China Merchants Bank up sharply in HK on Jan-Sept profit

forecast

China Merchants Bank Co Ltd was sharply higher in Hong Kong after announcing that it expects its net profit for the nine months to September to be up more than 100 pct from a year earlier, dealers said.

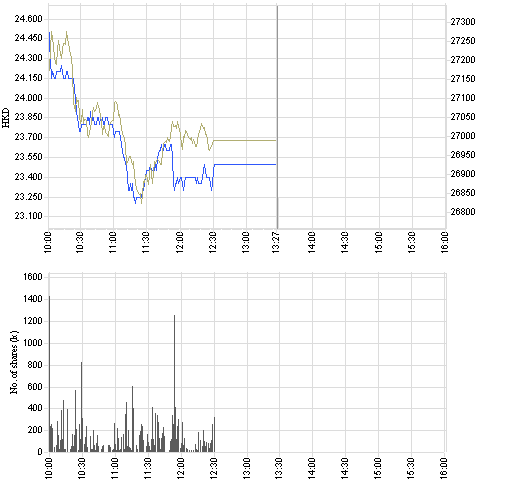

The stock was up 1.25 hkd or 3.22 pct at 40.05.

The mainland China-based lender said last night that it expects a sharp increase in its earnings for the January-September period due to several factors, including an increase in loans and interest spread and accelerated growth of non-interest income.

It also cited asset expansion as a significant factor for the earnings growth, while a reduction in credit cost and the cost-to-revenue ratio, as well as a drop in effective income tax rate, also helped.

China Merchants posted a net profit of 4.47 bln yuan during the January-September period last year, while earnings per share was at 0.31 yuan.

======

China Merchants Bank hits record high on expectations of strong 9-month

results

Hong Kong-listed shares of China Merchants Bank surged to an all-time high Tuesday after the mainland's sixth-largest bank by assets said it is expecting net profit for the first nine months to be more than double the 4.5 billion yuan it made a year before because of increased income from fees.

China Merchants Bank shares were last up 1.20 Hong Kong dollars or 3 percent at 40.00 dollars, off a fresh record of 40.15 dollars.

In a statement to the Hong Kong Stock Exchange late Monday, the bank gave no profit estimate for the first nine months but said it will release detailed figures at a later date.

The bank is expected to release its January to September earnings on Oct 23.

""The main reasons for the improved result are that our asset scale has expanded, while the company has generated an increase in loans and interest spread, and non-interest income growth has accelerated,"" the bank said.

""The credit cost and the cost-to-revenue ratio have decreased. We anticipate that the effective tax rate will decrease,"" it said. It gave no details.

""We estimate net profit in the first nine months to be at least 8.937 billion yuan, or minimum 70.5 percent of our full-year estimate of 12.7 billion yuan ... potentially in line with, or slightly better than our estimates,"" said Ning Ma, an analyst with Goldman Sachs.

Ma said in a note to clients that the result was driven by steady loan growth, improved net interest margin and solid non-interest income growth.

Ma does not expect any ""substantial operating costs end-loading in the fourth quarter as the bank accrues costs/staff bonus on a quarterly basis.""

China's soaring economy is boosting the profit of mainland lenders, as the growing number of wealthy citizens gives them the opportunity to increase lending and sell more financial products and services.

China Merchants Bank made a net profit of 6.1 billion yuan in the first-half, more than double what it made a year before. Before the release of its first-half earnings, the bank forecast that profit for the period would probably rise 100 percent.

""This is broadly in line with our forecast,"" UBS Investment said in a report written by analysts Sally Ng and Victor Wang.

""Assuming third-quarter net profit accounts for 50 percent of our second-half net profit estimate of 7.16 billion yuan, we are confident of our second-half forecast,"" UBS said.

UBS will review its net profit estimate, price target and ""buy"" rating for China Merchants Bank.

China Merchants Bank was established in 1987 and has 467 branches in 35 major mainland cities, a branch in Hong Kong and a representative office in New York.

China's gross domestic product expanded 11.9 percent in the second quarter, the fastest pace in 12 years.