The Sherwin-Williams Company Reports 2018 First Quarter Financial Results

PR Newswire

CLEVELAND, April 24, 2018

CLEVELAND, April 24, 2018 /PRNewswire/ --

- Consolidated net sales increased 43.6% in the quarter to a record $3.97 billion; Valspar sales increased consolidated net sales in the quarter by $1.07 billion, or 38.6%

- Diluted net income per common share increased 3.6% to $2.62 per share in the quarter

- Consolidated EPS in the first quarter of 2018 and 2017, excluding acquisition-related costs and purchase accounting impacts in both quarters, was $3.57 and $2.61 per share, respectively

- Charges of $.95 and $.08 per share were recorded in the first quarter of 2018 and 2017, respectively, for acquisition-related costs and purchase accounting impacts

- Earnings Before Interest, Taxes, Depreciation and Amortization (EBITDA) increased 44.0% in the quarter to $551.8 million

- Revising FY18 EPS guidance to $14.95 to $15.45 per share to include an estimated $.40 per share net reduction related to an expanded customer agreement primarily impacting Valspar operations, compared to $18.67 per share in FY17

- Consolidated FY18 EPS guidance, excluding one-time impacts and acquisition-related costs and purchase accounting impacts, is $18.35 to $18.95 per share, versus $15.07 per share on a comparable basis in FY17

- Consolidated FY18 EPS guidance includes charges of $3.40 to $3.50 per share for acquisition-related costs and purchase accounting impacts

- Consolidated FY17 EPS included a one-time benefit of $7.04 per share from deferred income tax reductions, partially offset by charges totaling $3.44 per share for discontinued operations, acquisition-related costs and purchase accounting impacts

The Sherwin-Williams Company (NYSE: SHW) announced its financial results for the first quarter ended March 31, 2018. Compared to the same period in 2017, consolidated net sales increased $1.20 billion, or 43.6%, to $3.97 billion in the quarter due primarily to the addition of Valspar sales, selling price increases and higher paint sales volume in The Americas Group. Excluding sales from Valspar, net sales from core Sherwin-Williams operations increased 4.9% in the quarter. As a result of the new revenue standard (ASC 606), certain advertising support that was previously classified as selling, general and administrative expenses is now classified as a reduction of revenue with no effect on net income. The new revenue standard did not have a material impact on consolidated net sales.

Diluted net income per common share in the quarter increased to $2.62 per share from $2.53 per share in 2017. First quarter 2018 diluted net income per common share included a $.95 per share charge from acquisition-related costs. Valspar operations increased EPS by $.68 per share in the quarter, including a $.40 per share charge from interest expense on new debt. Currency translation rate changes increased diluted net income per common share in the quarter by $.03 per share. First quarter 2017 diluted net income per common share included an $.08 per share charge from acquisition-related costs.

Net sales in The Americas Group increased 6.6% to $2.08 billion in the quarter due primarily to higher architectural paint sales volume across most end market segments and selling price increases. Net sales from stores in U.S. and Canada open for more than twelve calendar months increased 5.2% in the quarter over last year's comparable period. The Americas Group segment profit increased $32.2 million to $337.4 million in the quarter due primarily to higher paint sales volume and selling price increases, partially offset by increased raw material costs. Segment profit as a percent to net sales increased in the quarter to 16.2% from 15.6% last year.

Net sales of the Consumer Brands Group increased 103.0% to $656.4 million in the quarter due primarily to the inclusion of Valspar sales and selling price increases, partially offset by lower volume sales to some of the Group's retail customers. Valspar sales increased Group net sales 108.3% in the quarter. Currency translation rate changes increased net sales by 1.6%. The revenue reclassification related to the adoption of ASC 606 reduced net sales by 2.1%. Segment profit increased to $74.2 million in the quarter from $55.9 million last year due primarily to the inclusion of Valspar and selling price increases, partially offset by increased raw material costs. As a percent to net external sales, segment profit decreased in the quarter to 11.3% from 17.3% last year due primarily to acquisition-related impacts and higher raw material costs, partially offset by selling price increases. In the quarter, segment profit was increased by Valspar operations profit of $56.7 million, partially offset by purchase accounting amortization expense of $31.8 million.

The Performance Coatings Group's net sales stated in U.S. dollars increased 153.4% to $1.23 billion in the quarter due primarily to the inclusion of Valspar sales and selling price increases. Valspar sales contributed 148.1% to Group net sales in the quarter. Currency translation rate changes increased net sales by 3.9%. Stated in U.S. dollars, segment profit increased in the quarter to $90.8 million from $57.1 million last year due primarily to the inclusion of Valspar and selling price increases, partially offset by increased raw material costs. Currency translation rate changes increased segment profit $4.6 million in the quarter. As a percent to net external sales, segment profit decreased in the quarter to 7.4% from 11.8% last year. In the quarter, segment profit was increased by Valspar operations profit of $98.1 million, partially offset by purchase accounting amortization expense of $57.5 million.

ARIVA.DE Börsen-Geflüster

Weiter aufwärts?

| Kurzfristig positionieren in Sherwin-Williams Company | ||

|

ME56QD

| Ask: 3,15 | Hebel: 4,41 |

| mit moderatem Hebel |

Zum Produkt

| |

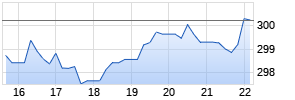

Kurse

|

The Company purchased 600,000 shares of its common stock in the three months ended March 31, 2018. At March 31, 2018, the Company had remaining authorization to purchase 11.05 million shares of its common stock through open market purchases.

Commenting on the first quarter, John G. Morikis, Chairman, President and Chief Executive Officer, said, "The Company performed well in the first quarter despite some widely recognized headwinds, including a slow start to the painting season in North America, persistent raw material inflation and choppy global economic growth. The contribution of the Valspar business to our consolidated revenue and profit continues to build momentum, and we saw positive sales volume, pricing and improving operating results from each of our reportable segments. The Americas Group posted another quarter of volume growth and profit improvement. Our Consumer Brands Group finalized a significantly expanded partnership with one of its largest retail customers which we expect will be accretive to net sales this year. The Performance Coatings Group had volume and sales growth across most of their businesses. Both Consumer Brands and Performance Coatings Groups have made great progress in integrating commercial teams and key business processes relating to pricing, selling and marketing programs.

"In the first three months, we opened 4 net new store locations in The Americas Group. During the quarter, we increased the dividend rate to $.86 from $.85 last year. Our cash generation remains strong, which has enabled us to resume open market treasury stock purchases after suspending these purchases for the last 8 quarters.

"For the second quarter, we anticipate our Sherwin-Williams' core net sales will increase a mid-to-high single digit percentage compared to last year's second quarter. In addition, we expect incremental sales from the Valspar acquisition to be approximately $600 million for April and May in the second quarter. For the full year 2018, we expect Sherwin-Williams' core net sales to increase by a mid-to-high single digit percentage compared to full year 2017. In addition, we expect incremental sales from Valspar for the first five months to be approximately $1.7 billion in 2018. With annual sales at that level, we anticipate our 2018 diluted net income per common share to be in the range of $14.95 to $15.45 per share, including an estimated $.40 per share net reduction related to an expanded customer agreement, compared to $18.67 per share earned in 2017. Full year 2018 diluted net income per common share guidance includes a $3.40 to $3.50 per share charge from costs associated with the acquisition of Valspar, and an increase of $2.30 to $2.50 per share from Valspar operations. The increase from Valspar operations includes interest expense on new debt of $1.65 per share for the full year and a $.40 per share net reduction related to an expanded customer agreement. We continue to expect our 2018 effective tax rate to be in the low-to-mid twenty percent range. Full year 2017 earnings per share included a one-time benefit of $7.04 per share from deferred income tax reductions, a one-time charge of $.44 per share for discontinued operations and a charge of $3.00 per share for acquisition-related cost and purchase accounting impacts."

The Company will conduct a conference call to discuss its financial results for the first quarter, and its outlook for the second quarter and full year 2018, at 11:00 a.m. EDT on Tuesday, April 24, 2018. The conference call will be webcast simultaneously in the listen only mode by Issuer Direct. To listen to the webcast on the Sherwin-Williams website, www.sherwin.com, click on About Us, choose Investor Relations, then select Press Releases and click on the webcast icon following the reference to the April 24th release. The webcast will also be available at Issuer Direct's Investor Calendar website, www.investorcalendar.com. An archived replay of the live webcast will be available at www.sherwin.com beginning approximately two hours after the call ends and will be available until May 14, 2018 at 5:00 p.m. EDT.

Founded in 1866, The Sherwin-Williams Company is a global leader in the manufacture, development, distribution, and sale of paints, coatings and related products to professional, industrial, commercial, and retail customers. The company manufactures products under well-known brands such as Sherwin-Williams®, Valspar®, HGTV HOME® by Sherwin-Williams, Dutch Boy®, Krylon®, Minwax®, Thompson's® Water Seal®, Cabot® and many more. With global headquarters in Cleveland, Ohio, Sherwin-Williams® branded products are sold exclusively through a chain of more than 4,900 company-operated stores and facilities, while the company's other brands are sold through leading mass merchandisers, home centers, independent paint dealers, hardware stores, automotive retailers, and industrial distributors. The Sherwin-Williams Performance Coatings Group supplies a broad range of highly-engineered solutions for the construction, industrial, packaging and transportation markets in more than 110 countries around the world. Sherwin-Williams shares are traded on the New York Stock Exchange (symbol: SHW). For more information, visit www.sherwin.com.

Regulation G Reconciliation

Management of the Company believes that investors' understanding of the Company's operating performance is enhanced by the disclosure of diluted net income per common share excluding the Valspar acquisition-related costs. This adjusted earnings per share measurement is not in accordance with U.S. generally accepted accounting principles (GAAP). It should not be considered a substitute for earnings per share computed in accordance with U.S. GAAP and may not be comparable to similarly titled measures reported by other companies. The following tables reconcile diluted net income per common share computed in accordance with U.S. GAAP to diluted net income per common share excluding the impact from the Valspar acquisition.

| | Three Months | | Year Ended | ||||||||

| | Ended | | December 31, 2018 | ||||||||

| | March 31, | | (guidance) | ||||||||

| | 2018 | | Low | | High | ||||||

| | | | | | | ||||||

| Diluted net income per common share | $ | 2.62 | | | $ | 14.95 | | | $ | 15.45 | |

| | | | | | | ||||||

| Transaction and integration costs | .24 | | | .75 | | | .85 | | |||

| Purchase accounting impacts | .71 | | | 2.65 | | | 2.65 | | |||

| Total acquisition costs | .95 | | | 3.40 | | | 3.50 | | |||

| | | | | | | ||||||

| Consolidated excluding Valspar acquisition costs | 3.57 | | | 18.35 | | | 18.95 | | |||

| | | | | | | ||||||

| Valspar operations income | 1.08 | | | 3.95 | | | 4.15 | | |||

| New debt interest expense | (.40) | | | (1.65) | | | (1.65) | | |||

| Total Valspar income contribution | .68 | | | 2.30 | | | 2.50 | | |||

| | | | | | | ||||||

| Adjusted diluted net income per common share | $ | 2.89 | | | $ | 16.05 | | | $ | 16.45 | |

| | Three Months | | Three Months | | Six Months | | Year | ||||||||

| | Ended | | Ended | | Ended | | Ended | ||||||||

| | March 31, | | June 30, | | June 30, | | December 31, | ||||||||

| | 2017 | | 2017 | | 2017 | | 2017 | ||||||||

| | | | | | | | | ||||||||

| Diluted net income per common share | $ | 2.53 | | | $ | 3.36 | | | $ | 5.90 | | | $ | 18.67 | |

| One-time charge related to discontinued operations | — | | | .44 | | | .44 Werbung Mehr Nachrichten zur Sherwin-Williams Company Aktie kostenlos abonnieren

E-Mail-Adresse

Bitte überprüfe deine die E-Mail-Adresse.

Benachrichtigungen von ARIVA.DE (Mit der Bestellung akzeptierst du die Datenschutzhinweise) -1  Vielen Dank, dass du dich für unseren Newsletter angemeldet hast. Du erhältst in Kürze eine E-Mail mit einem Aktivierungslink. Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte. Andere Nutzer interessierten sich auch für folgende News | ||||||||