Anzeige

Meldung des Tages: Der nächste Gold-Hebel? 200 Meter Treffer, volle Kassen – warum diese Aktie jetzt auffällt

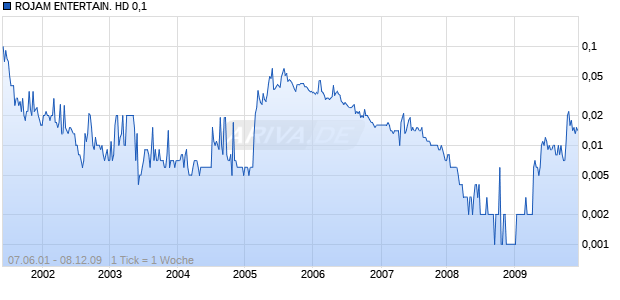

ROJAM ENTERTAIN. HD 0,1

Aktie

WKN: A0YFMV ISIN: BMG7627B1147

Keine aktuellen Kursdaten verfügbar

Depot/Watchlist

Dieses Wertpapier ist nicht mehr handelbar.

Marktkapitalisierung *

-

Streubesitz

-

KGV

-

Dividende

0,011 €

Index-Zuordnung

-

- Push

- Intraday

- 1W

- 3M

- 6M

- 1J

- 5J

- Gesamt

Dividenden Historie

| Datum | Dividende |

| 17.05.2007 | 0,011 € |

| 15.06.2005 | 0,0013 € |

alle Dividenden & Splits »

Werbung

Mehr Nachrichten kostenlos abonnieren

E-Mail-Adresse

Bitte überprüfe deine die E-Mail-Adresse.

Benachrichtigungen von ARIVA.DE

(Mit der Bestellung akzeptierst du die Datenschutzhinweise)

(Mit der Bestellung akzeptierst du die Datenschutzhinweise)

Vielen Dank, dass du dich für unseren Newsletter angemeldet hast. Du erhältst in Kürze eine E-Mail mit einem Aktivierungslink.

Leider können wir deine Anfrage auf diesem Weg nicht entgegennehmen.

Bitte schreibe uns an: portal.support@ariva.de

Bitte schreibe uns an: portal.support@ariva.de

Termine

Keine Termine bekannt.

Prognose & Kursziel

Keine aktuellen Prognosen oder Kursziele bekannt.

Stammdaten

| Aktientyp | Stammaktie |

Community-Beiträge zu ROJAM ENTERTAIN. HD 0,1

brodz

Aus ROJAM ist das geworden...

was ich immer geahnt habe. Und P.Zocker hat bestimmt auch noch seine Miesen damit gemacht. Wo ist er eigentlich abgeblieben?

ank

Auch ich war mal an Rojam drann!

Aber nichts mehr los mit dieser Aktie, kein Mensch interessiert sich noch dafür!

Skydust

ROJAM kz. 0,039 o. T.

P.Zocker

Hier etwas zum lesen

FIRST QUARTERLY RESULTS ANNOUNCEMENT

FOR THE THREE MONTHS ENDED 30TH JUNE 2005

CHARACTERISTICS OF THE GROWTH ENTERPRISE MARKET (“GEM”) OF THE STOCK

EXCHANGE OF HONG KONG LIMITED (THE “STOCK EXCHANGE”)

GEM has been established as a market designed to accommodate companies to which a

high investment risk may be attached. In particular, companies may list on GEM with

neither a track record of profitability nor any obligation to forecast future profitability.

Furthermore, there may be risks arising out of the emerging nature of companies listed on

GEM and the business sectors or countries in which the companies operate. Prospective

investors should be aware of the potential risks of investing in such companies and should

make the decision to invest only after due and careful consideration. The greater risk

profile and other characteristics of GEM mean that it is a market more suited to professional

and other sophisticated investors.

Given the emerging nature of companies listed on GEM, there is a risk that securities

traded on GEM may be more susceptible to high market volatility than securities traded

on the main board of the Stock Exchange and no assurance is given that there will be a

liquid market in the securities traded on GEM.

The principal means of information dissemination on GEM is publication on the internet

website operated by the Stock Exchange. Listed companies are not generally required to

issue paid announcements in gazetted newspapers. Accordingly, prospective investors should

note that they need to have access to the GEM website in order to obtain up-to-date

information on GEM-listed issuers.

The Stock Exchange takes no responsibility for the contents of this announcement, makes no representation as

to its accuracy or completeness and expressly disclaims any liability whatsoever for any loss howsoever arising

from or in reliance upon the whole or any part of the contents of this announcement.

This announcement, for which the directors of Rojam Entertainment Holdings Limited (the “Directors”) collectively

and individually accept full responsibility, includes particulars given in compliance with the Rules Governing the

Listing of Securities on the Growth Enterprise Market of The Stock Exchange of Hong Kong Limited (the “GEM

Listing Rules”) for the purpose of giving information with regard to Rojam Entertainment Holdings Limited. The

Directors, having made all reasonable enquiries, confirm that, to the best of their knowledge and belief: (1) the

information contained in this announcement is accurate and complete in all material respects and not misleading;

(2) there are no other matters the omission of which would make any statement in this announcement

misleading; and (3) all opinions expressed in this announcement have been arrived at after due and careful

consideration and are founded on bases and assumptions that are fair and reasonable.

– 2 –

HIGHLIGHTS

Turnover amounted to HK$118.9 million, 3 times of the turnover of the corresponding

period in last year.

Profit attributable to shareholders amounted to HK$7.3 million, compared to loss of HK$3.0

million of the corresponding period in previous year.

Basic earnings per share was 0.5 HK cent, compared to the loss per share of 0.2 HK cent in

last year.

The digital distribution business star ted contributing to the Group’s turnover.

New investment to accelerate digital content distribution.

The Board does not recommend the payment of an interim dividend for the three months

ended 30th June 2005.

RESULTS

The board of directors (the “Board”) of Rojam Entertainment Holdings Limited (the “Company”, together

with its subsidiaries, the “Group”) is pleased to present the unaudited consolidated results of the Group

for the three months ended 30th June 2005 together with the comparative unaudited figures for the

corresponding period in 2004.

Unaudited

Three months ended

30th June

2005 2004

Note HK$’000 HK$’000

Turnover 2 118,892 40,064

Other revenue 2 198 89

Total revenues 119,090 40,153

Cost of sales (75,118) (22,302)

Selling and distribution expenses (20,203) (11,009)

Other operating expenses (10,636) (7,902)

Amortisation of goodwill – (1,370)

Profit/(loss) before taxation 13,133 (2,430)

Taxation 3 (5,868) (435)

Profit/(loss) for the period 7,265 (2,865)

Profit/(loss) attributable to:

Equity holders of the Company 7,265 (2,954)

Minority interests – 89

7,265 (2,865)

Earnings/(loss) per share for profit/loss

attributable to the equity holders of the Company

during the period

– basic 4 0.5 cent (0.2 cent)

– 3 –

Notes:

1. Basis of preparation and accounting policies

The Company was incorporated in the Cayman Islands on 29th February 2000 as an exempted company with limited

liability under the Companies Law (Revised) of the Cayman Islands. Its shares were listed on GEM on 31st May 2001.

The unaudited consolidated accounts have been prepared in accordance with accounting principles generally accepted

in Hong Kong and comply with accounting standards issued by the Hong Kong Institute of Cer tified Public Accountants.

They have been prepared under the historical cost convention. The unaudited consolidated accounts have not been

audited by the Company’s auditors, but have been reviewed by the Company’s audit committee.

The accounting policies and methods of computation used in the preparation of the unaudited consolidated accounts

are consistent with those used in the annual financial statements for the year ended 31st March 2005 except that the

Group has changed cer tain of its accounting policies following its adoption of new/revised Hong Kong Financial

Reporting Standards (“HKFRS”) and Hong Kong Accounting Standards (“HKAS”) (collectively referred as “new HKFRSs”)

which are effective for accounting periods commencing on or after 1st Januar y 2005.

With effect from 1st April 2004, the Group has early adopted HKFRS 3 “Business Combinations”, HKAS 36 “Impairment

of Assets” and HKAS 38 “Intangible Assets”. The details of the accounting policies have been disclosed in the annual

financial statements for the year ended 31st March 2005.

With effect from 1st April 2005, the Group adopted other new HKFRSs which are relevant to its operations. The

adoption of these new HKFRSs did not result in substantial changes to the Group’s accounting policies. No prior period

adjustment has been made.

2. Turnover and revenue

The amounts of each significant category of revenue recognised during the three months ended 30th June 2005 are as

follows:

Unaudited

Three months ended

30th June

2005 2004

HK$’000 HK$’000

Turnover

Record distribution income 113,276 35,322

Music production income 1,139 428

Music publishing royalty 11 5

Digital distribution income 137 –

Discotheque income 4,098 4,132

Event management income 229 –

Merchandise sales 2 3

Banner advertising income – 174

118,892 40,064

Other revenue

Bank interest income 198 89

Total revenues 119,090 40,153

– 4 –

3. Taxation

No provision for Hong Kong profits tax has been made as the Company and its subsidiaries in Hong Kong have no

assessable profits for the current and prior year. No provision for United States income tax has been made as the

subsidiary in the United States of America has no assessable profit for the current and prior year.

The Japanese corporate income tax has been provided on the profit of the Group’s subsidiar y in Japan and calculated at

the applicable rates. The People’s Republic of China (the “PRC”) taxation has been provided on the profit of the

Group’s subsidiary in the PRC and calculated at the applicable rates.

The amount of taxation charged to the consolidated profit and loss account represents:

Unaudited

Three months ended

30th June

2005 2004

HK$’000 HK$’000

Current taxation

– Japanese corporate income tax 5,715 –

– PRC taxation 153 129

Deferred taxation – 306

Taxation charge 5,868 435

4. Earnings/loss per share

The calculation of the basic earnings/loss per share is based on the Group’s profit attributable to shareholders of

HK$7,265,000 (2004: loss of HK$2,954,000) and 1,554,684,403 (2004: 1,554,684,403) ordinary shares in issue during

the period.

Diluted earnings per share has not been presented for the three months ended 30th June 2005 as there was no dilutive

event during the period. Diluted loss per share has not been presented for the three months ended 30th June 2004 as

the conversion of the potential ordinary shares would have anti-dilutive effect to the basic loss per share.

5. Interim dividend

The Board does not recommend the payment of an interim dividend for the three months ended 30th June 2005

(2004: Nil).

– 5 –

6. Reserves

Share Exchange Accumulated

premium reserve losses Total

HK$’000 HK$’000 HK$’000 HK$’000

At 1st April 2004 148,329 (7,317) (65,159) 75,853

Loss for the period – – (2,954) (2,954)

Exchange adjustment on translation of

the accounts of overseas subsidiaries – (2,124) – (2,124)

At 30th June 2004 (unaudited) 148,329 (9,441) (68,113) 70,775

At 1st April 2005 148,329 (8,302) (7,335) 132,692

Profit for the period – – 7,265 7,265

Final dividend for the year ended

31st March 2005 – – (18,656) (18,656)

Exchange adjustment on translation of

the accounts of overseas subsidiaries – (3,985) – (3,985)

At 30th June 2005 (unaudited) 148,329 (12,287) (18,726) 117,316

BUSINESS REVIEW AND PROSPECTS

Financial Highlights

First Quarter in

Current Quarter Previous Quarter 2004/2005

(Apr to Jun 2005) (Jan to Mar 2005) (Apr to Jun 2004)

HK$’M HK$’M HK$’M

Turnover 118.9 61.1 40.1

Operating expenditures* 106.0 78.6 41.2

Profit/(loss) from operations 13.1 (17.5) (2.4)

Profit/(loss) attributable to shareholders 7.3 (22.6) (3.0)

* Cost of sales, selling & other operating expenses

– 6 –

Sales by Business Segments

Current Previous First Quarter

Quarter Quarter in 2004/2005

(Apr to Jun 2005) (Jan to Mar 2005) (Apr to Jun 2004)

HK$’M % HK$’M % HK$’M %

Record distribution 113.3 95 56.5 93 35.4 88

Music production 1.1 1 0.3 – 0.4 1

Discotheque 4.1 4 4.3 7 4.1 10

Others 0.4 – – – 0.2 1

Group Total 118.9 100 61.1 100 40.1 100

Financial Review

The first quar ter has been always a challenge for the Group due to the seasonal characteristics of the

music industry. In the past years, number of products being released in the first quarter was comparatively

fewer than that in other quarters among the year. This year, the Group has adjusted its release schedule. It

released the best-selling DVD in this quar ter. The Group recorded a turnover of HK$118.9 million in the

first quar ter of the financial year 2005/2006, representing an increase of 95% and 197% when compared

with the fourth quarter and the first quarter of 2004/2005 respectively.

The profit attributable to shareholders for the first quar ter amounted to HK$7.3 million, representing a

significant improvement compared with the loss of HK$22.6 million and HK$3.0 million for the four th

quarter and the first quar ter of 2004/2005 respectively. Earnings per share was 0.5 HK cent, compared to

loss per share of 1.5 HK cents and 0.2 HK cent in the previous quarter and the corresponding period of

last year respectively.

The main growth driver of the Group remains within the record distribution business. Of the total

turnover, HK$113.3 million or 95% was generated from the record distribution business, HK$1.1 million or

1% was generated from the music production business and HK$4.1 million or 4% was generated from the

discotheque business.

The operating expenditures including the cost of sales and selling and distribution expenses increased by

35% and 157% when compared to the fourth quar ter and the first quar ter of 2004/2005 respectively,

which was due to the increase of the turnover. In view of the Group’s small size, it can manage its

operation more effectively and efficiently.

At 30th June 2005, the Group had a cash balance of approximately HK$90.1 million, representing 57%

decrease from HK$209.8 million at 31st March 2005. The decrease in cash during the first quar ter is

attributed to the payment of the final dividend, and increased working capital requirements and trade

receivables. The Group’s trade receivables at 30th June 2005 increased to HK$56.1 million from HK$10.2

million at 31st March 2005, primarily due to the release of popular products near the end of the first

quarter and most of the trade receivables were not due. The Group has no long-term borrowing during

the quar ter, the same as for the past years.

– 7 –

Operations Review

Record distribution

Turnover from the record distribution business for the first quar ter of the financial year 2005/2006

amounted to HK$113.3 million, representing twofold of HK$56.5 million in the previous quar ter and

threefold of HK$35.4 million in the same period of last year. This business division accounted for

approximately 95% of the total turnover of the Group in the first quarter.

Due to the effect of seasonality, record and DVD sales are in general lower in the first quar ter than in

other quarters of the financial year. This year, the Group has adjusted its release schedule. It released the

popular DVD namely “ DVD�� �� �� �� �� (5)(��” in late

June of this quar ter. Based on historical records, the Downtown’s DVD series “ ” is

one of the best sellers of the Group. The change of release date of this major DVD from the last financial

year to the current financial year had a significant impact on the operating results.

During the first quar ter, the Group’s own label produced 23 music records and 13 DVDs. The products

released in the corresponding quarter of last year were 7 music records, 7 video tapes and 11 DVDs. The

more recent releases were also performing well including music records from Kingkong Kajiwara, Kinya,

Hound Dog and Fayray as well as DVDs titled “M-1 2004” and “ ”.

Digital distribution

In the past months, the Group has been at the forefront of the digital market in the telecommunication

sector in Japan. The Group has entered into digital par tnerships, in cooperation with Fandango, Inc.

(“Fandango”), with major mobile phone carriers in Japan, namely KDDI, NTT DoCoMo and Vodafone. The

Group’s full-length music tracks can be downloaded to subscribers’ mobile phones. The basic download

rate ranges from 100 Yen (HK$7) to 360 Yen (HK$25) per song.

Turnover from the digital distribution business is the net revenue received from Fandango after deducting

all external costs. The net revenue recognised to the accounts was HK$137,000 for the first quar ter.

Although the digital distribution business has yet to bring to the Group significant sales and profit contribution,

the Group will further develop this business.

Rojam Disco

Turnover from the discotheque business amounted to HK$4.1 million for the first quar ter, representing a

slight decline of 5% and 1% when compared to the previous quarter and the corresponding quarter in last

year. The decrease in turnover was mainly attributable to the reduction of admission under the current

competitive market. However, the successful international DJ par ties held every weekend helped

compensating for most of the patrons loss due to the intense competition.

The lease of the discotheque premises in Shanghai was renewed during the first quarter. As the rents of

the premises were approximately 25% of the total expenses of the discotheque on average, the operating

results of the discotheque were typically impacted by higher rents. In view of this, Rojam Disco has

successfully secured reasonable rental rates for each of the five years to reduce exposure to substantial

increase in rents in the next five years.

– 8 –

New investment

The subscription of 30,000 shares of Series A Conver tible Preferred Stocks of Bellrock Media, Inc.

(“Bellrock”) at an aggregate cash consideration of US$3,000,000 (equivalent to approximately

HK$23,400,000) was completed during the first quar ter.

Bellrock was established in Delaware, the United States on 26th January 2005. The principal focus of

Bellrock is to engage in the development, production and distribution of digital entertainment content

through multi-media platforms such as the mobile and internet markets in the United States and throughout

Asia. In addition, Bellrock will pursue strategic investment opportunities within the emerging mobile and

internet markets through an affiliated investment fund in Japan. Other investors in Bellrock include Intel

Corporation, a well-known leader in semiconductor manufacturing and technology, and Faith, Inc., a

Japan-based mobile industry leader of enabling software and ringtone technology.

The investment in Bellrock is in line with the Group’s objective to grow through strategic par tnerships with

technology companies providing music and enter tainment content in the digital distribution sector, in

particular companies with exper tise in mobile and internet-related technologies. The investment also

presents an excellent opportunity for the Group to establish itself as a leader in the music and entertainment

content distribution business and will complement and enhance the existing business of the Group.

Prospects

The current financial year has got off to a good star t. The Group’s performance in the first quar ter is

keeping the Group on track to achieve its full-year financial targets of achieving double-digit growth in both

revenue and net profit, and maximising growth in earnings per share.

The Group’s performance will continue to improve. A key driver will be the very rapid growth in digital

music and content. With the proliferation of increasingly more sophisticated handsets, mobile phones are

moving closer to become true mobile audio and visual machines. While the audio and video quality

possible on handsets is yet to be improved, the commercial success of ringtones and music download

show that there is promise for driving music and content sales and the potential for better applications as

the technology allows it. Digital content over mobile is increasingly being driven by improvements in

handsets as well as in 3G (third-generation) mobile phone networks.

The Group aims to enable its exclusive entertainment content to be downloaded to mobile phones or

through the broadband based internet soon. The management remains confident that digital distribution

business will drive the Group forward at attractive growth rates in the current financial year and that it will

become a significantly larger proportion of the Group’s business in the near future.

The recent revaluation of the Chinese currency will have little impact on the Group’s results because only

approximately 4% of the Group’s revenues currently come from its mainland operation, Rojam Disco.

However, the appreciation is cer tain to increase the exchange rate used to translate the results of Rojam

Disco from Renminbi into the Group’s presentation currency for reporting purpose.

– 9 –

DIRECTORS’ AND CHIEF EXECUTIVES’ INTERESTS AND SHORT POSITIONS IN THE

SHARES, UNDERLYING SHARES AND DEBENTURES OF THE COMPANY OR ANY

ASSOCIATED CORPORATION

At 30th June 2005, the interests and shor t positions of the Directors and chief executives of the Company

in the shares, underlying shares and debentures of the Company or any associated corporation (within the

meaning of Par t XV of the Securities and Futures Ordinance (“SFO”)), as recorded in the register

maintained by the Company under section 352 of the SFO or as notified to the Company and the Stock

Exchange were as follows:

Ordinary shares of HK$0.10 each in the Company

Approximate

shareholding

Capacity in which Personal in the

Name of Director the shares are held interests Company

Mr. Takeyasu Hashizume Beneficial owner 1,730,000 0.11%

Mr. Arihito Yamada Beneficial owner 8,913,600 0.57%

Mr. Yukitsugu Shimizu Beneficial owner 430,000 0.03%

Mr. Hiroshi Osaki Beneficial owner 1,300,000 0.08%

Save as disclosed above, at 30th June 2005, none of the Directors, chief executive or their respective

associates (as defined in the GEM Listing Rules) was deemed to have any interests or shor t positions in the

shares, underlying shares and debentures of the Company or any of its associated corporation (within the

meaning of Par t XV of the SFO) as recorded in the register required to be kept by the Company under

section 352 of the SFO or which, pursuant to Rules 5.46 to 5.67 of the GEM Listing Rules relating to

securities transactions by Directors, to be notified to the Company and the Stock Exchange.

Save as disclosed above, at no time during the three months ended 30th June 2005 was the Company, its

holding companies or any of its subsidiaries or fellow subsidiaries a par ty to any arrangement to enable the

Directors and chief executives of the Company to acquire benefits by means of the acquisition of shares

in, or debentures of, the Company or its associated corporation.

