Handelsbanken: New macro forecast: Stronger BRIC versus weaker PIGS

We expect no hard landing in China, no double-dip in the US, no collapse in the eurozone (yet!) - but the world economy needs monetary stimulus to accelerate out of the 2011 slowdown. We see clear signs that credit easing in China is having an impact on money and credit growth. This is likely to be followed by an upswing for BRIC imports. The US is pulling its weight already, but the eurozone remains a problem. The PIGS crisis is escalating, with Spain looking problematic. The ECB needs to undertake more easing to keep the banking system afloat. Relative to the Fed, the ECB will look increasingly soft; we expect the euro to continue its descent.

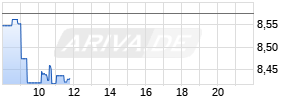

Many factors favour the USD over the EUR. A year ago, we made a call on the USD strengthening to around 1.15-1.20 versus the EUR. By the end of 2011, the EUR/USD came a little more than halfway to that point and has moved sideways since. None of the arguments favouring the dollar have weakened. Instead, it has become even clearer now that more needs to be done structurally in the eurozone to keep the system together. In the shorter term, the IMF and ESM will probably need to provide help in recapitalising banks. Until such measures are taken, the ECB has a crucial role to play to keep banks alive. Economic conditions are much worse than in the US and we expect the ECB to be much softer than the Fed during 2012-14; hence, we maintain our forecast of a weaker EUR.

FED will likely make a first hike in late-2013 as risk of inflation increases. Business sentiment rebounded modestly recently, but there are remaining economic problems. In a broader perspective, the labour market is far from normal, despite increasing employment since 2010. In the end, the prevailing high unemployment will likely have to be addressed through thorough structural reforms and not by general policy measures.

The Eurozone is divided. The northern part consisting of Germany stands strong along with a few others and will benefit from low interest rates and a further euro weakening. France is lagging behind, which will add to the political tensions already. However, the southern part is in bad shape. Now, Spain has come into focus again rather than Italy, and rightly so. Its massive bubble is continuing to deflate this year, impacting unemployment, banks and public finances. The ECB will need to ease more. Support ailing eurozone banks , cut rates, another LTRO as well as bond purchases are all increasingly likely as the crisis progresses.

China's economy is slowing, as expected, although the risk of a hard landing is abating. New stimulation is likely to be limited, however, as the focus is shifting to structural reforms needed to avoid the middle income trap. However, such reforms threaten the absolute power of the Communist Party. Thus, the recent political drama in Beijing is unlikely to be the last.

Most of the Swedish slowdown is likely over, but we find no strong drivers to lift the slumping economy in the short-term, despite strong growth potential. We anticipate a gradual acceleration in demand but forecast GDP growth remaining weak in 2012. Accordingly, we do not expect a turnaround in the labour market. Soft monetary policy should cushion domestic conditions, fuelling a gradual pick-up and eventually lifting growth above trend. However, this is unlikely to be enough to banish high unemployment. We assume that the government will maintain its cautious stance short term, delaying fiscal policy stimulation.

Jan Häggström, Chief Economist

For more information please call: +46 8 701 10 97, +46 70 761 4366

The owner of this announcement warrants that:

(i) the releases contained herein are protected by copyright and other applicable laws; and

(ii) they are solely responsible for the content, accuracy and originality of the

information contained therein.

Source: Handelsbanken via Thomson Reuters ONE

Mehr Nachrichten zur Svenska Handelsbanken AB A Aktie kostenlos abonnieren

(Mit der Bestellung akzeptierst du die Datenschutzhinweise)

Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte.