The Sherwin-Williams Company Reports 2023 Year-End and Fourth Quarter Financial Results

PR Newswire

CLEVELAND, Jan. 25, 2024

CLEVELAND, Jan. 25, 2024 /PRNewswire/ -- The Sherwin-Williams Company (NYSE: SHW) announced its financial results for the year and fourth quarter ended December 31, 2023. All comparisons are to the full year and fourth quarter of the prior year, unless otherwise noted.

- Consolidated net sales increased 4.1% in the year to a record $23.05 billion

- Net sales from stores in the Paint Stores Group open more than twelve calendar months increased 6.8% in the year

- Diluted net income per share increased 19.8% to $9.25 per share in the year compared to $7.72 per share in the full year 2022

- Adjusted diluted net income per share increased to $10.35 per share in the year compared to $8.73 per share in the full year 2022

- Diluted net income per share decreased 6.1% to $1.39 per share and adjusted diluted net income per share decreased 4.2% to $1.81 per share, in the fourth quarter of 2023

- Generated net operating cash of $3.52 billion, or 15.3% of net sales, in the year

- Adjusted Earnings Before Interest, Taxes, Depreciation and Amortization (Adjusted EBITDA) increased 17.5% in the year to $4.24 billion or 18.4% of net sales

- Full year 2024 diluted net income per share guidance in the range of $10.05 to $10.55 per share, including acquisition-related amortization expense of $0.80 per share

- Full year 2024 adjusted diluted net income per share guidance in the range of $10.85 to $11.35 per share

CEO REMARKS

"Sherwin-Williams delivered solid fourth quarter results, with positive sales growth and significant year-over-year gross margin improvement," said President and Chief Executive Officer, Heidi G. Petz. "We continued our accelerated growth investments in the quarter, which we are confident will continue to drive profitable above-market growth in future periods. Sales in all three reportable segments were within or better than our guidance. In our architectural businesses, commercial and residential repaint were the strongest performers, while DIY remained challenging. In our industrial businesses, growth varied by division and region, reflecting ongoing choppiness in the market. Paint Stores Group and Performance Coatings Group segment margins expanded year over year.

"For the full year, sales grew to a record $23.05 billion, gross margin expanded to 46.7% (which is well within our current targeted range) and adjusted diluted net income per share increased 18.6% to a record $10.35 per share. We generated strong net operating cash in the year, which enabled us to continue to invest in customer-focused innovation, while returning $2.06 billion to shareholders through dividends and share repurchases. From a segment perspective, Paint Stores Group overcame a difficult demand environment characterized by challenging conditions in new residential and existing home sales markets to deliver high-single digit percentage growth against a low-teens comparison, while also expanding its segment margin. Consumer Brands Group faced weak DIY demand, but grew in its targeted Pros Who Paint market and completed the divestiture of non-core aerosol product lines and its China architectural business. Performance Coatings Group generated sales growth in a market that was highly variable by region and business, further integrated recent acquisitions and delivered strong adjusted segment margin."

ARIVA.DE Börsen-Geflüster

Weiter abwärts?

| Kurzfristig positionieren in Sherwin-Williams Company | ||

|

HS3URE

| Ask: 0,80 | Hebel: 6,29 |

| mit moderatem Hebel |

Zum Produkt

| |

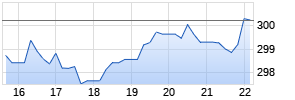

Kurse

|

| FOURTH QUARTER CONSOLIDATED RESULTS | |||||||

| | |||||||

| | Three Months Ended December 31, | ||||||

| | 2023 | | 2022 | | $ Change | | % Change |

| Net sales | $ 5,252.2 | | $ 5,230.5 | | $ 21.7 | | 0.4 % |

| Income before income taxes | $ 474.0 | | $ 494.9 | | $ (20.9) | | (4.2) % |

| As a % of net sales | 9.0 % | | 9.5 % | | | | |

| Net income per share - diluted | $ 1.39 | | $ 1.48 | | $ (0.09) | | (6.1) % |

| Adjusted net income per share - diluted | $ 1.81 | | $ 1.89 | | $ (0.08) | | (4.2) % |

Consolidated net sales increased primarily due to an increase in Paint Stores Group net sales volume. This growth was partially offset by lower net sales volumes in the Performance Coatings and Consumer Brands Groups.

Income before income taxes decreased primarily due to continued investments in long-term growth strategies, higher employee-related expense, including incentive-based compensation expense, and higher environmental expense, partially offset by moderating raw material costs year-over-year. Higher non-operating costs including a loss related to the significant devaluation of the Argentine Peso in December 2023 as part of economic reforms implemented by the government of Argentina (Argentine Devaluation) and impairment related to trademarks, also decreased Income before income taxes.

Diluted net income per share included charges of $0.19 per share for acquisition-related amortization expense, $0.16 per share related to the Argentine Devaluation and $0.07 associated with impairment related to trademarks.

| FOURTH QUARTER SEGMENT RESULTS | |||||||

| | |||||||

| Paint Stores Group (PSG) | |||||||

| | |||||||

| | Three Months Ended December 31, | ||||||

| | 2023 | | 2022 | | $ Change | | % Change |

| Net sales | $ 2,944.6 | | $ 2,877.0 | | $ 67.6 | | 2.3 % |

| Same-store sales (1) | 2.1 % | | 15.5 % | | | | |

| Segment profit | $ 567.3 | | $ 494.0 | | $ 73.3 | | 14.8 % |

| Reported segment margin | 19.3 % | | 17.2 % | | | | |

| | | | | | | | |

| (1) Same-store sales represents net sales from stores open more than twelve calendar months. | |||||||

Net sales in PSG increased primarily due to low-single digit percentage net sales volume growth driven by protective and marine, commercial and residential repaint end markets. PSG segment profit increased due to growth in net sales volume and moderating raw material costs, partially offset by continued investments in long-term growth strategies and higher employee-related expenses.

| Consumer Brands Group (CBG) | |||||||

| | |||||||

| | Three Months Ended December 31, | ||||||

| | 2023 | | 2022 | | $ Change | | % Change |

| Net sales | $ 692.3 | | $ 745.6 | | $ (53.3) | | (7.1) % |

| Segment profit | $ 3.6 | | $ 35.1 | | $ (31.5) | | (89.7) % |

| Reported segment margin | 0.5 % | | 4.7 % | | | | |

| Adjusted segment profit (1) | $ 74.7 | | $ 95.0 | | $ (20.3) | | (21.4) % |

| Adjusted segment margin | 10.8 % | | 12.7 % | | | | |

| | | | | | | | |

| (1) | Adjusted segment profit equals Segment profit excluding the impact of acquisition-related amortization expense, impairment related to trademarks, the Argentine Devaluation and restructuring costs. In CBG, acquisition-related amortization expense was $16.4 million and $18.8 million in the fourth quarter of 2023 and 2022, respectively, impairment related to trademarks and the loss related to the Argentine Devaluation were $23.9 million and $30.8 million, respectively, in the fourth quarter of 2023 and restructuring costs (including associated impairment related to trademarks) were $41.1 million in the fourth quarter of 2022. |

Mehr Nachrichten zur Sherwin-Williams Company Aktie kostenlos abonnieren

(Mit der Bestellung akzeptierst du die Datenschutzhinweise)

Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte.