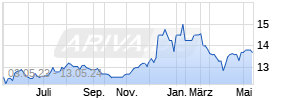

Mission Valley Bancorp Releases Strong First Quarter Results

PR Newswire

SUN VALLEY, Calif., May 9, 2013

SUN VALLEY, Calif., May 9, 2013 /PRNewswire/ -- Mission Valley Bancorp – (parent company of Mission Valley Bank (OTCBB: MVLY.OB)), reports first quarter (March 31, 2013) un-audited earnings of $318,000.

President and CEO Tamara Gurney stated, "I am pleased to report that 2013 is off to a strong start having closed the 1st Quarter with net income of $318,000, representing a 194% increase over the same period in 2012. While there are a number of contributing factors to this improved performance, first and foremost is improved credit quality. The health of our loan portfolio is such that there was no need to place additional funds in reserve for the quarter. The Bank's reserve for loan losses as of March 31, 2013 was $5.2 million or 2.98% of total loans compared to $5.6 million or 3.09% of total loans as of March 31, 2012. Couple this with a 25% decrease in interest expense as well as a slight improvement in other income and operating expense, it was a very respectable 1st Quarter."

Gurney continued, "Total deposits surpassed $249 million and assets grew to almost $289 million at March 31, 2013. A portion of this increase was due to a short term, $34 million deposit that was held until early April. While not expected to reoccur, this transaction is reflected in both deposits and assets at quarter end. Total deposits and assets have since readjusted. By removing this short term transaction from the equation, you'll find that deposits increased 11% and assets held steady reflecting a 1% increase despite Mission Valley paying off its last FHLB advance of $5 million during the quarter, further decreasing interest expense. Net loans contracted slightly to $171 million, down 3.5% from March 31, 2012, though net interest income after provision performed well, up 12%, reaching $2.7 million from the $2.4 million reported for the same period of 2012."

Mission Valley capital ratios continue to far exceed regulatory requirements with Tier 1 Leverage, Tier 1 Risk-based Capital and Total Risk-based Capital Ratios of 14.1%, 17.8%, and 19.1%, respectively, as of March 31, 2013. Regulatory requirements for a "well-capitalized bank" are 5%, 6%, and 10%, respectively.

Gurney continued, "At Mission Valley we have met the challenges presented, due to the economic downturn, head on. Knowing that compressed margins, decreased loan demand and increased regulatory restrictions are part of our business landscape for the foreseeable future, we opted to work toward positioning our bank to thrive despite the economic climate. We have streamlined our operations and successfully launched several less traditional revenue streams including a growing Merchant Bankcard Processing division, Accounts Receivable Financing and a robust SBA Lending Division. We are excited by the momentum we are experiencing within all of these areas and are looking forward to continued progress in 2013."

About Mission Valley Bank

Mission Valley Bank is a full-service, independent, commercial bank specializing in the banking needs of small to medium businesses in the San Fernando & Santa Clarita Valleys. The Bank was chartered in July 2001, with a vision of local ownership and a commitment to providing financial solutions to meet the needs of its clients.

Forward-looking statements:

Certain matters discussed in this news release constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements are based upon current management expectations and, therefore, are subject to certain risks and uncertainties that could cause actual results, performance, or achievements to differ materially from those expressed, suggested, or implied by the forward-looking statements. Forward-looking statements are effective only as of the date that they are made and Mission Valley Bank assumes no obligation to update this information.

SOURCE Mission Valley Bancorp

Mehr Nachrichten zur Mission Vly Bcp Ca Aktie kostenlos abonnieren

(Mit der Bestellung akzeptierst du die Datenschutzhinweise)

Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte.