LIONSGATE REPORTS RESULTS FOR FIRST QUARTER FISCAL 2021

PR Newswire

SANTA MONICA, Calif. and VANCOUVER, BC, Aug. 6, 2020

SANTA MONICA, Calif. and VANCOUVER, BC, Aug. 6, 2020 /PRNewswire/ -- Global content leader Lionsgate (NYSE: LGF.A, LGF.B) today reported revenue of $813.7 million and net income attributable to Lionsgate shareholders of $51.1 million, or fully diluted earnings per share of $0.23, on 219.9 million diluted weighted average common shares outstanding for the quarter ended June 30, 2020. Adjusted net income attributable to Lionsgate shareholders was $86.1 million, or adjusted diluted earnings per share of $0.39, operating income was $89.4 million, and adjusted OIBDA was $173.7 million.

"We're pleased to report a quarter with strong financial results in which all of our priorities were evident," said Lionsgate CEO Jon Feltheimer. "During the quarter we took steps to monetize our film and television library, embraced innovative distribution strategies for our films, and acquired new properties while renewing others. Most important, it was a quarter in which we used all of our resources to continue growing a unique, valuable and scalable global streaming platform at Starz."

Library revenue in the quarter grew to a record $219.0 million driven by strong demand for content and revenues from the recent syndication of Mad Men.

Segment Results

Media Networks segment revenue was flat from the prior year quarter at $367.3 million while segment profit increased 18.5% to $71.8 million driven by lower losses at STARZPLAY International. Starz Networks domestic OTT subscribers grew to 7.4 million in the quarter and the Company's global OTT subscribers (including STARZ, STARZPLAY Arabia and PANTAYA) increased to 11.4 million in the quarter.

Motion Picture segment revenue decreased by 29.4% to $280.7 million compared to the prior year quarter and segment profit was $101.1 million. The performance in the Motion Picture segment reflects the impact of theatre closings related to the COVID-19 global pandemic, reduced theatrical P&A expenses and increased home entertainment and library revenues.

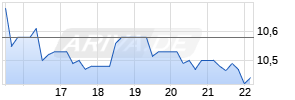

ARIVA.DE Börsen-Geflüster

Kurse

|

|

Television Production segment revenue decreased 30.1% to $195.7 million, primarily due to the timing of production schedules and episodic deliveries impacted by production delays related to the COVID-19 global pandemic, while segment profit increased 39.6% to $34.9 million reflecting the recent syndication of Mad Men.

Lionsgate senior management will hold its analyst and investor conference call to discuss its fiscal 2021 first quarter results at 5:00 PM ET/2:00 PM PT this afternoon, August 6. Interested parties may listen to the live webcast by visiting the events page on the Lionsgate corporate website or via https://services.choruscall.com/links/lgf200806B6TNG20q.html. A full replay will become available later this afternoon by clicking the same link.

ABOUT LIONSGATE

Combining the STARZ premium global subscription platform with world-class motion picture and television studio operations, Lionsgate (NYSE: LGF.A, LGF.B) brings a unique and varied portfolio of entertainment to consumers around the world. Its film, television, subscription and location-based entertainment businesses are backed by a 17,000-title library and the largest collection of film and television franchises in the independent media space. A digital age company driven by its entrepreneurial culture and commitment to innovation, the Lionsgate brand is synonymous with bold, original, relatable entertainment for the audiences it serves worldwide.

For further information, investors should contact:

James Marsh

310-255-3651

jmarsh@lionsgate.com

For media inquiries, please contact:

Peter Wilkes

310-255-3726

pwilkes@lionsgate.com

The matters discussed in this press release include forward-looking statements, including those regarding the performance of future fiscal years. Such statements are subject to a number of risks and uncertainties. Actual results in the future could differ materially and adversely from those described in the forward-looking statements as a result of various important factors, including the potential effects of the COVID-19 global pandemic on the Company, economic and business conditions; the substantial investment of capital and increased costs required to produce and market films and television series; budget overruns; limitations imposed by our credit facilities and notes; unpredictability of the commercial success of our motion pictures and television programming; risks related to acquisition and integration of acquired businesses; the effects of dispositions of businesses or assets, including individual films or libraries; the cost of defending our intellectual property; technological changes and other trends affecting the entertainment industry; other trends affecting the entertainment industry; potential adverse reactions or changes to business or employee relationships; and the other risk factors as set forth in Lionsgate's Quarterly Report on Form 10-Q filed with the Securities and Exchange Commission on August 6, 2020. The Company undertakes no obligation to publicly release the result of any revisions to these forward-looking statements that may be made to reflect any future events or circumstances.

Additional Information Available on Website

The information in this press release should be read in conjunction with the financial statements and footnotes contained in the Company's Quarterly Report on Form 10-Q for the quarter ended June 30, 2020, which will be posted on the Company's website at http://investors.lionsgate.com/financial-reports/sec-filings, when filed with the Securities and Exchange Commission. Trending schedules containing certain financial information will also be available at http://investors.lionsgate.com/governance/governance-documents.

| LIONS GATE ENTERTAINMENT CORP. | |||||||

| | | | | ||||

| | June 30, | | March 31, | ||||

| | (Unaudited, amounts in millions) | ||||||

| ASSETS | | | | ||||

| Cash and cash equivalents | $ | 376.1 | | | $ | 318.2 | |

| Accounts receivable, net | 430.6 | | | 522.0 | | ||

| Program rights | — | | | 310.5 | | ||

| Other current assets | 147.8 | | | 157.4 | | ||

| Total current assets | 954.5 | | | 1,308.1 | | ||

| Investment in films and television programs and program rights, net | 1,712.2 | | | 1,517.3 | | ||

| Property and equipment, net | 138.4 | | | 140.9 | | ||

| Investments | 38.2 | | | 40.3 | | ||

| Intangible assets | 1,682.5 | | | 1,719.6 | | ||

| Goodwill | 2,833.5 | | | 2,833.5 | | ||

| Other assets | 396.7 | | | 391.5 | | ||

| Total assets | $ | 7,756.0 | | | $ | 7,951.2 | |

| LIABILITIES | | | | ||||

| Accounts payable and accrued liabilities | $ | 414.6 | | | $ | 526.9 | |

| Participations and residuals | 444.3 | | | 441.9 | | ||

| Film obligations and production loans | 308.2 | | | 353.7 | | ||

| Debt - short term portion | 73.7 | | | 68.6 | | ||

| Deferred revenue | 89.4 | | | 116.6 | | ||

| Total current liabilities | 1,330.2 | | | 1,507.7 | | ||

| Debt | 2,646.1 | | | 2,664.4 | | ||

| Participations and residuals | 373.8 | | | 421.6 | | ||

| Film obligations and production loans | 80.5 | | | 96.9 | | ||

| Other liabilities | 345.6 | | | 334.9 | | ||

| Deferred revenue | 59.8 | | | 61.3 Werbung Mehr Nachrichten zur Lions Gate Entertainment Corp. Aktie kostenlos abonnieren

E-Mail-Adresse

Bitte überprüfe deine die E-Mail-Adresse.

Benachrichtigungen von ARIVA.DE (Mit der Bestellung akzeptierst du die Datenschutzhinweise) -1  Vielen Dank, dass du dich für unseren Newsletter angemeldet hast. Du erhältst in Kürze eine E-Mail mit einem Aktivierungslink. Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte. | |||