8,698,080 | | $ 7,694,682 | | $ 7,251,986 | | $ 7,405,262 | | $ 7,721,491 |

| | | | | | | | | | |

| Non-Interest Expenses | | | | | | | | | |

| Officer and Employee Compensation | | | | | | | | | |

| and Benefits | 3,769,535 | | 3,905,728 | | 3,674,499 | | 3,544,148 | | 3,735,139 |

| Occupancy Expense | 242,163 | | 233,967 | | 233,807 | | 255,233 | | 391,876 |

| Equipment and Depreciation Expense | 8,726 | | 20,951 | | 285,083 | | 185,959 | | 20,661 |

| Insurance Expense | 225,766 | | 228,224 | | 232,774 | | 229,259 | | 224,007 |

| Professional Fees | 470,310 | | 451,065 | | 532,379 | | 568,765 | | 526,574 |

| Data and Item Processing | 538,213 | | 684,698 | | 433,431 | | 395,579 | | 435,967 |

| Advertising | 83,115 | | 90,368 | | 172,136 | | 162,354 | | 114,999 |

| Franchise Taxes and State Assessment Fees | 314,214 | | 316,976 | | 329,056 | | 276,843 | | 309,869 |

| Mortgage Fees and Settlements | 87,258 | | 119,037 | | 123,853 | | 83,617 | | 95,001 |

| Other Operating Expense | 281,611 | | 417,893 | | 374,273 | | 349,979 | | 372,233 |

| | | | | | | | | | |

| Total Non-interest Expenses | 6,020,911 | | 6,468,907 | | 6,391,291 | | 6,051,736 | | 6,226,326 |

| Income before Income Taxes | 2,392,486 | | 1,240,697 | | 314,256 | | 2,521,526 | | 1,522,651 |

| | | | | | | | | | |

| Income Tax Expense | 373,138 | | 83,793 | | (30,663) | | 477,293 | | 358,425 |

| | | | | | | | | | |

| Net Income | $ 2,019,348 | | $ 1,156,904 | | $ 344,919 | | $ 2,044,233 | | $ 1,164,226 |

| Earnings per Common Share - Basic | $ 0.28 | | $ 0.16 | | $ 0.05 | | $ 0.28 | | $ 0.16 |

| Earnings per Common Share - Diluted | $ 0.28 | | $ 0.16 | | $ 0.05 | | $ 0.28 | | $ 0.16 |

| Weighted-Average Common Shares | | | | | | | | | |

| Outstanding - Basic | 7,283,696 | | 7,268,087 | | 7,263,880 | | 7,267,044 | | 7,285,108 |

| Weighted-Average Common Shares | | | | | | | | | |

| Outstanding - Diluted | 7,285,900 | | 7,324,559 | | 7,299,553 | | 7,305,392 | | 7,325,415 |

| Average Balances, Income and Expenses, Yields and Rates | | | | | | | | | | | | | | | | | | | | | | | | | | | | ||

| (Unaudited) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | | | Three Months Ended | | | | | | | | Three Months Ended | | | | | | Three Months Ended | | | | | | Three Months Ended | | | | |

| | March 31, 2025 | | | | December 31, 2024 | | | | | | | | September 30, 2024 | | | | | | June 30, 2024 | | | | | | March 31, 2024 | | | | |

| | Average Balance | Income/ | Yield | | Average Balance | | Income/ | | Yield | | | | Average Balance | | Income/ | | Yield | | Average Balance | | Income/ | | Yield | | Average Balance | | Income/ | | Yield |

| Assets | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Cash | $36,901,243 | $262,507 | 2.89 % | | $ 39,134,308 | | $ 446,184 | | 4.54 % | | | | $ 29,674,932 | | $ 390,373 | | 5.23 % | | $ 26,916,165 | | $ 375,815 | | 5.62 % | | $ 28,655,861 | | $ 328,257 | | 4.61 % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Investments (Tax Exempt) | $9,803,235 | $188,489 | 7.80 % | | 20,664,409 | | 201,561 | | | | | | 20,716,896 | | 203,062 | | | | 20,889,466 | | 204,795 | | | | 21,297,872 | | 204,625 | | |

| Investments (Taxable) | $223,040,366 | $2,424,769 | 4.41 % | | 220,415,008 | | 2,639,187 | | | | | | 223,526,525 | | 2,771,800 | | | | 222,105,603 | | 2,765,518 | | | | 219,134,075 | | 2,709,825 | | |

| Total Investments | $232,843,601 | $2,613,258 | 4.55 % | | 241,079,417 | | 2,840,748 | | 4.69 % | | | | 244,243,421 | | 2,974,862 | | 4.85 % | | 242,995,069 | | 2,970,313 | | 4.92 % | | 240,431,947 | | 2,914,450 | | 4.88 % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Total Loans | $764,147,542 | $12,703,493 | 6.74 % | | 775,756,877 | | 11,991,578 | | 6.15 % | | | | 780,143,594 | | 12,358,391 | | 6.30 % | | 768,712,204 | | 11,893,288 | | 6.22 % | | 773,171,917 | | 12,283,239 | | 6.39 % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Earning Assets | $1,033,892,386 | $15,579,258 | 6.11 % | | 1,055,970,602 | | 15,278,510 | | 5.76 % | | | | 1,054,061,947 | | 15,723,626 | | 5.93 % | | 1,038,623,438 | | 15,239,416 | | 5.90 % | | 1,042,259,725 | | 15,525,946 | | 5.99 % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Assets | $1,083,851,440 | | | | $ 1,110,466,582 | | | | | | | | $ 1,111,788,038 | | | | | | $ 1,096,367,899 | | | | | | $ 1,093,119,403 | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Liabilities | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Interest Checking | $211,572,944 | $929,609 | 1.78 % | | $ 209,540,976 | | $ 2,092,017 | | 3.97 % | | | | $ 204,529,638 | | $ 2,268,166 | | 4.41 % | | $ 226,698,645 | | $ 2,476,138 | | 4.39 % | | $ 229,520,401 | | $ 2,515,315 | | 4.41 % |

| Money Market | $259,289,920 | $1,924,822 | 3.01 % | | 257,016,702 | | 2,412,389 | | 3.73 % | | | | 259,041,124 | | 2,686,977 | | 4.13 % | | 230,692,880 | | 2,480,219 | | 4.32 % | | 274,088,309 | | 2,930,085 | | 4.30 % |

| Savings | $4,398,923 | $1,178 | 0.11 % | | 3,151,116 | | 1,185 | | 0.15 % | | | | 3,098,470 | | 1,188 | | 0.15 % | | 2,544,712 | | 993 | | 0.16 % | | 3,416,245 | | 1,129 | | 0.13 % |

| Time Deposits | $294,336,342 | $4,090,584 | 5.64 % | | 291,606,111 | | 3,122,791 | | 4.26 % | | | | 286,346,982 | | 3,012,594 | | 4.19 % | | 287,465,021 | | 2,908,583 | | 4.07 % | | 261,965,440 | | 2,577,362 | | 3.96 % |

| Interest Bearing Deposits | $769,598,129 | $6,946,193 | 3.66 % | | 761,314,905 | | 7,628,382 | | 3.99 % | | | | 753,016,214 | | 7,968,925 | | 4.21 % | | 747,401,258 | | 7,865,933 | | 4.23 % | | 768,990,395 | | 8,023,891 | | 4.20 % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Borrowings | $78,341,429 | $913,154 | 4.73 % | | $ 98,205,747 | | $ 1,183,419 | | 4.79 % | | | | $ 118,452,626 | | $ 1,613,452 | | 5.42 % | | $ 108,848,304 | | $ 1,142,481 | | 4.22 % | | $ 84,021,016 | | $ 911,926 | | 4.37 % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Interest Bearing Liabilities | $847,939,558 | $7,859,347 | 3.76 % | | 859,520,652 | | 8,811,801 | | 4.08 % | | | | 871,468,840 | | 9,582,377 | | 4.37 % | | 856,249,562 | | 9,008,414 | | 4.23 % | | 853,011,411 | | 8,935,817 | | 4.21 % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Non Interest Bearing Deposits | $139,885,803 | | | | $ 153,895,858 | | | | | | | | $ 143,171,313 | | | | | | $ 146,541,629 | | | | | | $ 146,048,180 | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Cost of Funds | | | 3.23 % | | | | | | 3.46 % | | | | | | | | 3.76 % | | | | | | 3.61 % | | | | | | 3.60 % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

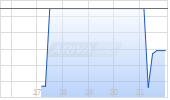

| Net Interest Margin | | $7,719,911 | 3.03 % | | | | $ 6,466,709 | | 2.44 % | | | | | | $ 6,141,249 | | 2.32 % | | | | $ 6,231,002 | | 2.41 % | | | | $ 6,590,129 | | 2.54 % |

| Shareholders Equity | $82,331,438 | | | | $ 82,536,219 | | | | | | | | $ 80,948,259 | | | | | | $ 76,737,805 | | | | | | $ 77,333,773 | | | | |

| Selected Financial Data by Quarter Ended: | | | | | |

| (Unaudited) | | | | | |

| Balance Sheet Ratios | March 31, 2025 | December 31, 2024 | September 30, 2024 | June 30, 2024 | March 31, 2024 |

| Loans held-for-investment to Deposits | 82.65 % | 84.43 % | 87.42 % | 88.20 % | 85.07 % |

| Income Statement Ratios (Quarterly) | | | | | |

| Return on Average Assets (ROAA) | 0.76 % | 0.41 % | 0.12 % | 0.75 % | 0.43 % |

| Return on Average Equity (ROAE) | 9.95 % | 5.58 % | 1.70 % | 10.71 % | 6.05 % |

| Efficiency Ratio | 69.22 % | 84.07 % | 88.13 % | 81.72 % | 80.64 % |

| Net Interest Margin | 3.03 % | 2.44 % | 2.32 % | 2.41 % | 2.54 % |

| Yield on Average Earning Assets | 6.11 % | 5.76 % | 5.93 % | 5.90 % | 5.99 % |

| Yield on Securities | 4.55 % | 4.69 % | 4.85 % | 4.92 % | 4.88 % |

| Yield on Loans | 6.74 % | 6.15 % | 6.30 % | 6.22 % | 6.39 % |

| Cost of Funds | 3.23 % | 3.46 % | 3.76 % | 3.61 % | 3.60 % |

| Noninterest income to Total Revenue | 11.25 % | 16.51 % | 15.90 % | 16.44 % | 15.21 % |

| Liquidity Ratios | | | | | |

| Uninsured Deposits to Total Deposits | 22.50 % | 21.55 % | 22.51 % | 22.76 % | 24.31 % |

| Total Liquidity to Uninsured Deposits | 122.33 % | 162.14 % | 150.84 % | 150.53 % | 156.40 % |

| Total Liquidity to Unfunded Commitments, CDs and Borrowings maturing in next 30 days | 292.23 % | 264.35 % | 264.41 % | 317.68 % | 386.89 % |

| Tangible Common Equity Ratio | 7.68 % | 7.47 % | 7.54 % | 7.24 % | 7.09 % |

| Tangible Common Equity Ratio (adjusted for unrealized losses on HTM securities) | 7.50 % | 7.27 % | 7.38 % | 7.01 % | 6.85 % |

| | | | | | |

| Available -for-Sale securities (as % of total securities) | 91.12 % | 91.16 % | 91.47 % | 91.33 % | 91.24 % |

| Per Share Data | | | | | |

| Tangible Book Value | $11.87 | $11.39 | $11.64 | $11.11 | $10.83 |

| Tangible Book Value (ex AOCI) | $14.26 | $13.94 | $13.78 | $13.70 | $13.39 |

| Share Price Data | | | | | |

| Closing Price | $9.90 | $10.32 | $11.50 | $9.75 | $9.75 |

| Book Value Multiple | 98 % | 91 % | 99 % | 88 % | 92 % |

| Common Stock Data | | | | | |

| Outstanding Shares at End of Period | 7,002,103 | 7,150,055 | 7,133,105 | 7,137,030 | 7,155,058 |

| Weighted Average shares outstanding, basic | 7,283,696 | 7,268,087 | 7,263,880 | 7,267,044 | 7,285,108 |

| Weighted Average shares outstanding, diluted | 7,285,900 | 7,324,559 | 7,299,553 | 7,305,392 | 7,325,415 |

| Capital Ratios (Bank Only) | | | | | |

| Tier 1 Leverage ratio | 10.76 % | 10.39 % | 10.23 % | 10.28 % | 10.26 % |

| Common Equity Tier 1 ratio | 14.14 % | 13.57 % | 13.21 % | 13.05 % | 12.92 % |

| Tier 1 Risk Based Capital ratio | 14.14 % | 13.57 % | 13.21 % | 13.05 % | 12.92 % |

| Total Risk Based Capital ratio | 14.95 % | 14.35 % | 14.22 % | 14.01 % Für dich aus unserer Redaktion zusammengestelltHinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte. Weitere Artikel des AutorsThemen im Trend |