Date: 02.28.07

Time: 09:28pm

A Minor Bounce Provides Minor Hope

Rev Shark Investing

Greetings Shark Investors:

The major indices were able to regain a bit of lost ground on Wednesday, but given the carnage we saw the day before, it was not surprising to see at least a little reflexive bounce. However,

the bounce was rather mild and the action was choppy which indicates a high level of uncertainty and a general lack of conviction.

There are likely still plenty of folks just waiting to lighten up on their long-side positions at the first hint of further downside pressure. As we consider Tuesday’s pullback, the most important thing we need to focus on is not the huge point loss or the intensity of the selling, but rather if it signaled that a

change in the market’s character is underway. Over the past several months, an unusual confluence of positive economic data and corporate growth gave buyers the confidence to move aggressively on any weakness, and as stock prices moved higher, their confidence only grew. As a result,

the markets became technically extended and were long overdue for a significant pullback.

In Tuesday evening’s newsletter, we mentioned that

the technical analysis textbooks will tell you that you should move quickly to cash once there is a breach of key uptrend lines and support levels. Many critics will dismiss this as overly simplistic and just too obvious to be effective, but they are missing out on the important insights into investor psychology that technical analysis can provide.

Investors suffered both emotional and financial damage Tuesday, and it will take more than a 50 point rebound in the Dow to repair that.

Still, the bulls will say that the fact that we didn’t see more selling pressures today and that things were able to stabilize is a positive. However, the bears will reply that, with so many stocks taking a severe drubbing, they would have expected bargain hunters to move around with a bit more assurance. However, given that the bulls have stepped in so many times to save this market over the past seven months, we need to give them room to prove that they have the juice to stave off any possible sustained downtrend.

Meanwhile, a pullback like we saw Tuesday creates terrific opportunities in small stocks. These names will get sucked into the down-draft, but are oftentimes unfairly punished as folks look to unload their positions no matter the cost. We have been complaining for a long time that we have not been able to find prudent entry-points in a great number of these names, and yesterday’s correction may have fixed that to some degree.

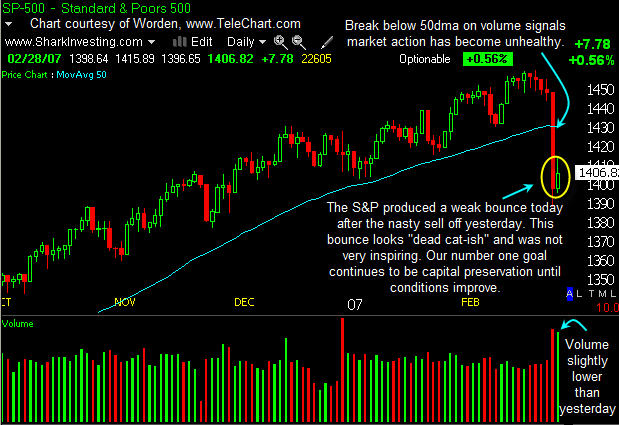

Let’s go to the charts.

The Nasdaq edged slightly higher today on declining volume. Technology names notched minor gains as many of the stocks that took huge hits yesterday produced feeble bounces on light volume. The action today looked very “dead cat-ish,” and we think that there could be some more downside in the cards.

The S&P 500 [unten] posted modest gains during Wednesday’s session on lighter volume after taking a beating yesterday. After the magnitude of the drop yesterday, one can’t be too trusting of pops that occur on light volume like we saw today. Though we bounced, we continue to have major technical damage to repair, and we will remain in capital protection mode.

(Verkleinert auf 90%)

7.60 (0.13%)

7.60 (0.13%) #080">16.60 #080">(0.41%)

#080">16.60 #080">(0.41%)