Ovintiv Reports Fourth Quarter and Year-end 2022 Financial and Operating Results

PR Newswire

DENVER, Feb. 27, 2023

Company Delivers Record Financial Results and Significant Inventory Additions

Highlights:

Full Year 2022

- Generated net earnings of $3.6 billion, cash from operating activities of $3.9 billion, Non-GAAP Cash Flow of $4.1 billion and Non-GAAP Free Cash Flow of $2.3 billion after capital expenditures of $1.8 billion

- Reduced total long-term debt by approximately $1.2 billion; Non-GAAP Debt to Adjusted EBITDA ratio of 0.8 times at year-end, down from 1.5 times at year-end 2021

- Returned $958 million to shareholders through the combination of base dividend payments and share buybacks

- Added approximately 450 net premium drilling locations through inventory renewal program, replacing approximately 200% of full-year 2022 net wells turned in line ("TIL")

- Increased quarterly dividend payments by 25% to $1.00 per share annualized

- Delivered average annual production volumes of 510 thousand barrels of oil equivalent per day ("MBOE/d"), including 176 thousand barrels per day ("Mbbls/d") of oil and condensate, 86 Mbbls/d of other NGLs (C2 to C4) and 1,494 million cubic feet per day ("MMcf/d") of natural gas; all in line with Company guidance

Fourth Quarter 2022

- Generated fourth quarter net earnings of $1.3 billion, cash from operating activities of $875 million, Non-GAAP Cash Flow of $895 million and Non-GAAP Free Cash Flow of $537 million after capital expenditures of $358 million

- Delivered average quarterly production volumes of 524 MBOE/d, including 175 Mbbls/d of oil and condensate, 89 Mbbls/d of other NGLs and 1,561 MMcf/d of natural gas; all in line with Company guidance

2023 Outlook

- Announced 2023 capital program of approximately $2.15 to $2.35 billion, which is expected to deliver total production volumes of 500 to 525 MBOE/d

DENVER, Feb. 27, 2023 /PRNewswire/ - Ovintiv Inc. (NYSE: OVV) (TSX: OVV) ("Ovintiv" or the "Company") today announced its fourth quarter and year-end 2022 financial and operating results. The Company plans to hold a conference call and webcast at 9:00 a.m. MT (11:00 a.m. ET) on February 28, 2023. Please see dial-in details within this release, as well as additional details on the Company's website at www.ovintiv.com.

Ovintiv CEO Brendan McCracken said, "2022 was a milestone year for Ovintiv. At $2.3 billion, our team delivered a record Non-GAAP Free Cash Flow. We returned nearly $1 billion directly to our shareholders through our base dividend and share buybacks, we reduced long-term debt by approximately $1.2 billion and we expanded our drilling inventory with approximately 450 new premium return locations. These results demonstrate that our strategy is working, and our strong financial performance is translating into durable returns for our shareholders."

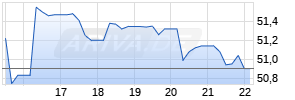

ARIVA.DE Börsen-Geflüster

Weiter aufwärts?

| Kurzfristig positionieren in Ovintiv Inc. | ||

|

HS0QJZ

| Ask: 9,14 | Hebel: 4,01 |

| mit moderatem Hebel |

Zum Produkt

| |

Kurse

|

Full Year and Fourth Quarter 2022 Financial and Operating Results

- The Company recorded full year net earnings of $3.6 billion, or $14.08 per diluted share of common stock.

- Fourth quarter net earnings totaled $1.3 billion, or $5.30 per diluted share of common stock.

- Full year cash from operating activities was $3.9 billion, Non-GAAP Cash Flow was $4.1 billion and capital investment totaled approximately $1.8 billion, resulting in $2.3 billion of Non-GAAP Free Cash Flow.

- Fourth quarter cash from operating activities was $875 million, Non-GAAP Cash Flow was $895 million and capital investment totaled approximately $358 million, resulting in $537 million of Non-GAAP Free Cash Flow.

- Average annual total production was approximately 510 MBOE/d, including 176 Mbbls/d of oil and condensate, 86 Mbbls/d of other NGLs and 1,494 MMcf/d of natural gas.

- Fourth quarter average total production was approximately 524 MBOE/d, including 175 Mbbls/d of oil and condensate, 89 Mbbls/d of other NGLs and 1,561 MMcf/d of natural gas.

2023 Guidance

The Company issued the following 2023 guidance:

| | 1Q 2023 | Full Year 2023 |

| Total Production (MBOE/d) | ~500 | 500 - 525 |

| Oil & Condensate (Mbbls/d) | ~160 | 165 - 175 |

| Other NGLs (Mbbls/d) | ~84 | 80 - 85 |

| Natural Gas (MMcf/d) | ~1,525 | 1,525 – 1,575 |

| Capital Investment ($ Millions) | $600 - $650 | $2,150 - $2,350 |

2023 Outlook

With 2023 capital investment of approximately $2.25 billion at the midpoint, the Company expects to deliver total production volumes of 500 to 525 MBOE/d. This range reflects a flat production program relative to 2022. During the first half of the year, Ovintiv plans to bring wells online which were drilled but uncompleted in the fourth quarter of 2022.This will result in slightly higher capital expenditures in the first half of the year.

Inventory Renewal

Over the year, the Company made significant additions to its premium drilling inventory across its asset base. The combination of low-cost bolt-on transactions and organic inventory appraisal and assessment added approximately 450 net premium drilling locations, or approximately twice the number of net wells drilled in 2022 for only $286 million of acquisition capital. The largest share of those additions occurred in the Permian asset where the additions were all offsetting existing company acreage in Martin, Midland, Upton, and Howard counties.

Returns to Shareholders

Through Ovintiv's capital allocation framework, the Company currently returns to shareholders 50% of the previous quarter's Non-GAAP Free Cash Flow after base dividends through share buybacks.

In the fourth quarter of 2022, the Company returned approximately $249 million to shareholders through share buybacks totaling approximately $188 million and its base dividend of approximately $61 million.

Full year shareholder returns totaled approximately $958 million, consisting of share buybacks of approximately $719 million and base dividend payments of approximately $239 million.

During the year, Ovintiv purchased for cancellation, approximately 14.7 million common shares at an average price of $49.08 per share.

First quarter 2023 shareholder returns are expected to total approximately $300 million, consisting of share buybacks of approximately $238 million and base dividend payments of approximately $61 million, bringing total direct shareholder returns since the third quarter of 2021 to approximately $1.4 billion, or approximately 9% of common shares outstanding, assuming the closing share price on February 24, 2023.

Continued Debt Reduction

Ovintiv reduced total long-term debt by approximately $1.2 billion in 2022. This represents approximately $3.3 billion of debt reduction since year-end 2020.

At year-end, the Company had $3.3 billion in total liquidity, which included available credit facilities of $3.5 billion, available uncommitted demand lines of $195 million, and cash and cash equivalents of $5 million, net of outstanding commercial paper of $393 million.

As of year-end, Ovintiv remained investment grade rated by four credit ratings agencies.

Dividend Declared

On February 27, 2023, Ovintiv's Board declared a quarterly dividend of $0.25 per share of common stock payable on March 31, 2023, to shareholders of record as of March 15, 2023.

Asset Highlights

Permian

Permian production averaged 122 MBOE/d (79% liquids) in the fourth quarter. The company had 16 net wells TIL.

In 2023, the Company plans to spend $850 to $950 million in the basin to run an average of three gross rigs and bring on 70 to 80 net wells.

Montney

Montney production averaged 216 MBOE/d (21% liquids) in the fourth quarter. The Company had 11 net wells TIL.

In 2023, the Company plans to spend $500 to $600 million in the basin to run an average of four gross rigs and bring on 70 to 80 net wells.

Uinta & Bakken

Uinta production averaged 20 MBOE/d (84% liquids) in the fourth quarter. The Company had three net wells TIL.

Bakken production averaged 32 MBOE/d (80% liquids) in the fourth quarter. The Company had six net wells TIL.

In 2023, the Company plans to spend $500 to $600 million combined in the Uinta and Bakken assets to run an average of two gross rigs, shared between the plays, to bring on 40 to 50 net wells.

Anadarko

Anadarko production averaged 128 MBOE/d (63% liquids) in the fourth quarter. The Company had eight net wells TIL.

In 2023, the Company plans to spend $200 to $300 million in the basin to run an average of one gross rig and bring on 25 to 30 net wells.

Year-End 2022 Reserves

SEC proved reserves at year-end 2022 were 2.3 billion BOE, of which approximately 50% were liquids and 57% were proved developed. Total proved reserves replacement excluding the impact of commodity prices was 135% of 2022 production. Ovintiv's reserve life index at year-end was 12.2 years.

NI 51-101 Exemption

The Canadian securities regulatory authorities have issued a decision document (the "Decision") granting Ovintiv exemptive relief from the requirements contained in Canada's National Instrument 51-101 Standards of Disclosure for Oil and Gas Activities ("NI 51-101"). As a result of the Decision, and provided that certain conditions set out in the Decision are met on an on-going basis, Ovintiv will not be required to comply with the Canadian requirements of NI 51-101 and the Canadian Oil and Gas Evaluation Handbook and, accordingly, will not be required to file Form 51-101F1 Statement of Reserves Data and Other Oil and Gas Information or related forms and disclosure as part of its annual filings. In lieu of such filings, the Decision permits Ovintiv to provide disclosure in respect of its oil and gas activities in the form permitted by, and in accordance with, the legal requirements imposed by the U.S. Securities and Exchange Commission ("SEC"), the Securities Act of 1933, the Securities and Exchange Act of 1934, the Sarbanes-Oxley Act of 2002 and the rules of the New York Stock Exchange. The Decision also provides that Ovintiv is required to file all such oil and gas disclosures with the Canadian securities regulatory authorities on www.sedar.com as soon as practicable after such disclosure is filed with the SEC.

For additional information, please refer to the Fourth Quarter and Year-end 2022 Results Presentation available on Ovintiv's website, www.ovintiv.com under Presentations and Events – Ovintiv.

Conference Call Information

A conference call and webcast to discuss the Company's fourth quarter and year-end results will be held at 9:00 a.m. MT (11:00 a.m. ET) on February 28, 2023.

To join the conference call without operator assistance, you may register and enter your phone number at https://bit.ly/3IGLDNX to receive an instant automated call back. You can also dial direct to be entered to the call by an Operator. Please dial 888-664-6383 (toll-free in North America) or 416-764-8650 (international) approximately 15 minutes prior to the call.

The live audio webcast of the conference call, including slides and financial statements, will be available on Ovintiv's website, www.ovintiv.com under Investors/Presentations and Events. The webcast will be archived for approximately 90 days.

Refer to Note 1 Non-GAAP measures and the tables in this release for reconciliation to comparable GAAP financial measures.

Capital Investment and Production

| (for the period ended December 31) | 4Q 2022 | 4Q 2021 | 2022 | 2021 |

| Capital Expenditures (1) ($ millions) | 358 | 421 | 1,831 | 1,519 |

| Oil (Mbbls/d) | 132.0 | 129.8 | 131.6 | 140.3 |

| NGLs – Plant Condensate (Mbbls/d) | 42.7 | 47.8 | 44.0 | 50.9 |

| Oil & Plant Condensate (Mbbls/d) | 174.7 | 177.6 | 175.6 | 191.2 |

| NGLs – Other (Mbbls/d) | 88.7 | 84.6 | 85.5 | 83.3 |

| Total Liquids (Mbbls/d) | 263.4 | 262.2 | 261.1 | 274.5 |

| Natural gas (MMcf/d) | 1,561 | 1,476 | 1,494 | 1,556 |

| Total production (MBOE/d) | 523.6 | 508.2 Werbung Mehr Nachrichten zur Ovintiv Inc. Aktie kostenlos abonnieren

E-Mail-Adresse

Bitte überprüfe deine die E-Mail-Adresse.

Benachrichtigungen von ARIVA.DE (Mit der Bestellung akzeptierst du die Datenschutzhinweise) -1  Vielen Dank, dass du dich für unseren Newsletter angemeldet hast. Du erhältst in Kürze eine E-Mail mit einem Aktivierungslink. Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte. Andere Nutzer interessierten sich auch für folgende News |