Scotiabank Economics Commodity Price Index Falls: Trade Frictions Weigh On Metal Demand Expectations, Canadian Crude Discounts Swell as Rail Lags

Canada NewsWire

TORONTO, Sept. 26, 2018

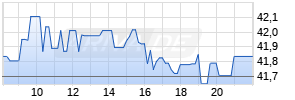

TORONTO, Sept. 26, 2018 /CNW/ - The Scotiabank Commodity Price Index retreated by 5.3% m/m in August, with all major sub-indices falling back on a combination of demand concerns stemming from the US-China trade dispute and shortcomings in North American crude oil transportation infrastructure.

Additional tariffs in the escalating US-China trade dispute have dampened the demand outlook for base metals like copper, detailed Scotiabank Commodity Economist Rory Johnston in his latest Commodity Price Index published by Scotiabank today.

"Base metals felt the brunt of US-China trade war headwinds but Chinese copper premiums have reached 3-year highs despite weaker global copper contracts, indicating that global bearishness concerning Chinese demand has likely run ahead of any actual slowdown in physical Chinese purchases", wrote Rory Johnston, Commodity Economist.

Other highlights of the September 26 2018 Report include:

- The US continues to ramp up trade pressure on China with tariffs on an additional $200B in Chinese exports.

- In an unlikely reversal, base metals are waning just as bulk commodities are picking up steam.

- Canadian crude discounts swell on the back of maxed out pipelines and oil-by-rail services that are failing to keep pace with voracious demand for alternative egress out of Western Canada.

Scotiabank Economics provides in-depth commentary on economic, financial market, and policy developments, both domestically and internationally.

Read the full September 26 2018 Scotiabank Commodity Price Index online here.

About Scotiabank

Scotiabank is Canada's international bank and a leading financial services provider in the Americas. We are dedicated to helping our 25 million customers become better off through a broad range of advice, products and services, including personal and commercial banking, wealth management and private banking, corporate and investment banking, and capital markets. With a team of more than 96,000 employees and assets of $947 billion (as at July 31, 2018), Scotiabank trades on the Toronto (TSX: BNS) and New York Exchanges (NYSE: BNS). Scotiabank distributes the Bank's media releases using Marketwired. For more information, please visit www.scotiabank.com and follow us on Twitter @ScotiabankViews.

SOURCE Scotiabank

Mehr Nachrichten zur Scotiabank SA Aktie kostenlos abonnieren

(Mit der Bestellung akzeptierst du die Datenschutzhinweise)

Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte.