Highland Global Allocation Fund (HGLB) Announces Addition to Portfolio Management Team, Provides Update on Recent NAV Increase

DALLAS, Oct. 7, 2025

DALLAS, Oct. 7, 2025 /PRNewswire/ -- The Highland Global Allocation Fund (NYSE: HGLB) ("HGLB" or the "Fund") today announced an addition to the Fund's portfolio management team. Effective October 7, 2025. Scott Johnson has been named as a portfolio manager of the Fund. Mr. Johnson will join current portfolio manager James Dondero in overseeing the Fund's investment activities.

Mr. Johnson is managing director and portfolio manager at NexPoint. He has over 25 years of investment management experience with extensive experience in private equity, mergers and acquisitions, and long/short hedge funds. Mr. Johnson received a B.B.A. in Finance with honors from the University of Texas at Austin and an MBA from Harvard Business School.

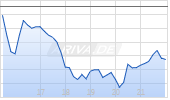

In addition to the portfolio manager changes, the Fund provided an update on a recent change in the Fund's net asset value ("NAV"). On October 1, 2025, the Fund's NAV increased by 18.86% or $2.24. This increase was primarily driven by an investment in a data center real estate investment trust ("REIT"), Fermi, Inc. The Fund's investment converted to common stock from a public listing that was previously a convertible preferred equity position. The REIT is now listed on the Nasdaq under the ticker FRMI.

This was not an outsized position in the Fund; however, the investment had an outsized impact on the Fund's NAV as a result of the initial success of the IPO.

The investment was facilitated by NexPoint's corporate credit and equities team, which is led by Mr. Johnson.

"We are pleased to add Scott as a portfolio manager to HGLB," said James Dondero, NexPoint founder and principal, and portfolio manager of the Fund. "Scott's portfolio management experience and ability to source and execute unique private market investment opportunities, like the FRMI investment, will be a valuable addition to the portfolio management team as we look to maximize value for HGLB investors."

The Fund will continue to be managed pursuant to the investment objective and strategies as described in the Fund's Prospectus without change.

About the Highland Global Allocation Fund

The Highland Global Allocation Fund (NYSE:HGLB) is a closed-end fund managed by NexPoint Asset Management, L.P. For more information visit nexpointassetmgmt.com/global-allocation-fund.

About NexPoint Asset Management, L.P.

NexPoint Asset Management, L.P. is an SEC-registered investment adviser. It is the adviser to a suite of registered funds, including open-end mutual funds, and closed-end funds. For more information visit nexpointassetmgmt.com.

Disclosures

Before investing in the Fund, you should carefully consider the Fund's investment objectives, risks, charges, and expenses. For a copy of a prospectus or summary prospectus, which contains this and other information, please visit our website at www.nexpointassetmgmt.com or call 1-800-357-9167. Please read the fund prospectus carefully before investing.

Shares of closed-end investment companies frequently trade at a discount to NAV. The price of the Fund's shares is determined by a number of factors, several of which are beyond the control of the Fund. Therefore, the Fund cannot predict whether its shares will trade at, below or above net asset value. Past performance does not guarantee future results.

CONTACTS

Investor Relations

Kristen Griffith

Media Relations

![]() View original content:https://www.prnewswire.com/news-releases/highland-global-allocation-fund-hglb-announces-addition-to-portfolio-management-team-provides-update-on-recent-nav-increase-302576867.html

View original content:https://www.prnewswire.com/news-releases/highland-global-allocation-fund-hglb-announces-addition-to-portfolio-management-team-provides-update-on-recent-nav-increase-302576867.html

SOURCE Highland Global Allocation Fund

Für dich aus unserer Redaktion zusammengestellt

Dein Kommentar zum Artikel im Forum

Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte.