Shepard Blasts Donegal Group CEO Nikolaus for Outrageous Potential Dilution of Shareholders

PR Newswire

BRADENTON, Fla., April 11, 2013

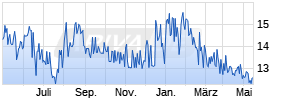

BRADENTON, Fla., April 11, 2013 /PRNewswire/ -- (NASDAQ: "DGICB") – Gregory M. Shepard announced today that he has sent a letter to Donegal Group Inc.'s ("Donegal") CEO and President, Don Nikolaus, demanding that he explain the extraordinarily high number of options granted to himself and other Donegal insiders and employees relative to industry peers at Donegal's upcoming Annual Meeting of Shareholders on April 18, 2013. The letter is available on the SEC's website at www.sec.gov, under Donegal Group or under Gregory Mark Shepard, as an attachment to Mr. Shepard's Schedule TO amendment filed today.

According to Mr. Shepard, "The number of Donegal Class A shares issuable upon the exercise of options granted through December 31, 2012, is approximately 33% of Donegal's total number of Class A shares outstanding, calculated on a fully diluted basis." Mr. Shepard continued, "I hired Duff & Phelps to assist me in compiling the numbers. The results show a staggering disregard on the part of Don Nikolaus and the Donegal Board of Directors for their shareholders, in my opinion. Don Nikolaus and the Board members have enriched themselves at the expense of shareholders."

According to Mr. Shepard, "The potential dilution to Donegal shareholders because of option grants far exceeds that of the peer companies listed by Donegal in its 2012 10-K. The peer companies listed by Donegal are Cincinnati Financial Corp. ("CINF"), Eastern Insurance Holdings Inc. ("EIHI"), EMC Insurance Group Inc. ("EMCI"), The Hanover Insurance Group, Inc. ("THG"), Horace Mann Educator's Corp. ("HMN"), Selective Insurance Group, Inc. ("SIGI"), State Auto Financial Corp. ("STFC"), Tower Group International, Ltd. (formerly Tower Group Inc.) ("TWGP") and United Fire and Casualty Co. ("UFCS"). The shares issuable upon the exercise of options granted through December 31, 2012 by these peer companies amount to 4.8%, 13.7%, 12.3%, 6.5%, 4.8%, 2.0%, 8.2%, and 2.2% of their respective total outstanding shares (data unavailable for United Fire)."

"In comparison, the Donegal Class A shares issuable upon the exercise of options granted as of December 31, 2012, are an astounding 33% of the total outstanding Class A shares – almost three times as high as the next closest peer group company," said Mr. Shepard.

Mr. Shepard continued, "Shame on Don Nikolaus and the Donegal Board of Directors. At the upcoming Annual Meeting of Shareholders, Don Nikolaus and the Board want shareholders to approve a new Class A stock option plan that would authorize the granting of options for yet another 4.5 million Class A shares, plus options for an additional 600,000 Class A shares to the Donegal directors, including the directors of Donegal Mutual. This is on top of the previously granted options for 6,700,825 Class A shares. Donegal currently has only approximately 20.1 million Class A shares and 5.6 million Class B shares outstanding."

"It is particularly ironic that Donegal declined to recommend my tender offer to Class B stockholders, in part because Donegal wants these new stock option plans approved," said Mr. Shepard.

Mr. Shepard added, "I first became a Donegal stockholder in 2005. At year-end 2005, Donegal had granted options for 735,802 Class A shares, representing approximately 5.2% of the 14,258,646 then-outstanding Class A shares and 4.0% of the 18,440,663 then-outstanding Class A and Class B shares combined. At the end of 2012, Donegal has granted options for 6,700,825 Class A shares, representing 33.5% of the 20,025,199 outstanding Class A Shares and 26.2% of the 25,601,974 outstanding Class A and Class B shares combined. The options have increased by 655% (i.e., 26.2% / 4.0%) in 7 years. That is outrageous. By comparison, Donegal's book value has only increased by a total of 13% in the last 5 years."

Mr Shepard asks stockholders to call Don Nikolaus, at 800-877-0600, and Jeffrey Miller, Senior Vice President and Chief Financial Officer, at 717-426-1931, if they are dissatisfied with the potential dilution to the shareholders.

On March 20, 2013, Gregory M. Shepard announced a tender offer for 962,636 of the outstanding shares of Class B Common Stock of Donegal at a price of $30 per Class B share (the "Offer"). The Offer represents approximately a 42% premium to the closing price of Donegal Class B shares on NASDAQ on March 19, 2013 – the last full trading day prior to the commencement of the Offer.

The Offer is not subject to any financing contingency. Other conditions apply to the Offer, including the tender of at least 925,000 Class B shares, insurance and bank regulatory approvals, expiration or early termination of the Hart-Scott-Rodino waiting period, and no litigation involving the Offer. Mr. Shepard is also seeking the appointment of three persons selected by him to the Donegal Board and the Board of Donegal Mutual Insurance Company ("Donegal Mutual"), as a condition of the Offer, without an increase in the size of each board from 12 directors.

The Offer will expire on April 19, 2013 at 11:59 p.m., New York City time, unless extended. Tenders of shares of Donegal's Class B Common Stock must be made prior to the expiration of the Offer and may be withdrawn at any time prior to the expiration of the Offer. Only shares properly tendered and not properly withdrawn pursuant to the Offer will be purchased. The Offer includes withdrawal rights so that a tendering shareholder can freely withdraw any shares prior to acceptance of such shares for payment under the Offer.

Mr. Shepard is the beneficial owner of 3,602,900 Class A shares and 397,100 Class B shares of Donegal, which he acquired at a total cost of $58.6 million. Mr. Shepard has been a Class A and a Class B shareholder of Donegal since 2005, and he is now by far Donegal's largest shareholder with the exception of Donegal Mutual.

This press release is neither an offer to purchase nor a solicitation of an offer to sell shares of Donegal. It does not purport to be complete and is qualified in its entirety by reference to the complete text of the Offer to Purchase and the related Letter of Transmittal, which contain important information that should be read carefully before any decision is made with respect to the Offer.

The Offer to Purchase and the related Letter of Transmittal and Notice of Guaranteed Delivery are filed with the SEC and are available through the SEC's website at http://www.sec.gov/. Any questions or requests for assistance or for additional copies of the Offer to Purchase, the related Letter of Transmittal and other related tender offer materials may be directed to the Information Agent at its address and telephone numbers set forth below, and copies will be furnished promptly at the Offeror's expense. The Information Agent for the Offer is: D.F. King & Co., Inc.,48 Wall Street, 22nd Floor, New York, NY 10005. Banks and Brokerage Firms please call collect: (212) 269-5550. All others call toll-free: (800) 967-5079. Email: information@dfking.com

Duff & Phelps' analysis was provided to Mr. Shepard, at his request and expense, solely for informational purposes. The analysis is derived from data sourced from third parties, and Duff & Phelps takes no responsibility for any inaccuracies, errors or omissions in the third party source data or the analysis, and Duff & Phelps offers no representations, warranties or assurances with respect to, and accepts no liability or responsibility in connection with, either the source data or the analysis.

THE OFFER IS NOT INTENDED TO AND DOES NOT CONSTITUTE (I) A SOLICITATION OF A PROXY, CONSENT OR AUTHORIZATION FOR OR WITH RESPECT TO THE ANNUAL MEETING OR ANY SPECIAL MEETING OF DONEGAL'S STOCKHOLDERS OR (II) A SOLICITATION OF A CONSENT OR AUTHORIZATION IN THE ABSENCE OF ANY SUCH MEETING.

SOURCE Gregory M. Shepard

Mehr Nachrichten zur Donegal Group B Aktie kostenlos abonnieren

(Mit der Bestellung akzeptierst du die Datenschutzhinweise)

Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte.