Aufrufe: 53

Aufrufe: 53

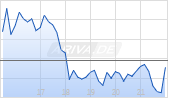

Power Integrations Reports Fourth-Quarter and Full-Year Financial Results

For the full year 2025, net revenue was $443.5 million, up six percent compared to the prior year. GAAP net income was $22.1 million or $0.39 per diluted share compared to $0.56 per diluted share in the prior year. Cash flow from operations for the year was $111.5 million.

In addition to its GAAP results, the company provided non-GAAP measures that exclude stock-based compensation, amortization of acquisition-related intangible assets, expenses related to an employment-litigation matter, and the tax effects of these items. Non-GAAP net income for the fourth quarter of 2025 was $12.7 million or $0.23 per diluted share compared to $0.36 per diluted share in the prior quarter and $0.30 per diluted share in the fourth quarter of 2024. Full-year non-GAAP net income was $70.7 million or $1.25 per diluted share compared to $1.16 per diluted share in the prior year. A reconciliation of GAAP to non-GAAP financial results and outlook is included with the tables accompanying this press release.

Power Integrations also today announced that it has carried out a restructuring plan, reducing its global workforce by seven percent. The company expects to incur a charge of between $3.5 million and $4.0 million in the first quarter of 2026 associated with severance benefits and related expenses.

Power Integrations CEO Jen Lloyd commented: “I am pleased that we returned to growth in 2025 with a six-percent increase in total revenue, led by our industrial category which grew 15 percent. The growth in industrial was driven by record sales in our high-power gate-driver business, plus strength in metering, power tools, automotive and broad-based industrial applications. Additionally, total revenue from PowiGaN™ products grew more than 40 percent for the year.”

Dr. Lloyd continued: “Our addressable market continues to expand as AI data centers, electrification, grid modernization and other macro trends drive demand for innovative high-voltage technologies. We are taking steps to align our organization with these opportunities, including a restructuring of our workforce to better align expenses with revenue and create flexibility to invest in the products, people, and markets we expect to drive long-term growth and profitability.”

Financial Outlook / Dividend

The company issued the following forecast for the first quarter of 2026:

- Revenue is expected to be in a range of $104 million to $109 million.

- GAAP gross margin is expected to be between 52 percent and 53 percent, and non-GAAP gross margin is expected to be between 53 percent and 54 percent.

- GAAP operating expenses are expected to be between $54 million and $55.5 million, and non-GAAP operating expenses are expected to be $46 million plus or minus $0.5 million.

- The company paid a dividend of $0.21 per share on December 31, 2025. A dividend of $0.215 per share will be paid on March 31, 2026, to stockholders of record as of February 27, 2026.

Conference Call Today at 1:30 p.m. Pacific Time

Power Integrations management will hold a conference call today at 1:30 p.m. Pacific time. A webcast of the call will be available on the company's investor web page, http://investors.power.com.

About Power Integrations

Power Integrations, Inc. is a leading innovator in semiconductor technologies for high-voltage power conversion. The company’s products are key building blocks in the clean-power ecosystem, enabling the generation of renewable energy as well as the efficient transmission and consumption of power in applications ranging from milliwatts to megawatts. For more information, please visit www.power.com.

Note Regarding Use of Non-GAAP Financial Measures

In addition to the company's consolidated financial statements, which are presented according to GAAP, the company provides certain non-GAAP financial information that excludes stock-based compensation expenses recorded under ASC 718-10, amortization of acquisition-related intangible assets, expenses stemming from an employment litigation matter and the tax effects of these items. The company uses these measures in its financial and operational decision-making and, with respect to one measure, in setting performance targets for compensation purposes. The company believes that these non-GAAP measures offer important analytical tools to help investors understand its operating results, and to facilitate comparability with the results of companies that provide similar measures. Non-GAAP measures have limitations as analytical tools and are not meant to be considered in isolation or as a substitute for GAAP financial information. For example, stock-based compensation is an important component of the company’s compensation mix and will continue to result in significant expenses in the company’s GAAP results for the foreseeable future but is not reflected in the non-GAAP measures. Also, other companies, including companies in Power Integrations’ industry, may calculate non-GAAP measures differently, limiting their usefulness as comparative measures. Reconciliations of non-GAAP measures to GAAP measures are attached to this press release.

