Aufrufe: 39

Aufrufe: 39

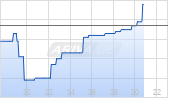

Maurel & Prom: Closing of the Acquisition of a 61% Interest in the Sinu-9 Gas Permit in Colombia

The transactions comprise two acquisitions, for a total consideration of $229 million:

- A 40% working interest acquired from MKMS Enerji Anonim Sirketi S.A. (a subsidiary of NG Energy International Corp). The agreement was signed on 9 February 2025, with effective economic date of 1 February 2025.

- An additional 21% working interest acquired from Desarrolladora Oleum S.A. de C.V. and Clean Energy Resources S.A.S, which includes the transfer of operatorship. The agreements were signed on 2 July 2025, with effective economic date at closing.

Taking into account the advance payments already made by M&P, the total outstanding consideration amounted to $185 million. Of this amount, $78 million was paid at closing, with the balance of $108 million payable in instalments during 2026.

Following the satisfaction of all remaining customary closing conditions, M&P now holds a 61% working interest in the Sinu-9 licence and assumes operatorship of the asset. M&P also retains an option to acquire an additional 5% working interest in Sinu-9 from NG Energy for a consideration of $18.75 million within 12 months, subject to adjustments for cash flows from the effective date on 1 February 2025.

Olivier de Langavant, Chief Executive Officer of M&P, declared: “We are very happy to have completed this acquisition and to become operator of the Sinu-9 licence. This marks the beginning of a new phase for M&P in Colombia. The teams are fully mobilised, and we are now focused on execution and value creation.”

Sinu-9 started production in November 2024 as part of the ongoing long-term test of the Magico-1X and Brujo-1X wells. Gross production capacity has been around 21 mmcfd since July, following the commissioning of the main plant. Evacuation infrastructure is in place today for gross production of 30 mmcfd, which will be increased to 40 mmcfd by Q2 2026. The start of the six-well exploration campaign is scheduled for February 2026.

Glossary

| French |

|

| English |

| pieds cubes | pc | cf | cubic feet |

| millions de pieds cubes par jour | Mpc/j | mmcfd | million cubic feet per day |

| milliards de pieds cubes | Gpc | bcf | billion cubic feet |

| baril | b | bbl | barrel |

| barils d’huile par jour | b/j | bopd | barrels of oil per day |

| millions de barils | Mb | mmbbls | million barrels |

| barils équivalent pétrole | bep | boe | barrels of oil equivalent |

| barils équivalent pétrole par jour | bep/j | boepd | barrels of oil equivalent per day |

| millions de barils équivalent pétrole | Mbep | mmboe | million barrels of oil equivalent |

For more information, please visit www.maureletprom.fr/en/

This document may contain forecasts regarding the financial position, results, business and industrial strategy of Maurel & Prom. By their very nature, forecasts involve risk and uncertainty insofar as they are based on events or circumstances which may or may not occur in the future. These forecasts are based on assumptions we believe to be reasonable, but which may prove to be incorrect and which depend on a number of risk factors, such as fluctuations in crude oil prices, changes in exchange rates, uncertainties related to the valuation of our oil reserves, actual rates of oil production rates and the related costs, operational problems, political stability, legislative or regulatory reforms, or even wars, terrorism and sabotage.

Maurel & Prom is listed on Euronext Paris

CAC Mid & Small – CAC All-Tradable – PEA-PME and SRD eligible

Isin FR0000051070 / Bloomberg MAU.FP / Reuters MAUP.PA

View source version on businesswire.com: https://www.businesswire.com/news/home/20260105338807/en/

Für dich aus unserer Redaktion zusammengestellt

Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte.