Shepard Amends Tender Offer for Donegal Group Class B Shares to Drop Director Condition and Waives Class A Option Condition, Extends Offer Until May 20, 2013

PR Newswire

BRADENTON, Fla., April 22, 2013

BRADENTON, Fla., April 22, 2013 /PRNewswire/ -- (NASDAQ: "DGICB") – Mr. Gregory Mark Shepard announced today that he has dropped the director representation condition and has waived the restriction on future grants of Class A options by Donegal Group Inc. ("Donegal"). He has also extended the Offer until May 20, 2013, to permit regulatory agencies to process the applications required before Mr. Shepard can acquire any additional Class B shares.

Based on information received from the Depositary, as of 5:00 p.m., New York City time, on April 19, 2013, approximately 362,745 shares of Class B common stock had been tendered and not withdrawn from the Offer, plus an additional 8,872 shares had been submitted by guaranteed delivery. Stockholders who have already tendered their shares do not have to re-tender their shares or take any other action as a result of the extension of the expiration date.

Mr. Shepard stated, "In Donegal's response to my Offer on Schedule 14D-9, one of its main objections was my condition that three of my designees be appointed to the Boards of Directors of Donegal and Donegal Mutual Insurance Company ("Donegal Mutual"). Today I drop that condition and I also waive the restriction on future grants of Class A options."

Mr. Shepard added, "Donegal has repeatedly and unfairly called my Offer 'illusory'. Well, if the Offer is illusory, it is only because of Donegal's actions to block the Class B stockholders from obtaining $30 per share. Now that I have dropped the director representation condition, and waived any condition against future grants of Class A options, Donegal should have no problem recommending my Offer to the Class B stockholders – since Donegal has voiced no objection to the adequacy of my $30 per share Offer price."

Mr. Shepard continued, "The success of the Offer is now substantially in the hands of Don Nikolaus, in my opinion. My tender offer is a litmus test as to whether Don Nikolaus has the best interests of shareholders at heart. If Don Nikolaus supports my Offer, the Class B shareholders will receive $30 per share. If Don Nikolaus does not support my Offer, then the shareholders will have Don Nikolaus to blame. I urge Class B shareholders to call Don Nikolaus at 800-877-0600, and Jeffrey Miller at 717-426-1931, to tell them that you want $30 per share for your Class B shares."

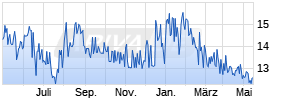

On March 20, 2013, Gregory M. Shepard announced a tender offer for 962,636 of the outstanding shares of Class B Common Stock of Donegal at a price of $30 per Class B share (the "Offer"). The Offer represents approximately a 42% premium to the closing price of Donegal Class B shares on NASDAQ on March 19, 2013 – the last full trading day prior to the commencement of the Offer.

The Offer is not subject to any financing contingency. Other conditions apply to the Offer, including the tender of at least 925,000 Class B shares, insurance and bank regulatory approvals, expiration or early termination of the Hart-Scott-Rodino waiting period, and no litigation involving the Offer.

The Offer will expire on May 20, 2013 at 11:59 p.m., New York City time, unless extended. Tenders of shares of Donegal's Class B Common Stock must be made prior to the expiration of the Offer and may be withdrawn at any time prior to the expiration of the Offer. Only shares properly tendered and not properly withdrawn pursuant to the Offer will be purchased. The Offer includes withdrawal rights so that a tendering shareholder can freely withdraw any shares prior to acceptance of such shares for payment under the Offer.

Mr. Shepard is the beneficial owner of 3,602,900 Class A shares and 397,100 Class B shares of Donegal, which he acquired at a total cost of $58.6 million. Mr. Shepard has been a Class A and a Class B shareholder of Donegal since 2005, and he is now by far Donegal's largest shareholder with the exception of Donegal Mutual.

This press release is neither an offer to purchase nor a solicitation of an offer to sell shares of Donegal. It does not purport to be complete and is qualified in its entirety by reference to the complete text of the Offer to Purchase and the related Letter of Transmittal, which contain important information that should be read carefully before any decision is made with respect to the Offer.

The Offer to Purchase and the related Letter of Transmittal and Notice of Guaranteed Delivery are filed with the SEC and are available through the SEC's website at http://www.sec.gov/. Any questions or requests for assistance or for additional copies of the Offer to Purchase, the related Letter of Transmittal and other related tender offer materials may be directed to the Information Agent at its address and telephone numbers set forth below, and copies will be furnished promptly at the Offeror's expense. The Information Agent for the Offer is: D.F. King & Co., Inc.,48 Wall Street, 22nd Floor, New York, NY 10005. Banks and Brokerage Firms please call collect: (212) 269-5550. All others call toll-free: (800) 967-5079. Email: information@dfking.com

THE OFFER IS NOT INTENDED TO AND DOES NOT CONSTITUTE (I) A SOLICITATION OF A PROXY, CONSENT OR AUTHORIZATION FOR OR ANY SPECIAL MEETING OF DONEGAL'S STOCKHOLDERS OR (II) A SOLICITATION OF A CONSENT OR AUTHORIZATION IN THE ABSENCE OF ANY SUCH MEETING.

SOURCE Gregory M. Shepard

Mehr Nachrichten zur Donegal Group B Aktie kostenlos abonnieren

(Mit der Bestellung akzeptierst du die Datenschutzhinweise)

Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte.