M&T Bank Corporation Announces First Quarter Results

PR Newswire

BUFFALO, N.Y., April 16, 2018

BUFFALO, N.Y., April 16, 2018 /PRNewswire/ -- M&T Bank Corporation ("M&T") (NYSE: MTB) today reported its results of operations for quarter ended March 31, 2018.

GAAP Results of Operations. Diluted earnings per common share measured in accordance with generally accepted accounting principles ("GAAP") for the initial quarter of 2018 were $2.23, up from $2.12 in the similar 2017 quarter and $2.01 in the fourth quarter of 2017. GAAP-basis net income in the recent quarter aggregated $353 million, compared with $349 million in the first quarter of 2017 and $322 million recorded in the final 2017 quarter. GAAP-basis net income for the first quarter of 2018 expressed as an annualized rate of return on average assets and average common shareholders' equity was 1.22% and 9.15%, respectively, compared with 1.15% and 8.89%, respectively, in the year-earlier quarter and 1.06% and 8.03%, respectively, in the fourth quarter of 2017.

During the recent quarter, M&T increased its reserve for litigation matters by $135 million to reflect the status of pre-existing litigation. That increase, on an after-tax basis, reduced net income by $102 million, or $.68 of diluted earnings per common share. In addition, income tax expense in the first quarter of 2018 reflects the reduction of the corporate Federal income tax rate from 35% to 21% by the Tax Cuts and Jobs Act ("the Tax Act") that was enacted on December 22, 2017. Incremental income tax expense recorded in the fourth quarter of 2017 related to provisions of the Tax Act was $85 million, representing $.56 of diluted earnings per common share.

Darren J. King, Executive Vice President and Chief Financial Officer, commented on M&T's financial performance, "M&T's results for the first quarter reflected several positive factors – a continued widening of the net interest margin, favorable credit results, and limited core expense growth. We continued with our capital plan by repurchasing $721 million of common stock during the quarter, while maintaining our regulatory capital levels far in excess of minimum requirements. M&T is off to a good start in 2018."

| Earnings Highlights | | |||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | Change 1Q18 vs. | | |||||

| ($ in millions, except per share data) | | 1Q18 | | | 1Q17 | | | 4Q17 | | | 1Q17 | | | 4Q17 | | |||||

| | | | | | | | | | | | | | | | | | | | | |

| Net income | | $ | 353 | | | $ | 349 | | | $ | 322 | | | | 1 | % | | | 9 | % |

| Net income available to common shareholders - diluted | | $ | 333 | | | $ | 329 | | | $ | 302 | | | | 1 | % | | | 10 | % |

| Diluted earnings per common share | | $ | 2.23 | | | $ | 2.12 | | | $ | 2.01 | | | | 5 | % | | | 11 | % |

| Annualized return on average assets | | | 1.22 | % | | | 1.15 | % | | | 1.06 | % | | | | | | | | |

| Annualized return on average common equity | | | 9.15 | % | | | 8.89 | % | | | 8.03 | % | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

Supplemental Reporting of Non-GAAP Results of Operations. M&T consistently provides supplemental reporting of its results on a "net operating" or "tangible" basis, from which M&T excludes the after-tax effect of amortization of core deposit and other intangible assets (and the related goodwill, core deposit intangible and other intangible asset balances, net of applicable deferred tax amounts) and expenses associated with merging acquired operations into M&T, since such items are considered by management to be "nonoperating" in nature. The amounts of such "nonoperating" expenses are presented in the tables that accompany this release. Although "net operating income" as defined by M&T is not a GAAP measure, M&T's management believes that this information helps investors understand the effect of acquisition activity in reported results.

Diluted net operating earnings per common share were $2.26 in the first quarter of 2018, $2.15 in the year-earlier quarter and $2.04 in the fourth quarter of 2017. Net operating income for the first three months of 2018 was $357 million, compared with $354 million in the year-earlier period and $327 million in the final quarter of 2017. Expressed as an annualized rate of return on average tangible assets and average tangible common shareholders' equity, net operating income was 1.28% and 13.51%, respectively, in the recent quarter, compared with 1.21% and 13.05%, respectively, in the initial quarter of 2017 and 1.12% and 11.77%, respectively, in the fourth quarter of 2017.

Taxable-equivalent Net Interest Income. Net interest income expressed on a taxable-equivalent basis aggregated $980 million in the first quarter of 2018, up 6% from $922 million in the first three months of 2017. That growth resulted from a widening of the net interest margin to 3.71% in the recent quarter from 3.34% in the initial 2017 quarter. The widening was offset, in part, by lower average earning assets of $4.8 billion, including a decline in average loans and leases of $2.0 billion, as compared with the year-earlier quarter. Taxable-equivalent net interest income in the fourth quarter of 2017 was also $980 million. A 15 basis point widening of the net interest margin in the recent quarter was offset by a decline in average earning assets of $2.2 billion as compared with the final 2017 quarter. Average loans and leases in the recent quarter were little changed from the fourth quarter of 2017.

| | | | | | | | | | | | | | | | | | | | | |

| Taxable-equivalent Net Interest Income | | |||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | Change 1Q18 vs. | | |||||

| ($ in millions) | | 1Q18 | | | 1Q17 | | | 4Q17 | | | 1Q17 | | | 4Q17 | | |||||

| | | | | | | | | | | | | | | | | | | | | |

| Average earning assets | | $ | 107,231 | | | $ | 112,008 | | | $ | 109,412 | | | | -4 | % | | | -2 | % |

| Net interest income - taxable-equivalent | | $ | 980 | | | $ | 922 | | | $ | 980 | | | | 6 | % | | | — | |

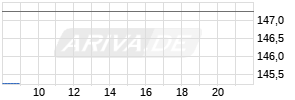

| Net interest margin | | | 3.71 | % | | | 3.34 | % Werbung Mehr Nachrichten zur M&T Bank Corporation Aktie kostenlos abonnieren

E-Mail-Adresse

Bitte überprüfe deine die E-Mail-Adresse.

Benachrichtigungen von ARIVA.DE (Mit der Bestellung akzeptierst du die Datenschutzhinweise) -1  Vielen Dank, dass du dich für unseren Newsletter angemeldet hast. Du erhältst in Kürze eine E-Mail mit einem Aktivierungslink. Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte. | ||||||||||||