Manulife Investments announces monthly fund distributions for the Closed-End Funds

Canada NewsWire

TORONTO, Sept. 19, 2018

C$ unless otherwise stated

TSX/NYSE/PSE: MFC SEHK: 945

TORONTO, Sept. 19, 2018 /CNW/ - Manulife Investments today announced distributions for Manulife U.S. Regional Bank Trust and Manulife Floating Rate Senior Loan Fund.

For the months ending September 2018, October 2018 and November 2018, Manulife U.S. Regional Bank Trust and Manulife Floating Rate Senior Loan Fund will make the following distributions:

|

Fund |

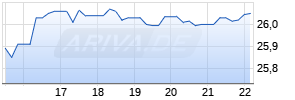

ARIVA.DE Börsen-GeflüsterKurse

TSX | Distribution |

Record Date |

Payment Date | |||

| Manulife U.S. Regional Bank Trust | MBK.UN | $0.04160 | September 28, 2018 | October 15, 2018 | |||

| Manulife U.S. Regional Bank Trust | MBK.UN | $0.04160 | October 31, 2018 | November 15, 2018 | |||

| Manulife U.S. Regional Bank Trust | MBK.UN | $0.04160 | November 30, 2018 | December 14, 2018 | |||

| Manulife U.S. Regional Bank Trust (Class U) | Not listed | US$0.04160 | September 28, 2018 | October 15, 2018 | |||

| Manulife U.S. Regional Bank Trust | Not listed | US$0.04160 | October 31, 2018 | November 15, 2018 | |||

| Manulife U.S. Regional Bank Trust | Not listed | US$0.04160 | November 30, 2018 | December 14, 2018 | |||

| Manulife Floating Rate Senior Loan Fund | MFR.UN | $0.05625 | September 28, 2018 | October 15, 2018 | |||

| Manulife Floating Rate Senior Loan | MFR.UN | $0.05625 | October 31, 2018 | November 15, 2018 | |||

| Manulife Floating Rate Senior Loan | MFR.UN | $0.05625 | November 30, 2018 | December 14, 2018 | |||

| Manulife Floating Rate Senior Loan | Not listed | US$0.05625 | September 28, 2018 | October 15, 2018 | |||

| Manulife Floating Rate Senior Loan | Not listed | US$0.05625 | October 31, 2018 | November 15, 2018 | |||

| Manulife Floating Rate Senior Loan | Not listed | US$0.05625 | November 30, 2018 | December 14, 2018 |

About Manulife Investments

Manulife Investments, a division of Manulife Asset Management Limited, builds on 125 years of Manulife's wealth and investment management expertise in managing assets for Canadian investors. As one of Canada's leading integrated financial services providers, Manulife Investments and its affiliates offer a variety of products and services including exchange traded funds, segregated fund contracts, mutual funds and guaranteed interest contracts.

About Manulife Asset Management

Manulife Asset Management is the global asset management arm of Manulife Financial Corporation ("Manulife"). We provide comprehensive asset management solutions for investors across a broad range of public and private asset classes, as well as asset allocation solutions. We also provide portfolio management for affiliated retail Manulife and John Hancock product offerings.

Our investment expertise includes public and private equity and fixed income, real estate and infrastructure equity and debt, timberland and farmland, oil and gas, and mezzanine debt. We operate in the United States, Canada, Brazil, the United Kingdom, New Zealand, Australia, Japan, Hong Kong, Singapore, Taiwan, Indonesia, Thailand, Vietnam, Malaysia, the Philippines, as well as through a China joint venture, Manulife TEDA. We also serve investors in select European, Middle Eastern, and Latin American markets.

As at June 30, 2018, assets under management for Manulife Asset Management were approximately C$516 billion (US$392 billion, GBP£297 billion, EUR€336 billion). Additional information may be found at ManulifeAM.com.

About Manulife

Manulife Financial Corporation is a leading international financial services group that helps people make their decisions easier and lives better. We operate primarily as John Hancock in the United States and Manulife elsewhere. We provide financial advice, insurance, as well as wealth and asset management solutions for individuals, groups and institutions. At the end of 2017, we had about 35,000 employees, 73,000 agents, and thousands of distribution partners, serving more than 26 million customers. As of June 30, 2018, we had over $1.1 trillion (US$849 billion) in assets under management and administration, and in the previous 12 months we made $27.6 billion in payments to our customers. Our principal operations are in Asia, Canada and the United States where we have served customers for more than 100 years. With our global headquarters in Toronto, Canada, we trade as 'MFC' on the Toronto, New York, and the Philippine stock exchanges and under '945' in Hong Kong.

SOURCE Manulife Financial Corporation

Mehr Nachrichten zur Manulife Financial Corp Aktie kostenlos abonnieren

(Mit der Bestellung akzeptierst du die Datenschutzhinweise)

Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte.