fundamental ein solider Wert, mit weiterer Wachstumsphantasie.

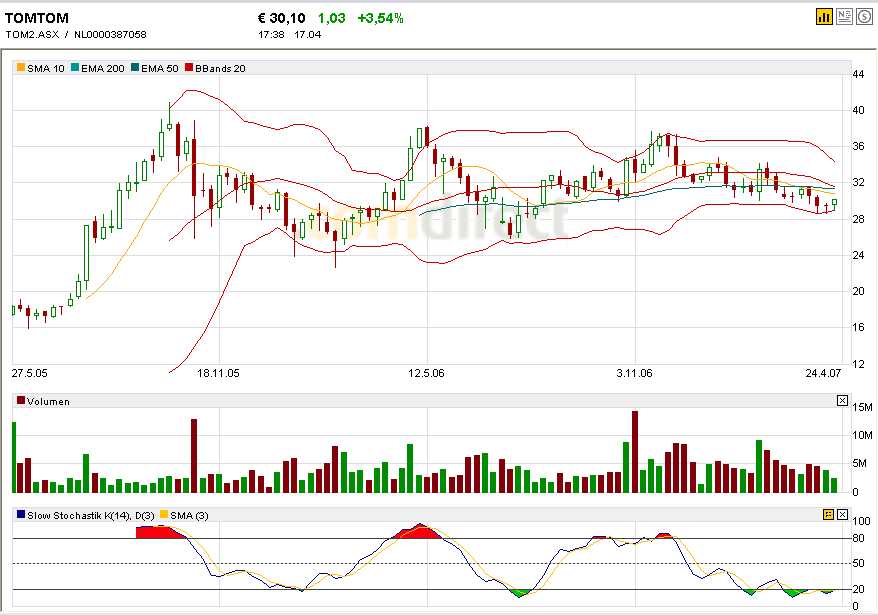

Auch vom Chart her ist TomTom interessant: Nach einer längeren Seitwärtsbewegung ist die Aktie momentan überverkauft und die engen Bollinger Bänder in der Wochenansicht deuten eine dynamische Bewegung an.

In der Annahme, dass gute Zahlen präsentiert werden, dürfte der Kurs in den nächsten Tagen weiter steigen.

Zur Information sind hier die letzten Quartalszahlen (inklusive Ausblick für 2007) präsentiert am 22. Februar 2007:

Fourth quarter results release 2006

TomTom Reports Fourth Quarter and Full Year Results 2006

Record Quarterly Revenue and Earnings

Fourth quarter financial highlights

Compared with Q4 2005

• Revenue increased by 65% to €478 million

• 1.9 million portable navigation devices (PNDs) shipped, up 146%

• Gross margin increased by 3 percentage points to 46%

• Operating margin increased by 3 percentage points to 26%

• Net profit increased by 67% to €80 million

• Fully diluted EPS increased by 66% to €0.68

• Cash generated from operations of €132 million

Compared with Q3 2006

• Revenue increased by 35%

• PNDs shipped increased by 62%

• Gross margin increased by 2 percentage points

• Fully diluted EPS increased by 10%

Full year highlights

• Revenue increased by 89% to €1,364 million

• 4.7 million PNDs shipped, up 178%

• Net profit increased by 55% to €222 million

• Fully diluted EPS increased by 51% to €1.90

• Cash balances increased by €260 million to €438 million

Fourth quarter operational highlights

• Clear leadership of European market, market share of 50% during important quarter; Consolidated number two position in North American market; number of retail outlets increased by 4,000 to 20,000

• New TomTom ONE became world’s best selling PND

• Joint development announced with Vodafone to deliver a unique new advanced travel time information system in the Netherlands

Outlook 2007

We expect that the European and North American market for PNDs will together grow to around 18 million units in 2007, up from over 10 million units in 2006. Full year 2007 revenues are expected to be in the range of €1.6 billion to €1.8 billion. We continue to target a gross margin of around 40% of revenue and an operating margin of around 20% of revenue.

Key figures

(unaudited) (in € millions) Q4 ‘06 Q3 ‘06 Q4 ‘05 FY ‘06 FY ‘05 change

Revenue 478 353 289 1,364 720 89%

Gross profit 218 154 123 579 311 86%

Gross margin 46% 44% 43% 42% 43%

Operating profit 126 101 67 340 195 74%

Operating margin 26% 29% 23% 25% 27%

Net profit 80 73 48 222 143 55%

EPS – fully diluted (€ per share) 0.68 0.62 0.41 1.90 1.26 51%

(Verkleinert auf 63%)

Werbung

Werbung