Vaisala Corporation Interim Report January–September 2023

Vaisala Corporation Interim Report October 27, 2023, at 9.00 a.m. (EEST)

Vaisala Corporation Interim Report January–September 2023

Q3 operating result increased following improvement in gross margin in an uncertain market environment

Third quarter 2023 highlights

- Orders received EUR 119.7 (129.5) million, decrease 8%

- Order book at the end of the period EUR 165.8 (162.5) million, increase 2%

- Net sales EUR 130.4 (133.3) million, decrease 2%

- Operating result (EBIT) EUR 25.2 (22.0) million, 19.3 (16.5) % of net sales

- Earnings per share EUR 0.51 (0.44)

- Cash flow from operating activities EUR 18.5 (7.3) million

January–September 2023 highlights

- Orders received EUR 381.0 (371.7) million, increase 3%

- Net sales EUR 393.0 (372.6) million, increase 5%

- Operating result (EBIT) EUR 50.3 (49.9) million, 12.8 (13.4) % of net sales

- Earnings per share EUR 0.99 (1.00)

- Cash flow from operating activities EUR 54.2 (7.1) million

Market development for the remaining 2023 and business outlook for 2023

Markets for high-end industrial instruments and life science have somewhat declined and we do not expect recovery yet this year. Markets for power and energy, and liquid measurements are expected to grow.

Markets for renewable energy as well as roads and automotive are expected to grow. Market for aviation is expected to be stable or to grow. Market for meteorology is expected to be stable.

Uncertainty in the business environment is high due to weak economic outlook, high inflation, and increased interest rates. The war in Ukraine and sanctions against Russia are not expected to have direct material impact on Vaisala’s operations, financial position or cash flow. The additional costs related to component spot purchases are expected to be insignificant in the fourth quarter.

Vaisala estimates that its full-year 2023 net sales will be in the range of EUR 530–560 million and its operating result (EBIT) will be in the range of EUR 65–75 million.

Vaisala’s President and CEO Kai Öistämö

“Vaisala’s third quarter 2023 reflected uncertainty in the business environment. Our quarterly net sales decreased slightly Y/Y following the continued soft demand for industrial products and services and headwinds from currency exchange rates. However, our gross margin improved clearly, and hence, our operating result reached 19.3% of net sales.

The demand for products and services for Industrial Measurements business area continued to be soft during the third quarter. The lower demand in industrial instruments, life science, as well as power and energy market segments led to a 14% decrease in orders received and 6% decrease in net sales Y/Y. However, we believe we have maintained our market position.

On the other hand, during the quarter, business environment for Weather and Environment business area was more resilient than in industrial measurements. The business area reached previous year’s level both in orders received and net sales. In order intake, aviation was the strongest market segment during the quarter.

Our gross margin improved clearly to 58% as additional costs related to component spot purchases have been fading away as expected and the sales mix in Weather and Environment business area was more favorable compared to previous year. The higher share of more profitable product and subscription sales played an important role in the business area’s gross margin improvement.

Our strategy execution continued as planned. In Weather and Environment business area, growth of subscription sales and growth businesses continued, and flagship business focused on profitability improvement. In Industrial Measurements business area, we continued our strategic investments in new technologies and products for long-term growth.

During the quarter, we also took the next steps on our journey of increasing climate action. In September, we submitted our science-based emission reduction targets for validation by the Science-Based Targets initiative (SBTi). We expect to receive approval from SBTi by February 2024.

The uncertainty in the business environment is expected to remain high during the fourth quarter of 2023. The additional costs related to component spot purchases are expected to be insignificant in the fourth quarter. We continue to estimate that our full-year 2023 net sales will be in the range of EUR 530–560 million and operating result (EBIT) to be in the range of EUR 65–75 million.”

| Key figures | |||||||

| MEUR | 7-9/ 2023 | 7-9/ 2022 | Change | 1-9/ 2023 | 1-9/ 2022 | Change | 1-12/ 2022 |

| Orders received | 119.7 | 129.5 | -8% | 381.0 | 371.7 | 3% | 500.8 |

| Order book | 165.8 | 162.5 | 2% | 165.8 | 162.5 | 2% | 154.6 |

| Net sales | 130.4 | 133.3 | -2% | 393.0 | 372.6 | 5% | 514.2 |

| Gross profit | 75.6 | 72.9 | 4% | 221.6 | 206.2 | 7% | 282.0 |

| Gross margin, % | 58.0 | 54.7 | 56.4 | 55.3 | 54.8 | ||

| Operating expenses | 50.4 | 50.9 | -1% | 171.5 | 156.6 | 10% | 219.7 |

| Operating result | 25.2 | 22.0 | 50.3 | 49.9 | 62.5 | ||

| Operating result, % | 19.3 | 16.5 | 12.8 | 13.4 | 12.2 | ||

| Result before taxes | 24.1 | 20.7 | 47.1 | 47.4 | 59.6 | ||

| Result for the period | 18.5 | 16.1 | 36.0 | 36.1 | 45.1 | ||

| Earnings per share | 0.51 | 0.44 | 15% | 0.99 | 1.00 | 0% | 1.24 |

| Return on equity, % | 19.0 | 20.1 | 18.7 | ||||

| Research and development costs | 13.6 | 13.6 | 0% | 49.6 | 45.0 | 10% | 62.4 |

| Capital expenditure | 4.1 | 3.3 | 26% | 10.9 | 9.6 | 13% | 13.7 |

| Depreciation, amortization and impairment | 6.2 | 5.9 | 5% | 18.2 | 17.3 | 5% | 23.6 |

| Cash flow from operating activities | 18.5 | 7.3 | 154% | 54.2 | 7.1 | 662% | 29.8 |

| Cash and cash equivalents | 65.8 | 52.1 | 26% | 55.5 | |||

| Interest-bearing liabilities | 62.8 | 76.0 | -17% | 63.4 | |||

| Gearing, % | -1.2 | 9.6 | 3.2 |

As of the beginning of 2023, Weather and Environment business area’s subscription business has been excluded from orders received and order book. Comparison period has been reported accordingly.

Financial review Q3/2023

Orders received and order book

| MEUR | 7-9/ 2023 | 7-9/ 2022 | Change | FX* | 1-12/ 2022 |

| Orders received | 119.7 | 129.5 | -8% | -2% | 500.8 |

| Order book, end of period | 165.8 | 162.5 | 2% | 154.6 |

* Change with comparable exchange rates

Third quarter 2023 orders received decreased by 8% compared to previous year and totaled EUR 119.7 (129.5) million. Orders received decreased in both business areas and in most of the market segments.

At the end of September 2023, order book amounted EUR 165.8 (162.5) million and increased by 2% compared to previous year. Order book increased in Weather and Environment business area but decreased in Industrial Measurements business area. EUR 93.5 (92.5) million of the order book is scheduled to be delivered in 2023.

Financial performance

| MEUR | 7-9/ 2023 | 7-9/ 2022 | Change | FX** | 1-12/ 2022 |

| Net sales | 130.4 | 133.3 | -2% | 2% | 514.2 |

| Product sales | 97.3 | 96.9 | 0% | 375.5 | |

| Project sales | 14.5 | 19.8 | -27% | 73.5 | |

| Service sales | 10.1 | 9.1 | 11% | 35.0 | |

| Subscription sales | 7.8 | 7.3 | 7% | 28.4 | |

| Lease income | 0.8 | 0.3 | 185% | 1.7 | |

| Gross margin, % | 58.0 | 54.7 | 54.8 | ||

| Operating result | 25.2 | 22.0 | 62.5 | ||

| % of net sales | 19.3 | 16.5 | 12.2 | ||

| R&D costs | 13.6 | 13.6 | 0% | 62.4 | |

| Amortization* | 2.1 | 2.1 | 8.2 |

* Amortization of intangible assets related to the acquired businesses

** Change with comparable exchange rates

Third quarter 2023 net sales decreased by 2% compared to previous year and were EUR 130.4 (133.3) million. In constant currencies, net sales increased by 2%. Net sales decreased in Industrial Measurements business area and were at previous year’s level in Weather and Environment business area. Net sales decreased in aviation, industrial instruments, and life science market segments. Net sales growth in renewable energy, roads and automotive, as well as in power and energy market segments was very strong.

Gross margin improved to 58.0 (54.7) %. Additional costs related to component spot purchases had a 0.7 (4.2) percentage point negative impact on gross margin.

Third quarter 2023 operating result increased compared to previous year following improvement in gross margin and was EUR 25.2 (22.0) million, 19.3 (16.5) % of net sales. Operating expenses were at previous year’s level.

Third quarter 2023 financial income and expenses were EUR -1.0 (-1.3) million. This was mainly a result of valuation of foreign currency denominated items, currency hedging and interest expenses. Income taxes were EUR 5.7 (4.7) million and estimated effective tax rate for the whole year was 23.4 (23.9) %. Result before taxes was EUR 24.1 (20.7) million and result for the period EUR 18.5 (16.1) million. Earnings per share was EUR 0.51 (0.44).

Financial review January–September 2023

Orders received and order book

| MEUR | 1-9/ 2023 | 1-9/ 2022 | Change | FX* | 1-12/ 2022 |

| Orders received | 381.0 | 371.7 | 3% | 5% | 500.8 |

| Order book, end of period | 165.8 | 162.5 | 2% | 154.6 |

* Change with comparable exchange rates

January–September 2023 orders received increased by 3% compared to previous year and totaled EUR 381.0 (371.7) million. Orders received grew in Weather and Environment business area but decreased in Industrial Measurements business area. Orders received grew very strongly in roads and automotive market segment, but on the other hand, decreased strongly in life science market segment.

Financial performance

| MEUR | 1-9/ 2023 | 1-9/ 2022 | Change | FX** | 1-12/ 2022 |

| Net sales | 393.0 | 372.6 | 5% | 8% | 514.2 |

| Product sales | 293.4 | 273.1 | 7% | 375.5 | |

| Project sales | 46.5 | 53.2 | -13% | 73.5 | |

| Service sales | 28.3 | 25.3 | 12% | 35.0 | |

| Subscription sales | 23.3 | 19.9 | 17% | 28.4 | |

| Lease income | 1.5 | 1.1 | 34% | 1.7 | |

| Gross margin, % | 56.4 | 55.3 | 54.8 | ||

| Operating result | 50.3 | 49.9 | 62.5 | ||

| % of net sales | 12.8 | 13.4 | 12.2 | ||

| R&D costs | 49.6 | 45.0 | 10% | 62.4 | |

| Amortization* | 6.2 | 6.1 | 8.2 |

* Amortization of intangible assets related to the acquired businesses

** Change with comparable exchange rates

January–September 2023 net sales increased by 5% compared to previous year and were EUR 393.0 (372.6) million. In constant currencies, net sales increased by 8%. Net sales grew in both business areas. Net sales increased very strongly in roads and automotive, renewable energy, industrial instruments as well as in power and energy market segments.

Gross margin improved to 56.4 (55.3) %. Additional costs related to component spot purchases had a 0.9 (2.5) percentage point negative impact on gross margin.

January–September 2023 operating result was at previous year’s level and totaled EUR 50.3 (49.9) million, 12.8 (13.4) % of net sales. Operating expenses increased due to investments in sales and marketing as well as in R&D and IT system renewal.

January–September 2023 financial income and expenses were EUR -3.3 (-2.5) million. This was mainly a result of valuation of foreign currency denominated items, currency hedging and interest expenses. Income taxes were EUR 11.0 (11.3) million and estimated effective tax rate for the whole year was 23.4 (23.9) %. Result before taxes was EUR 47.1 (47.4) million and result for the period EUR 36.0 (36.1) million. Earnings per share was EUR 0.99 (1.00).

Statement of financial position, cash flow and financing

Vaisala’s financial position remained strong during January–September 2023. At the end of September, statement of financial position totaled EUR 432.9 (Dec 31, 2022: 439.2) million. Cash and cash equivalents totaled EUR 65.8 (Dec 31, 2022: 55.5) million. Dividend payment, decided by the Annual General Meeting on March 28, 2023, totaled EUR 26.1 million.

In January–September 2023, cash flow from operating activities increased to EUR 54.2 (7.1) million. Change in net working capital was EUR 0.4 (-48.8) million and this was mainly a result of decrease in trade receivables.

On September 30, 2023, Vaisala had interest-bearing borrowings totaling EUR 50.0 (Dec 31, 2022: 52.5) million. EUR 50 million of the interest-bearing borrowings related to an unsecured term loan, which is due in 2026. The loan has a financial covenant (gearing) tested semi-annually. Vaisala had not issued any domestic commercial papers on September 30, 2023 (Dec 31, 2022: EUR 12.5 million). Vaisala has also a EUR 50 million committed revolving credit facility, which was undrawn on September 30, 2023, as at the end of 2022. In addition, interest-bearing lease liabilities totaled EUR 12.8 (Dec 31, 2022: 10.9) million.

Capital expenditure

In January–September 2023, capital expenditure in intangible assets and property, plant, and equipment totaled EUR 10.9 (9.6) million. Capital expenditure was mainly related to investments in machinery and equipment to develop and maintain Vaisala’s production, R&D, and service operations as well as facilities.

Depreciation, amortization, and impairment were EUR 18.2 (17.3) million. This included EUR 6.2 (6.1) million of amortization of identified intangible assets related to the acquired businesses.

Personnel

The average number of personnel employed during January–September 2023 was 2,328 (2,115). At the end of September 2023, the number of employees was 2,328 (Dec 31, 2022: 2,235). 77 (77) % of employees were located in EMEA, 16 (16) % in Americas and 7 (8) % in APAC. 66 (66) % of employees were based in Finland.

Q3 and January–September 2023 review by business area

Industrial Measurements business area

| MEUR | 7-9/ 2023 | 7-9/ 2022 | Change | FX** | 1-9/ 2023 | 1-9/ 2022 | Change | FX** | 1-12/ 2022 |

| Orders received | 50.4 | 58.8 | -14% | -8% | 163.0 | 169.8 | -4% | 0% | 234.2 |

| Order book, end of period | 34.3 | 39.1 | -12% | 34.3 | 39.1 | -12% | 41.8 | ||

| Net sales | 53.9 | 57.6 | -6% | 0% | 169.8 | 165.3 | 3% | 6% | 225.6 |

| Product sales | 48.8 | 53.0 | -8% | 154.9 | 152.4 | 2% | 208.1 | ||

| Service sales | 5.1 | 4.6 | 11% | 14.8 | 13.0 | 14% | 17.5 | ||

| Gross margin, % | 64.0 | 60.9 | 62.2 | 62.8 | 61.9 | ||||

| Operating result | 14.7 | 14.6 | 36.5 | 40.7 | 51.5 | ||||

| of net sales, % | 27.3 | 25.3 | 21.5 | 24.6 | 22.8 | ||||

| R&D costs | 5.1 | 5.8 | -13% | 19.2 | 18.6 | 3% | 25.3 | ||

| Amortization* | 0.4 | 0.4 | 1.2 | 1.2 | 1.7 |

* Amortization of intangible assets related to the acquired businesses

** Change with comparable exchange rates

Q3/2023 review

Industrial Measurements business area’s third quarter 2023 orders received decreased by 14% compared to previous year totaling EUR 50.4 (58.8) million. Orders received decreased in industrial instruments, life science, as well as in power and energy market segments. Orders received in liquid measurements market segment were at previous year’s level.

At the end of September 2023, Industrial Measurements business area’s order book amounted to EUR 34.3 (39.1) million and decreased by 12% compared to previous year. EUR 26.5 (28.7) million of the order book is scheduled to be delivered in 2023. Order book decreased in life science, power and energy, as well as in industrial instruments market segments. Order book for liquid measurements market segment was at previous year’s level.

Third quarter 2023 net sales were EUR 53.9 (57.6) million and decreased by 6% compared to previous year. In constant currencies, net sales were flat compared to previous year. Net sales decreased in life science and industrial instruments market segments and were at previous year’s level in liquid measurements market segment. Net sales in power and energy market segment grew very strongly.

Gross margin improved compared to previous year and was 64.0 (60.9) %. Additional costs related to component spot purchases had a 0.7 (6.3) percentage point negative impact on gross margin. Price pressure especially in China and unfavorable product mix burdened gross margin.

Industrial Measurements business area’s third quarter 2023 operating result was at previous year’s level and totaled EUR 14.7 (14.6) million, 27.3 (25.3) % of net sales. Operating expenses were at previous year’s level.

January–September 2023 review

Industrial Measurements business area’s January–September 2023 orders received decreased by 4% compared to previous year and totaled EUR 163.0 (169.8) million. Orders received decreased in life science and industrial instruments market segments and were at previous year’s level in power and energy market segment. Orders received in liquid measurements market segment increased compared to previous year.

January–September 2023 net sales increased by 3% compared to previous year and were EUR 169.8 (165.3) million. In constant currencies, net sales increased by 6%. Net sales grew in industrial instruments as well as in power and energy market segment, whereas net sales in liquid measurements market segment were at previous year’s level. Net sales in life science market segment decreased compared to previous year.

Gross margin was at previous year’s level 62.2 (62.8) %. Additional costs related to component spot purchases had a 1.2 (3.4) percentage point negative impact on gross margin. Price pressure especially in China and unfavorable product mix burdened gross margin.

Industrial Measurements business area’s January–September 2023 operating result decreased compared to previous year following increase in operating expenses and totaled EUR 36.5 (40.7) million, 21.5 (24.6) % of net sales. Operating expenses increased due to investments in sales and marketing as well as in R&D and IT system renewal.

Weather and Environment business area

| MEUR | 7-9/ 2023 | 7-9/ 2022 | Change | FX** | 1-9/ 2023 | 1-9/ 2022 | Change | FX** | 1-12/ 2022 |

| Orders received | 69.3 | 70.7 | -2% | 2% | 218.1 | 201.9 | 8% | 10% | 266.6 |

| Order book, end of period | 131.5 | 123.4 | 7% | 131.5 | 123.4 | 7% | 112.8 | ||

| Net sales | 76.4 | 75.7 | 1% | 4% | 223.3 | 207.3 | 8% | 9% | 288.6 |

| Product sales | 48.5 | 43.9 | 10% | 138.5 | 120.7 | 15% | 167.4 | ||

| Project sales | 14.5 | 19.8 | -27% | 46.5 | 53.2 | -13% | 73.5 | ||

| Service sales | 5.0 | 4.5 | 11% | 13.5 | 12.4 | 9% | 17.5 | ||

| Subscription sales | 7.8 | 7.3 | 7% | 23.3 | 19.9 | 17% | 28.4 | ||

| Lease income | 0.8 | 0.3 | 185% | 1.5 | 1.1 | 34% | 1.7 | ||

| Gross margin, % | 53.7 | 49.9 | 52.0 | 49.5 | 49.3 | ||||

| Operating result | 10.4 | 7.5 | 13.6 | 9.3 | 11.1 | ||||

| of net sales, % | 13.7 | 9.9 | 6.1 | 4.5 | 3.8 | ||||

| R&D costs | 8.5 | 7.8 | 9% | 30.5 | 26.4 | 16% | 37.2 | ||

| Amortization* | 1.7 | 1.7 | 5.0 | 4.9 | 6.6 |

* Amortization of intangible assets related to the acquired businesses

** Change with comparable exchange rates

Q3/2023 review

Weather and Environment business area’s third quarter 2023 orders received decreased by 2% compared to previous year and totaled EUR 69.3 (70.7) million. Orders received decreased in meteorology market segment, whereas orders received in aviation market segment increased very strongly. Orders received in roads and automotive as well as in renewable energy market segments were at previous year’s level.

At the end of September 2023, Weather and Environment business area’s order book amounted to EUR 131.5 (123.4) million and increased by 7% compared to previous year. EUR 67.0 (63.9) million of the order book is scheduled to be delivered in 2023. Order book increased in roads and automotive as well as in aviation market segments, whereas order book in meteorology and renewable energy market segments were at previous year’s level.

Third quarter 2023 net sales were at previous year’s level and totaled EUR 76.4 (75.7) million. In constant currencies, net sales increased by 4%. Net sales grew very strongly in renewable energy as well as in roads and automotive market segments but decreased strongly in aviation market segment. Net sales in meteorology market segment grew somewhat.

Gross margin improved compared to previous year and was 53.7 (49.9) %. Additional costs related to component spot purchases had a 0.6 (2.5) percentage point negative impact on gross margin. Higher share of more profitable product and subscription sales improved gross margin.

Weather and Environment business area’s third quarter 2023 operating result increased compared to previous year following improved gross margin and totaled EUR 10.4 (7.5) million, 13.7 (9.9) % of net sales. Operating expenses were at previous year’s level.

January–September 2023 review

Weather and Environment business area’s January–September 2023 orders received increased by 8% compared to previous year and totaled EUR 218.1 (201.9) million. Orders received grew in roads and automotive, meteorology and aviation market segments, whereas orders received in renewable energy market segment were at previous year’s level. Growth of orders received was very strong in roads and automotive market segment.

January–September 2023 net sales were EUR 223.3 (207.3) million and increased by 8% compared to previous year. In constant currencies, net sales increased by 9%. Net sales grew very strongly in roads and automotive as well as in renewable energy market segments and decreased in aviation market segment. Net sales in meteorology market segment were at previous year’s level.

Gross margin improved compared to previous year and was 52.0 (49.5) %. Additional costs related to component spot purchases had a 0.7 (1.8) percentage point negative impact on gross margin. Higher share of more profitable product and subscription sales improved gross margin.

Weather and Environment business area’s January–September 2023 operating result increased compared to previous year following growth in net sales and improved gross margin and totaled EUR 13.6 (9.3) million, 6.1 (4.5) % of net sales. Operating expenses increased due to investments in sales and marketing as well as in R&D and IT system renewal.

Changes in Leadership Team

On May 6, 2023, Heli Lindfors started as Chief Financial Officer and member of the Vaisala Leadership Team. Vaisala’s Chief Sustainability and Strategy Officer Anne Jalkala was appointed member of the Vaisala Leadership Team as of May 5, 2023. They report to President and CEO Kai Öistämö.

Members of the Vaisala Leadership Team on September 30, 2023

- Kai Öistämö, President and CEO, Chair of the Leadership Team

- Anne Jalkala, Chief Sustainability and Strategy Officer

- Sampsa Lahtinen, EVP, Industrial Measurements business area

- Timo Leskinen, EVP, Human Resources

- Heli Lindfors, Chief Financial Officer

- Olli Nastamo, EVP, Operational Excellence

- Vesa Pylvänäinen, EVP, Operations

- Jarkko Sairanen, EVP, Weather and Environment business area

- Katriina Vainio, EVP, Group General Counsel

Annual General Meeting 2023

Vaisala Corporation’s Annual General Meeting was held on March 28, 2023. The meeting approved the financial statements and discharged the members of the Board of Directors and the President and CEO from liability for the financial period January 1–December 31, 2022.

Dividend

The Annual General Meeting decided a dividend of EUR 0.72 per share. The record date for the dividend payment was March 30, 2023, and the payment date was April 12, 2023.

Board of Directors

The Annual General Meeting confirmed that the number of Board members is eight. Petri Castrén, Antti Jääskeläinen, Petra Lundström, Jukka Rinnevaara, Kaarina Ståhlberg, Tuomas Syrjänen, Raimo Voipio and Ville Voipio will continue as members of the Board of Directors.

The Annual General Meeting confirmed that the annual remuneration payable to the Chairman of the Board of Directors is EUR 55,000 and each Board member EUR 40,000 per year. Approximately 40% of the annual remuneration will be paid in Vaisala Corporation’s series A shares acquired from the market and the rest in cash. In addition, the Annual General Meeting confirmed that the meeting fee for the Chairman of the Audit Committee would be EUR 1,500 per attended meeting and EUR 1,000 for each member of the Audit Committee and Chairman and each member of the People and Sustainability Committee, the Nomination Committee and any other committee established by the Board of Directors for a term until the close of the Annual General Meeting in 2024. The meeting fees are paid in cash. Possible travel expenses are reimbursed according to the travel policy of the company.

Auditor

The Annual General Meeting elected PricewaterhouseCoopers Oy as the auditor of the company and APA Niina Vilske will act as the auditor with the principal responsibility. The Auditors are reimbursed according to invoice presented to the company.

Proposal by the Board of Directors to amend the articles of association

The Annual General Meeting resolved to amend the articles of association so that the § 6 of Articles of Association stipulates that the term of Board members from now on terminates on the closing of the first Annual General Meeting, and the number of board members is 6–9, and § 13 of Articles of Association stipulates that a general meeting can be organized without a meeting venue as a so-called remote meeting.

Authorization for the directed repurchase of own series A shares

The Annual General Meeting authorized the Board of Directors to resolve on the directed repurchase of a maximum of 800,000 of the company's own series A shares in one or more instalments by using company's unrestricted equity. The authorization is valid until the closing of the next Annual General Meeting, however, no longer than September 28, 2024.

Authorization on the issuance of the company's own series A shares

The Annual General Meeting authorized the Board of Directors to resolve on the issuance of a maximum of 935,976 company's own series A shares. The issuance of own shares may be carried out in deviation from the shareholders' pre-emptive rights (directed issue). The authorization entitles the issuance of treasury series A shares as a directed issue without payment as part of the company's share-based incentive plan. The subscription price of the shares can instead of cash also be paid in full or in part as contribution in kind. The authorization is valid until September 28, 2024. The authorization for the company's incentive program shall however be valid until March 28, 2027.

The organizing meeting of the Board of Directors

At its organizing meeting held after the Annual General Meeting the Board elected Ville Voipio as the Chair of the Board of Directors and Raimo Voipio as the Vice Chair.

Kaarina Ståhlberg was elected as the Chair and Petri Castrén, Antti Jääskeläinen and Raimo Voipio as members of the Audit Committee. Ville Voipio was elected as the Chair and Petra Lundström, Jukka Rinnevaara and Tuomas Syrjänen as members of the People and Sustainability Committee. Ville Voipio was elected as the Chair and Petra Lundström, Kaarina Ståhlberg and Raimo Voipio as members of the Nomination Committee. The Chair and all members of the Audit Committee, People and Sustainability Committee as well as Nomination Committee are independent both of the company and of significant shareholders.

Shares and shareholders

Share capital and shares

Vaisala’s share capital totaled EUR 7,660,808 on September 30, 2023. Vaisala has 36,436,728 shares, of which 6,731,092 are series K shares and 29,705,636 series A shares. The series K shares and series A shares are differentiated by the fact that each series K share entitles its owner to 20 votes at a General Meeting of Shareholders while each series A share entitles its owner to 1 vote. The series A shares represented 81.5% of the total number of shares and 18.1% of the total votes. The series K shares represented 18.5% of the total number of shares and 81.9% of the total votes.

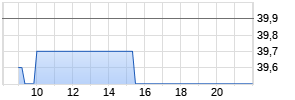

Trading and share price development

In January–September 2023, a total of 2,430,758 series A shares with a value totaling EUR 95.1 million were traded on the Nasdaq Helsinki Ltd. The closing price of the series A share on the Nasdaq Helsinki stock exchange was EUR 33.20. Shares registered a high of EUR 44.55 and a low of EUR 32.70. Volume-weighted average share price was EUR 39.14.

The market value of series A shares on September 30, 2023, was EUR 980.1 million, excluding company’s treasury shares. Valuing the series K shares – which are not traded on the stock market – at the rate of the series A share’s closing price on the last trading day of September, the total market value of all the series A and series K shares together was EUR 1,203.5 million, excluding company’s treasury shares.

Treasury shares

In September, a total of 500 of Vaisala’s Corporation’s treasury shares were conveyed without consideration to a person participating in the Restricted Share Unit Plan 2022–2026 under the terms and conditions of the plan. The directed share issue was based on an authorization given by the Annual General Meeting held on March 28, 2023.

In May 2023, the Board of Directors decided to exercise the authorization of the 2023 Annual General Meeting to repurchase own series A shares. The repurchases started on May 10, 2023, and ended on June 15, 2023. During this period, Vaisala repurchased a total of 50,000 own series A shares for an average price of EUR 42.4587 per share. The shares were repurchased in public trading on Nasdaq Helsinki Ltd. at the market price prevailing at the time of purchase. The shares are planned to be used as a reward payment for Vaisala’s share-based incentive plans.

In March 2023, a total of 72,511 of Vaisala Corporation's treasury shares were conveyed without consideration to the 43 key employees participating in the Performance Share Plan 2020–2022 under the terms and conditions of the plan. The directed share issue was based on an authorization given by the Annual General Meeting held on March 29, 2022.

