| EQS-Ad-hoc: Commerzbank Aktiengesellschaft / Key word(s): Miscellaneous Commerzbank has decided on new Capital Return Policy 28-Sep-2023 / 18:17 CET/CEST Disclosure of an inside information acc. to Article 17 MAR of the Regulation (EU) No 596/2014, transmitted by EQS News - a service of EQS Group AG. The issuer is solely responsible for the content of this announcement. Commerzbank expects an increased profitability of its businesses and with a CET1 ratio of 13.5% a net RoTE of more than 11% by 2027. On this basis Commerzbank’s Board of Managing Directors has decided to update the Bank’s Capital Return Policy following consultation with the Supervisory Board. For 2022 to 2024 Commerzbank intends to return €3bn to shareholders as dividends and share buy-backs. To reach this target, the pay-out ratio will be at least 70% for 2024. For the years 2025 to 2027 Commerzbank aims for a pay-out ratio well above 50% but not more than the net result after AT1 coupon payments and minorities. The pay-out is dependent on the economic development and business opportunities. Prerequisite for a dividend is a CET1 ratio of at least MDA + 250bp after distribution. Additional prerequisite for a share buy-back is a CET1 ratio of at least 13.5% after distribution. Each year the AGM decides on the dividend. Additional prerequisite for a share buy-back is the approval of the ECB and the German Finanzagentur. The full, revised Capital Return Policy will shortly be available on our website. (https://investor-relations.commerzbank.com/capital-return-policy/) The business plan for the years 2024 to 2027 will be published on the Capital Markets Update on 8 November 2023.

Disclaimer This release contains forward-looking statements. Forward-looking statements are statements that are not historical facts. In this release, these statements concern inter alia the expected future business of Commerzbank, efficiency gains and expected synergies, expected growth prospects and other opportunities for an increase in value of Commerzbank as well as expected future financial results, restructuring costs and other financial developments and information. These forward-looking statements are based on the management’s current plans, expectations, estimates and projections. They are subject to a number of assumptions and involve known and unknown risks, uncertainties and other factors that may cause actual results and developments to differ materially from any future results and developments expressed or implied by such forward-looking statements. Such factors include the conditions in the financial markets in Germany, in Europe, in the USA and other regions from which Commerzbank derives a substantial portion of its revenues and in which Commerzbank holds a substantial portion of its assets, the development of asset prices and market volatility, especially due to the ongoing European debt crisis, potential defaults of borrowers or trading counterparties, the implementation of its strategic initiatives to improve its business model, the reliability of its risk management policies, procedures and methods, risks arising as a result of regulatory change and other risks. Forward-looking statements therefore speak only as of the date they are made. Commerzbank has no obligation to update or release any revisions to the forward-looking statements contained in this release to reflect events or circumstances after the date of this release. Contact: Christoph Wortig Head of Investor Relations Commerzbank AG Investor Relations Tel.: +49 69 9353 10080 e-mail:ir@commerzbank.com 28-Sep-2023 CET/CEST The EQS Distribution Services include Regulatory Announcements, Financial/Corporate News and Press Releases. Archive at www.eqs-news.com |

| Language: | English |

| Company: | Commerzbank Aktiengesellschaft |

| Kaiserstraße 16 | |

| 60311 Frankfurt am Main | |

| Germany | |

| Phone: | +49 (069) 136 20 |

| Fax: | - |

| E-mail: | newsroom@commerzbank.com |

| Internet: | www.commerzbank.de |

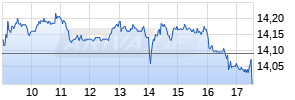

| ISIN: | DE000CBK1001 |

| WKN: | CBK100 |

| Indices: | DAX, CDAX, HDAX, PRIMEALL |

| Listed: | Regulated Market in Frankfurt (Prime Standard); Regulated Unofficial Market in Berlin, Dusseldorf, Hamburg, Hanover, Munich, Stuttgart, Tradegate Exchange |

| EQS News ID: | 1737403 |

| End of Announcement | EQS News Service |

| |

1737403 28-Sep-2023 CET/CEST