alles klar, es war Raymond A. Myers

Data Late This Year, With Approval Possible as Soon as Mid-2010

Under Fast Track Review – Novelos completed full 840-patient

enrollment as planned, in March, 2008. Timely enrollment is encouraging

because we believe this reduces the risk of unexpected side effects or other

problems involving study conduct. Enrollment continued to include nearly

900 total patients. Based on the rate of “events,” i.e. patient deaths,

Novelos anticipates reaching 725 events and reporting survival data late this

year. Previously, management had anticipated reaching 725 events in mid-

2009. Management pushed this estimate out a few months because patients

are living slightly longer than forecast. Since the study remains blinded, it

is unknown whether the increased survival may be attributed to increased

survival of the NOV-002 treated group, of the placebo group, or unrelated

factors. Still, the extended survival appears encouraging. Also favorable is

the fact that an independent data monitoring group periodically reviews the

study results for safety and efficacy, and has not stopped the trial. This is

not an affirmative indication that NOV-002 is effective, but it does mitigate

the risk of unusual side effects or clearly unfavorable survival associated

with treatment.

Recent Development Partnership Provides Capital to Complete P-III

In February, Novelos completed a development and marketing partnership

with Mundipharma and Purdue Pharma, which are related private

companies. The agreement licensed European and Asia/Pacific marketing

rights, excluding China, to Mundipharma and raised $10m in gross

proceeds through the sale of convertible preferred stock to Purdue Pharma.

We expect these funds will carry Novelos through the completion of the

phase-III lung cancer trial. Assuming that data is favorable, we anticipate

that Novelos would then be in a position to raise capital by licensing U.S.

marketing rights, or to sell equity at favorable terms.

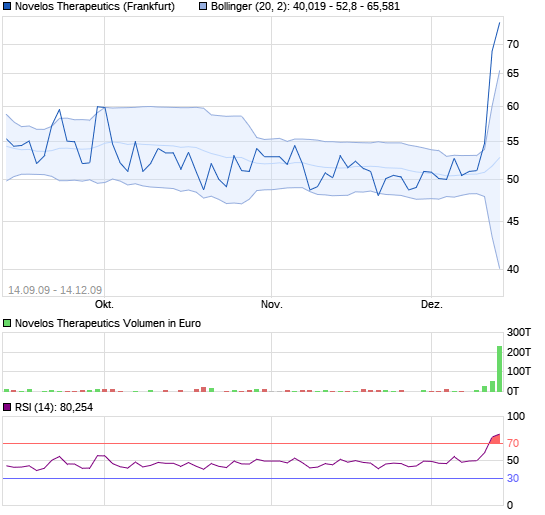

Potential for Substantial 2009 Appreciation – We are optimistic about

Novelos shares because we continue to believe that the risk of the phase-III

data to be released by year-end is outweighed by the substantial gain that we

anticipate would be realized if these results are favorable. With 144 million

fully diluted shares outstanding, Novelos’ market capitalization is just $52m.

With favorable pivotal phase-III efficacy data in lung cancer, we anticipate

the stock could exceed $5/share, or $720m market capitalization. With

greater than a 10x return potential in one-year, we believe risk tolerant

institutional investors should own Novelos shares. Our $5 one-year price

target is based on 30x our fully taxed $0.40 EPS estimate in 2012,

discounted to 2010 at 50% annually.

Moderation

Zeitpunkt: 28.10.09 15:00

Aktion: Nutzer-Sperre für immer

Kommentar: Doppel-ID

Link:

Nutzungsbedingungen  Werbung

Werbung