Intrexon Announces Second Quarter and First Half 2015 Financial Results

PR Newswire

GERMANTOWN, Md., Aug. 10, 2015

GERMANTOWN, Md., Aug. 10, 2015 /PRNewswire/ -- Intrexon Corporation (NYSE: XON), a leader in synthetic biology, today announced its second quarter and first half results for 2015.

Business Highlights and Recent Developments:

- During the second quarter, Intrexon's exclusive collaboration and license agreement with the biopharmaceutical business of Merck KGaA, Darmstadt, Germany, to develop and commercialize chimeric antigen receptor T-cell (CAR-T) cancer therapies became effective, resulting in the receipt of $115 million, 50% of which is payable to ZIOPHARM Oncology, Inc., as an upfront fee in July 2015. Focused on the generation of leading-edge products that empower the immune system in a regulated manner, the collaboration's first two CAR-T targets of interest have been selected and Intrexon has initiated research and development efforts on these programs;

- Granted a special stock dividend of ZIOPHARM Oncology, Inc. (NASDAQ: ZIOP) shares owned by Intrexon to its shareholders valued at approximately $172 million at the time of distribution. Holders of Intrexon common stock received 0.162203 shares of ZIOPHARM common stock at $9.67 per share with respect to each outstanding share of Intrexon common stock they owned;

- Announced a Cooperative Research and Development Agreement with the National Cancer Institute (NCI). The principal goal is to develop and evaluate improved adoptive cell transfer-based immunotherapies (ACT) using NCI proprietary methods for the identification of autologous peripheral blood lymphocytes with naturally occurring endogenous anti-tumor activity combined with the RheoSwitch Therapeutic System® for introducing spatially and temporally controlled interleukin-12 (IL-12) expression in ACT/PBL/IL-12 for the treatment of patients with solid tumor malignancies;

- Completed the acquisition of Okanagan Specialty Fruits, the pioneering agricultural company behind the Arctic® apple, the world's first non-browning apple without the use of any flavor-altering chemical or antioxidant additives;

- Entered into a multi-year collaboration with an investment fund sponsored by Harvest Capital Strategies, LLC. The fund is dedicated to the inventions and discoveries of Intrexon and will have the exclusive rights of first-look and first negotiation for Intrexon's investment proposals suitable for pursuit by a startup. The fund will be complementary to Intrexon's ongoing programs and will not prohibit the Company's ability to execute other collaborations and joint ventures;

- In collaboration with Fibrocell Science, Inc. (NASDAQ: FCSC) announced submission of an Investigational New Drug Application to the U.S. Food and Drug Administration for FCX-007 for the treatment of recessive dystrophic epidermolysis bullosa (RDEB). RDEB is a debilitating genetic skin disorder caused by a mutation in the gene encoding type VII collagen (COL7), a protein that forms anchoring fibrils which hold together the layers of skin. Additionally, the companies reported positive proof-of-concept data from in vivo pre-clinical studies for FCX-007. Fibrocell expects to initiate a Phase I/II clinical trial by year-end to evaluate the safety, mechanism of action, and efficacy of FCX-007;

- Expanded relationship with Oragenics (NYSE MKT: OGEN) through a new Exclusive Channel Collaboration (ECC) to pursue development of biotherapeutics for oral mucositis and other diseases of the oral cavity, throat, and esophagus, including clinical advancement of ActoBiotics™ AG013 for the treatment of oral mucositis; and

- In conjunction with Oragenics, announced selection of lead clinical candidate for the lantibiotics program and reported positive in vivo efficacy data in critical animal study on multiple compounds from Oragenics' Mutacin 1140 platform. Lantibiotics are a class of antibiotics with a novel mechanism of action active against a broad spectrum of Gram-positive bacteria, including multi-drug resistant infectious bacteria, which could provide an important new tool in the fight against global bacterial antibiotic resistance.

Second Quarter Financial Highlights:

- Total revenues of $44.9 million, an increase of 281% over the second quarter of 2014;

- Net loss of $40.7 million attributable to Intrexon, or $(0.37) per basic share;

- Excluding the special stock dividend of ZIOPHARM Oncology, Inc. shares, Pro Forma Net Income Attributable to Intrexon during the second quarter would have been of $0.9 million, or $0.01 per basic share;

- Adjusted EBITDA of $54.4 million, or $0.50 per basic share; and

- Cash consideration received for reimbursement of research and development services, Cost Recovery, covered 60% of cash operating expenses (exclusive of operating expenses of consolidated subsidiaries).

First Half Financial Highlights:

- Total revenues of $78.7 million, an increase of 301% over the first half of 2014;

- Net loss of $13.6 million attributable to Intrexon, or $(0.13) per basic share;

- Excluding the special stock dividend of ZIOPHARM Oncology, Inc. shares, Pro Forma Net Income Attributable to Intrexon during the first half would have been $28.0 million, or $0.26 per basic share;

- Adjusted EBITDA of $39.8 million, or $0.37 per basic share; and

- Total consideration received for technology access fees and reimbursement of research and development services covered 187% of cash operating expenses (exclusive of operating expenses of consolidated subsidiaries).

"We continue satisfactorily to balance contemporary inputs to outputs while advancing a growing portfolio of programs that should provide significant and unburdened contribution to our bottom line," commented Randal J. Kirk, Chairman and Chief Executive Officer of Intrexon. "The scalability of our technology platforms and our organizational model are allowing us to grow our company rapidly across an ever diversifying array of great product candidates while we add important new talent to our team. That we can execute such an ambitious plan while also making acquisitions that provide positions of genuine industrial leadership is a testament to the great team that so zealously advances our mission to 'power the bioindustrial revolution.'"

Second Quarter 2015 Financial Results Compared to Prior Year Period

Total revenues were $44.9 million for the quarter ended June 30, 2015 compared to $11.8 million for the quarter ended June 30, 2014, an increase of $33.1 million, or 281%. Product revenue includes $12.6 million from the sale of pregnant cows, live calves and the sale of livestock used in production. Service revenue totaling $11.6 million relates to the provision of in vitro fertilization and embryo transfer services performed. Collaboration revenues increased $5.4 million due to (i) the recognition of deferred revenue for upfront payments received from our license and collaboration agreement with the biopharmaceutical business of Merck KGaA, which became effective in May 2015, and from collaborations signed by us between July 1, 2014 and June 30, 2015, (ii) the recognition of research and development services performed by us pursuant to these new collaborations, and (iii) increased research and development services performed by us related to collaboration programs in effect prior to July 1, 2014 as a result of progression of current programs and the initiation of new programs with these collaborators.

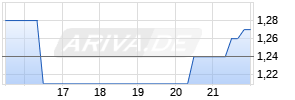

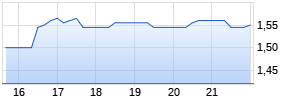

ARIVA.DE Börsen-Geflüster

Kurse

|

|

|

|

Total operating expenses were $62.3 million for the quarter ended June 30, 2015 compared to $29.9 million for the quarter ended June 30, 2014, an increase of $32.4 million, or 108%. Research and development expenses were $20.4 million for the quarter ended June 30, 2015 compared to $14.4 million for the quarter ended June 30, 2014, an increase of $5.9 million, or 41%. Salaries, benefits and other personnel costs increased $2.5 million due to (i) increases in research and development headcount to support the new collaborations discussed above, and (ii) compensation expenses related to performance and retention incentives for research and development employees. Lab supplies and consultants increased $2.1 million due to the increased level of research and development services provided to our collaborators. Selling, general and administrative expenses were $23.7 million for the quarter ended June 30, 2015 compared to $15.4 million for the quarter ended June 30, 2014, an increase of $8.3 million, or 54%. Salaries, benefits and other personnel costs increased $5.5 million due to (i) the inclusion of selling, general and administrative employees of companies we have acquired since July 1, 2014, including Trans Ova and ActoGeniX, and (ii) compensation expenses related to performance and retention incentives for general and administrative employees. Depreciation and amortization increased $0.8 million primarily as a result of property and equipment and intangible assets acquired from Trans Ova. Total operating expenses for the quarter ended June 30, 2015 also include $18.2 million of products and services costs which primarily consist of employee compensation costs, livestock, feed, drug supplies and facility charges related to the production of such products and services.

Total other expense, net, was $21.0 million for the quarter ended June 30, 2015 compared to $33.8 million for the quarter ended June 30, 2014, a decrease of $12.8 million, or 38%. This decrease was primarily related to the changes in the value of our securities portfolio, including a realized gain of $81.4 million which resulted from the special stock dividend of all of our shares of ZIOPHARM to our shareholders in June 2015.

First Half 2015 Financial Results Compared to Prior Year Period

Total revenues were $78.7 million for the six months ended June 30, 2015 compared to $19.6 million for the six months ended June 30, 2014, an increase of $59.1 million, or 302%. Product revenue includes $20.1 million from the sale of pregnant cows, live calves and the sale of livestock used in production. Service revenue totaling $20.0 million relates to the provision of in vitro fertilization and embryo transfer services performed. Collaboration revenues increased $12.4 million due to (i) the recognition of deferred revenue for upfront payments received from our license and collaboration agreement with the biopharmaceutical business of Merck KGaA, which became effective in May 2015, collaborations signed by us between July 1, 2014 and June 30, 2015 and our collaboration with Intrexon Energy Partners, which was signed in March 2014, (ii) recognition of research and development services performed by us pursuant to these new collaborations, and (iii) increased research and development services performed by us for collaborations in effect prior to July 1, 2014 as a result of the progression of current programs and the initiation of new programs with these collaborators.

Total operating expenses were $183.3 million for the six months ended June 30, 2015 compared to $55.6 million for the six months ended June 30, 2014, an increase of $127.7 million, or 230%. Research and development expenses were $99.7 million for the six months ended June 30, 2015 compared to $26.5 million for the six months ended June 30, 2014, an increase of $73.2 million, or 276%. In January 2015, we issued 2,100,085 shares of our common stock valued at $59.6 million to the University of Texas MD Anderson Cancer Center, or MD Anderson, in exchange for an exclusive license to certain technologies owned by MD Anderson. Salaries, benefits and other personnel costs increased $5.9 million due to (i) increases in research and development headcount to support the new collaborations discussed above, and (ii) compensation expenses related to performance and retention incentives for research and development employees. Lab supplies and consultants expenses increased $4.0 million as a result of the increased level of research and development services provided to our collaborators. Selling, general and administrative expenses were $51.3 million for the six months ended June 30, 2015 compared to $29.0 million for the six months ended June 30, 2014, an increase of $22.3 million, or 77%. Salaries, benefits and other personnel costs increased $13.4 million due to (i) the inclusion of selling, general and administrative employees of companies we have acquired since July 1, 2014, including Trans Ova and ActoGeniX, and (ii) compensation expenses related to performance and retention incentives for general and administrative employees. Stock-based compensation expenses for the annual options granted to our non-employee directors, pursuant to our non-employee director compensation policy, increased $1.0 million due to a higher grant-date fair value in 2015 compared to 2014. Legal and professional expenses increased $2.7 million primarily due to costs associated with acquisitions, the license agreement with MD Anderson, the January 2015 public securities offering and other business development activity. Depreciation and amortization increased $1.6 million primarily as a result of property and equipment and intangible assets acquired from Trans Ova. Total operating expenses for the six months ended June 30, 2015 also include $32.1 million of products and services costs which primarily consist of employee compensation costs, livestock, feed, drug supplies and facility charges related to the production of such products and services.

Total other income, net, was $94.7 million for the six months ended June 30, 2015 compared to total other expense, net, of $11.8 million for the six months ended June 30, 2014, an increase of $106.5 million, or 903%. This increase was primarily related to the changes in the value of our securities portfolio, including a realized gain of $81.4 million which resulted from the special stock dividend of all of our shares of ZIOPHARM to our shareholders in June 2015.

Conference Call and Webcast

The Company will host a conference call on August 10, 2015, at 5:30 PM ET to discuss the second quarter and first half 2015 financial results and provide a general business update. The conference call may be accessed by dialing 1-888-346-3959 (Domestic US) and 1-412-902-4262 (International) and asking to join the "Intrexon Corporation Call." Participants may also access the live webcast through Intrexon's website in the Investors section under Calendar of Events.

About Intrexon Corporation

Intrexon Corporation (NYSE: XON) is Powering the Bioindustrial Revolution with Better DNA™ to create biologically-based products that improve the quality of life and the health of the planet. The Company's integrated technology suite provides its partners across diverse markets with industrial-scale design and development of complex biological systems delivering unprecedented control, quality, function, and performance of living cells. We call our synthetic biology approach Better DNA®, and we invite you to discover more at www.dna.com.

Non-GAAP Financial Measures

This press release presents Adjusted EBITDA, Adjusted EBITDA per share, Pro Forma Net Income Attributable to Intrexon and Pro Form Net Income Attributable to Intrexon Per Basic Share which are non-GAAP financial measures within the meaning of applicable rules and regulations of the Securities and Exchange Commission (SEC). For a reconciliation of these measures to the most directly comparable financial measure calculated in accordance with generally accepted accounting principles and for a discussion of the reasons why the company believes that these non-GAAP financial measures provide information that is useful to investors see the tables below under "Reconciliation of GAAP to Non-GAAP Measures." Such information is provided as additional information, not as an alternative to Intrexon's consolidated financial statements presented in accordance with GAAP, and is intended to enhance an overall understanding of the Company's current financial performance.

Trademarks

Intrexon, UltraVector, LEAP and Better DNA are trademarks of Intrexon and/or its affiliates. Other names may be trademarks of their respective owners.

Safe Harbor Statement

Some of the statements made in this press release are forward-looking statements that involve a number of risks and uncertainties and are made pursuant to the Safe harbor Provisions of the Private Securities Litigation Reform Act of 1995. These forward-looking statements are based upon Intrexon's current expectations and projections about future events and generally relate to Intrexon's plans, objectives and expectations for the development of Intrexon's business. Although management believes that the plans and objectives reflected in or suggested by these forward-looking statements are reasonable, all forward-looking statements involve risks and uncertainties and actual future results may be materially different from the plans, objectives and expectations expressed in this press release. These risks and uncertainties include, but are not limited to, (i) Intrexon's current and future ECCs and joint ventures; (ii) Intrexon's ability to successfully enter new markets or develop additional products, whether with its collaborators or independently; (iii) actual or anticipated variations in Intrexon's operating results; (iv) actual or anticipated fluctuations in Intrexon's competitors' or its collaborators' operating results or changes in their respective growth rates; (v) Intrexon's cash position; (vi) market conditions in Intrexon's industry; (vii) Intrexon's ability, and the ability of its collaborators, to protect Intrexon's intellectual property and other proprietary rights and technologies; (viii) Intrexon's ability, and the ability of its collaborators, to adapt to changes in laws or regulations and policies; (ix) the rate and degree of market acceptance of any products developed by a collaborator under an ECC or through a joint venture; (x) Intrexon's ability to retain and recruit key personnel; (xi) Intrexon's expectations related to the use of proceeds from its public offerings and other financing efforts; (xii) Intrexon's estimates regarding expenses, future revenue, capital requirements and needs for additional financing; and (xiii) Intrexon's expectations relating to its subsidiaries and other affiliates. For a discussion of other risks and uncertainties, and other important factors, any of which could cause Intrexon's actual results to differ from those contained in the forward-looking statements, see the section entitled "Risk Factors" in Intrexon's Annual Report on Form 10-K, as well as discussions of potential risks, uncertainties, and other important factors in Intrexon's subsequent filings with the Securities and Exchange Commission. All information in this press release is as of the date of the release, and Intrexon undertakes no duty to update this information unless required by law.

For more information regarding Intrexon Corporation, contact:

Investor Contact:

Christopher Basta

Vice President, Investor Relations

Tel: +1 (561) 410-7052

investors@intrexon.com

Corporate Contact:

Marie Rossi, Ph.D.

Senior Manager, Technical Communications

Tel: +1 (301) 556-9850

publicrelations@intrexon.com

| Intrexon Corporation and Subsidiaries | |||||||

| Consolidated Balance Sheets | |||||||

| (Unaudited) | |||||||

| | |||||||

| (Amounts in thousands) | | June 30, 2015 | | | December 31, 2014 | ||

| Assets | | | | | | | |

| Current assets | | | | | | | |

| Cash and cash equivalents | | $ | 98,899 | | | $ | 27,466 |

| Short-term investments | | | 67,431 | | | | 88,495 |

| Receivables | | | | | | | |

| Trade, net | | | 141,133 | | | | 14,582 |

| Related parties | | | 17,406 | | | | 12,622 |

| Note | | | 1,521 | | | | 1,501 |

| Other | | | 670 | | | | 559 |

| Inventory | | | 27,001 | | | | 25,789 |

| Prepaid expenses and other | | | 5,477 | | | | 3,759 |

| | | | | | | | |

| Total current assets | | | 359,538 | | | | 174,773 |

| Long-term investments | | | — | | | | 27,113 |

| Equity securities | | | 101,896 | | | | 164,889 |

| Property, plant and equipment, net | | | 40,863 | | | | 38,000 |

| Intangible assets, net | | | 162,234 | | | | 65,947 |

| Goodwill | | | 118,965 | | | | 101,059 |

| Investments in affiliates | | | 2,960 | | | | 3,220 |

| Other assets | | | 6,483 | | | | 1,271 |

| | | | | | | | |

| Total assets | | $ | 792,939 | | | $ | 576,272 |

| | | | | ||||

| | | | | ||||

| Liabilities and Total Equity | | | | ||||

| | | | | | | | |

| Current liabilities | | | | | | | |

| Accounts payable | | $ | 7,322 | | | $ | 6,267 Werbung Mehr Nachrichten zur Oragenics Aktie kostenlos abonnieren

E-Mail-Adresse

Bitte überprüfe deine die E-Mail-Adresse.

Benachrichtigungen von ARIVA.DE (Mit der Bestellung akzeptierst du die Datenschutzhinweise) -1  Vielen Dank, dass du dich für unseren Newsletter angemeldet hast. Du erhältst in Kürze eine E-Mail mit einem Aktivierungslink. Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte. Andere Nutzer interessierten sich auch für folgende News |