Surge Copper Signs Option Agreement to Acquire a 70% Interest in The Berg Copper Project from Centerra Gold Inc.

PR Newswire

VANCOUVER, BC, Dec. 15, 2020

TSX-V Trading Symbol: SURG

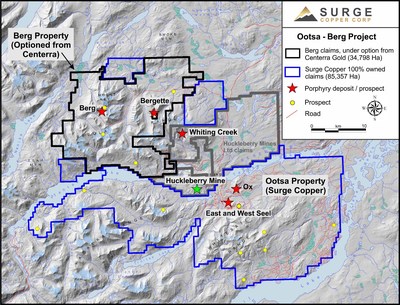

VANCOUVER, BC, Dec. 15, 2020 /PRNewswire/ - Surge Copper Corp. (TSXV: SURG) ("Surge" or the "Company") has entered into a definitive option agreement (the "Option Agreement") with Thompson Creek Metals Company Inc., a wholly owned subsidiary of Centerra Gold Inc., a TSX listed Company ("Centerra") whereby Surge will have the right to acquire a 70% interest in the Berg copper-molybdenum-silver project through issuing C$5 million in common shares of Surge and C$8 million in spending commitments, in each case, over a period of up to five years. Berg hosts a large porphyry copper-molybdenum-silver deposit located in the Tahtsa Ranges in central British Columbia. The main deposit at Berg is located approximately 28km northwest of Surge's Ootsa project on a 34,798 hectare tenement package which is contiguous with the Ootsa property. Berg is currently 100% owned by Centerra.

Dr. Shane Ebert, Chief Executive Officer of Surge, commented: "The acquisition of Berg is highly strategic to Surge, as it solidifies the Company's position in the district, and adds both significant, high quality historical resources, and a large, prospective land package. Surge is advancing a multitrack agenda of aggressive exploration and strategic copper district consolidation in British Columbia, and this transaction represents an important step in our path forward."

HIGHLIGHTS

- Definitive Option Agreement to acquire 70% interest in Berg

- Option includes $5 million in share payments to Centerra plus $8 million in project spending commitments over a period of five years

- 2018 resource estimate (classified as historical) of 397 Mt grading 0.44% CuEq in the Measured & Indicated categories, and 14 Mt grading 0.34% CuEq in the Inferred category(1). A qualified person has not done sufficient work to classify the historical estimate as a current mineral resource or reserve and Surge Copper is not treating it as a current mineral resource or reserve.

- Mineralization at Berg is close to surface, exhibits excellent vertical continuity, remains open at depth and radially outward, and is notable for having a significant supergene enrichment zone

- Project is contiguous with Surge's Ootsa property, and is located 22km northwest of the Huckleberry Mine and Mill Complex, in an area of B.C. with excellent transport, power, and water infrastructure

- Large land package with attractive pipeline of known porphyry and polymetallic hydrothermal vein targets, including 16 known magnetic anomalies developed through airborne geophysics

- Select historic drill hole highlights are shown in the table below

Table listing select historic holes drilled in 2011 by Thompson Creek Metals

| Hole | From (m) | To (m) | Interval (m) | Cu % | Mo % | Ag g/t | Cu Eq %* |

| BRG11-215 | 54.0 | 404.2 | 350.2 | 0.41 | 0.031 | 8.3 | 0.60 |

| including | 54.0 | 134.4 | 80.4 | 0.56 | 0.036 | 13.9 | 0.83 |

| BRG11-219 | 6.0 | 69.0 | 63.0 | 0.56 | 0.070 | 60.5 | 1.44 |

| BRG11-221 | 15.0 | 350.2 | 332.2 | 0.46 | 0.039 | 5.6 | 0.65 |

| including | 15.0 | 132.0 | 114.0 | 0.58 | 0.025 | 5.4 | 0.72 |

| BRG11-223 | 27.0 | 178.3 | 151.3 | 0.50 | 0.017 | 4.8 | 0.61 |

| BRG11-228 | 33.0 | 294.6 | 261.6 | 0.35 | 0.035 | 5.3 | 0.52 |

| BRG-11-229 | 15.5 | 325.4 | 309.9 | 0.46 | 0.016 | 4.6 | 0.56 |

| including | 15.5 | 191.5 | 176.0 | 0.63 | 0.020 | 4.8 | 0.75 |

| *Cu Eq. (copper equivalent) has been used to express the combined value of copper, molybdenum, and silver as a percentage of copper, and is provided for illustrative purposes only. No allowances have been made for recovery losses that may occur should mining eventually result. Calculations use metal prices of US $3/lb copper, $22 silver, and $10/lb molybdenum using the formula Cu Eq.% = Cu% + (Mo% x 3.33) + (Ag g/t x 0.0107). |

Details of the Berg Project

The Berg property sits immediately northwest of Imperial Metals' Huckleberry Mine and the Ootsa property sits immediately to the southeast. The Berg and Ootsa properties are adjoining on the west side and combined they cover the majority of the Seel-Huckleberry-Berg porphyry trend, having a total combined area of 120,155 hectares. Mineralization at the Berg deposit forms an annular shape around a broadly cylindrical, multi-phase intrusive stock known as the Berg Stock. The historic resources comprise two highly fractured mineralized zones in the northeast and southern portions of the annulus. Hypogene mineralization is characterized by several generations of veining, and a well-developed supergene enrichment blanket is superimposed on the hypogene mineralization.

A total of 53,754 metres over 215 holes have been completed on the deposit by prior operators including Kennecott, Placer Dome, Terrane Metals, and Thompson Creek Metals. Drilling in most areas of the Berg deposit remains wide-spaced and mineralization is open to depth and outward from the Berg Stock. The deposit has been shown to have excellent vertical continuity with significant mineralization intersected greater than 550m below surface.

Numerous metallurgical test programs have been conducted on mineralization at Berg, with a focus on developing a flowsheet to produce copper and molybdenum concentrates from both supergene and hypogene composite samples. Historical work has demonstrated that conventional flotation processes, comprised of primary grinding, rougher flotation, bulk rougher concentrate regrind, and three stage bulk cleaner flotation followed by conventional copper and molybdenum separation, can be used to produce marketable copper and molybdenum concentrates.

Historical Resource for The Berg Deposit(1)

| Category | M. | Cu % | Mo % | Ag g/t Werbung Mehr Nachrichten zur Centerra Gold Aktie kostenlos abonnieren

E-Mail-Adresse

Bitte überprüfe deine die E-Mail-Adresse.

Benachrichtigungen von ARIVA.DE (Mit der Bestellung akzeptierst du die Datenschutzhinweise) -1  Vielen Dank, dass du dich für unseren Newsletter angemeldet hast. Du erhältst in Kürze eine E-Mail mit einem Aktivierungslink. Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte. Andere Nutzer interessierten sich auch für folgende News |