Note Regarding Forward-Looking Statements

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements generally relate to future events or the company’s future financial or operating performance. In some cases, you can identify forward looking statements because they contain words such as "may," "will," "should," "expects," "plans," "anticipates,” “going to,” "could," "intends," "target," "projects," "contemplates," "believes," "estimates," "predicts," "potential" or "continue" or the negative of these words or other similar terms or expressions that concern the company expectations, strategy, priorities, plans or intentions. Forward-looking statements in this release include, but are not limited to, the company’s restructuring plans and anticipated charges, the company’s guidance and outlook for the first quarter of 2026, and the trends and assumptions underlying such guidance and outlook, and the company’s expectations regarding its upcoming dividend, including the timing and amount of such dividend. The company’s expectations and beliefs regarding these matters may not materialize, and actual results in future periods are subject to risks and uncertainties that could cause actual results to differ materially from those projected, including the company’s ability to forecast its performance; changes in trade policies, in particular the escalation and imposition of new and higher tariffs, which could reduce demand for end products that incorporate our integrated circuits and/or place pressure on our prices as our customers seek to offset the impact of increased tariffs on their own products; the company’s ability to supply products and its ability to conduct other aspects of its business, such as competing for new design wins; changes in global economic and geopolitical conditions, including such factors as inflation, armed conflicts and trade negotiations, which may impact the level of demand for the company’s products; potential changes and shifts in customer demand away from end products that utilize the company's integrated circuits to end products that do not incorporate the company's products; the effects of competition, which may cause the company’s revenue to decrease or cause the company to decrease its selling prices for its products; unforeseen costs and expenses; and unfavorable fluctuations in component costs or operating expenses resulting from changes in commodity prices and/or exchange rates; and product development delays and defects and market acceptance of the new products. The forward-looking statements contained in this release are also subject to other risks and uncertainties, including those more fully described in the company’s filings with the Securities and Exchange Commission (“SEC”), including the company’s Annual Report on Form 10-K, filed with the Securities and Exchange Commission on February 7, 2025 and subsequent Quarterly Reports on Form 10-Q filed with the SEC. The forward-looking statements in this release are based on information available to the company as of the date hereof and the company disclaims any obligation to update or alter its forward-looking statements, except as otherwise required by law.

Power Integrations, PowiGaN and the Power Integrations logo are trademarks or registered trademarks of Power Integrations, Inc. All other trademarks are property of their respective owners.

| POWER INTEGRATIONS, INC. | ||||||||||||||||||||

| CONSOLIDATED STATEMENTS OF INCOME (LOSS) | ||||||||||||||||||||

| (in thousands, except per-share amounts) | ||||||||||||||||||||

| Three Months Ended | Twelve Months Ended | |||||||||||||||||||

| December 31, 2025 | September 30, 2025 | December 31, 2024 | December 31, 2025 | December 31, 2024 | ||||||||||||||||

| NET REVENUE | 103,204 |

| 118,919 |

| 105,250 |

| 443,504 |

| 418,973 |

| ||||||||||

| COST OF REVENUE |

| 48,595 |

|

| 54,068 |

|

| 47,983 |

|

| 201,855 |

|

| 194,222 |

| |||||

| GROSS PROFIT |

| 54,609 |

|

| 64,851 |

|

| 57,267 |

|

| 241,649 |

|

| 224,751 |

| |||||

| OPERATING EXPENSES: | ||||||||||||||||||||

| Research and development |

| 24,334 |

|

| 26,696 |

|

| 25,689 |

|

| 101,116 |

|

| 100,790 |

| |||||

| Sales and marketing |

| 15,773 |

|

| 17,455 |

|

| 16,931 |

|

| 67,952 |

|

| 67,825 |

| |||||

| General and administrative |

| 9,472 |

|

| 10,374 |

|

| 10,728 |

|

| 42,701 |

|

| 38,207 |

| |||||

| Other operating expenses |

| (3,744 |

| 14,279 |

|

|

|

| 19,686 |

|

|

| ||||||||

| Total operating expenses |

| 45,835 |

|

| 68,804 |

|

| 53,348 |

|

| 231,455 |

|

| 206,822 |

| |||||

| INCOME (LOSS) FROM OPERATIONS |

| 8,774 |

|

| (3,953 |

| 3,919 |

|

| 10,194 |

|

| 17,929 |

| ||||||

| OTHER INCOME |

| 2,373 |

|

| 2,555 |

|

| 3,384 |

|

| 10,785 |

|

| 12,825 |

| |||||

| INCOME (LOSS) BEFORE INCOME TAXES |

| 11,147 |

|

| (1,398 |

| 7,303 |

|

| 20,979 |

|

| 30,754 |

| ||||||

| PROVISION (BENEFIT) FOR INCOME TAXES |

| (2,143 |

| (42 |

| (1,837 |

| (1,114 |

| (1,480 | ||||||||||

| NET INCOME (LOSS) | 13,290 |

| (1,356 | 9,140 |

| 22,093 |

| 32,234 |

| |||||||||||

| EARNINGS (LOSS) PER SHARE: | ||||||||||||||||||||

| Basic | 0.24 |

| (0.02 | 0.16 |

| 0.39 |

| 0.57 |

| |||||||||||

| Diluted | 0.24 |

| (0.02 | 0.16 |

| 0.39 |

| 0.56 |

| |||||||||||

| SHARES USED IN PER-SHARE CALCULATION: | ||||||||||||||||||||

| Basic |

| 55,329 |

|

| 55,796 |

|

| 56,848 |

|

| 56,063 |

|

| 56,820 |

| |||||

| Diluted |

| 55,694 |

|

| 55,796 |

|

| 57,097 |

|

| 56,324 |

|

| 57,130 |

| |||||

| SUPPLEMENTAL INFORMATION: | Three Months Ended | Twelve Months Ended | ||||||||||||||||||

| December 31, 2025 | September 30, 2025 | December 31, 2024 | December 31, 2025 | December 31, 2024 | ||||||||||||||||

| Stock-based compensation expenses included in: | ||||||||||||||||||||

| Cost of revenue | 232 |

| 517 |

| 541 |

| 1,998 |

| 2,090 |

| ||||||||||

| Research and development |

| 1,945 |

|

| 2,850 |

|

| 3,280 |

|

| 10,235 |

|

| 12,587 |

| |||||

| Sales and marketing |

| 1,042 |

|

| 1,910 |

|

| 2,074 |

|

| 6,460 |

|

| 8,064 |

| |||||

| General and administrative |

| 1,626 |

|

| 2,374 |

|

| 3,394 |

|

| 12,563 |

|

| 12,335 |

| |||||

| Other operating expenses |

| (5,120 |

| 13,554 |

|

|

|

| 8,434 |

|

|

| ||||||||

| Total stock-based compensation expense | (275 | 21,205 |

| 9,289 |

| 39,690 |

| 35,076 |

| |||||||||||

| Cost of revenue includes: | ||||||||||||||||||||

| Amortization of acquisition-related intangible assets | 147 |

| 147 |

| 147 |

| 587 |

| 1,034 |

| ||||||||||

| Three Months Ended | Twelve Months Ended | |||||||||||||||||||

| REVENUE MIX BY END MARKET | December 31, 2025 | September 30, 2025 | December 31, 2024 | December 31, 2025 | December 31, 2024 | |||||||||||||||

| Communications |

| 15 |

| 11 |

| 13 |

| 12 |

| 12 | ||||||||||

| Computer |

| 14 |

| 13 |

| 15 |

| 13 |

| 14 | ||||||||||

| Consumer |

| 34 |

| 34 |

| 37 |

| 37 |

| 39 | ||||||||||

| Industrial |

| 37 |

| 42 |

| 35 |

| 38 |

| 35 | ||||||||||

| POWER INTEGRATIONS, INC. | ||||||||||||||||||||

| RECONCILIATION OF NON-GAAP FINANCIAL MEASURES TO GAAP RESULTS | ||||||||||||||||||||

| (in thousands, except per-share amounts) | ||||||||||||||||||||

| Three Months Ended | Twelve Months Ended | |||||||||||||||||||

| December 31, 2025 | September 30, 2025 | December 31, 2024 | December 31, 2025 | December 31, 2024 | ||||||||||||||||

| RECONCILIATION OF GROSS PROFIT | ||||||||||||||||||||

| GAAP gross profit | 54,609 |

| 64,851 |

| 57,267 |

| 241,649 |

| 224,751 |

| ||||||||||

| GAAP gross margin |

| 52.9 | % |

| 54.5 | % |

| 54.4 | % |

| 54.5 | % |

| 53.6 | % | |||||

| Stock-based compensation included in cost of revenue |

| 232 |

|

| 517 |

|

| 541 |

|

| 1,998 |

|

| 2,090 |

| |||||

| Amortization of acquisition-related intangible assets |

| 147 |

|

| 147 |

|

| 147 |

|

| 587 |

|

| 1,034 |

| |||||

| Non-GAAP gross profit | 54,988 |

| 65,515 |

| 57,955 |

| 244,234 |

| 227,875 |

| ||||||||||

| Non-GAAP gross margin |

| 53.3 | % |

| 55.1 | % |

| 55.1 | % |

| 55.1 | % |

| 54.4 | % | |||||

| Three Months Ended | Twelve Months Ended | |||||||||||||||||||

| RECONCILIATION OF OPERATING EXPENSES | December 31, 2025 | September 30, 2025 | December 31, 2024 | December 31, 2025 | December 31, 2024 | |||||||||||||||

| GAAP operating expenses | 45,835 |

| 68,804 |

| 53,348 |

| 231,455 |

| 206,822 |

| ||||||||||

| Less:Stock-based compensation expense included in operating expenses | ||||||||||||||||||||

| Research and development |

| 1,945 |

|

| 2,850 |

|

| 3,280 |

|

| 10,235 |

|

| 12,587 |

| |||||

| Sales and marketing |

| 1,042 |

|

| 1,910 |

|

| 2,074 |

|

| 6,460 |

|

| 8,064 |

| |||||

| General and administrative |

| 1,626 |

|

| 2,374 |

|

| 3,394 |

|

| 12,563 |

|

| 12,335 |

| |||||

| Other operating expenses |

| (5,120 |

| 13,554 |

|

|

|

| 8,434 |

|

|

| ||||||||

| Other operating expenses |

| 1,376 |

|

| 725 |

|

|

|

| 11,252 |

|

|

| |||||||

| Total |

| 869 |

|

| 21,413 |

|

| 8,748 |

|

| 48,944 |

|

| 32,986 |

| |||||

| Non-GAAP operating expenses | 44,966 |

| 47,391 |

| 44,600 |

| 182,511 |

| 173,836 |

| ||||||||||

| Three Months Ended | Twelve Months Ended | |||||||||||||||||||

| RECONCILIATION OF INCOME (LOSS) FROM OPERATIONS | December 31, 2025 | September 30, 2025 | December 31, 2024 | December 31, 2025 | December 31, 2024 | |||||||||||||||

| GAAP income (loss) from operations | 8,774 |

| (3,953 | 3,919 |

| 10,194 |

| 17,929 |

| |||||||||||

| GAAP operating margin |

| 8.5 | % |

| -3.3 | % |

| 3.7 | % |

| 2.3 | % |

| 4.3 | % | |||||

| Add:Total stock-based compensation |

| (275 |

| 21,205 |

|

| 9,289 |

|

| 39,690 |

|

| 35,076 |

| ||||||

| Amortization of acquisition-related intangible assets |

| 147 |

|

| 147 |

|

| 147 |

|

| 587 |

|

| 1,034 |

| |||||

| Other operating expenses |

| 1,376 |

|

| 725 |

|

|

|

| 11,252 |

|

|

| |||||||

| Non-GAAP income from operations | 10,022 |

| 18,124 |

| 13,355 |

| 61,723 |

| 54,039 |

| ||||||||||

| Non-GAAP operating margin |

| 9.7 | % |

| 15.2 | % |

| 12.7 | % |

| 13.9 | % |

| 12.9 | % | |||||

| Three Months Ended | Twelve Months Ended | |||||||||||||||||||

| RECONCILIATION OF PROVISION (BENEFIT) FOR INCOME TAXES | December 31, 2025 | September 30, 2025 | December 31, 2024 | December 31, 2025 | December 31, 2024 | |||||||||||||||

| GAAP provision (benefit) for income taxes | (2,143 | (42 | (1,837 | (1,114 | (1,480 | |||||||||||||||

| GAAP effective tax rate |

| -19.2 | % |

| -3.0 | % |

| -25.2 | % |

| -5.3 | % |

| -4.8 | % | |||||

| Tax effect of adjustments to GAAP results |

| (1,806 |

| (527 |

| (1,366 |

| (2,965 |

| (2,153 | ||||||||||

| Non-GAAP provision (benefit) for income taxes | (337 | 485 |

| (471 | 1,851 |

| 673 |

| ||||||||||||

| Non-GAAP effective tax rate |

| -2.7 | % |

| 2.3 | % |

| -2.8 | % |

| 2.6 | % |

| 1.0 | % | |||||

| Three Months Ended | Twelve Months Ended | |||||||||||||||||||

| RECONCILIATION OF NET INCOME (LOSS) PER SHARE (DILUTED) | December 31, 2025 | September 30, 2025 | December 31, 2024 | December 31, 2025 | December 31, 2024 | |||||||||||||||

| GAAP net income (loss) | 13,290 |

| (1,356 | 9,140 |

| 22,093 |

| 32,234 |

| |||||||||||

| Adjustments to GAAP net income (loss) | ||||||||||||||||||||

| Stock-based compensation |

| (275 |

| 21,205 |

|

| 9,289 |

|

| 39,690 |

|

| 35,076 |

| ||||||

| Amortization of acquisition-related intangible assets |

| 147 |

|

| 147 |

|

| 147 |

|

| 587 |

|

| 1,034 |

| |||||

| Other operating expenses |

| 1,376 |

|

| 725 |

|

|

|

| 11,252 |

|

|

| |||||||

| Tax effect of items excluded from non-GAAP results |

| (1,806 |

| (527 |

| (1,366 |

| (2,965 |

| (2,153 | ||||||||||

| Non-GAAP net income | 12,732 |

| 20,194 |

| 17,210 |

| 70,657 |

| 66,191 |

| ||||||||||

| Average shares outstanding for calculation | ||||||||||||||||||||

| of non-GAAP net income per share (diluted) |

| 55,694 |

|

| 56,162 |

|

| 57,097 |

|

| 56,324 |

|

| 57,130 |

| |||||

| Non-GAAP net income per share (diluted) | 0.23 |

| 0.36 |

| 0.30 |

| 1.25 |

| 1.16 |

| ||||||||||

| GAAP net income (loss) per share (diluted) | 0.24 |

| (0.02 | 0.16 |

| 0.39 |

| 0.56 |

| |||||||||||

| Twelve Months Ended | ||||||||||||||||||||

| RECONCILIATION OF FREE CASH FLOW | December 31, 2025 | |||||||||||||||||||

| Cash flow from operations | 111,518 |

| ||||||||||||||||||

| Purchases of property and equipment |

| (24,396 | ||||||||||||||||||

| Free cash flow | 87,122 |

| ||||||||||||||||||

| POWER INTEGRATIONS, INC. | ||||||||

| RECONCILIATION OF NON-GAAP MEASURES TO GAAP IN FIRST-QUARTER 2026 FORECAST | ||||||||

| (dollar amounts in millions) | ||||||||

| RECONCILIATION OF GROSS MARGIN FORECAST | LOW | HIGH | ||||||

| GAAP gross margin forecast |

| 52.0 |

| 53.0 | ||||

| Adjustments to reconcile GAAP to non-GAAP | ||||||||

| Stock-based compensation included in cost of revenue |

| 0.6 |

| 0.6 | ||||

| Amortization of acquisition-related intangible assets |

| 0.1 |

| 0.1 | ||||

| Restructuring charge |

| 0.3 |

| 0.3 | ||||

| Non-GAAP gross margin forecast |

| 53.0 |

| 54.0 | ||||

| RECONCILIATION OF OPERATING EXPENSE FORECAST | LOW | HIGH | ||||||

| GAAP operating-expense forecast | 54.0 |

| 55.5 |

| ||||

| Adjustments to reconcile GAAP to non-GAAP | ||||||||

| Stock-based compensation |

| (5.3 |

| (5.3 | ||||

| Restructuring charge |

| (3.2 |

| (3.7 | ||||

| Non-GAAP operating-expense forecast | 45.5 |

| 46.5 |

| ||||

| POWER INTEGRATIONS, INC. | ||||||||||||

| CONSOLIDATED BALANCE SHEETS | ||||||||||||

| (in thousands) | ||||||||||||

| December 31, 2025 | September 30, 2025 | December 31, 2024 | ||||||||||

| ASSETS | ||||||||||||

| CURRENT ASSETS: | ||||||||||||

| Cash and cash equivalents | 58,755 |

| 48,646 |

| 50,972 |

| ||||||

| Short-term marketable securities |

| 190,755 |

|

| 193,214 |

|

| 249,023 |

| |||

| Accounts receivable, net |

| 18,254 |

|

| 31,515 |

|

| 27,172 |

| |||

| Inventories |

| 166,887 |

|

| 164,618 |

|

| 165,612 |

| |||

| Prepaid expenses and other current assets |

| 23,678 |

|

| 18,070 |

|

| 21,260 |

| |||

| Total current assets |

| 458,329 |

|

| 456,063 |

|

| 514,039 |

| |||

| PROPERTY AND EQUIPMENT, net |

| 146,536 |

|

| 147,915 |

|

| 149,562 |

| |||

| INTANGIBLE ASSETS, net |

| 7,244 |

|

| 7,452 |

|

| 8,075 |

| |||

| GOODWILL |

| 95,271 |

|

| 95,271 |

|

| 95,271 |

| |||

| DEFERRED TAX ASSETS |

| 35,594 |

|

| 37,125 |

|

| 36,485 |

| |||

| OTHER ASSETS |

| 29,233 |

|

| 28,704 |

|

| 25,394 |

| |||

| Total assets | 772,207 |

| 772,530 |

| 828,826 |

| ||||||

| LIABILITIES AND STOCKHOLDERS’ EQUITY | ||||||||||||

| CURRENT LIABILITIES: | ||||||||||||

| Accounts payable | 33,963 |

| 37,459 |

| 29,789 |

| ||||||

| Accrued payroll and related expenses |

| 13,840 |

|

| 14,233 |

|

| 13,987 |

| |||

| Taxes payable |

| 962 |

|

| 890 |

|

| 961 |

| |||

| Other accrued liabilities |

| 21,596 |

|

| 18,513 |

|

| 10,580 |

| |||

| Total current liabilities |

| 70,361 |

|

| 71,095 |

|

| 55,317 |

| |||

| LONG-TERM LIABILITIES: | ||||||||||||

| Income taxes payable |

| 3,663 |

|

| 4,556 |

|

| 3,871 |

| |||

| Other liabilities |

| 25,338 |

|

| 24,903 |

Für dich aus unserer Redaktion zusammengestelltHinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte. Weitere Artikel des AutorsThemen im Trend | ||||||