– 10 –

SUBSTANTIAL SHAREHOLDERS’ INTERESTS AND SHORT POSITIONS IN THE SHARES

AND UNDERLYING SHARES OF THE COMPANY

The register of substantial shareholders maintained under section 336 of the SFO shows that as at 30th

June 2005, the Company had been notified of the following substantial shareholders’ interests and shor t

positions, being 5% or more of the Company’s issued share capital:

Interests in

the ordinary Approximate

shares of HK$0.10 shareholding in

Name of shareholder each in the Company the Company

Yoshimoto America, Inc. 450,000,000 28.94%

Fandango, Inc. (Note 1) 1,053,666,167 67.77%

Yoshimoto Kogyo Co., Ltd. (Note 2) 1,053,666,167 67.77%

CS Loginet Inc. 91,750,000 5.90%

Notes:

1. Yoshimoto America, Inc. is a wholly-owned subsidiary of Fandango, Inc. (“Fandango”), Fandango is deemed to have

interest in the 450,000,000 shares in the Company held by Yoshimoto America, Inc. in addition to 603,666,167 shares in

the Company directly held by itself.

2. Fandango controlled as to 63.5% by Yoshimoto Kogyo Co., Ltd. (“Yoshimoto”). Accordingly, Yoshimoto was interested in

1,053,666,167 shares in the Company by attribution.

Save as disclosed above, at 30th June 2005, the Directors or chief executives of the Company were not

aware of any other person (other than the Directors or chief executives of the Company) who had an

interest or shor t position in the shares or underlying shares of the Company under section 336 of the

SFO.

DIRECTORS’ INTEREST IN COMPETING BUSINESS

Mr. Yukitsugu Shimizu and Mr. Hiroshi Osaki, executive Directors of the Company, are directors of

Yoshimoto, a substantial shareholder of the Company, and certain of its associates (as defined in the GEM

Listing Rules). Pursuant to two deeds of non-competition undertakings, both dated 10th October 2002, as

each amended by a supplemental deed dated 28th September 2004, and entered into between Yoshimoto

and each of (i) the Company and (ii) R and C Ltd. (“R&C”), Yoshimoto irrevocably and unconditionally

undertakes to each of the Company and R&C that, unless with the written consent of the Company or

R&C (as the case may be) or except for cer tain circumstances, it will not and will procure that its

subsidiaries and associates will not, carry on or be engaged, concerned or interested directly or indirectly

in the production of master tapes and licensing of such master tape rights. Details of the deeds of

non-competition undertakings are set out in the circulars issued by the Company dated 31st July 2002 and

3rd September 2004.

Save as disclosed above, none of the Directors or the management shareholders (as defined in the GEM

Listing Rules) of the Company have any interest in a business, which competed or may compete with the

business of the Group or have any other conflict of interests with the Group.

Quadra

Jetzt anmelden und diskutieren

Registrieren

Login

Zum Thread wechseln Häufig gestellte Fragen zur ROJAM ENTERTAIN. HD 0,1 Aktie und zum ROJAM ENTERTAIN. HD 0,1 Kurs

Ja, ROJAM ENTERTAIN. HD 0,1 zahlt Dividenden. Zuletzt wurde am 17.05.2007 eine Dividende in Höhe von 0,011 € gezahlt.

Zuletzt hat ROJAM ENTERTAIN. HD 0,1 am 17.05.2007 eine Dividende in Höhe von 0,011 € gezahlt.

Dies entspricht einer Dividendenrendite von 0,00%. Die Dividende wird jährlich gezahlt.

Dies entspricht einer Dividendenrendite von 0,00%. Die Dividende wird jährlich gezahlt.

Die letzte Dividende von ROJAM ENTERTAIN. HD 0,1 wurde am 17.05.2007 in Höhe von 0,011 € je Aktie ausgeschüttet.

Das ergibt, basierend auf dem aktuellen Kurs, eine Dividendenrendite von 0,00%.

Das ergibt, basierend auf dem aktuellen Kurs, eine Dividendenrendite von 0,00%.

Die Dividende wird jährlich gezahlt.

Der letzte Zahltag der Dividende war am 17.05.2007. Es wurde eine Dividende in Höhe von 0,011 € gezahlt.

Um eine Dividende ausgezahlt zu bekommen, muss man die Aktie am Ex-Tag (Ex-Date) im Depot haben.