LIONSGATE REPORTS RESULTS FOR FOURTH QUARTER AND FULL YEAR FISCAL 2020

PR Newswire

SANTA MONICA, Calif. and VANCOUVER, British Columbia, May 21, 2020

SANTA MONICA, Calif. and VANCOUVER, British Columbia, May 21, 2020 /PRNewswire/ -- Global content leader Lionsgate (NYSE: LGF.A, LGF.B) today reported fourth quarter (quarter ended March 31, 2020) revenue of $944 million, operating loss of $12 million and net loss attributable to Lionsgate shareholders of $45 million or $0.20 diluted net loss per share on 219.9 million diluted weighted average common shares outstanding. Adjusted net income attributable to Lionsgate shareholders in the quarter was $47 million or adjusted diluted EPS of $0.21, with adjusted OIBDA of $126 million. Fourth quarter cash flow provided by operating activities was $180 million and adjusted free cash flow was $175 million.

"We reported a strong quarter to end a solid fiscal year despite the disruption posed by the COVID-19 global pandemic," said Lionsgate CEO Jon Feltheimer. "Our Lionsgate family has risen to the challenge of these unprecedented times with resilience, dedication and collaboration. Thanks to their efforts, Starz is continuing to deliver great entertainment to our audiences in the current at home environment, and we're working closely with all of our content partners to ensure that when production resumes and theatres re-open, we will be ready."

Full year fiscal 2020 (fiscal year ended March 31, 2020) revenue was $3.89 billion, operating income was $2.8 million, and net loss attributable to Lionsgate shareholders was $188 million, or $0.86 diluted net loss per share on 217.9 million diluted weighted average common shares outstanding. Adjusted net income attributable to Lionsgate shareholders was $124.3 million or adjusted diluted EPS of $0.56 and adjusted OIBDA was $462 million for fiscal 2020. Full year adjusted free cash flow was $349 million.

Driven by robust sales in the at home environment in the quarter, library revenues for the fiscal year reached a record $600 million.

The Company reported a charge of $50.5 million in the quarter due to the COVID-19 global pandemic and related economic disruption. This charge included, among other things, certain motion picture and television impairments and development charges associated with changes in performance expectations and the feasibility of project completions, along with costs associated with pausing film and television production.

Fourth Quarter Results

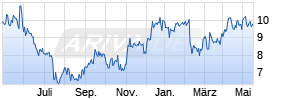

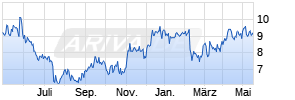

ARIVA.DE Börsen-Geflüster

Kurse

|

|

Segment Results

Media Networks segment revenue of $358 million was essentially unchanged from the prior year quarter while segment profit of $26 million was impacted by the continued investment in STARZPLAY's international expansion. STARZPLAY has launched in 50 countries and exceeded subscriber targets for the fiscal year. Domestically, STARZ grew its OTT subscribers to 6.8 million in the quarter.

Motion Picture segment revenue increased by 10% to $393 million compared to the prior year quarter due to the strong home entertainment performance of Knives Out and other titles. The only new theatrical release in the quarter, I Still Believe, was in theatres for only four days before they closed, but the studio pivoted quickly to launch the title in an exclusive premium video-on-demand window to mitigate lost theatrical revenue. Segment profit was $101 million.

Television Production segment revenue was $258 million and segment profit was $22 million driven in part by strong library sales.

COVID-19 Impact

The impact of the ongoing COVID-19 global pandemic and measures to prevent its spread, and the resulting unprecedented economic uncertainty, are affecting our business in a number of ways. To date, we have experienced early termination of the theatrical run of one of our films domestically and one of our films in the UK, delayed theatrical distribution of several films domestically and internationally, and delayed production of film and television content resulting in changes in future release dates for some titles and series. Our partners have also closed several location-based entertainment attractions based on our film and television properties. We may not be able to accurately predict when theatres re-open, production resumes or if and when certain of our content will be released. The full extent of the impact of the COVID-19 global pandemic on our business, operations and financial results will depend on numerous evolving factors that we may not be able to accurately predict.

Conversely, television and streaming consumption around the globe has increased as well as home entertainment demand. STARZ has experienced an increase in viewership of its content across all platforms as well as an increase in subscribers to its OTT services, both domestically and internationally. This increase, however, may not be indicative of future results and growth may slow as governmental and other restrictions are relaxed, and as a result of the current and possible longer term negative economic impact of the pandemic. In a number of instances, we have also been able to adapt to these new circumstances by releasing one of our theatrical films earlier on streaming platforms, completing post-production of one of our television series remotely and continuing the development of a number of our television series utilizing virtual writers' rooms. These changes in the way we operate may be helpful to partially offset some of the negative impacts from the pandemic. However, the impact of these changes and the COVID-19 global pandemic are uncertain and cannot be predicted.

As a direct result of the COVID-19 global pandemic and the related economic disruption, including the worldwide closure of most theatres, international travel restrictions and the pausing of motion picture and television productions, during the fourth quarter of fiscal 2020 we have incurred $50.5 million in incremental costs which were expensed in the period. These costs include $46.0 million reflected in direct operating expense, which include certain motion picture and television impairments and development charges associated with changes in performance expectations or the feasibility of completing the project, costs associated with the pausing of productions, including certain cast and crew costs and incremental costs associated with bad debt reserves. In addition, these costs include $4.2 million reflected in distribution and marketing expense, which primarily consists of early marketing spends for film releases and events that have been canceled or delayed and will provide no economic benefit, and $0.3 million in restructuring and other costs primarily due to transitioning the Company to a remote-work environment and other incremental costs associated with the COVID-19 global pandemic during this period. We expect to incur additional incremental costs in future periods. We are in the process of seeking insurance recovery for some of these costs, which cannot be estimated at this time, and therefore have not been recorded in our consolidated financial statements. These costs, along with other items, are excluded from segment operating results, Adjusted OIBDA, Adjusted Net Income Attributable to Lions Gate Entertainment Corp. Shareholders, and Adjusted EPS (see Use of Non-GAAP Financial Measures).

Lionsgate senior management will hold its analyst and investor conference call to discuss its fiscal 2020 fourth quarter and full year results at 5:00 PM ET/2:00 PM PT this afternoon, May 21. Interested parties may listen to the live webcast by visiting the events page on the Lionsgate corporate website or via https://services.choruscall.com/links/lgf200521OrPx2lYU.html. A full replay will become available later this afternoon by clicking the same link.

ABOUT LIONSGATE

The first major new studio in decades, Lionsgate is a global content leader whose films, television series, digital products and linear and over-the-top platforms reach next generation audiences around the world. Lionsgate film and television properties also support a global network of location-based entertainment and other branded attractions as well as a robust video game business. Lionsgate's content initiatives are backed by a nearly 17,000-title film and television library and delivered through a global sales and distribution infrastructure. The Lionsgate brand is synonymous with original, daring and ground-breaking content created with special emphasis on the evolving patterns and diverse composition of the Company's worldwide consumer base.

For further information, investors should contact:

James Marsh

310-255-3651

jmarsh@lionsgate.com

For media inquiries, please contact:

Peter D. Wilkes

310-255-3726

pwilkes@lionsgate.com

The matters discussed in this press release include forward-looking statements, including those regarding the performance of future fiscal years. Such statements are subject to a number of risks and uncertainties. Actual results in the future could differ materially and adversely from those described in the forward-looking statements as a result of various important factors, including, but not limited to: the potential effects of the COVID-19 global pandemic on the Company, economic and business conditions; the substantial investment of capital required to produce and market films and television series; budget overruns; limitations imposed by our credit facilities and notes; unpredictability of the commercial success of our motion pictures and television programming; risks related to acquisition and integration of acquired businesses; the effects of dispositions of businesses or assets, including individual films or libraries; the cost of defending our intellectual property; technological changes and other trends affecting the entertainment industry; potential adverse reactions or changes to business or employee relationships; and the other risk factors as set forth in Lionsgate's Annual Report on Form 10-K for the fiscal year ended March 31, 2020, to be filed with the Securities and Exchange Commission. The Company undertakes no obligation to publicly release the result of any revisions to these forward-looking statements that may be made to reflect any future events or circumstances.

Additional Information Available on Website

The information in this press release should be read in conjunction with the financial statements and footnotes contained in the Company's Annual Report on Form 10-K for the fiscal year ended March 31, 2020, which will be posted on the Company's website at http://investors.lionsgate.com/financial-reports/sec-filings, when filed with the Securities and Exchange Commission. Trending schedules containing certain financial information will also be available on the Company's website.

| LIONS GATE ENTERTAINMENT CORP. | |||||||

| CONSOLIDATED BALANCE SHEETS | |||||||

| | |||||||

| | March 31, | | March 31, | ||||

| | (Unaudited, amounts in millions) | ||||||

| ASSETS | | | | ||||

| Cash and cash equivalents | $ | 318.2 | | | $ | 184.3 | |

| Accounts receivable, net | 522.0 | | | 647.2 | | ||

| Program rights | 310.5 | | | 295.7 | | ||

| Other current assets | 157.4 | | | 267.2 | | ||

| Total current assets | 1,308.1 | | | 1,394.4 | | ||

| Investment in films and television programs and program rights, net | 1,517.3 | | | 1,672.0 | | ||

| Property and equipment, net | 140.9 | | | 155.3 | | ||

| Investments | 40.3 | | | 26.2 | | ||

| Intangible assets | 1,719.6 | | | 1,871.6 | | ||

| Goodwill | 2,833.5 | | | 2,833.5 | | ||

| Other assets | 391.5 | | | 436.1 | | ||

| Deferred tax assets | — | | | 19.8 | | ||

| Total assets | $ | 7,951.2 | | | $ | 8,408.9 | |

| LIABILITIES | | | | ||||

| Accounts payable and accrued liabilities | $ | 526.9 | | | $ | 531.2 | |

| Participations and residuals | 441.9 | | | 408.5 | | ||

| Film obligations and production loans | 353.7 | | | 512.6 | | ||

| Debt - short term portion | 68.6 | | | 53.6 | | ||

| Deferred revenue | 116.6 | | | 146.5 | | ||

| Total current liabilities | 1,507.7 | | | 1,652.4 | | ||

| Debt | 2,664.4 | | | 2,850.8 | | ||

| Participations and residuals | 421.6 Werbung Mehr Nachrichten zur Lions Gate Entertainment Corp. Aktie kostenlos abonnieren

E-Mail-Adresse

Bitte überprüfe deine die E-Mail-Adresse.

Benachrichtigungen von ARIVA.DE (Mit der Bestellung akzeptierst du die Datenschutzhinweise) -1  Vielen Dank, dass du dich für unseren Newsletter angemeldet hast. Du erhältst in Kürze eine E-Mail mit einem Aktivierungslink. Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte. | ||||||