The total number of series A treasury shares on September 30, 2023, was 185,476, which represents 0.6% of series A shares and 0.5% of total shares.

Shareholders

At the end of September 2023, Vaisala had 14,572 (13,605) registered shareholders. Ownership outside of Finland and nominee registrations represented 21.7 (21.1) % of the company's shares. Households owned 40.5 (40.3) %, private companies 13.5 (12.9) %, financial and insurance institutions 10.2 (11.7) %, non-profit organizations 10.0 (10.3) % and public sector organizations 4.1 (3.7) % of the shares.

More information about Vaisala’s shares and shareholders are presented on the company’s website at vaisala.com/investors.

Near-term risks and uncertainties

Inflationary environment and geopolitical situation including the war in Ukraine and the situation in the Middle East will affect economic situation and increase risk of achieving Vaisala’s financial targets.

Vaisala’s delivery capability may deteriorate due to disruptions in suppliers’ operations, Vaisala’s production or project delivery operation, or disruptions in incoming and/or outgoing logistics. Industrial actions in Finland may cause disruptions in Vaisala’s operations and deteriorate Vaisala’s delivery capability. Component availability has normalized during the year, but temporary component shortage may cause delays or interruptions in deliveries or generate additional material costs. Cyber risk and transition into new ERP system may impact operations and delivery capability.

New and changing regulations impacting product acceptance, operation’s capability to meet changing compliance requirements, and changes in international trade policies may cause delays or interruptions in supply chain. Customers’ preference for local manufacturing may reduce demand for Vaisala’s products and services. Customers’ budgetary constraints, complex decision-making processes, and missing financing solutions may postpone closing of infrastructure contracts in Weather and Environment business area.

Further information about risk management and risks are available on Annual Report’s Corporate Governance/Risk management section and on the company’s website at vaisala.com.

Events after reporting period

On October 5, 2023, Vaisala signed a EUR 50 million three-year unsecured revolving credit facility with two one-year extension options with two of its core banks. The facility agreement includes a financial covenant based on gearing, which is tested semi-annually. The revolving credit facility is for general corporate and working capital purposes. The arrangement replaced undrawn EUR 50 million facility signed in October 2018.

Financial calendar 2024

Financial Statement Release 2023: February 14, 2024

Annual Report 2023: Week 9

Interim Report January–March 2024: May 3, 2024

Half Year Financial Report 2024: July 25, 2024

Interim Report January–September 2024: October 24, 2024

Vantaa, October 26, 2023

Vaisala Corporation

Board of Directors

The forward-looking statements in this report are based on the current expectations, known factors, decisions, and plans of Vaisala's management. Although the management believes that the expectations reflected in these forward-looking statements are reasonable, there is no assurance that these expectations would prove to be correct. Therefore, the results could differ materially from those implied in the forward-looking statements, due to for example changes in the economic, market and competitive environments, regulatory or other government-related changes, or shifts in exchange rates.

Financial information and changes in accounting policies

This Interim Report has been prepared in accordance with IAS 34 Interim Financial Reporting, following the same accounting policies and principles as in the annual financial statements for 2022. All figures in this Interim Report are group figures. All presented figures have been rounded and consequently the sum of individual figures may deviate from the sum presented. The Interim Report is unaudited.

Preparation of Interim Report in accordance with IFRS requires Vaisala’s management to make estimates and assumptions that affect the valuation of the reported assets and liabilities and the recognition of income and expenses in statement of income. Although estimates are based on management’s best knowledge at the date of Interim Report, actual results may differ from those estimates.

New and amended IFRS standards effective for the year 2023

Amendments to IAS 1, IAS 1 and IFRS Practice Statement 2 as well as IAS 8 have been adopted from January 1, 2023. The adoption of these amendments is not expected to have an impact on the group’s consolidated financial statements in future periods.

Amendments to IAS 12 Income Taxes: Deferred Tax related to Assets and Liabilities arising from a Single Transaction

The amendments are effective for annual reporting periods beginning on or after January 1, 2023. Vaisala has applied the amendments in accordance with transition rule with the effect of initial application recognized as of January 1, 2022.

Mehr Nachrichten zur Vaisala Oy A Aktie kostenlos abonnieren

(Mit der Bestellung akzeptierst du die Datenschutzhinweise)

Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte.