Are US Corporations Borrowing So Much If Profits Are At A Record Percentage Of GDP?

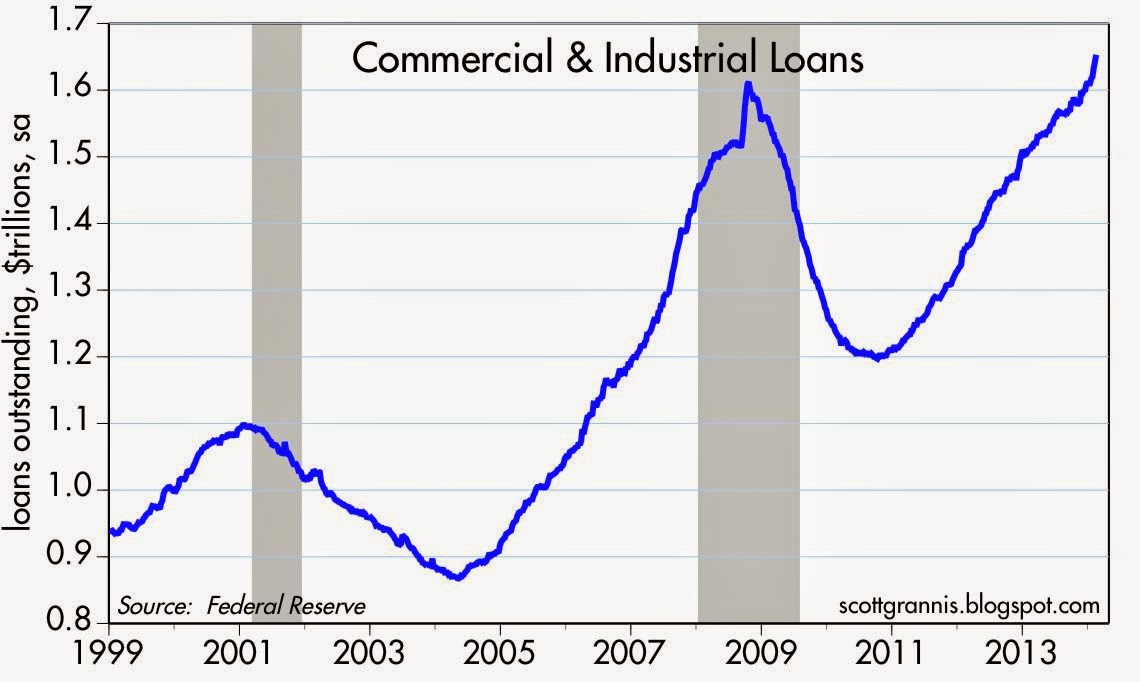

Reuters has noted that US lending for commercial and industrial purposes rose at an annualised pace of 26.4% in February, the biggest such spike since the fall of Lehman. The economic bulls will have you think that this is a sign of rising confidence in the economy and diminished uncertainty, which is finally generating the long expected pickup in investment that so far has been allusive.

But it"s worthwhile questioning that narrative, as it is just as likely that companies accessing liquidity because of fear of a slowdown. Despite the age of capital stock and intellectual property, investment is thin on the ground. The latest Deloitte survey of company executives showed plans for reduced capex this year compared to plans this time last year.

The second possibility is that companies are taking out loans, usually from existing committed facilities, at a faster pace which is symptomatic of distressed borrowing amidst a slowing economy. Even though stated profits remain very high, the large decline in the public sector fiscal deficit argues strongly that there has been at least something of a decline in the corporate profit rate and financial surplus over the last several years. Indeed, if the current account data in the National Flow of Funds, and the budgetary data presented by the OMB are correct, then by accounting identity, financial surpluses must be going down and that it is only via accounting chicanery that profits appear high relative to GDP....

...Bear in mind that the latest US non-financial sector debt to GDP figure is 245.89%. It is down from the all time high of 247.6% in September 2009 but you will recall that was the result of the backward revision of GDP data in July 2013. Nevertheless it has been rising since Q3 last year, so again it would appear that, whatever the explanation for the increased loan growth is, it is not adding to the productive base of the economy; debt is once again rising relative to GDP. That shouldn"t be happening if corporate savings (profits) are booming.'

macrobits.pinetreecapital.com/...rofits-record-percentage-gdp/

(Verkleinert auf 49%)

'Being a contrarian is tough, lonely and generally right'